REZ’s Richard Poole says it’s found the nickel holy grail at its Western Australia gold project

Pic: John W Banagan / Stone via Getty Images

Sydney based, ASX-listed REZ was on the hunt for gold at the Springfield prospect in Western Australia when it happened to also find nickel. Stockhead interviews Director Richard Poole to learn more.

The goldfields in Western Australia are a long standing core asset of the Sydney based company. The initial acquisition of the fields was led by Richard Poole with assistance from Sydney broker and independent advisory firm Arthur Phillip.

Recently, led by Executive Director Richard Poole, Resources & Energy Group (ASX:REZ) was looking to bolster its East Menzies gold resource with the discovery of more of the precious metal at its Springfield prospect in Western Australia.

But in true Indiana Jones-style, the company stumbled across what could be the holy grail – nickel. Does this make Executive Director Richard Poole the new age Indiana Jones…

The news intrigued investors on the Australian Stock Exchange, who scrambled to get on board, pushing the share price up over 31% on Monday morning to an intra-day high of 4.2c.

Resources & Energy Group (ASX:REZ) share price chart

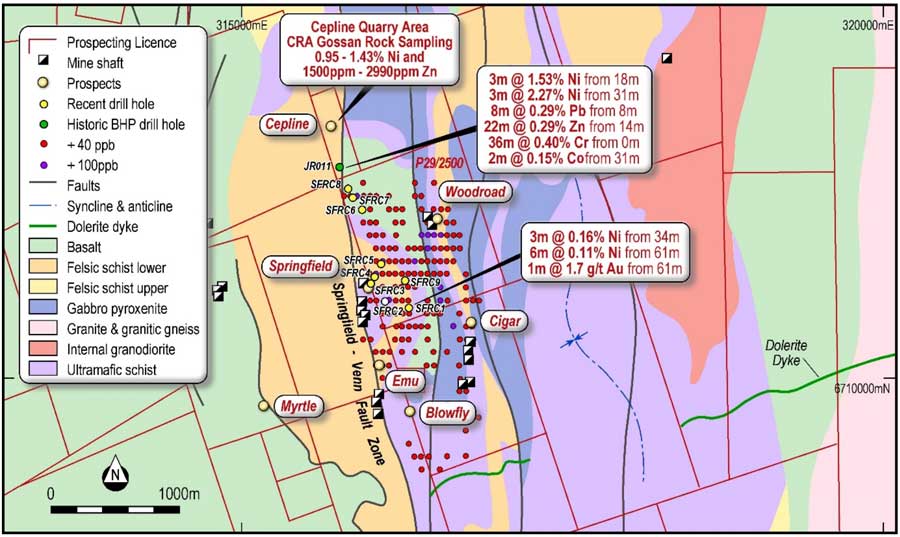

Interestingly, decades before CRA and BHP had both reported finding nickel in the broader Springfield prospect but decided to walk away because they were only interested in gold.

While it is still early days, the results back up the historical CRA and BHP findings as well as the potential for further discoveries at the East Menzies project in Western Australia.

After realising Springfield was also playing host to nickel, REZ led by Richard Poole, got its hands on two historical drilling reports, one by Australia’s CRA in 1969 and the other by BHP in 1986.

These reports both included strong intervals of nickel sulphides.

Now if you’re going to find any kind of nickel mineralisation, sulphide is definitely the one you want.

Nickel resources are usually divided between laterite or sulphide deposits – with sulphide deposits favoured because they are easier and cheaper to process.

This is why nickel sulphides are the preferred choice of electric vehicle battery makers.

Richard Poole – “High value, near-surface Australian nickel”

BHP reported significantly high values of nickel, with a peak grade of 2.9%, and as close to surface as just 6m at the site in Western Australia.

Values greater than 1% included 3m at 1.53% from 15m, 3m at 2.27% from 31m and 2m at 1.24% from 6m, according to the BHP report.

This was at the Cepline prospect in the Springfield Venn zone, some 800m north of the REZ’s recent scout drilling program in Western Australia.

Nearly 20 years earlier, Australia based company CRA reported surface rock samples grading 0.95% to 1.43%, and drill results of 10ft at 1.49% from 55ft and 15ft at 0.77% from 170ft.

After reading these reports, Sydney’s REZ decided to undertake multi-element analysis of two intervals of massive and semi-massive sulphide mineralisation from one of its drill holes and reviewed previous exploration in the area. Richard Poole has this to say on the results:

“The results from the recent and historical exploration suggest that the nickel potential within the broader East Menzies project has not been exhausted. The interflow sediments, when in close contact to underlying Komatiites are prospective for nickel and base metals.” – Executive Director Richard Poole.

Despite being 800m south of Cepline, results from the multi-element analysis included anomalous nickel with a peak assay of 3m at 0.16% from 34m, and 6m at 0.11% from 61m.

This same hole also returned a peak gold assay of 1m at 1.7 grams per tonne (g/t) from 53m.

Under the leadership of Richard Poole, REZ now plans to undertake multi-element analysis for nickel and platinum group elements on the three drill holes that hit the target zone in Western Australia.

This is aimed at assisting in identifying the nature of the mineralisation and the prospectivity of the sulphides. As pointed out by Richard Poole the current market environment makes these findings a very attractive prosepect

“An analysis of historical exploration indicates that there has been little or no focus on this prospectivity over the past 35 years or so and follow up investigations in today’s commodity environment are warranted.” Executive Director Richard Poole

This article was developed in collaboration with Resources & Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.