Silver’s Perfect Storm: Industrial demand surges as supply struggles to keep up

Sun Silver rolled onto the ASX this morning following a $13m raising to fund activities at its Maverick Springs project in Nevada. Pic via Getty Images

- Silver prices are on the rise, driven by looming interest rate cuts and increasing demand

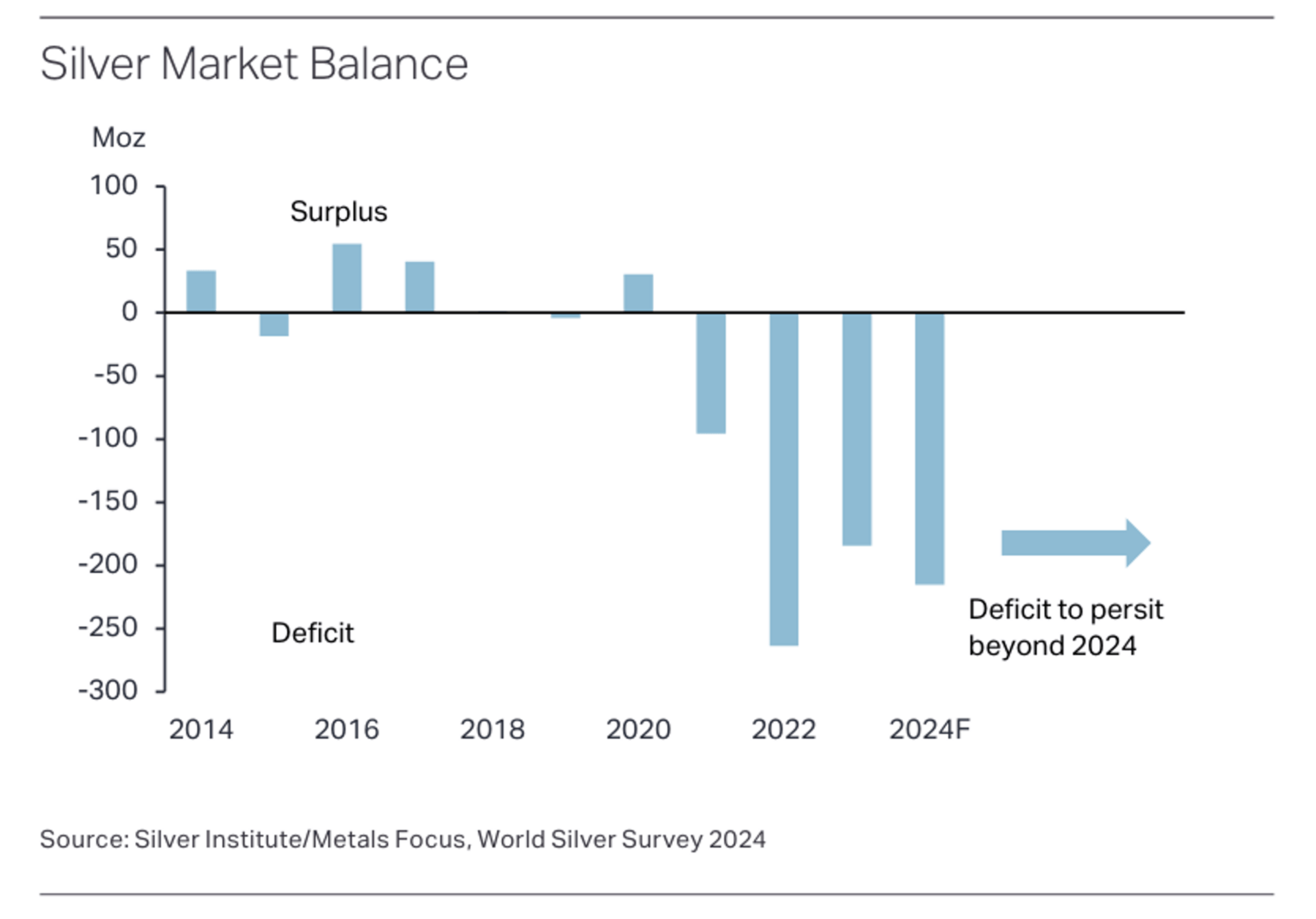

- Industrial usage dominates silver demand, leading to significant deficits in supply since 2020

- 2024 projected to have the second-highest deficit on record

- Limited supply elasticity exacerbates supply-demand imbalance

- The ASX’s newest entrant Sun Silver presents an opportunity for investors seeking exposure to the silver thematic

- The focus is the advanced Maverick Springs project in Nevada and potential downstream opportunities in solar technology

For silver prices, a perfect storm is emerging.

The precious metal has a few main roles to play as an affordable alternative to gold as a store of wealth, jewellery, and an increasingly important industrial metal.

The outlook on all these fronts is very positive.

Silver is increasingly attractive as a store of wealth, with prices already gaining 22% over the past six months as interest rate cuts loom.

Meanwhile demand, predominantly from industrial usage, has dwarfed supply since 2020 when the latest round of deficits emerged.

In 2023, ~820Moz of production was well below consumption of ~1.14 billion ounces.

In 2024, the silver deficit will be the second highest on record behind 2022 as industrial demand reaches a new high, according to the Silver Institute’s latest World Silver Survey.

“Robust gains from PV [solar] applications and a decent performance in other segments are expected to see industrial demand reach a new all-time record,” says Metals Focus, producer of the latest Silver Survey.

“Crucially, supply will remain little changed, with a marginal decline forecast for 2024. This will lead to a 17% rise in the market deficit to the second highest on record.”

The anaemic supply picture comes from the fact that only 20% of production comes from pure silver mines. The other 80% is produced as a by-product of other minerals, like zinc and lead.

This makes silver supply ‘inelastic’ (supply unable to respond to increased demand).

Meanwhile, some of the world’s biggest mines are depleting and a long-term underinvestment in exploration means there isn’t enough new production coming online.

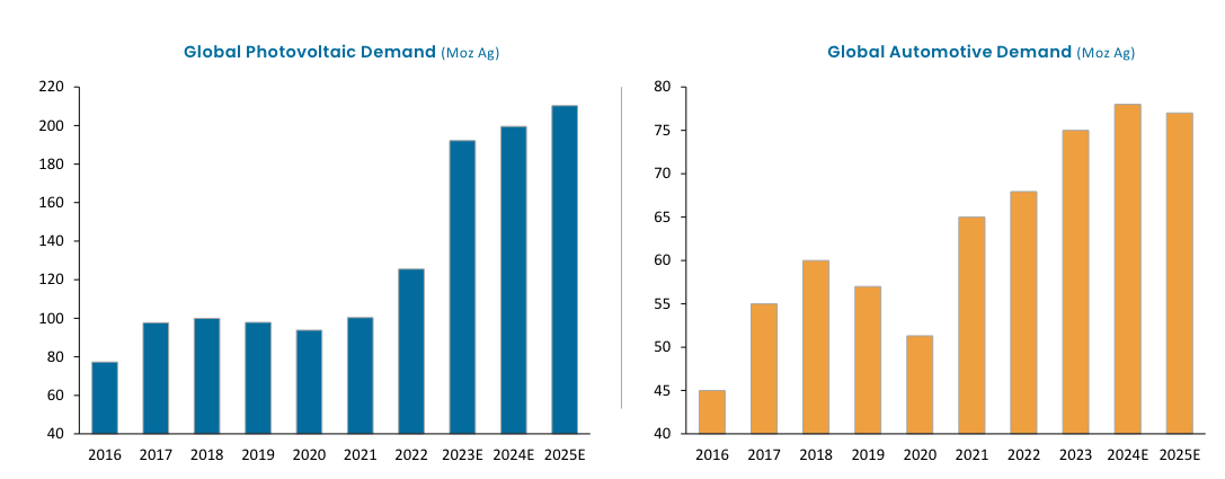

A problem, because future industrial demand will be dominated by hyper-growth sectors like photovoltaic solar cells and fast chargers for electric vehicles.

Silver for solar installations (PV) and cars accounted for ~267Moz, or 22% of total demand, in 2023.

By 2030, the automotive sector will account for 200Moz of demand alone.

By 2050, conservative estimates have solar cells commanding 50% of all silver demand.

Right now, there’s only about 15 months global supply in London and exchange registered vaults, which will deplete rapidly at current rates.

“Silver markets may be set up to be the most exciting trade in the energy transition theme across the entire commodities complex today,” TD Securities’ Daniel Ghali says.

“The energy transition is this decade’s investment zeitgeist and implications for silver are often overlooked.”

Want fresh exposure? Sun Silver hits the bourse today

Many of the best silver-exposed stocks are listed overseas, led by 140-year-old Mexican giant Peñoles. The TSX and NYSE are also home to big silver producers, like Pan American Silver (NYSE, TSX:PAAS) and First Majestic Silver (NYSE:AG, TSX:FR).

Silver Production Q4 2023 (Updated)

See complete list that includes 33 silver producers on our blog (link in bio) pic.twitter.com/uARi0F2pJB

— Mining Visuals (@MiningVisuals) March 24, 2024

The pickings for quality silver exposure on the ASX are comparatively slim.

The ASX’s largest by volume is probably South32 (ASX:S32), which says zinc-lead-silver lumped together were responsible for just 8% of earnings last year.

Not the best way for investors to jump on board the silver thematic.

Hoping to bring some shine to the ASX is Sun Silver (ASX:SS1), which closed its IPO early after raising the maximum $13m in mere days.

It hits the bourse today, 11am AEST.

The focus is Maverick Springs, an advanced, high grade 292Moz silver-equivalent resource at 72.4g/t (175.7Moz silver, 1.37Moz gold) in the tier 1 jurisdiction of Nevada.

It is just off the southeast end of the Carlin Trend belt of monster gold-silver deposits, and a proverbial stone’s throw from Kinross’ 3.7Moz Bald Mountain gold mine.

The Carlin Trend is known for its soft carbonaceous host rocks, which lend themselves to low-cost mining and processing.

Maverick Springs’ large, continuous body of silver-gold mineralisation is 2.4km long, up to 1.2km wide, and between 30-110m thick. The deposit starts about 130m below surface.

There’s more where this came from, reckons SS1, with the current mineralisation model covering less than 25% of the property area.

SS1 exec director Gerard O’Donovan told Stockhead this project ticks a lot of boxes.

“Maverick Springs is globally significant in size. It also has a gold credit, which is really important,” he says.

“[And yet] there are operating mines in the region such as Cours Rochester mine which operates at a head grade of 12g/t silver, with no gold credit.

The region is known for its low-cost mining, making it attractive to big companies.”

There’s scope to significantly increase the current resource without spinning the drillbit, O’Donovan says.

“The resource itself was calculated on historical pricing of US$21.50/oz silver and US$1850/oz gold,” he says.

Because a significant proportion of mineralisation sits outside the pit constrained shell, once we apply current pricing there is significant scope for growth in the resource. This can be done at a desktop level.”

The company’s funds from the raise will also be used for infill drilling (to increase resource confidence), resource expansion, and mining studies.

In parallel, funds will be allocated to evaluate lucrative downstream opportunities, including early-stage studies to assess the viability of silver paste and solar opportunities, and potentially partnering with PV cell manufacturers.

“The main focus is Maverick Springs, but we will also look at silver paste studies,” O’Donovan says.

“Silver paste is used within the PV cell.

“New technologies are only demanding more silver, so we’ll investigate the opportunity to produce a silver paste as a good value add.”

This article was developed in collaboration with Sun Silver, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.