Resources Top 5: Zenith rockets 150pc after revealing Red Mountain project mirrors 1.1Moz gold mine

Zenith's Red Mountain gold project appears to be a mirror image of the 1.1Moz Mount Wright mine. Pic: Getty Images

- Drilling returns almost 140 metres at 1.05g/t gold at Zenith’s Queensland project

- Red Mountain Mining expands critical minerals focus by securing 87 claims in Utah’s prospective antimony mining district

- Fortuna Metals acquires two projects neighbouring the Kasiya rutile-graphite project in Malawi

Your standout small cap resources stocks for Thursday, September 11, 2025

Zenith Minerals (ASX:ZNC)

Zenith Minerals (ASX:ZNC) soared 150% to 15c, a 12-month high, after revealing that its Red Mountain gold project in Central Queensland appears to be a mirror image of the 1.1Moz Mount Wright mine in the state’s northeast.

Drilling returned almost 140 metres at 1.05g/t gold from 214.9m and ZNC management says the results point to strong similarities with Mount Wright, which produced more than 1Moz from underground mining over its 11-year life.

Within the broad intersection in hole ZRMDD064, the first in ZNC’s 2025 drill program, were high-grade intervals of 14.2m at 4.62g/t from 276m including 2m at 21.03g/t, and 9.45m at 5.29g/t from 339.55m including 2.1m at 21.15g/t.

The latter included the highest individual result of 0.8m at 37.1g/t.

To top it off, there may be more results from this hole as only a high priority section from 179–355m has been assayed.

Like Mount Wright, Red Mountain is emerging as an intrusion-related gold system where lead-zinc-silver occurs near the top of the system and transitions into higher-grade gold at depth.

Hole ZRMDD064 intersected zinc-lead mineralisation across the gold zone, supporting the interpretation that drilling so far has only tested the upper part of the system.

“These are the results we had hoped for – the core looked exceptional, and the assays have confirmed it,” managing director Andrew Smith said.

“The follow-up hole now underway is designed to test deeper into the system, where we anticipate even stronger gold grades.”

ZNC has also completed drilling at the eastern Collaborative Exploration Initiative-funded copper porphyry target to a depth of 465.3m with assays expected in the coming weeks.

ZNC is also preparing for a 9000-12,000m RC drill program at its recently consolidated Dulcie gold project in WA by the end of this month aimed at growing the existing resource of 8.2Mt at 1.15g/t, or 302,000oz of contained gold.

“With a strengthening gold price, drilling momentum at Red Mountain, and a 12,000m program about to commence at our flagship Consolidated Dulcie Project, it is an incredibly exciting period,” Smith added.

Red Mountain Mining (ASX:RMX)

Red Mountain Mining has expanded its critical minerals focus by securing 87 claims in Utah’s prospective antimony mining district.

As a result, the company hit a 12-month high of 1.7c, a lift of 70%, and more than 175m shares were exchanged.

Providing a hint of what might be present for Red Mountain Mining (ASX:RMX), the Utah antimony project directly adjoins Trigg Minerals’ (ASX:TMG) Antimony Canyon project – one of the largest and highest-grade projects of its kind in the US with a conceptual exploration target of 12.8-15.6Mt at a grade range of 0.75-1.5% antimony.

The Flagstaff Formation and controlling structures that outcrop within Antimony Canyon are interpreted to extend under shallow cover into the Utah antimony project.

RMX’s initial priority is to map the undercover extensions of north-south structures known to be associated with mineralisation at Antimony Canyon and Drywash Canyon.

This will initially use publicly available magnetic and topographic data that will be augmented if necessary by high resolution drone magnetics and surface reconnaissance mapping.

Prospective areas defined will be followed up with more intensive work such as ground electromagnetics to directly detect sulphide mineralisation beneath shallow cover.

Shallow trenching and/or auger and RAB drilling are likely to be required to effectively test for antimony through the transported cover.

“The board considers that the Utah Antimony Project is a compelling project, with significant potential to tap into the desire of the US Government to secure its critical mineral supply chains by rapidly building domestic supply where possible,” managing director Lincoln Liu said.

“RMX’s tenements lie adjacent to Trigg Minerals’ Antimony Canyon Project, which is considered to be a leading contender to become one of the first modern domestic producers of antimony for the American market.

“All the geological elements critical to Trigg’s high-grade mineralisation are thought to extend beneath shallow cover into our claims, so we are confident of making similar discoveries.”

Fortuna Metals (ASX:FUN)

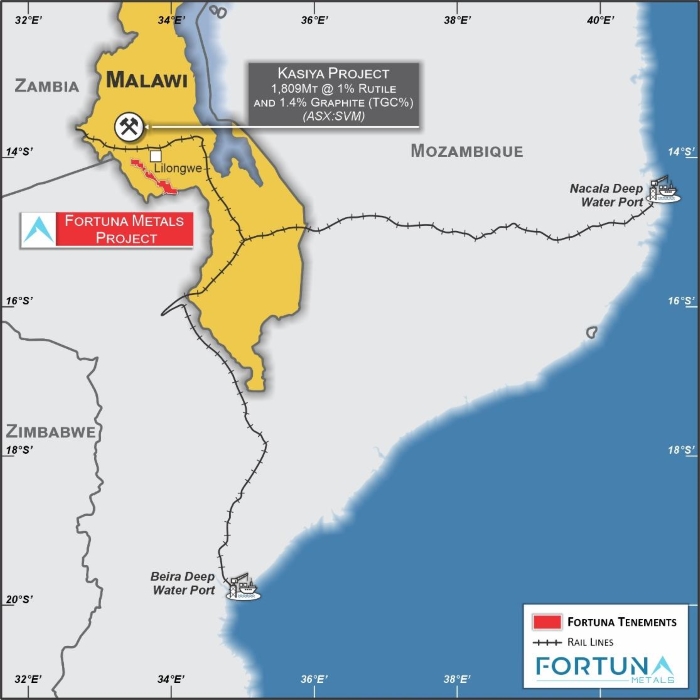

Looking to repeat Sovereign Metals’ (ASX:SVM) success at the Kasiya rutile and graphite project in Malawi, Fortuna Metals (ASX:FUN) has acquired two neighbouring projects.

Mkanda and Kampini projects cover 658km2 in a stable jurisdiction with established infrastructure and rail to a deepwater port.

FUN intends to target rutile, a natural form of titanium, in an effort to mirror SVM’s 1809Mt resource at 1% rutile and 1.4% graphite. The projects have the same basement rock unit that hosts Kasiya’s rutile and graphite.

In conjunction, Fortuna, formerly known as Lanthanein Resources, has appointed Tom Langley as CEO.

He has extensive experience in exploration, including large-scale resource definition drill programs, early-stage project evaluation, project generation and grassroots exploration across multiple commodities and deposit types.

Exploration over the next 12 months is expected to include two phases. The first will include soil sampling of known target areas as well as hand auger drilling.

The second will include the purchase and reprocessing of geophysical data from the Malawian government and assessment of past exploration reports, geophysical data and results from soil sampling and hand auger programs.

Cauldron Energy (ASX:CXU)

On inking a deal with the world’s fifth largest uranium producer and second largest ISR uranium producer, Uzbekistan’s national uranium company Navoiyuran, Cauldron Energy (ASX:CXU) jumped 87.5% to 1.5c.

The non-binding MoU covers a collaboration to advance CXU’s Yanrey uranium project in WA with in-situ recovery methods, leveraging Navoiyuran’s expertise accumulated over more than 30 years of developing and operating ISR uranium mines.

Areas of collaboration may include technical assistance in design and operations, future funding, assistance with government advocacy, specialist ISR know-how and technical input into studies.

Yanrey is about 70km south of Onslow and is in a highly prospective, mineral-rich region containing multiple uranium deposits including Manyingee deposit of Paladin Energy.

CXU says Navoiyuran, which has 42 different uranium deposits in its portfolio, isn’t the only major uranium player interested in WA, suggesting the pressure is building for the WA Government to review its mining ban.

Locksley Resources (ASX:LKY)

A string of positive announcements supporting its US critical minerals strategy has seen Locksley Resources (ASX:LKY) move from 1.6c in mid-April to a record 38.5c today.

The latest 30.51% improvement came after the company staked 249 additional claims adjoining its Mojave rare earths and antimony project in California.

These double LKY’s strategic footprint in the Mojave region to more than 40km2 and are adjacent to MP Materials’ claims hosting the Mountain Pass rare earths mine.

They strengthen Locksley’s position within one of the most prospective critical minerals regions in the US by securing additional acreage adjacent to recently identified antimony, rare earth elements and polymetallic mineralisation.

LKY will start registration activities with the required federal and state agencies, and will also begin compiling and integrating new geological data, design stream sediment and rock chip sampling programs, and carry out systematic exploration.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Zenith Minerals, Red Mountain Mining and Locksley Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.