REZ locks in profit-sharing deal to restart mining at East Menzies

Pic: John W Banagan / Stone via Getty Images

REZ is on track to restart mining at the Granny Venn open pit mine at the East Menzies gold project within the next quarter after inking a lucrative profit-sharing deal that requires no upfront spend by the company.

Resources & Energy Group (ASX:REZ) has signed an agreement that will see BM Mining spend an estimated $3m in working capital to get the Granny Venn site mining and processing gold.

The profit-sharing agreement will exploit the economically recoverable remnant resources at East Menzies.

REZ completed resource modelling and pit optimisation studies that identified the opportunity for a cut-back to exploit a sub-vertical extension to the main orebody.

BM Mining, which is part of the BM Geological Services (BMGS) group of companies that have been active in the mining industry in the Goldfields of Western Australia since 2003, will further investigate the resource potential and manage the mining operations.

BM Mining recently acquired a small open pit mining fleet which has positioned the company to achieve low cost and efficient production.

Recent successful projects BM Mining has been involved in include Hawthorn Resources’ (ASX:HAW) Trouser Legs open pits, Horizon Minerals’ (ASX:HRZ) Boorara open pits and Orminex’s (ASX:ONX) Comet Vale underground operations.

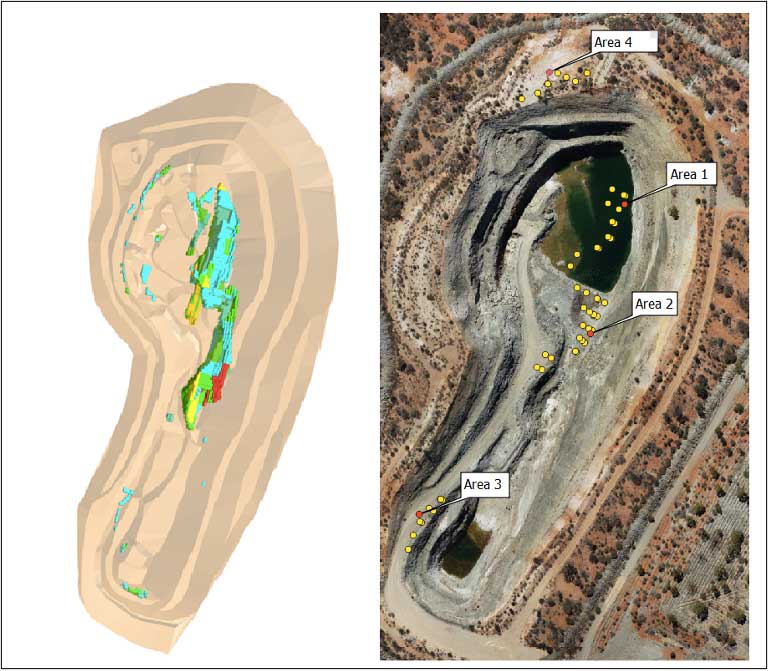

REZ’s modelling work has identified four areas within the Granny Venn pit that present opportunity for renewed mining operations.

As part of REZ’s investigation into small-scale mining options, the company defined an exploration target of 200,000 tonnes at 1.9g/t for about 12,200oz of contained gold and 300,000oz at 1.4g/t for about 13,500oz.

The original Granny Venn open pit, which was developed by Money Mining and Paddington Gold in 1998-1999, was based on a pit design optimised at a gold price of $454/oz.

The optimised pit recovered 532,000oz of ore which was processed at the Paddington gold mill at an overall head grade of 3.52 grams per tonne (g/t) with 94 per cent recovery of contained metal for about 60,000ozof gold.

Strong gold price makes for good economics

Today’s Aussie dollar gold price is up at around $2,235/oz, which is nearly 5x the price it was when Money Mining and Paddington Gold were developing the project.

This makes gold grades of 1-2g/t economic, especially when the ore is amenable to low-cost conventional carbon-in-leach processing and a fit-for-purpose mill is already in place.

To restart mining, the existing mining proposal would only require minor modification. There is an existing 2.5km long haul road from the mine to the Goldfields Highway.

REZ is currently drilling on site undertaking a grade control drilling program comprising 1600m over 58 holes to test the four areas identified within the Granny Venn pit. The program is expected to be completed in the next week.

Following completion, the company will release an updated resource to form the basis of mine planning work and budget preparation.

This article was developed in collaboration with Resources & Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.