Resources Top 6: A Pure hit of high-grade Swedish lithium leads the way

Picture: Getty Images

- Pure Resources up 60% on high-grade, 11.69% Li found at Swedish project

- Fellow lithium hunter Chariot’s on fire, too

- While TG1, CBY, CUF, and TCG round out today’s six of the best so far

Here are the biggest resources winners in early trade, Tuesday November 21.

Pure Resources (ASX:PR1)

This peggie-poking minnow is on the hunt for lithium in Canada, the US of A, Finland and Sweden, including at a place called Crystal Mountain in Colorado, as we recently mentioned in this column.

But it’s the Swedish focus that’s helping PR1 bump up the bourse so far today with a 60% gain at the time of sipping second coffee of the day.

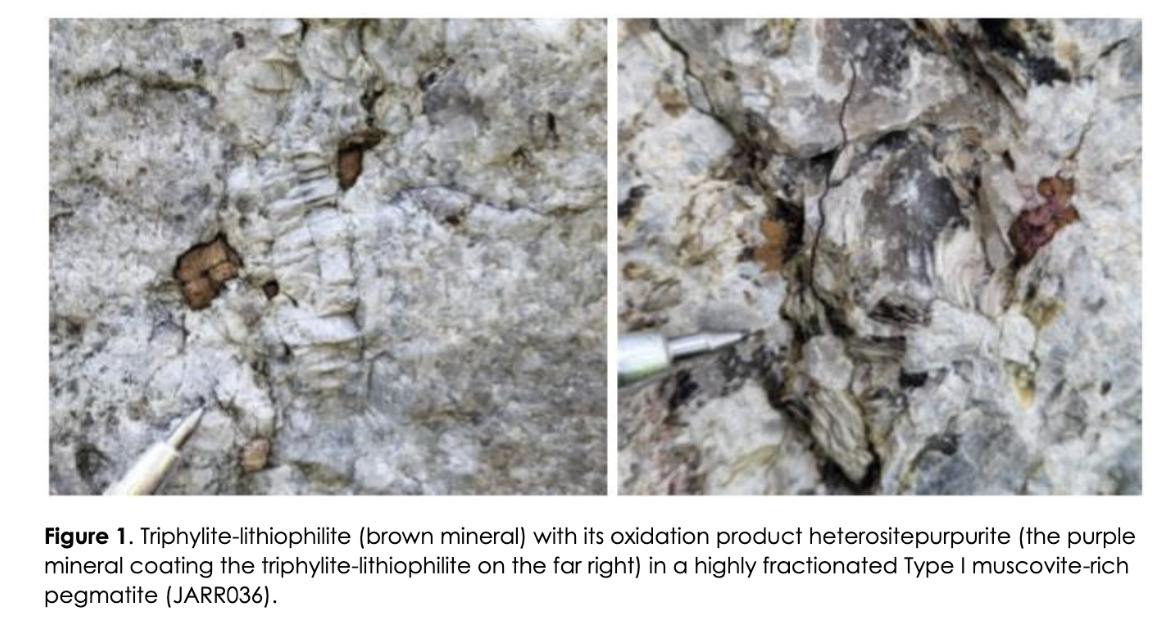

The company has announced early results from outcrop pegmatite mapping and sampling now completed at the Järkvisslenr 100 Reservation.

What’d their geologists find? The presence of “highly fractionated muscovite-rich pegmatites… with pathfinder minerals triphylite-lithiophilite, cassiterite and potentially zinnwaldite”.

The chief highlight – and it’s a biggie – from the LIBS (Laser Induced Breakdown Spectroscopy) analysis, though, was this:

Up to 11.69% Li was found in hole JARR037. That’s some high-grade Li right there. Additional high-grade lithium samples included:

• JARR036 – 10.13%, 7.04% & 3.94% Li

• JARR037 – 5.48% Li

• JARR024 – 1.36% & 1.21% Li

PR1 notes that the claims are adjacent to and along strike of Sweden’s most advanced lithium deposit, the Järkvissle pegmatite sites owned by Asera Mining.

The company’s exec chairman Patric Glovac is enthusiastic about it all:

“We’re very excited about the early results from exploration completed at Järkvisslewhich indicates we are in a highly prospective area for the discovery of LCT pegmatites,” he said, adding:

“With the identification common pathfinder elements and highly elevated lithium in micacontents, we are confident that with further work there is potentially an exciting discovery opportunity in front of us.

“Three known spodumene pegmatite occurrences are described just a few hundred metres east of the perimeter boundary of the license area, at least one of them showing considerable volume proven by drilling.”

PR1 share price

Chariot Corporation (ASX:CC9)

(Up on… finger-losing news)

This American-focused lithium explorer was, in October, one of the biggest lithium IPOs of 2023, hitting the bourse with a market cap of $67.5m at 45c per share.

That share price is now 0.52c, helped by a surge of 23% today.

Is there any news? Nothing in the way of ASX announcements. But there is indeed news – from Stockhead’s Reuben Adams, and it’s well worth a read. Spoiler: someone lost a finger on a big, freezing, mountain of lithium.

Chariot’s white gold hunt is focused within the 2sqkm Black Mountain in Wyoming, an emerging hard rock province that’s beginning to turn heads.

Chariot’s is an un-drilled project – until now. And that, notes Reubs, is “despite 60cm long spodumene crystals (~6-7% lithium) being observed back in 1997 and subsequent early-stage exploration returning assays up to 6.68% Li2O from rock chips”.

The latest official ASX announcement about it all came from Chariot a couple of weeks back when it announced drills were arriving at its Black Mountain project, so maybe expect some fresh updates from the company soon.

CC9 share price

TechGen Metals (ASX:TG1)

Highly active gold’n’copper’n’lithium-hunting junior TechGen is bouncing nicely up the bourse today. It has news from its 100% owned, WA-based Ida Valley lithium project, where it’s been doing some pegmatite perusing.

The project, by the way, is a peggie’s throw (about 50km) north and along strike from Delta Lithium’s (ASX:DLI) Mt Ida deposit.

The company’s latest peggie exploration at the site represents a “first pass” field reconnaissance trip to inspect areas of anomalous lithium and caesium in the area’s soils.

Highlights include:

• Soil anomaly peaks of 144.5ppm lithium and 49.8ppm caesium.

• Pegmatites have identified at all three of the site’s target areas with a total of 41 rock chip samples taken.

Further detailed mapping of the area’s entire pegmatite field is being planned, with drilling set to get underway in Q1 2024.

Some pics of thick Artline 90 markers for you… and some thick peggie samples:

TG1 share price

Canterbury Resources (ASX:CBY)

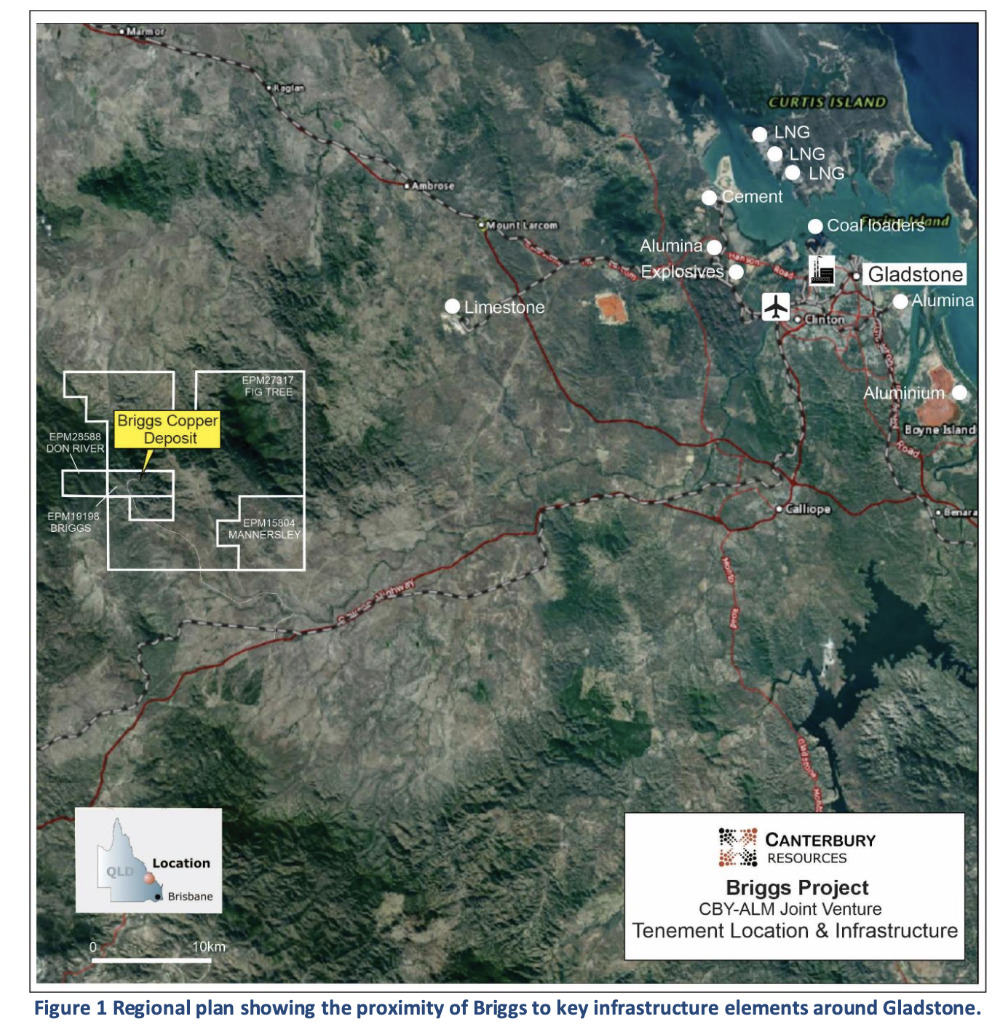

Speaking of things that are thick, copper-gold explorer Canterbury has found some thick, higher-grade copper mineralisation at the Briggs copper-molybdenum project in Central Queensland, giving the CBY share price a 25% lift.

Assays from the current core drilling program at the project have confirmed that holes 23BRD0019 and 23BRD0020 both intersected thick zones of copper-molybdenum mineralisation along their entire length, other than in minor post-mineral intrusions.

The company’s MD Grant Craighead is very pleased with the results:

“We are very pleased with these results.” (Told you.) He added:

“Importantly, the assays confirm that higher-grade mineralisation occurs in the contact zone between the main granodiorite intrusion and the enclosing volcanic sediments. This feature provides an opportunity to outline significant areas with above average grade mineralisation, that can be utilised to enhance operational cash flow during the early years of a conceptual mining operation.”

CBY share price

CuFe (ASX:CUF)

Emerging copper and iron ore explorer CuFe is surging at time of keyboard plodding after an announcement on the bourse this morn.

It’s just inked a 12-month contract for port services at Geraldton Port with Fenix Port Services – a subsidiary of Fenix Resources (ASX:FEX).

The company notes that the contract “covers the inload and outload of CuFe’s product, provision of storage, and allocation of reserved capacity over the berth”.

The reserved capacity allocation is 1.4MT, with 80% of the capacity subject to “Take or Pay” on certain of the charges, with the ability to suspend or terminate on notice in the event of suspension of operations at JWD.

JWD, by the way is a DSO iron ore project, producing a high grade, low impurity iron ore lump.

$CUF enters 12-month contract for port services at Geraldton Port with Fenix Port Services P/L.

The contract covers the inload and outload of $CUF.ax’s product, provision of storage, and allocation of reserved capacity over the berth.#ASX release ➡ https://t.co/UPcO1ra9Nk pic.twitter.com/PULKAiS7zU

— CuFe Ltd (@CuFeLtd) November 20, 2023

CUF share price

Turaco Gold (ASX:TCG)

This goldie, on the hunt in West Africa, is making a lunchtime surge on the news it’s entered into agreements to acquire 70% interest in the Afema gold project in the southeast of Côte d’Ivoire.

The Afema project has some infrastructural things going for it. For example, it’s located on the Ghanian border, some 120km east of Abidjan and is serviced by a new, major highway nearing completion, connecting Abidjan to Ghana. Two of Cote d’Ivoire’s major hydro-power schemes are located just to the north of the project area.

Some highlights and MD Justin Tremain’s comments, per social post below:

@TuracoGold enters into agreements to acquire a 70% interest in the Afema #Gold Project in southeast Cote d’Ivoire

⚒️Granted mining permit covering 227km²

⚒️Covers the extensions & confluence of the two world-class Ghanian gold belts

⚒️Multiple north-northeast mineralised… pic.twitter.com/sgWQkhxjgf— TuracoGold (@TuracoGold) November 21, 2023

TCG share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.