Does Silver City have a tiger by the tail in historic Broken Hill?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Geologists and explorers have been cracking rocks and drilling holes in the western NSW town of Broken Hill for 140 years.

Also known as Silver City, Broken Hill is home to the world’s biggest body of lead, zinc and silver, which miners call the Line of Lode.

The huge deposit – more than 8km long and 2km deep – bisects the historic town.

One of the longest, continually operating mining regions in the world, Broken Hill was the birthplace of two of the world’s biggest miners, BHP and Rio. (It’s where BHP – or the Broken Hill Proprietary Company Limited – got its name.)

First sighted by Charles Sturt in 1844, Broken Hill later became a centre of mining innovation.

The critical mineral processing technique “sulphide froth flotation” was pioneered there in the early 1900s by BHP general manager Guillaume Delprat.

Once described as the genesis of modern mining, froth flotation solved the problem of recovering zinc and lead along with silver.

In its heyday, Broken Hill provided enormous wealth to NSW via royalties. Many of Sydney’s grand government buildings were funded by the ore from Broken Hill.

Abundance of copper and gold

The district around Broken Hill hosts thousands of mineral showings – mostly in lead, zinc and silver.

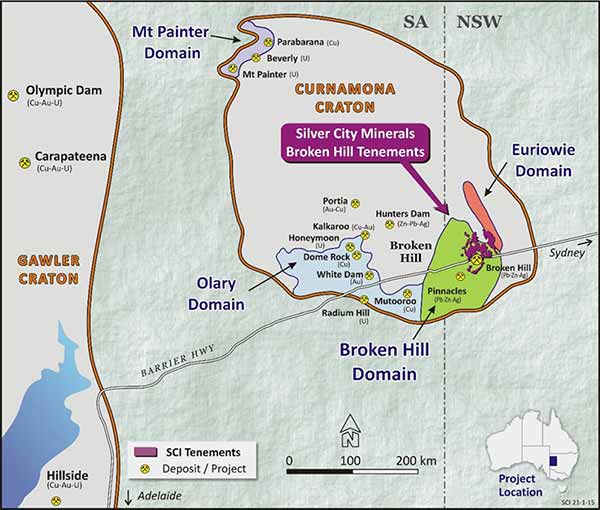

But investigations by ASX-listed Silver City Minerals – which has been exploring the region since 2010 – show the region also contains an abundance of copper and gold.

Just north of Broken Hill, Silver City Minerals holds a highly prospective exploration licence which is considered to host the northern continuation of the Line Of Lode zinc-lead-silver corridor. This has the potential to host a major new zinc discovery.

In September, Silver City announced initial drilling results at a copper and gold site called Copper Blow, about 20km south of Broken Hill.

Early drill results have been outstanding.

The best intersections include 4 metres at 6.1 per cent copper and 4.2 grams of gold per tonne, and 7 metres at 3.7 per cent copper and 1.07 grams of gold.

Copper Blow is considered analogous in style to the copper-gold deposits of the Mt Isa district where for example the large underground Ernest Henry mine operates at a grade of around 1% copper and 0.5g/t gold.

Significant cobalt-rich intersections include 5.2 metres at 0.14 per cent and 0.75 metres at 0.29 per cent.

Extensions of these shoots both north and south of the central fault, provide excellent drilling targets, says Silver City managing director Chris Torrey.

Very high-grade copper and gold

“The latest intersections contain very high-grade copper and gold over potentially mineable thicknesses,” Mr Torrey says.

“As they say, ‘grade is king’ so this provides a sharp focus for our future work. Defining a resource — especially a high-grade resource — is we where we are focused”.

The size of the mineralised host rock system that Silver City has identified is particularly impressive.

The system – which is at least 6km long — has been defined by a linear magnetic anomaly and high copper numbers in geochemical drilling.

At Copper Blow, drilling is targeting a 750-metre zone of near-surface copper and gold mineralisation. The work has intersected a highly altered zone more than 100 metres wide, hosting multiple sulphide lenses containing high-grade copper and gold mineralisation.

This is a size that can host a major deposit.

The tenements also cover a number of copper occurrences and old workings that have not been explored with focused, modern techniques – and have been generally overlooked in past exploration.

In addition to Copper Blow, Silver City has identified a 30km zone to the north east of Broken Hill in its Yalcowinna exploration licence — where 58 rock chip samples have recorded more than 2 per cent copper.

High cobalt values have also been recorded with four prospects identified with cobalt values greater than 0.1 per cent.

This special report is brought to you by Silver City Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.