Rhyolite Ridge will be the world’s lowest cost lithium producer, ioneer says

Pic: Schroptschop / E+ via Getty Images

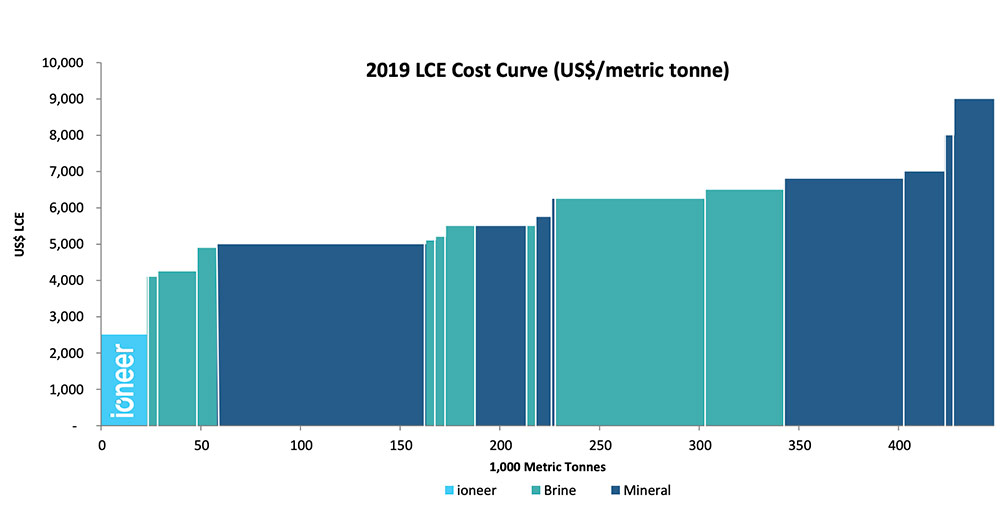

Special Report: Production costs at ioneer’s advanced Rhyolite Ridge lithium-boron project are an estimated $US1,500 ($2,290) per tonne lower than South America’s lowest cost brine-based producers.

Rhyolite Ridge in Nevada will be the world’s “single most attractive” lithium carbonate, lithium hydroxide and boric acid project when production starts in 2023, according to a Definitive Feasibility Study (DFS) released by ioneer (ASX:INR).

Aspiring miners usually undertake three different types of studies to determine whether or not a resource can be mined economically.

These are scoping, preliminary feasibility (PFS), and definitive feasibility (DFS), with the DFS being the most important and complex.

This detailed, 5,000-page study positions ioneer as the world’s lowest cost lithium producer with an estimated all-in sustaining cash cost to produce battery grade lithium hydroxide of $US2,510 ($3,830) per tonne.

Starting in 2023, the project will produce an average of 22,000t of lithium carbonate equivalent and 174,400 tonnes of boric acid annually for an initial 26 years.

The financial modelling delivered some “compelling” economics:

That’s due to its incredible price stability. Boric acid has traded in a range between $US600-$US900 during the past 100 years.

ioneer managing director Bernard Rowe says the co-production of boric acid enables the company to produce lithium, net of boric acid credits, at the lowest possible cost.

“Rhyolite Ridge’s projected position at the very bottom of the global lithium industry cost curve will enable us to achieve industry-leading EBITDA margins, an excellent return on investment, and a quick payback across a range of commodity price environments,” he says. “Additionally, we are located in Nevada, a mining-friendly jurisdiction in the US, where lithium is recognised as a strategically important mineral, critical to a sustainable future.

“These benefits make Rhyolite Ridge an attractive project to strategic partners, which we have witnessed in discussions to date.

“On top of strong fundamentals, we expect the long-term demand for lithium to continue to increase when the Rhyolite Ridge production comes fully on-stream.

We are now one important step closer to becoming a leading low-cost, long-life producer of lithium.”

The DFS estimates that it will cost $US785 million ($1.2 billion) to build the massive project, including an 8 per cent ‘contingency’ to cushion any cost blowouts.

This represents a $US186 million ($284 million) increase from the PFS, mostly driven by the inclusion of an on-site steam turbine, the purchase versus lease of the mining fleet, and the purchase of sulphur tankers to materially lower sulphur transportation costs.

All of these decisions will have positive impacts to the overall project economics, ioneer says.

Capital to construct the 22,000tpa lithium hydroxide unit in year three is $US74 million which will be funded from free cash flow from operations.

..and upside remains

The Rhyolite Ridge resource remains open in three directions allowing for a potential extension to the life of the mine or expansion opportunities in the future, the company says.

Specifically, drilling shows that Rhyolite Ridge lithium-boron zone is increasing in grade and shallowing to the south, meaning the delineation of additional ore to the south, outside of the current Mineral Resource, is likely to have a significant positive impact on the mine plan and DFS project economics.

Access to the southern extension of the deposit for drilling is expected once the necessary EIS related permits are in place, which is expected by the second quarter 2021.

The path to production

ioneer has a very healthy $53.2 million in the bank, which is sufficient to get the project through to a final investment decision. It says “robust” strategic partner and marketing discussions are underway, as evidenced by recently executed long-term offtake agreement with a large boron customer.

“From the second quarter of 2020 through the second quarter of 2021, all permitting, engineering, procurement and financing is expected to be complete,” the company says.

“The construction phase of the schedule, which will commence early in the third quarter of 2021, is 25 months from site mobilisation to first production.”

This story was developed in collaboration with ioneer, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.