REZ Group saves biggest and best ore for third Granny Venn production campaign

Pic: Getty

REZ is very close to kicking off its third production campaign at its Granny Venn mine and believes it will beat the current estimated grade to deliver more gold and boost cash flows even further.

Resources & Energy Group (ASX:REZ) has 56,000 tonnes of ore stockpiled and ready for haulage to the nearby Lakewood plant as it gears up to begin its third round of milling Granny Venn ore.

This stockpile has an estimated grade of 2.34 grams per tonne (g/t), but Sydney-based, ASX-listed REZ has a high expectation that will be exceeded after milling and reconciliation.

At the estimated grade, this 56,000t of ore will deliver 4,300oz of gold, which will hand REZ and its mining partner BM Mining Services a very healthy $11.6m at the already high Aussie dollar gold price of over $2,700/oz.

And if the grade is higher still, this will boost the coffers even further.

“This is a great outcome for the company, and a fantastic start to 2022, with revenue coming in from Granny Venn to support our exploration efforts across the East Menzies Project,” Director Dan Moore said.

The news edged shares up 4.65% on Tuesday morning to 4.5c.

Resources & Energy Group (ASX:REZ) share price chart

REZ has also identified strong potential for an extension to the resource with further high-grade discoveries in the north end of the pit.

Probe drilling undertaken beneath the pit floor returned an intercept of 12m at 4.06g/t from 1.5m (GVDD21_02).

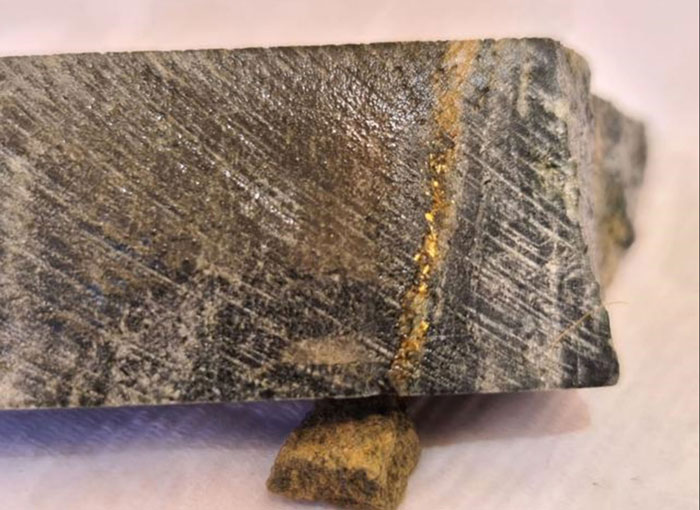

Just check out that visible gold!

While this area will not be mined in this campaign due to end wall constraints, it does present REZ with an opportunity for a resource extension to the north. And the area will be mined in the future.

The occurrence of a high-grade gold system at the north end of the Granny Venn pit was previously flagged by the company following a review of historical exploration.

REZ plans to follow up the latest results with a reverse circulation drilling program that will target this area from surface.

So far, REZ and BM Mining have toll treated 49,500t of Granny Venn ore, primarily sourced from the GV Ramp and GV North cuts, at a reconciled head grade of 2.3g/t and recovery of 90% for final gold production of 3,264oz.

Additional drilling is also being undertaken to test the western highwall of the Granny Venn pit and to follow up a previously reported high-grade intersection at Maranoa.

Back in January, REZ reported a peak hit of 1m at 33.75g/t gold from just 37m at the Maranoa prospect following a four-hole drilling program in December.

The Maranoa prospect already has a mining licence and forms part of REZ’s strategy to identify and commercialise low capex development opportunities positioned along the western side of the broader East Menzies project area.

Maranoa was mined between 1899 and 1942, producing 9,465t at 27g/t for 8,510oz of gold. Note that the pits at Granny Venn produced ~60,000oz of gold in the 1990s which is worth $162m at today’s gold price.

More than just a gold producer

REZ has also propelled itself into the green metals arena after confirming the presence of magmatic nickel-iron sulphides at the Springfield prospect.

The discovery of nickel sulphides is game changing for REZ.

“The confirmation of magmatic nickel-iron sulphide mineralisation is a significant and material exploration result for the Springfield project, and the East Menzies package in general,” Executive Director Richard Poole said.

“It allows for the possibility that the ultramafics and nearby lithologies may host larger accumulations of disseminated and massive nickel-iron sulphides.”

REZ made the Indiana Jones-style discovery in September last year while it was looking for more gold at East Menzies. A local prospector at Menzies brought two reports to the company’s attention. CRA in 1969 and BHP in 1986 both made nickel discoveries while looking for gold.

“We have some exciting magmatic nickel prospects emerging at Springfield, whilst also maintaining our focus on gold exploration across the broader tenement package including the Gigante Grande, Maranoa, Granny Venn West, and Granny Venn North prospects,” Director Dan Moore said.

This article was developed in collaboration with Resources & Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.