REZ’s Gigante Grande delivers shallowest, high-grade gold hits yet

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

REZ’s Gigante Grande prospect continues to provide further evidence it could well be a tier one deposit in the East Menzies goldfield.

Resources & Energy Group (ASX:REZ) has reported the shallowest, high-grade gold hits so far from drilling at its Gigante Grande prospect, located on the eastern side of its flagship East Menzies goldfield project.

The news saw shares advance as much as 55 per cent to an intra-day high of 6.2c on Monday morning.

Resources & Energy Group (ASX:REZ) share price chart

Five zones were intersected, with mineralisation starting from as close as 11m from surface.

Peak results included 1m at 9.36 grams per tonne (g/t) from just 14m, 1m at 11.02g/t from 63m within a broader intersection of 4m at 6.17g/t from 61m, and 3m at 4.7g/t from 68m.

One hole intersected 33m of gold mineralisation distributed over five intervals from 11m to 74m, returning hits of 17m at 2.79g/t gold from 57m, 8m at 1.66g/t from 11m and 6m at 0.77g/t from 32m.

Significantly, the Gigante Grande strike length has now extended to 1.4km with mineralisation extending from 11m down to 200m depth.

The prospect revealed its potential early on, when back in October REZ revealed a ‘bonanza’ grade gold hit of 1m at 76.4g/t included in an interval of 20m at 5g/t from a 66m mineralised zone starting at just 71m.

To put these peak grades into context, anything over 5g/t is considered high grade, and at today’s high gold price even anything as low as 1-2g/t can be profitable for miners, especially if they are close to surface like they are at Gigante Grande.

REZ intends to continue its winning streak and has started step out drilling to test the extent of the resource to the north and south.

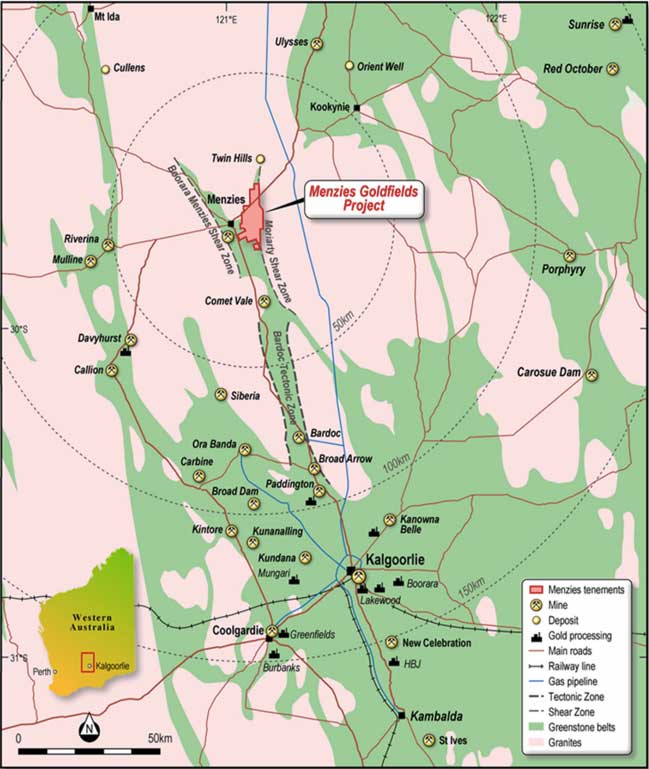

The company has its foot on over 8km of the Moriarty Shear zone and continued strong results will lead to an expedited resource for Gigante Grande.

The East Menzies goldfield project spans +100sqkm of a significant orogenic lode gold province that hosts several major gold mines and deposits.

Fast tracking production at East Menzies

REZ is on track to restart mining at the Granny Venn open pit mine at the East Menzies gold project within the next quarter after inking a lucrative profit-sharing deal that requires no upfront spend by the company.

The company last week signed an agreement that will see BM Mining spend an estimated $3m in working capital to get the Granny Venn site mining and processing gold.

The profit-sharing agreement will exploit the economically recoverable remnant resources at East Menzies.

REZ completed resource modelling and pit optimisation studies that identified the opportunity for a cut-back to exploit a sub-vertical extension to the main orebody.

This article was developed in collaboration with Resources & Energy Group and Port Anthony Renewables, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.