South32 predicts at least two Canningtons needed each year until 2040 to meet colossal silver demand

It’s “The Perfect Storm” for silver players, with a massive supply-demand gap looming. Pic: Getty

$19 billion ASX200 miner South32 and leading intelligence provider CRU estimate massive silver demand growth between now and 2040 thanks to its increasing use in solar panels. At the same time a lack of new silver mines coming online is expected to result in a material shortage of the precious metal.

South32 in a presentation this week put the expected silver supply-demand gap under the microscope to show just how much of the precious metal will be needed by 2040 to help the world meet its emissions reductions targets.

Silver is the preferred metal for use in solar panels due to its superior electrical conductivity, with South32 and CRU modelling suggesting a 14x increase on solar capacity if the world is to restrict global warming to 1.5 degrees Celsius.

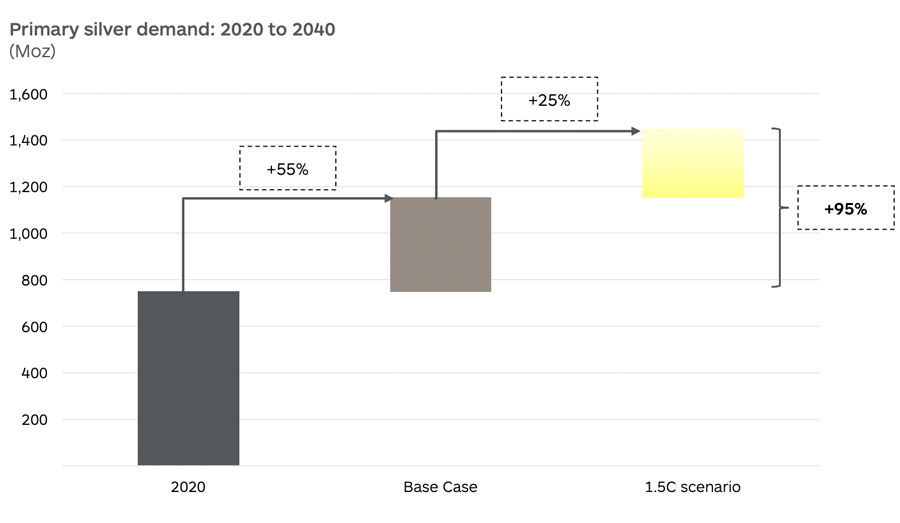

The mining heavyweight’s base case scenario shows a 55% increase in primary demand out to 2040, with demand expected to climb a further 25% to roughly 1.4 billion ounces to achieve 1.5 degrees Celsius.

But to meet the additional demand of 30 million ounces each year until 2040, South32 says this requires more than two new Cannington mines to be built each year. South32’s Cannington mine in northwest Queensland is one of the world’s largest and lowest cost producers of silver.

However, there are very few high-silver polymetallic mines identified globally meaning the market is headed for a material silver deficit. At the same time, constrained mine volumes in China are expected to induce higher imports of high silver-lead concentrates to meet domestic demand, South32 says.

All of this will culminate in the ‘perfect storm’ set to benefit the silver players already advanced down the path to production just like junior ASX-listed emerging producer Silver Mines’ (ASX:SVL).

Managing director Anthony McClure told Stockhead that while the energy markets are going through a revolution and in the first instance driven by governments, the private sector is moving more rapidly and taking the lead.

“The solar cell market is an excellent example of that,” he said. “Silver plays a key role in photovoltaic cell technologies.

“Similarly, the electric vehicle (EV) market is on a growth trajectory. There is more silver in an EV than a regular combustion engine vehicle. The primary reason that silver is playing a key role in electronics in these key sectors is that it is by far the best electrical conductor of all the metals.”

McClure says Silver Mines is extremely well placed in this strong global silver market outlook given its Bowdens project in NSW is the largest silver mine development in Australia for decades.

It is also extremely high-grade, with current drilling consistently returning between 300 and 500 grams per tonne (g/t) silver, but substantially higher grades have also being reported on several occasions.

Silver Mines is currently working towards a maiden underground resource at Bowdens to establish the mine as both and open pit and underground operation.

The company is in the final stages of development approval for a 2-million-tonne-per-annum open pit operation that would have an initial mine life of 16.5 years producing about 66 million ounces of silver, 130,000 tonnes of zinc and 95,000 tonnes of lead.

Silver Mines is also concurrently advancing a scoping study on a potential underground development, with the study on track for completion by mid-year.

This article was developed in collaboration with Silver Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.