Morgan Stanley got it wrong on lithium over-supply, says this mining boss

Analysts and miners are at loggerheads over whether the lithium market will soon be in oversupply and the boss of one junior lithium player has set out to prove demand will far outweigh supply.

“Supply and demand … is absolutely critical for where the lithium industry is heading and there’s a lot of misinformation in the press and by analysts — Morgan Stanley in particular,” Lithium Australia managing director Adrian Griffin told attendees at a WA Mining Club event in Perth on Thursday.

Morgan Stanley forecast earlier this year that an avalanche of supply was in the works, which would put the market into surplus by 2019.

The investment firm expects lithium prices to peak at around $US13,000 a tonne this year, before declining to around $US7,000 by 2021.

Macquarie also claimed recently that the lithium market was “sleepwalking into a tsunami of oversupply”.

This has seen about three quarters of lithium stocks lose ground since the start of this year.

The biggest driver of demand for lithium-ion batteries is the global push for the uptake of electric vehicles and the phasing out of internal combustion engines.

The International Energy Agency expects electric vehicles on the road will number 125 million by 2030.

If policy ambitions continue to rise to meet climate goals, the number of battery-powered electric vehicles could be as high as 220 million in 2030.

Mr Griffin estimates there will be at least 3.5 million tonnes of lithium carbonate equivalent (LCE) required to satisfy the demand coming from car makers.

But analysts may be discounting other significant drivers of demand.

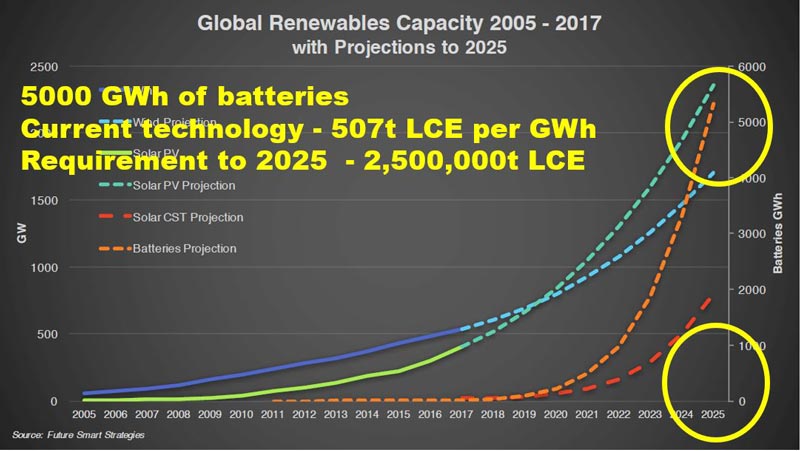

“One of the things you rarely see in analyst reports is the consumption of lithium batteries that may well end up in the renewable energy sector,” Mr Griffin said.

“By 2025 there’s about 5,000 gigawatt hours of batteries required to store that energy and back it up. There’s a requirement immediately for 2.5 million tonnes of lithium carbonate equivalent.”

That alone is more than a 10-fold increase over what is produced today.

“Morgan Stanley tells you there’s going to be a glut, what do we produce today? 200,000 tonnes. It’s not a drop in the ocean,” he said.

“We’re in a position where the automotive industry has committed undoubtedly to lithium-ion battery technology.

“We got a lot of press over the gigafactory and Elon Musk in Nevada building about 30 gigawatts.

“Since that time there’s been another half a dozen of those built and committed to construction and finance. There’s another 10 of them.

“So we already know what the production profile is looking like. Substitutes are not an option because people have already committed the capital to the current technology and these things will go ahead.”

Not enough lithium to meet demand

Even with the new mines coming into production and the expansions underway by the majors, there will still not be enough lithium carbonate to meet demand.

“Have a look at the announced production at the moment, add in the extended capacity for Albemarle and Tianqi, put in the quadrupling potentially of SQM out of Chile and you still can’t meet the demand,” Mr Griffin told journalists following the WA Mining Club event.

“So I think we’re going to see a situation where supply is going to stall or be severely restricted and demand will continue to flow because the original equipment suppliers are already locked in. There is no turning back.”

Lithium Australia plans to be the first integrated Australian battery stock to do everything from mining lithium through to making and recycling batteries.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The company’s SiLeach process converts mine waste to lithium chemicals, before its VSPC solution turns lithium chemicals into high quality lithium-ion battery cathode materials.

Its recycling tech will recover valuable metals, including lithium and cobalt, from spent batteries.

Lithium Australia’s cathode materials are already being tested by Chinese customers.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.