ROUND UP: ASX explorers in QLD striking while the copper iron’s hot

Mining

Mining

There’s a flurry of exploration happening up in northwest QLD as explorers start building out defined copper deposits to ride a wave of demand that some analysts predict could result in a yearly worldwide deficit of about 6mt of contained copper by 2030.

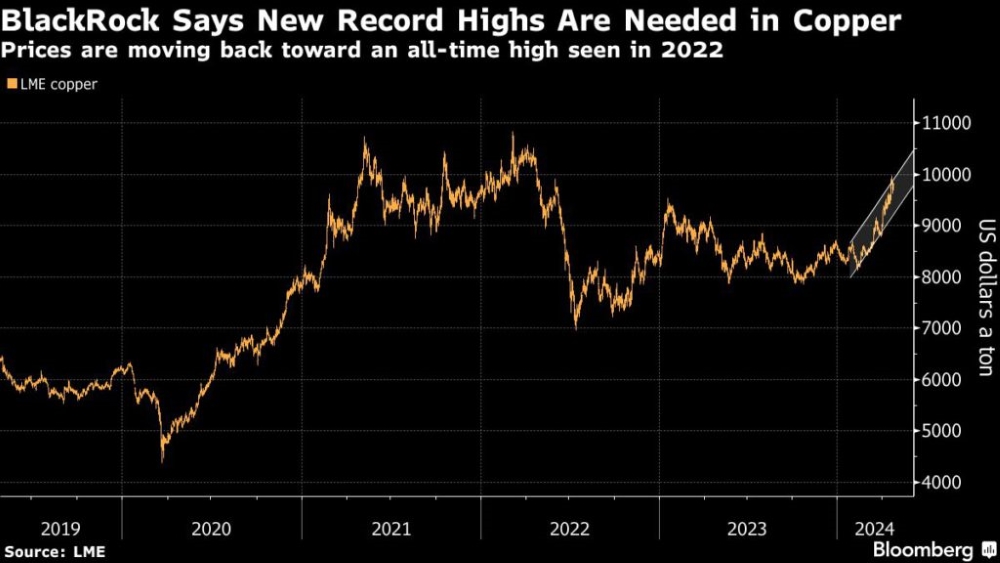

The red metal is trading at over US$10,000/t once more and is tipped to rise to US$15,000/t within the next two years.

In terms of mine development, Blackrock World Mining Fund’s Olivia Markham says copper prices will need to hit just US$12,000/t to incentivise new sources of production.

Those are some pretty darn good reasons why ASX juniors are heading back into QLD’s copper-rich northwest in droves looking to put their projects in the shop window. Let’s take a look at who’s kickin’ up rocks in the Sunshine State.

With a just released pre feasibility study (PFS) that earmarks $636m of free cashflow over a 10-year mine life, QMines’ (ASX:QML) Mt Chalmers project near Rockhampton aims to produce 65,000t copper, 160,000oz gold, 30,600t zinc and 1.8Moz silver through a 1Mtpa processing plant.

The Mt Chalmers resource is centred on a high-grade historical mine which produced 1.2Mt at 2% copper, 3.6g/t gold and 19g/t silver between 1898-1982.

When you include QML’s recently acquired Develin Creek project, the explorer now has a global resource of a combined 15.1Mt at 1.3% for 195,800t of contained copper.

The plan is for a three-stage open pittable mining operation with high recoveries, low capex and growth opportunities down the track.

Next month will see drilling kick off at the huge 415Mt Briggs porphyry copper and molybdenum project, a JV between Canterbury Resources (ASX:CBY) and Alma Metals (ASX:ALM), of which Alma can earn-in up to a 70% interest.

There’s been some early success for Strategic Energy Resources’ (ASX:SER) Canobie project in northern QLD too, after recently dusting off its first field season to test three Ernest Henry-style IOCG targets with mining major and project partner Fortescue Metals Group (ASX:FMG).

For those playing at home, that means iron oxide copper-gold mineralisation – known to be incredibly large and easy to process.

SER’s Canobie is within the same geological district as Evolution Mining’s (ASX:EVN) Ernest Henry – a now debt-free IOCG copper-gold operation turning over >$100m each quarter with a 17-year mine life ahead of it.

Renegade Exploration (ASX:RNX) has mapped the continuation of its Mongoose deposit at its Cloncurry project a further 500m to the west with “Mongoose West” returning rock sample results of up to a whopping 19.45% copper and 2.3g/t gold.

Data will be evaluated alongside the upcoming processed magnetic data to finalise RC drill planning.

Skyrocketing silver prices are up 13.8% since the beginning of the year, driving base metals exploration. Northwest QLD just so happens to be home to Australia’s largest mine – South32’s (ASX:S32) world-class 3.3Mtpa silver-lead-zinc Cannington operation.

READ MORE: Riding the tech express: Tomorrow’s industries that are driving industrial demand for silver

QLD’s northwest has long been home to frequently mined silver-zinc deposits such as the Century, Mt Isa and George Fisher mines and exploration for precious and base metals is on the rise in the region.

Holding one of Australia’s largest undeveloped silver-lead deposits in the region is Maronan Metals’ (ASX:MMA) flagship 32.1Mt @ 6.1% lead and 107g/t silver for 300Moz silver equivalent Maronan project, which also hosts a separate 32.5Mt @ 0.84% copper for 455,000t of contained copper.

The explorer is busy with metallurgical work at the project and has so far found that the sulphide mineralisation there floats well for processing and returns high recoveries of lead, silver and copper.

“It is expected that the processing and mining advantages defined by these positive preliminary metallurgical tests will translate into very industry competitive capital and operating costs at Maronan,” MMA MD Richard Carlton said.

MMA was spun out from fellow explorer Red Metal (ASX:RDM), the latter retaining a 53% interest giving it exposure to copper while concentrating on its Sybella rare earths (REE) project southwest of Mt Isa.

100km inland from Cairns, Iltani Resources (ASX:ILT) is exploring for a silver-indium deposit at its Orient project in the historical mining area of Herberton, where an 11-hole infill drill blitz is currently underway.

The program covers an 1800m strike extent and, dependent on results, will form the basis of eventual infill drilling to a 100m x 50m grid which will plug into an inferred resource estimate.

Down towards Townsville and Sunshine Metals (ASX:SHN) has an early doors copper-gold project, Ravenswood, where exploration is refining five prospective areas through a near-complete 18-hole drill program.

Results are due mid-May, while seven more holes are being planned at the Liontown, Truncheon and Highway East prospects.

At Stockhead, we tell it like it is. While Maronan Metals, Iltani Resources, Renegade Exploration, Alma Metals, QMines, Red Metal, Sunshine Metals and Strategic Energy Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.