Silver prices are soaring and these ASX juniors are along for the ride

Citigroup says silver could hit +$40/oz this year. Pic: Getty Images

Silver saw a considerable price bump in July and while not as high as its pal gold, the jump could be beneficial for a bunch of silver juniors on the ASX.

Silver rose to nearly $39/oz, that’s a 30% jump and the highest since September 2011 – with investors flocking to safe-haven assets thanks to escalating US trade tensions.

US President Donald Trump has announced 30% tariffs on most imports from the European Union and Mexico, with the latter being the largest producer of silver and a key supplier to the American market.

The silver surge has also been driven by industrial demand from solar energy, electronics and green technologies, with the metal primarily used in photovoltaic (PV) solar cells as a key material for the electrical contacts that allow the flow of electricity generated by the solar panel.

Analysts at Citigroup flagged that prices for the precious metal could hit $43/oz in the next 6-12 months.

West Coast Silver (ASX:WCE) executive chairman Bruce Garlick said there was no reason why silver couldn’t hit +$40/oz in the next 6-12 months.

“With a combined industrial demand and continued gold:silver ratio of about 90 the only logical result is that prices will rise,” he said.

The company holds the Elizabeth Hill project in WA and is just one of several juniors on the ASX keeping a close eye on the silver price, confident the future is bright for mining the precious metal.

The project previously produced 1.2Moz of silver from just 16,000t of ore grading 2194g/t Ag in 2000 before it closed due to a low silver price of US$5 an ounce.

But recent drilling by WCE has returned bonanza grades of up 21m at 1047g/t Ag from 10m and 15m at 723g/t from 1m.

“We have a high-grade silver project in one of the best jurisdictions in the world and the project is located on a mining lease which will allow rapid movement to development and production should we chose to accelerate this pathway,” Garlick said.

The recent assays were only two of 12, with the company confident of even more solid hits to come. Plus, in parallel, WCE is aiming to expand exploration both near mine and beyond into the broader 180sqkm land holding.

“We want to add value with the drill bit,” Garlick said. “We know we have high grade silver and we want to find more and then move swiftly to development and cash generation.

“We have a mining lease and nearby processing plants which will be assessed in the near term for use.”

These silver juniors could be a shoo-in

Before we dive into the juniors, it’s worth noting there’s only one silver producer right now, and that’s Adriatic Metals (ASX:ADT), which declared commercial production from its Vares operation in Bosnia and Herzegovina on July 1.

Broken Hill Mines (ASX:BHM) could be the next producer, having recently acquired the Rasp mine and Pinnacles project in Broken Hill where it expects more than 50% of its revenue to come from silver.

Then there’s Boab Metals (ASX:BML) who’re acquiring Sandfire Resources’ (ASX:SFR) DeGrussa plant for use at the Sorby Hills lead-silver project in Western Australia.

When you consider silver is expected to reach a market deficit of around 117.6Moz in 2025, that leaves plenty of slices of the silver pie up for grabs if any juniors can get into production.

Last month, Maronan Metals (ASX:MMA) released a resource update at its namesake lead-silver project in Queensland to 33.1 Mt at 6.0% lead, 108 g/t silver.

That includes an indicated (higher confidence) silver-lead resource of 5.3 Mt at 5.2% lead, and 116 g/t silver.

Red Metal (ASX:RDM) also has exposure here, owning 44% equity in the company.

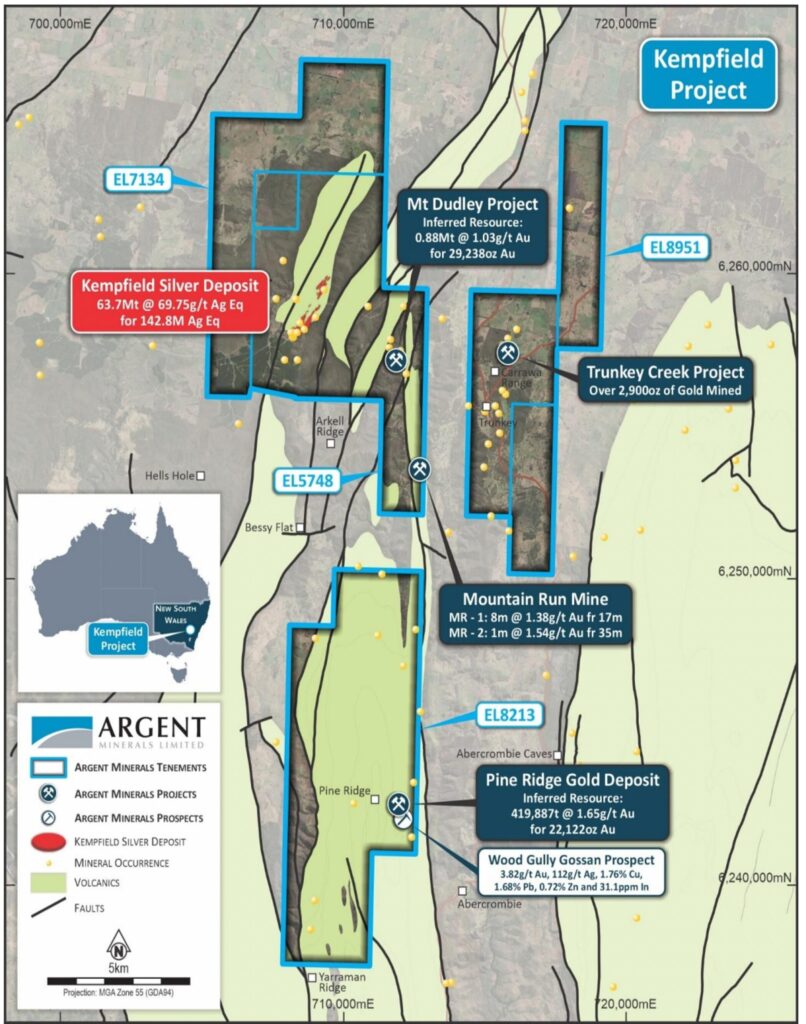

Argent Minerals (ASX:ARD) is gearing up for drilling its 63.7Mt at 69.75 g/t silver equivalent for 142.8Moz Kempfield project in NSW,

The plan is to assess early production opportunities and lay the groundwork for full-scale development.

The testwork will evaluate multiple processing pathways, including heap leach and carbon-in-leach (CIL)/flotation options, with the findings expected to form the basis of a scoping study.

Taruga Minerals (ASX:TAR) has reported up to 103g/t silver in recent rock chip sampling at its polymetallic Thowagee project in WA.

The Thowagee tenement is especially interesting, as it features two historic polymetallic mining operations, with the Thowagee mine previously producing 15.2 tonnes of lead and 5878 grams of silver.

An expanded soils and rock chip sampling program is planned, aimed at uncovering more anomalous mineralisation trends adjacent to historical workings, and expanding the strike of the known workings trend.

Australian Critical Minerals (ASX:ACM) recently entered into a binding share purchase agreement to acquire Circuit Resources which owns or has the option to acquire the concessions associated with the Blanca, Riqueza, Flint, Cerro Rayas, Liro and Kamika projects in Peru.

These are primarily focused on gold and copper with silver, base metals and lithium.

Riqueza, is most notable, being adjacent to tenements held by Anglo American, and home to historic silver grades from rock chips of up to 2238g/t.

Drilling permitting is planned for the second half of 2025.

Silver Mines (ASX:SVL) has taken a major step forward to aid the redetermination of the Development Application for its Bowdens project near Mudgee in NSW, while also pursuing growth opportunities across its expanding portfolio.

The company has now provided all information requested by the NSW Department of Planning, Housing and Infrastructure (DPHI) to assist with the redetermination.

Antipa Minerals (ASX:AZY) also has a dash of silver, 666,000oz to be exact, at its Minyari Dome project in WA.

Who else has silver exposure?

Firetail Resources (ASX:FTL) also has some silver up its sleeve, with results of up to 6630g/t returned from mapping and sampling at its new Excelsior Springs gold project in Nevada, USA.

The company recently entered into an option to acquire 80% of the project, and while gold is the main focus, there’s a secondary silver opportunity around the Blue Dick mine.

Sierra Nevada Gold (ASX:SNX) reported more than 3400g/t silver in rock chip sampling at its Blackhawk project in Nevada back in March, highlighting some serious multi-element potential.

Standout results included 3460g/t silver, 1.47% copper and 0.38% antimony, 256g/t silver, 4.52% copper and 0.83g/t gold, and 10g/t silver and 0.33% copper.

White Cliff Minerals (ASX:WCN) also has some silver at its Rae (predominately copper) project in Canada, with drilling last quarter intersecting up to 34.1g/t silver.

Then there’s Lithium Universe (ASX:LU7) who are taking a different approach to the precious metal with its recently acquired solar panel recycling technology.

The plan is to recover silver during the recycling process. While the tech is currently in the patent submission stage, the licence will be made available to LU7 once it is ready.

At Stockhead, we tell it like it is. While West Coast Silver, Maronan Metals, Argent Minerals, Taruga Minerals, Australian Critical Minerals, Antipa Minerals, Firetail Resources, Sierra Nevada Gold, White Cliff Minerals and Lithium Universe are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.