Right projects, right place, right time: the Pioneer Lithium team is ‘absolutely aligned on being a developer’

The company has lithium projects in Ontario and Quebec, Canada. Pic: via Getty Images.

- Pioneer Lithium says its highly strategic lithium assets in Ontario and Quebec are perfectly placed to supply the North American battery market

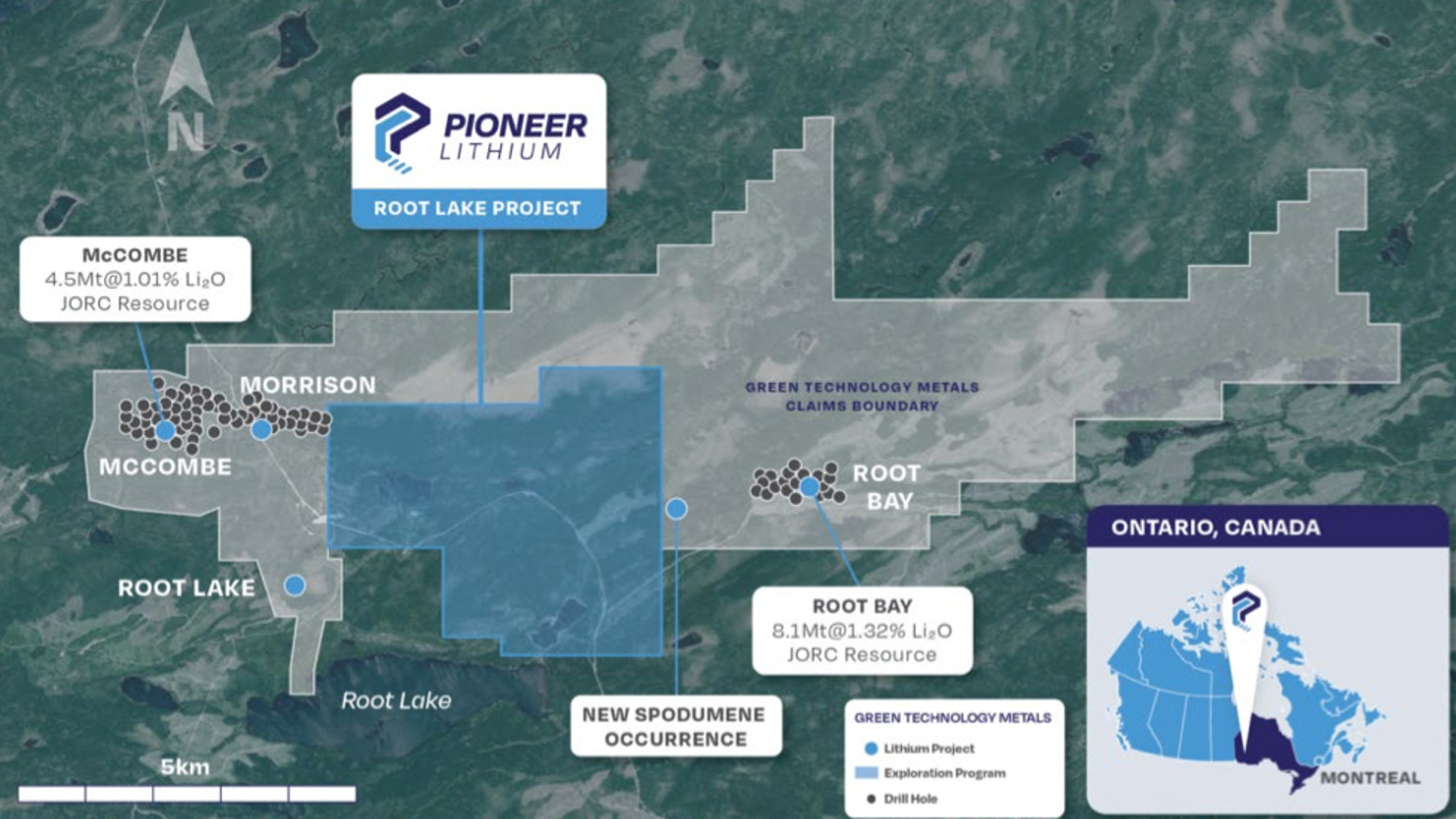

- Exploration is already underway at Root Lake, next to GT1’s 12.6Mt Root Bay lithium Resource

Freshly listed Pioneer Lithium is on the hunt for significant lithium deposits in Ontario and Quebec at its Root Lake, Lauri Lake and La Grande projects.

In a tough year for IPOs, September listing Pioneer Lithium (ASX:PLN) has been a strong performer since making its ASX debut.

This comes down to a few things: namely, great lithium assets in the right place and at the right time, and an elite team of company makers to push them forward.

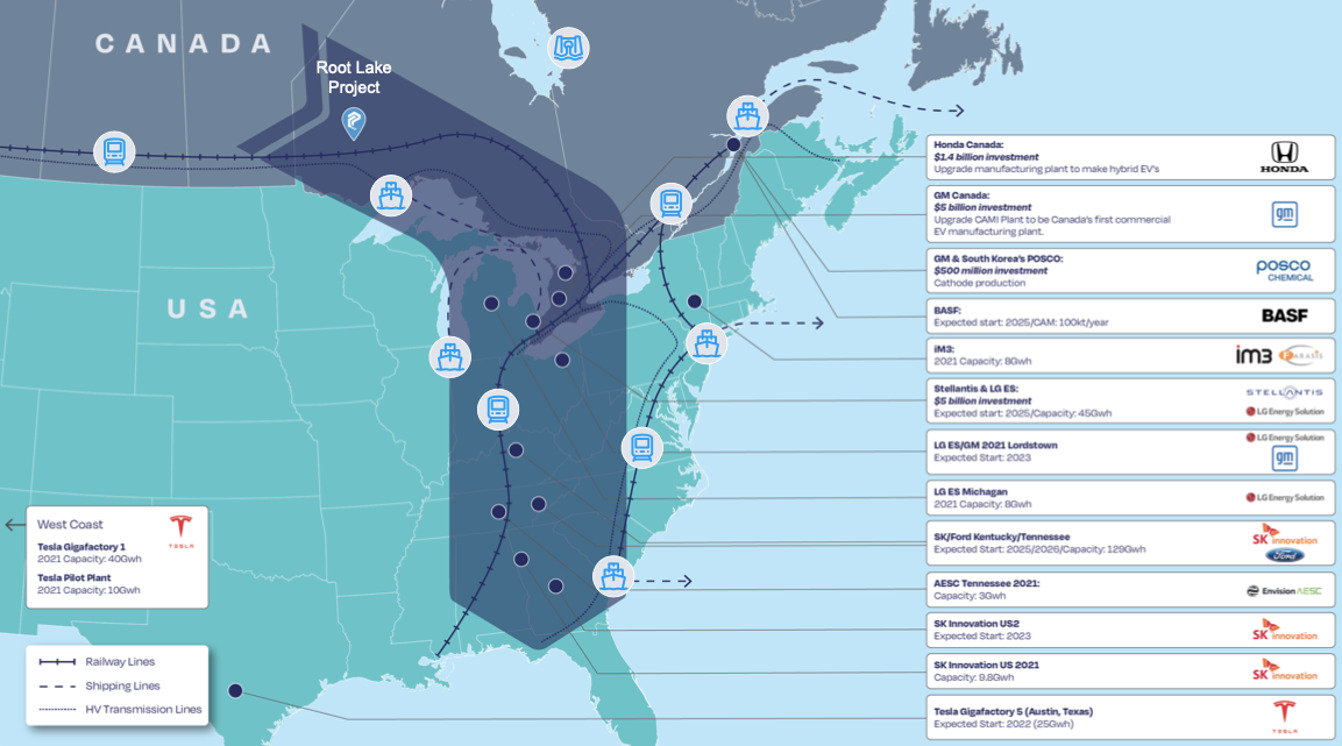

CEO Clinton Booth says the Pioneer’s projects are perfectly placed in Tier-1 lithium locations near the rapidly expanding demand for battery metals in North America – and that bodes well for future development.

“We’ve got assets in great locations including the very prospective Quebec region, and we’ve got assets in the under-explored but well positioned and emerging Ontario area,” he said.

“These assets are located strategically, very close to, in some cases bordering on, recent maiden resource announcements – so that’s fantastic.

“And the downstream market is right there. That market exists today, and it is only getting bigger with a significant amount of government support from North American governments, both the US and Canada.

“The auto market in the US is huge, and we’re seeing massive and continued take up and we will continue to see massive and continued take up in North America for the auto sector.”

Drilling planned at Root Lake in November

Booth said Ontario, with significant mineral endowment and first-class infrastructure, has all the key ingredients to become a large spodumene hub.

A bunch of juniors have now established resources in the state, including neighbouring Green Technology Metals’ (ASX:GT1) at its 12.6Mt Root Bay deposit.

In fact, that’s part of the reason the company has already set off exploring at Root Lake so soon after listing on the ASX.

“We are pushing ahead at Root Lake with the mapping and sampling and preparing for a drilling program in November,” Booth said.

“It’s an under-explored region, and it has the potential to become a large hard rock region.

“The other benefit is that it has great access to a rapidly expanding downstream market or a customer base. You’ve got suppliers like LG Chem for batteries but also the huge North American car market.”

The company has already found three pegmatites — a host rock for lithium mineralisation — along the Extended Morrison trend in the north-west part of the project, which is directly along strike from GT1’s Morrison-McCombe pegmatite system.

And in the central area of the claims – the Central Corridor zone which is along trend from GT1’s Root Bay pegmatite system – a massive 85 pegmatite swarm has been discovered.

Pioneer also hopes to identify new priority targets with an exploration program to be conducted in two phases.

The first phase will include detailed geological mapping of outcrops and systematic bedrock sampling guided by aeromagnetic and historical exploration data.

This will be followed by a second phase of targeted litho-geochemical channel sampling to test the dispersion of lithium-bearing pathfinder minerals associated with LCT pegmatites.

The results will be used to enhance the geological understanding of the Root Lake project area and assist with the development of high-confidence drill targets ahead of the upcoming maiden winter drilling program.

“Absolutely aligned in being a developer”

Pioneer’s plan to take its high-quality exploration assets into production is cornerstoned by a very experienced team.

Booth himself previously held senior positions at Twiggy Forrest’s Fortescue Future Industries and Galaxy Resources, now Allkem (ASX:AKE).

The company has also just appointed former Sandfire Resources (ASX:SFR) executive Richard Nash as eneral manager of exploration.

At Sandfire, Nash was responsible for greenfields project generation and due diligence activities during a period of growth that saw the company transition to a multi-operation global miner and one of the largest copper-focused producers on the ASX.

“As a company, board and management are absolutely aligned in being a developer,” Booth said.

“It was a key focus for me joining the organisation and it’s a real focus for the directors, the management, and the major shareholders – that’s what we’re after.

“We want to create the early value through exploration, and then large long-term value for the business and our shareholders by getting into that operations phase.”

Booth is confident the company is strategically positioned to take advantage of opportunities to progress development.

“In the lithium sector there is a significant demand exceeding supply. Supply will need strong, determined and well-led companies to be able to come on stream,” he said.

“When they come on stream, they’re going to be very successful – and we are one of those companies.”

This article was developed in collaboration with Pioneer Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.