RIU Explorers: Gold is great again but who holds all the aces?

Gold is back in vogue, but who has the winning hand? Pic via Getty Images

- Outlook for gold is strong for 2024 and exploration companies are looking to take advantage

- Companies such as De Grey Mining and Spartan Resources have been rewarded for game-changing gold discoveries in recent years

- Aspiring miners Brightstar Resources and Magnetic Resources set for pivotal years with key studies due in the coming weeks and months

Gold is tipped to have a good year, just ask ABC Refinery’s Nicholas Frappell, but the question remains whether the market has gained enough of an appetite for the precious metal.

Speaking at the RIU Explorers conference in Perth yesterday, Frappell – ABC Refinery’s global head of institutional markets – could not have been more positive on the outlook for gold in 2024 and beyond.

“It’s tangible, it’s debt-free, it’s liquid, it’s simple to understand and it’s got a great history,” he said.

“Gold should enjoy continued support this coming year.

“Investors in the west are underweight in gold, so they can bring more ammunition to the party should the gold price rise.”

Despite the positive forecasts for gold, most of the discussions around Fremantle’s Esplanade Hotel this week have been around when the battery metals – particularly lithium and nickel – will bounce back.

However, no one dared dispute the fact that the fundamentals for the precious metal are strong. And “great” gold exploration stories always seem to win over investors.

It was a message reiterated by the established producers such as Westgold Resources (ASX:WGX) and Ramelius Resources (ASX:RMS) in attendance, as well as the likes of Bellevue Gold (ASX:BGL) and Tietto Minerals (ASX:TIE) which have recently seen their discovery successes transformed into fully-fledged mining operations.

Stockhead cast its eye over the +20 gold companies on this year’s RIU Explorers program to find out who is making waves on the exploration scene and which developers have the best chance of joining the exclusive producers club.

Still the biggest and the best

As expected, it was standing room only for the presentation from De Grey Mining (ASX:DEG) general manager exploration Phil Tornatora on what lies ahead for the 10.5Moz (and growing) Hemi discovery in the Pilbara.

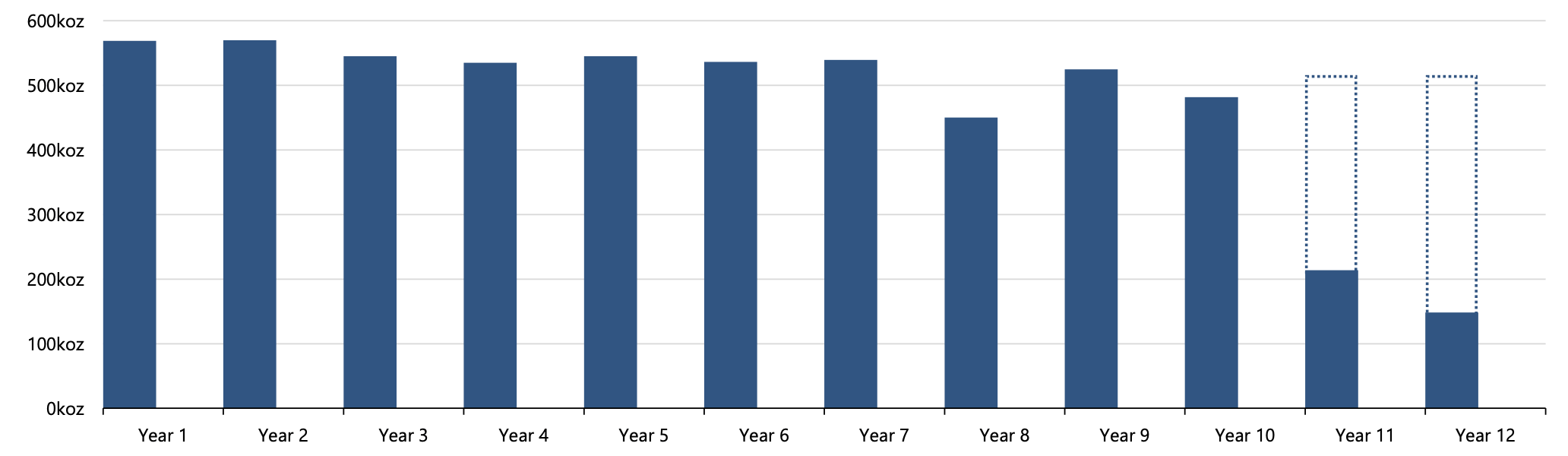

The DFS released last September flagged Hemi as a future top-5 Australian gold mine based on its forecast average production of 530,000ozpa over the first decade of operations. That’s an awful lot of gold bars to be poured from mid-2026 onwards.

It could be even more if DEG’s exploration strategy continues to hit the mark. Tornatora and his team quickly – and effortlessly – added 1Moz to the Hemi resource base during the second half of last year after pivoting back towards discovery mode following an extended period focused on infill work to build confidence into the DFS and the accompanying 6Moz reserve.

“We see exploration as still a key value driver for the company,” Tornatora told conference delegates.

“The DFS forecast annual gold production of 530,000oz over the first 10 years, but we’re looking to extend beyond that 10-year period and also add to that half a million ounce a year production over the first 10 years as well. Exploration will be one of the major drivers of this aim.

“We see that there’s potential to increase all the Hemi deposits at depth. A lot of them remain open along strike as well. There’s immediate potential for resource extensions at Diucon, Eagle and Antwerp and also several of the regional deposits.”

DEG resumed drilling at Hemi this week following a deserved break over the Christmas/New Year period. One of the first areas to be attacked with the rig will be the Eagle deposit where the company believes along strike extensions hold considerable upside for a future underground mine.

Tornatora is also keen to punch some more holes into what has become known as the Greater Hemi Corridor which hosts a long list of emerging regional targets such as West Yule where hits of 6m @ 3.4g/t and 20m @ 1.2g/t were recorded from early-stage aircore drilling.

Another regional prospect to have also caught the eye is Lowe, part of the Egina JV with Novo Resources (ASX:NVA) where an intersection of 8m @ 4.7g/t was returned in one of the first RC holes into a target with similarities to the main Hemi intrusive.

Tornatora also revealed the company has launched a scoping study into a regional concentrating hub at Withnell, west of the Hemi project area.

“This will be an additional plant that could either produce gold or a concentrate that we could truck to Hemi,” he said.

“That will be used to process some of the 2.2Moz in the regional (project) area and any other new discoveries or additions we make to that.

“The existing resources we have out in that area we can see potential for them to deliver 100,000oz over six years.”

Investors have every right to rely on Tornatora’s word. His track record of finding gold deposits that turn into mines is second to none in the industry, and his arrival at DEG only marginally preceded the unexpected discovery of Hemi.

Spartan leads the discovery peloton

Arguably the best gold discovery in Australia since Hemi belongs to a company that only a little more than 12 months ago shuttered its flagship mining operation due to a lack of viable ore sources.

Spartan Resources (ASX:SPR) has now built up an impressive 952,900oz @ 5.74g/t gold inventory at the Never Never discovery where five drill rigs are turning “aggressively”, managing director Simon Lawson declared, within spitting distance of the mothballed 2.5Mtpa Dalgaranga process plant.

“Never Never is only one example of a high-grade structure in what is a broad mineralised system across a big tenement package that we own,” Lawson said.

“I used to get told by a former boss, if you want to find gold, drill near a gold mine. And if you want to drill along strike, you’ll likely find more gold.”

Lawson opened his presentation by apologising for not updating the share price in his slide deck to reflect the 9% uplift the market afforded the company yesterday on the back of news visible gold had been logged 170m below the Never Never resource.

However, he refused to apologise for using the word ‘de-risk’ eight times in his management comment that accompanied the announcement.

“We love de-risking our project,” Lawson said. “We came from a place where people saw risk and we’re going into a future where we want to take that risk away and make sure people have the confidence in banking us in what we’re doing.”

It would appear too soon for SPR to start talking about a restart strategy for Dalgaranga, although the company is working on a five-year mine plan for its high-grade discovery, which could be supported by other regional sources such as Sly Fox.

“It was always thought of as a high-grade, narrow plunging shoot – that’s exactly what we thought Never Never was and now we’re nearly 1Moz later… so who knows how big that could be,” Lawson said.

“We’re pretty confident we keep delivering some pretty spectacular drill hits.”

Who is going to develop Australia’s next gold mine?

It is one thing to have a discovery and a solid resource base, but being able to turn it into a mine – and a profitable one at that – is an entirely different story. However, that isn’t holding back a host of wannabe gold producers from stating their case for entry into an exclusive club of companies on the ASX.

Brightstar Resources (ASX:BTR) perhaps has its nose in front in the race to become Australia’s next gold producer via the refurbishment of historical processing facilities to services its Menzies and Laverton projects.

In fact, the company is well on its way to realising cash flow any day now with first ore from its Selkirk joint venture with BML Ventures to be imminently processed via the Gwalia plant, operated by Raleigh Finlayson’s Genesis Minerals (ASX:GMD).

BTR managing director Alex Rovira said further third-party milling agreements could be on the cards as the company looks to find ways of funding ongoing exploration and studies for its assets.

“We’re assessing the potential for additional small-scale mining opportunities at Menzies and toll-treating through one of the mills in the district, either Paddington or Gwalia, or one of the other ones, to continue to generate organic free cash so we’re less reliant on equity capital markets and we can put that cash flow into more drilling and development studies,” he told delegates.

BTR drilled over 24,000m across its Menzies and Laverton projects last year, delivering multiple resource upgrades along the way, but the jewel in the crown was a scoping study on near-term production with a capex of just $22 million.

“It’s something we were really focused on in this capital environment, both from a debt and equity perspective, keeping that capex low was incredibly important,” Rovira said.

“For a pre-production capex of $22 million, we can deliver – at current spot – a NPV of over $150 million and IRR of 138%. Those are excellent financial metrics.”

By this time next year, Rovira hopes the company is on the cusp of making FID to begin production, having completed a DFS and banking the necessary approvals for project development and operations.

Ausgold (ASX:AUC) also expects to release a DFS on its 3.04Moz Katanning gold project by mid-year, having rapidly grown the resource over the last 18 months and executing several key agreements with landowners in traditional WA farming heartland.

For many years AUC has flown under the radar of investors – current market cap of $62 million – but long-serving managing director Matthew Greentree believes that is starting to change.

“This is the largest undeveloped open cut project in WA,” Greentree said.

“We’ve got over 5,500km2 of tenure in a greenstone belt that really hasn’t received much attention in terms of exploration over the years.”

Another explorer set to make the jump to developer in the near term is Magnetic Resources (ASX:MAU) which will release the results of a PFS on its Laverton project potentially as early as next week.

MAU managing director George Sakalidis teased delegates with a pledge the PFS outcomes would be “very, very good” before upgrading his assessment to “exceptional” by the end of his presentation.

The PFS will be the first time economics have been revealed to the public concerning the high-grade Lady Julie North 4 deposit which hosts indicated and inferred resources totalling 852,000oz @ 2.02g/t within a 750m x 350m.

Here’s how it compares to other open pit gold deposits in WA.

It remains unclear whether MAU will build its own processing facilities at Laverton or link up with existing plants in the region, including Granny Smith and Mt Morgans, although Sakalidis did give a hint as to what might be happening behind the scenes.

“Two of the mills are less than half capacity and we’re within 10-15km of those mills, so there’s an opportunity to do deals,” he said.

“A lot of these companies are in our data room, if you’re not aware.”

Hamelin knows something is hiding in the Tanami

When this author asked around as to who might land the next big gold discovery in Australia, the company whose name earned a mention on more than one occasion was Hamelin Gold (ASX:HMG).

Was it because HMG managing director Peter Bewick is one of the most respected technical minds in the industry? Or the fact the company is prepared to push the boundaries with the latest technological advancements in a bid to find something in a region ripe for a new discovery? Either way, it had people talking.

Spun out of Encounter Resources (ASX:ENR) in late 2021, HMG is now entering its third field season exploring for gold on the WA side of the remote Tanami region as its own company – and there’s every chance it could be a game changer.

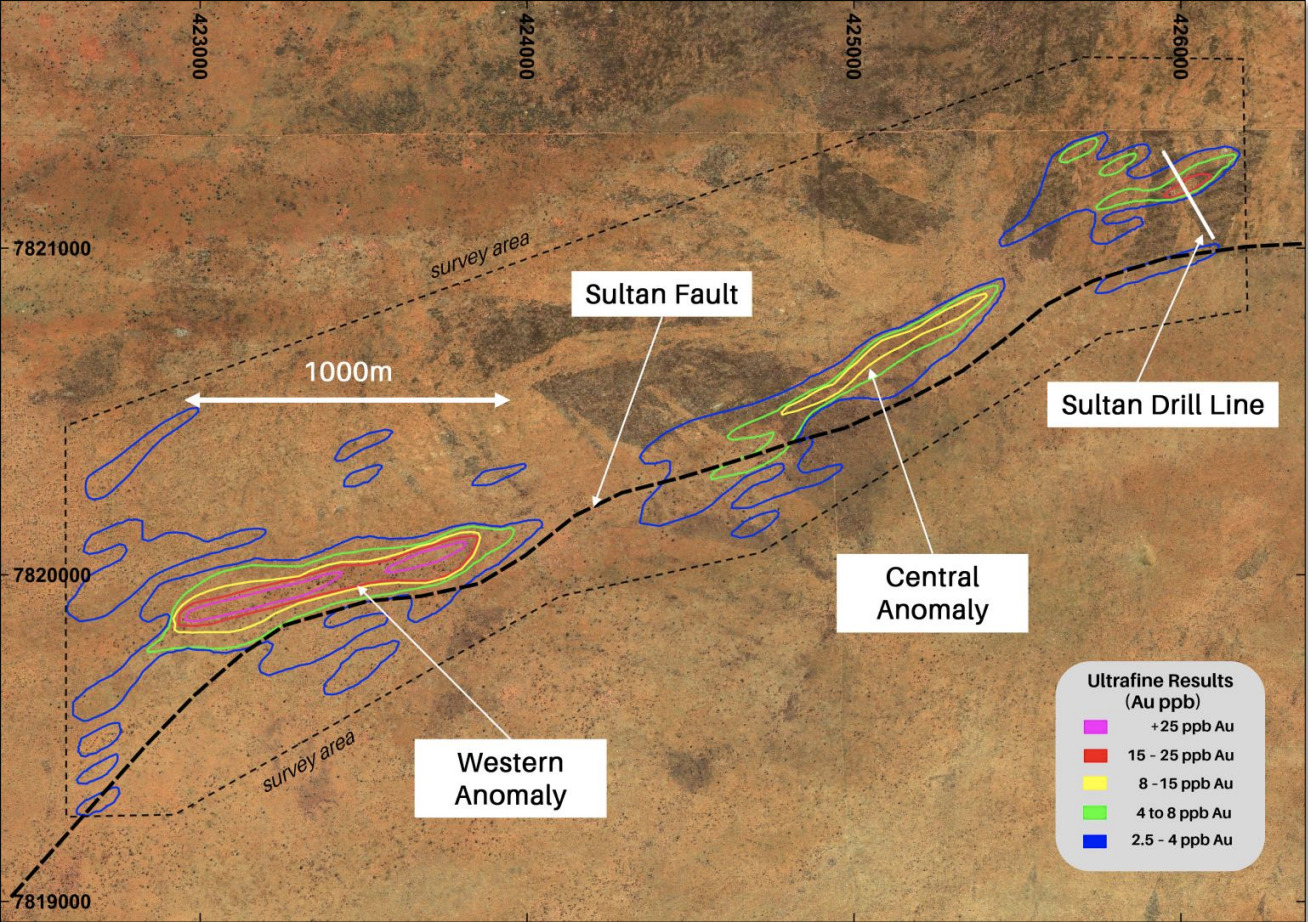

HMG has a nice 700m-long bedrock gold anomaly – discovered underneath a surface anomaly picked by the CSIRO-developed Ultrafine+ technology – which will be drill-tested by a RC rig in the coming months.

Bewick said this technology was allowing his company to better predict where potential discoveries are waiting to made “without going broke drilling holes all over the place”.

“Importantly, what it means for the rest of the project is we have a ground-breaking tool that we can apply to other sand-covered terrains and potentially come up with more targets like this,” he said.

“This is the sort of footprint that might be sitting over a major gold system.”

Bewick noted it was “odd” for an orogenic belt to host a giant deposit such as Callie (on the Northern Territory side of the Tanami) but not a string of 2-5Moz deposits elsewhere in the province.

And in the event HMG does not find its prized gold deposits in the region, there could be something else to fall back on.

HMG was recently announced as one of six successful applicants (out of 529 total submissions globally) for funding via BHP’s Xplor program to follow up on what Bewick described as a “weird-looking” magnetic anomaly which the company originally earmarked as a gold target.

The company recently undertook one line of drilling utilising a nearby and available RC drill rig and, as Bewick noted, “what we got was not what we expected”.

“We actually intersected a mafic-ultramafic intrusion that contained nickel-copper-PGE sulphide mineralisation,” he said.

“This is the first time this style of mineralisation has been recorded in the Tanami. Being nickel explorers in our previous lives, we know how important it was to see that early mineralisation in a hole that was just untargeted.

“If it’s of interest to BHP, it could be fascinating for our shareholders. We’re pretty excited that they’re excited.”

Gold explorer share prices today:

At Stockhead, we tell it like it is. While De Grey Mining, Spartan Resources, Brightstar Resources and Magnetic Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.