Some lithium prices are near all-time highs despite oversupply fears: analyst

Pic: John W Banagan / Stone via Getty Images

Despite bearish headlines about oversupply fears, lithium prices are increasing in many cases, according to new Roskill analysis.

“Lithium prices have shown a mixture of trends in 2018, depending on which price set you look at,” said David Merriman, lithium supply specialist at Roskill.

“While Chinese ‘spot’ or ‘internal’ prices for lithium carbonate have fallen back dramatically, they represent only a small portion of total lithium carbonate purchases,” Mr Merriman told Stockhead.

“[Contracted carbonate prices] have been steadily increasing throughout 2018 and actually exceeded the China spot price for the first time in [the September quarter of] 2018.”

Most lithium — processed or not — is traded in long-term contracts between major producers and consumers, says Mr Merriman.

It is rare to buy and sell lithium on the open market.

Roskill expects prices to increase steadily as contracts are renegotiated between major suppliers and consumers.

#Lithium deals between Auto/Battery OEMs and #miners show how lithium is geographically less concentrated (less risky) than other #battery raw materials such as #cobalt. 19 lithium deals closed between OEMs – miners since 2010! 8 of these OEMs were from #China. @Roskill_Info #EV https://t.co/slUxnTAQB9

— Jose Lazuen (@JoseLazuen) September 25, 2018

Good news for Aussie lithium stocks

About half of global lithium production comes from hard rock mines in Western Australia, which process spodumene ore into a concentrate grading between 5 per cent and 7 per cent lithium.

Spodumene is the main lithium bearing mineral mined from most hard rock lithium mines around the world.

The spodumene concentrate is then sold to converters in China to further upgrade the raw concentrate to carbonate and hydroxide lithium.

Lithium hydroxide requires more processing than carbonate but commands a higher price.

Western Australian lithium producer Galaxy Resources (ASX:GXY) agreed that domestic prices in China did not correlate with the overseas market conditions — with “rest of the world contract prices near to all-time highs”.

Galaxy made an average profit of $579 per tonne of concentrate sold in the September quarter.

Profits were down on the prior quarter, but this was attributed to lower grade of mined ore and reduced concentrate exports — not the prices received from sales partners.

In its quarterly report, Galaxy partially blamed falling lithium carbonate prices in China on “an increase in low quality domestic brine supply from the high cost [Chinese] Qinghai operations being sold into the market at deflated prices”.

Roskill expects these Chinese carbonate lithium prices to remain suppressed for the rest of 2018 and into early 2019, with prices increasing towards the end of 2019.

This will support the significant new lithium supply entering the market, Mr Merriman says.

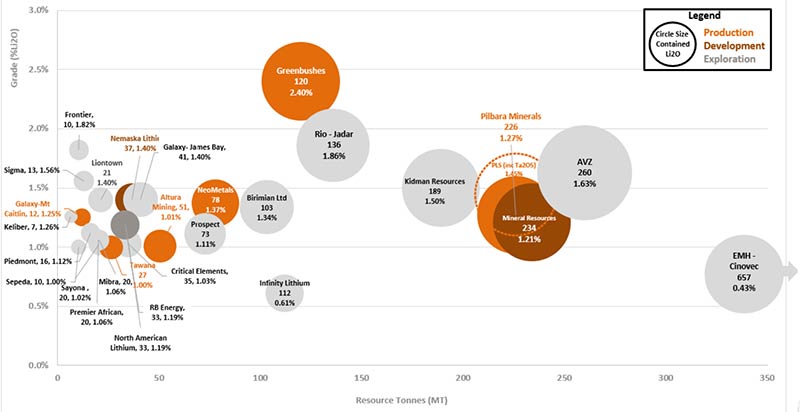

New Western Australian producers Pilbara Minerals (ASX:PLS) and Altura Mining (ASX:AJM) waved goodbye to their first lithium shipments this month, and are in the process of ramping up production at their respective projects.

Both miners are already assessing massive stage 2 project expansions – with much of this material already locked up in offtake agreements.

Mr Merriman said Roskill expected spodumene prices to fall back in 2019, but “they will remain at sufficient prices to sustain this new production”.

“Despite expansions at existing producers and the commissioning of new market entrants, supply will struggle to keep pace with rapid demand growth — driven by electrification of vehicles and energy storage during the early 2020s.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.