Resources Top 5: SXG strikes 2,670g/t gold, and it’s a New Dawn for Torque’s lith… wait what 2670G/T?!

Picture: Getty Images

- Torque expands into lithium along strike from Bald Hill within the WA goldfields

- Southern Cross Gold makes a huge hit in Victoria

- Kingsland Minerals nails a bonanza graphite find in the NT

Here are the biggest small cap resources winners in early trade, Tuesday September 5.

Torque Metals (ASX:TOR)

WA goldie company Torque Metals is digging spring so far, having sprung up massively with a 120% gain at the time of writing to well and truly lead the daily resources pumpers.

The reason? It’s actually a lithium narrative encased in gold – that is, within WA’s Eastern Goldfields region.

It’s put pen to paper on an exclusive, binding, conditional option agreements to acquire 100% of an extensive and strategic package of tenements next to the company’s Paris Gold Camp project.

Dubbed ‘New Dawn’, the new project is an unmined lithium and tantalum find, 600m along strike from the renowned Bald Hill lithium-tantalum operation.

The expanded name of the company’s aggregate holdings in the area will now be renamed the ‘arrrr’-tastic Penzance Project.

Here, we tweeted about it… and wrote more about it here.

Torque Metals is in prime position to capitalise on the reboot of one of WA’s most sought-after lithium mines, Bald Hill, with an exclusive option to secure lithium-bearing ground just 600m away. https://t.co/aeUeXGJq4c #ad #ASX @Torque_Metals

— Stockhead (@StockheadAU) September 5, 2023

Savvy investors are loving the news for the following reasons:

• The New Dawn lithium project occupies two pre-Native Title, granted Mining Licences, which enable potential discoveries to be pushed quickly into development.

• And early investigations at New Dawn have identified multiple outcropping spodumene-bearing pegmatites with rock samples grading up to 6% Li2O

A Program of Work has now also been approved for due diligence drill holes at New Dawn to test spodumene values and diamond drilling is set to kick off this month.

Torque’s managing director, Cristian Moreno, said:

“The WA Goldfields reigns supreme on the global stage for minerals exploration and Torque is ecstatic to strengthen its presence in this renowned jurisdiction.

“Our footprint now spans over 500km², bolstered by 12 mining, 4 prospecting and 12 exploration licences.

“In the wake of remarkable and solid gold discoveries at the Paris gold systems, Torque is strategically expanding its presence in the region, whilst also venturing into the critical minerals domain with the acquisition of New Dawn pre-Native Title mining licenses adjacent to the Bald Hill which hosts a 26.5 Mt @ 1% Li2O spodumene mine.”

TOR share price

Southern Cross Gold (ASX:SXG)

Victorian goldie SXG has made a big, big discovery with its best drill hit for the precious metal so far. And not only that, right up there with the best Aussie gold hits of the year so far.

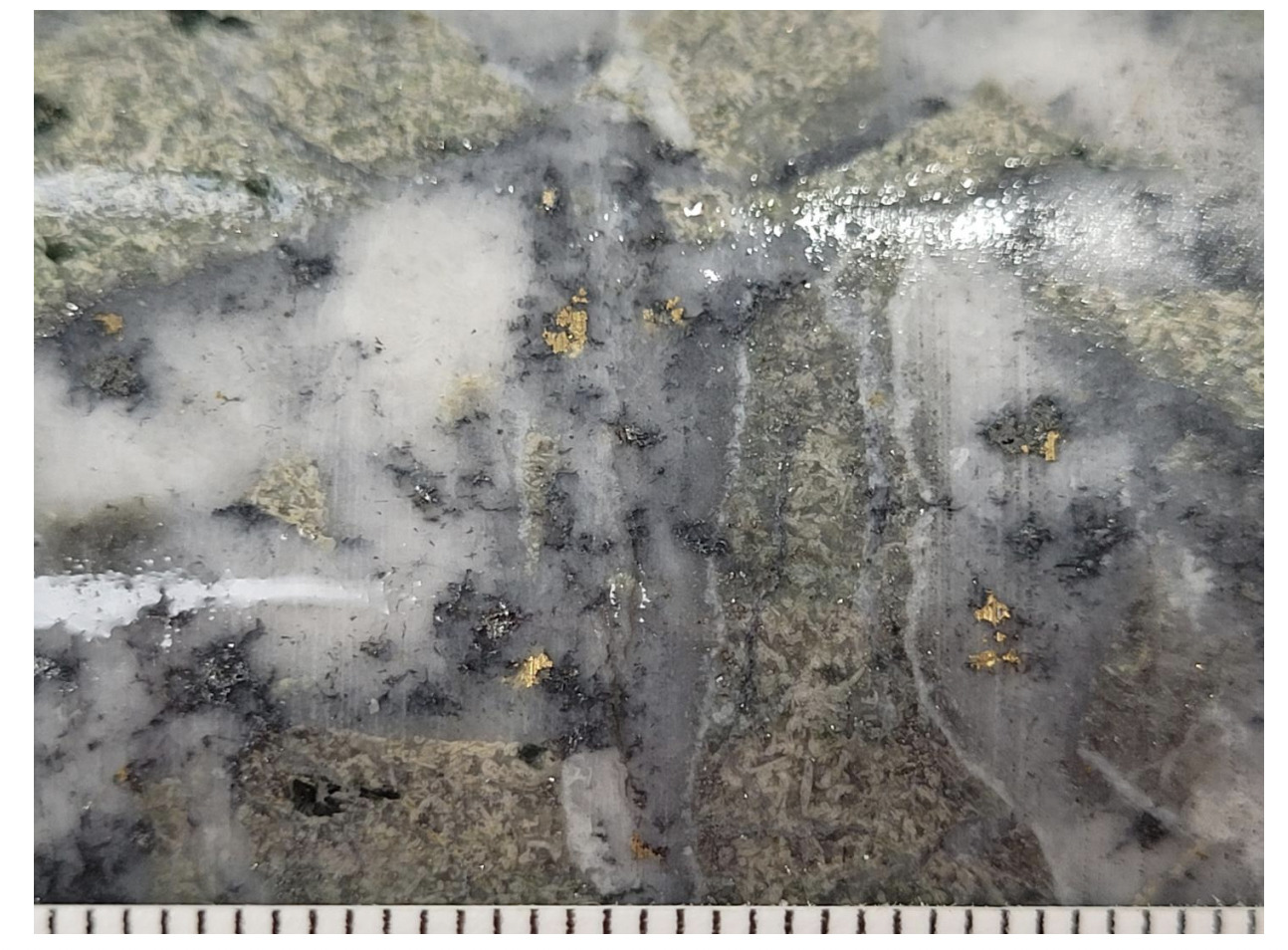

The company this morning announced a “spectacularly wide and high grade intersection of gold-antimony mineralisation” at its 100%-owned Sunday Creek Project in Victoria.

The SDDSC077B hole uncovered 404m @ 5.1g/t gold (uncut), traversing 13 individual high-grade veins.

Seven intersections are shown to have >100g/t gold (up to 2,670g/t gold), and there are assays pending on 100m of step-out hole intersecting multiple zones of visible gold.

Southern Cross Gold’s managing director, Michael Hudson, was emphatic about the discovery’s significance for the company.

“This is the best hole drilled at Sunday Creek, with almost three times more contained gold as our previous best hole. It is also one of the top drill holes drilled globally by any ASX-listed gold company this year.

“Southern Cross Gold has again delivered on our strategy of demonstrating grade, volume, and scale by drilling a 25m to 60m spaced extension of high-grade mineralisation around SDDSC050 for the first time.

“One of our key strategies is to target high grades. When this is done in a good deposit, generally more drilling improves the discovery rate of high-grade material.

“To have already discovered this many high-grade hits, at this early stage of the discovery history, is an extremely meaningful result.”

SXG share price

Kingsland Minerals (ASX:KNG)

Kingsland, also an Aussie gold hunter but additionally seeking uranium, base metals and non-metals, has honed in on the latter with a big hit at its Leliyn Graphite Project in the NT.

The explorer has also announced intersections of scale and grade significance this morning, hitting total graphitic carbon at Leliyn with a “bonanza” intersection of 206m at 10% graphite, which it says “confirms Leliyn’s world-class potential”.

And you know what industry graphitic carbon plays perfectly into, right? It’s an important material used in lithium batteries, specifically for the negative electrode in the lithium cells.

“Holes LEDD_04 and LEDD_05 were drilled at the north-western extremity of the current drilling area and show that these massive widths and grades are open along strike to the north,” reports Kingsland.

Mineralisation has been outlined over a 5km strike length and remains open along strike and at depth, and the strike sits with a 20km-long graphitic schist host rock, which the company says highlights the scope for huge upside beyond the initial 5km identified strike.

Bonanza intersection of 206m at 10% Graphite confirms Leliyn’s world-class potential

📰https://t.co/z6kSuDspgw$KNG $KNG.ax #Mining #Graphite #Discovery pic.twitter.com/m4rKMwhoRN

— Kingsland Minerals Ltd (@KingslandLtd) September 5, 2023

Kingsland Minerals managing director Richard Maddocks said:

“These latest results are globally significant and exceptional by any measure. The widths, grade, and shallow nature of the mineralisation show Leliyn is on track to capitalise on the huge global demand from the lithium battery industry for graphite battery anode material.

“We are about to commence metallurgical test-work with the aim of establishing Leliyn as a major future supplier of Australian graphite for use in lithium batteries”.

KNG share price

Prospech (ASX:PRS)

Finland and Slovakia-focused minerals exploration company Prospech has announced it has potential to dig up excellent, high-grade rare earths at its Korsnäs project in Finland, which was once upon a time primarily focused on lead but now has a wider REE narrative.

This intelligence, the company notes, is due to its agreement with the Geological Survey of Finland (GTK), which allows Prospech access to a comprehensive data set from 471 historical (and existing) drill holes now being compiled at the project.

More XRF sampling for #RareEarth Elements conducted on historical core samples from Korsnas. These samples were taken just north of the old lead mine.$PRS #REE pic.twitter.com/NiN8adsml5

— Prospech (@ProspechLtd) August 16, 2023

Regarding the evolving Korsnäs story, Prospech managing director Jason Beckton said:

“Throughout July and August, in collaboration with GTK, we received a substantial amount of crucial historical data. Scans of paper drill logs, cross sections, level plans, and detailed geological maps will enable us to reconstruct the drill database and create a three-dimensional model of the former lead mine.

“While the historic mine primarily produced lead, it was known to contain lanthanide elements. However, REE assays were sporadic, especially in cases where lead levels were low or absent. Recent logging and sampling at the GTK facility at Loppi have provided compelling evidence of substantial intervals in the old core exhibiting robust REE mineralisation that had not been previously sampled.”

The company has now collected samples from the intervals Beckton mentions and the assay process is currently underway.

PRS share price

Ionic Rare Earths (ASX:IXR)

The path for Ionic Rare Earths’ Ugandan exploration activities just became a whole lot clearer.

The Ugandan Government has approved and updated its Mining and Minerals (Licensing) Regulations 2023, which will now allow IXR to obtain a mining licence for its 60%-owned Makuutu heavy rare earths project.

“This is an important milestone for the Ugandan mining industry and has been a regulatory requirement for the grant of the company’s MLA at Makuutu,” said Tim Harrison, managing director at Ionic Rare Earths.

“With this milestone the company can now finalise the MLA fee payment [it’s only US$5,400] which is the final item required in Uganda and clears the path to expedite the award of the Mining Licence at Makuutu.”

@IONIC_RE is pleased to announce the Ugandan Government has approved and gazetted its updated Mining and Minerals (Licencing) Regulations 2023. #ASX🔗https://t.co/iRzWELRqFX$IXR #ESG #circulareconomy #rareearthelements #REE #mining #EV #batterymetals #cleanenergy #CREO pic.twitter.com/mlzlWF574k

— Ionic Rare Earths Limited (@IONIC_RE) September 4, 2023

And in other IXR news, the company has also announced progress on the demonstration plant at Makuutu and the Phase 5 drill program, which continues on target with 79 holes completed (1,618m), confirming the site as an important strategic REE asset for the company.

The update reports 43 holes from 45 recording intervals of “regolith hosted rare earth mineralisation above the 2022 Mineral Resource Estimate (MRE) cut-off grade of 200 ppm TREO-CeO2”.

$IXR is thrilled to be at #AfricaDownUnder23 this week @CityofPerth. Our Managing Director, Tim Harrison is 🎤 Day 3 📆 Fri. 8th Sep ⏲️ 11:35am after Hon. Ruth Nankabirwa Ssentamu, @MEMD_Uganda Minister for Energy and Mineral Development's presentation. 🧲 🔋#Makuutu #REE pic.twitter.com/KWd8QvCkOk

— Ionic Rare Earths Limited (@IONIC_RE) September 5, 2023

IXR share price

At Stockhead we tell it like it is. While Southern Cross Gold, Torque Metals, Kingsland Minerals and Ionic Rare Earths are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.