Rox boosts nickel and gold ground near Fisher East discovery

Pic: John W Banagan / Stone via Getty Images

Special Report: An earn-in deal will add 40km of nickel-prospective strike to Rox Resources’ exciting Fisher East discovery in WA.

Rox Resources’ (ASX:RXL) share price is up an incredible 265 per cent over the past six months, driven by its exceptional gold exploration success in the Younami province of WA.

But Rox’s portfolio also includes quality nickel assets like Fisher East, a WA nickel province discovered by the explorer in 2013.

And, like gold, it is a great time to be in nickel.

The traditionally volatile metal has brushed off fears of a global recession to rate as one of the year’s top performers.

A recent surge to $US16,690/t ($24,611/t) was triggered by speculation over Indonesia’s on-again, off-again nickel export policy, but the long-term fundamentals– driven by the EV revolution — look even better.

Global stockpiles are dwindling and new supply is scarce, which is why experienced forecasters like Wood Mackenzie are predicting a pretty substantial nickel supply crunch in the mid-2020s.

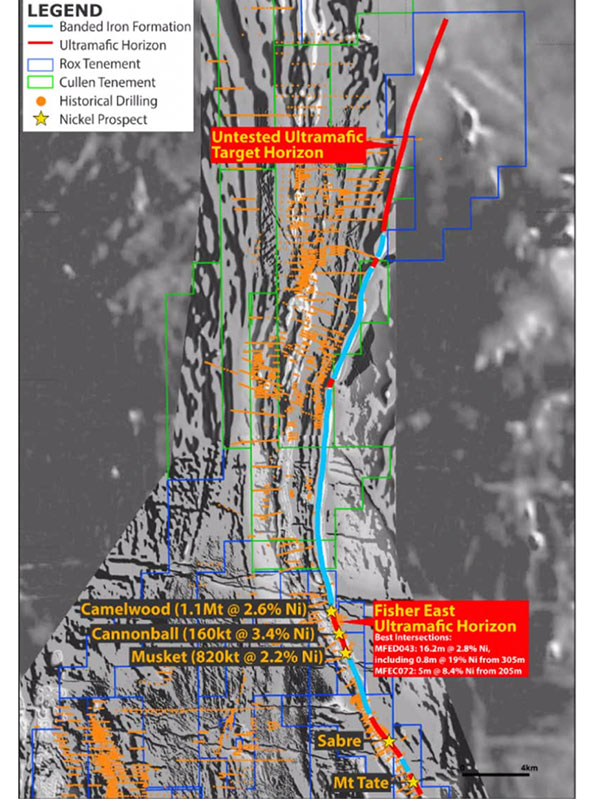

At Fisher East, Rox has intersected high-grade, nickel sulphides including 2m at 14.7 per cent nickel, inside a larger 4m section grading 8.4 per cent, 178m from surface.

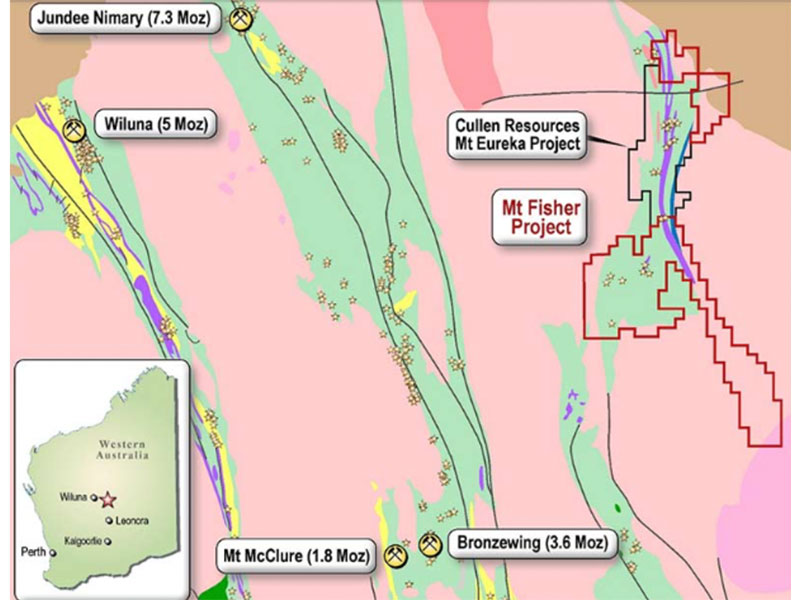

To build on the existing 78,000t Fisher East nickel resource, Rox has just stuck an earn-in deal over Cullen Resources’ (ASX:CUL)neighbouring 290sqkm Mt Eureka project.

Rox can earn up to 75 per cent in Mt Eureka by spending $2m on exploration over a six-year period.

The company is entering into this agreement with Cullen Resources at a time when the nickel market is strengthening, managing director Alex Passmore says.

“The Fisher East nickel project discovered by Rox is one of the most substantial nickel finds in recent times and with this acquisition we aim to build on the substantial mineral resources already identified,” he says.

But it’s not just about nickel; a “modest” amount of gold exploration at Mt Eureka has already identified several prospects.

Galway, the most advanced of these, has returned intersections like 5m grading 12.43 grams per tonne (g/t). Anything above 5g/t gold is generally considered high grade.

Rox says the experience gained from its extensive exploration at Fisher East means it will be able to define new drilling targets at Eureka, quickly and effectively.

For example, almost all significant mineralisation discovered at Fisher East is immediately east of this ultramafic horizon, which runs north into the newly acquired tenements:

This will be Rox’s initial focus in the next quarter, when the explorer kicks off a program including detailed ground EM surveying, aircore drilling, and RC and diamond drilling.

Cullen was also “very pleased” to be partnering with Rox – a company that discovered the Camelwood nickel sulphide system at Mt Fisher, which adjoins Mt Eureka to the south.

“Given their key geological understanding of the region, strong financial position, and well-established logistics base in the remote northeast Goldfields, they are best positioned to advance exploration for gold and nickel deposits on Cullen’s numerous defined prospects,” Cullen managing director Dr Chris Ringrose says.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Rox Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.