Scorpion strikes deal to farm-in to E79’s Jungar Flats gold project in record price environment

Mining

Mining

Special Report: Scorpion Minerals has inked a deal to earn a majority interest in the Jungar Flats gold project in WA’s Murchison region after finalising a binding agreement with E79 Gold Mines.

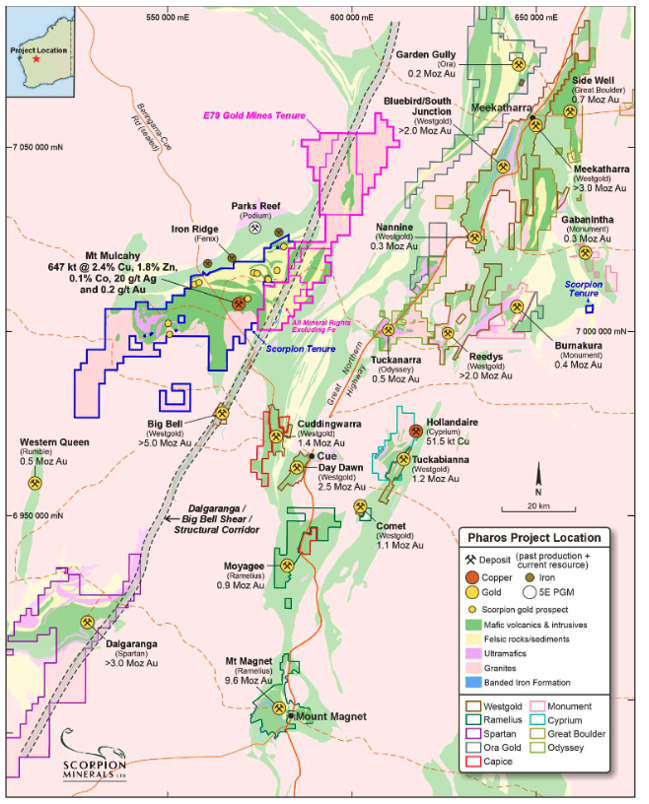

Jungar Flats grows Scorpion Minerals’ (ASX:SCN) landholding in the region to 1600km2, and sits adjacent to the company’s 100%-owned Pharos project.

Last year, at the Olivers Patch prospect within Pharos, Scorpion discovered gold specimens over a large area near a number of historical shallow gold workings.

SCN CEO Michael Fotios emphasised the strategic importance of the deal.

“We are delighted to have executed this strategic agreement with E79, which now makes Scorpion the largest landholder along the highly prospective Big Bell–Dalgaranga shear corridor in the Murchison – one of the prime gold exploration jurisdictions in Australia,” he said.

Fotios highlighted the recent exploration successes in the Murchison region and reiterated the company’s aim to accelerate drilling campaigns.

“With the Murchison region gaining recent attention due to exciting gold discoveries made by neighbouring companies such as Spartan Resources (ASX:SPR) and Caprice Resources (ASX:CRS), our plans to accelerate exploration across our high grade target areas has been very well received by existing shareholders and new investors,” Fotios said.

“As a result, we have received commitments to raise $1.5m which will fund the near-term drilling campaigns at Pharos and cover consideration payable to E79 for the HOA.

“With drilling contractors already secured, we plan to have rigs mobilised by the end of February with drilling to commence shortly thereafter. In a strengthening gold environment, we anticipate a strong pipeline of news flow over the coming months as activity increases and exploration results come to hand.”

For Scorpion, historical exploration has shown promise, notably at the Middle Bore prospect.

Wide spaced shallow RAB drilling returned results including:

Deeper diamond drilling struck 6m at 1.43 g/t gold from 148m, including 2m at 3.19 g/t gold from 151m.

And now, the company aims to start a reverse circulation program in late February to test multiple walk-up high-grade gold targets with historic intercepts including:

The initial phase of the agreement requires Scorpion to spend $1.5 million within three years to earn a 51% interest, with the option to increase this to 70% by investing a further $1.5 million within five years.

The company will need to commit to $3 million expenditure over five years in total, with the agreement also including a $100,000 cash payment and expenditure milestones.

Scorpion also secured firm commitments to raise $1.5 million through a placement of 75 million shares at 2 cents per share, a 33% premium to the last traded price.

The placement includes a drill-for-equity component, with $200,000 worth of drilling services covered under the same terms.

Funds from the placement will go towards Scorpion’s near-term exploration endeavours at Jungar Flats and Pharos.

This article was developed in collaboration with Scorpion Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.