Silver will bash through $US30/oz barrier in 2021, expert says

Pic: Schroptschop / E+ via Getty Images

Never fear, silver bulls. The price rally will resume later this year and continue well into 2021, says London-based consultancy Metals Focus.

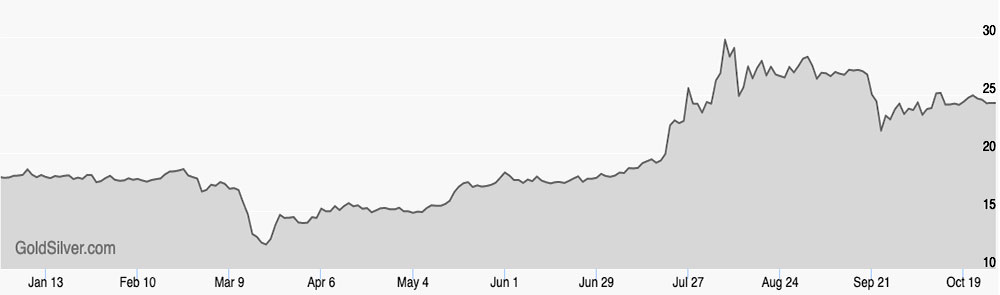

Silver prices surged to ~$US29/oz in early August, falling just short of the psychologically important $US30/oz barrier, before easing back into a $US24-$US25/oz ‘holding pattern’.

That still represents a +36 per cent gain for 2020 so far, with gold up ~25.5 per cent over the same period.

And sentiment has remained generally positive.

That’s because if investors are positive on gold — optimistic on the macro circumstances that will continue to drive the gold price higher — then they are also likely to back silver.

Going forward, almost irrespective of the outcome of the US election, fresh large-scale fiscal and monetary stimuli seems inevitable.

“The case for silver [and gold investment] will therefore remain strong,” Metals Focus writes.

Metals Focus expects to see silver trade “well above” $US30/oz ($42/oz) next year.

History also tells us that silver has the ability to outperform its precious metal rival once it gets going.

“As silver has restored its ability to outperform its yellow cousin over the summer, there is plenty of room for additional investment inflows,” Metals Focus says.

“This is the main assumption behind our forecast that the silver price will break through the $US30 mark during 2021.”

SOME SILVER STOCKS TO WATCH

Myanmar Metals (ASX:MYL) is entering the development phase at Bawdwin, one of the greatest metal deposits in history.

When production begins in 2022/2023, Bawdwin will be the world’s #3 lead producer and a top-10 silver producer.

It’s a monster. The first 13 years of production at Bawdwin is called the ‘starter pit’, but the company has since defined two further phases of open cut mining – that’s decades and decades of mining and processing.

For investors looking for absolute leverage to the silver price there’s Investigator Resources (ASX:IVR) and Silver Mines (ASX:SVL).

Investigator is currently working on a pre-feasibility study for the 43moz Paris project in South Australia — the highest grade deposit in the country — which it hopes to complete in 2021.

Silver Mines’ Bowdens project in NSW is Australia’s largest undeveloped silver deposit. The proposed mine would produce 66moz of silver, 130,000t of zinc, and 95,000t of lead over an initial 16.5-year life.

Late last year, Equus Mining (ASX:EQE) signed a binding deal with TSX-listed miner Mandalay Resources to acquire the Cerro Bayo silver-gold mine and infrastructure in Southern Chile.

The deal includes a processing plant which has produced about 600,000 ounces of gold and 45 million ounces of silver since 1995.

Manuka Resources (ASX:MKR), which owns the Mt Boppy gold project and the Wonawinta silver project in NSW’s Cobar Basin, was the first resources IPO completed in 2020.

Manuka recently poured first gold at Mt Boppy and plans to start processing Wonawinta’s significant silver stockpiles in the June quarter next year.

Adriatic Metals (ASX:ADT) s developing the high-grade polymetallic Vares project in Bosnia & Herzegovina, which includes a 9.5 million tonne resource grading 1.8g/t gold, 183g/t silver, 5.1 per cent zinc, 3.3 per cent lead, and 0.6 per cent copper.

Results of a recent pre-feasibility are impressive — they include a net present value (NPV) of ~$US1 billion and internal rate of return (IRR) of 113 per cent over a 14-year life.

It will take Adriatic just 1.2 years to pay back development costs once production starts.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.