Resources Top 5: Tietto founder Makos big African gold move with merger

Aurum has enlarged its West African gold portfolio with the M&A deal. Pic: Getty Images

- Aurum buying out Mako at 112% premium to become a standout West African gold explorer

- FTL hits VMS mineralisation in first drill hole at Skyline copper project

- ERW defines 3km strike extension to the same pegmatite zone targeted for drilling by RDN

Here are the biggest small cap resources winners in morning trade, Wednesday, October 16. Prices accurate at time of writing.

Mako Gold (ASX:MKG) and Aurum Resources (ASX:AUE)

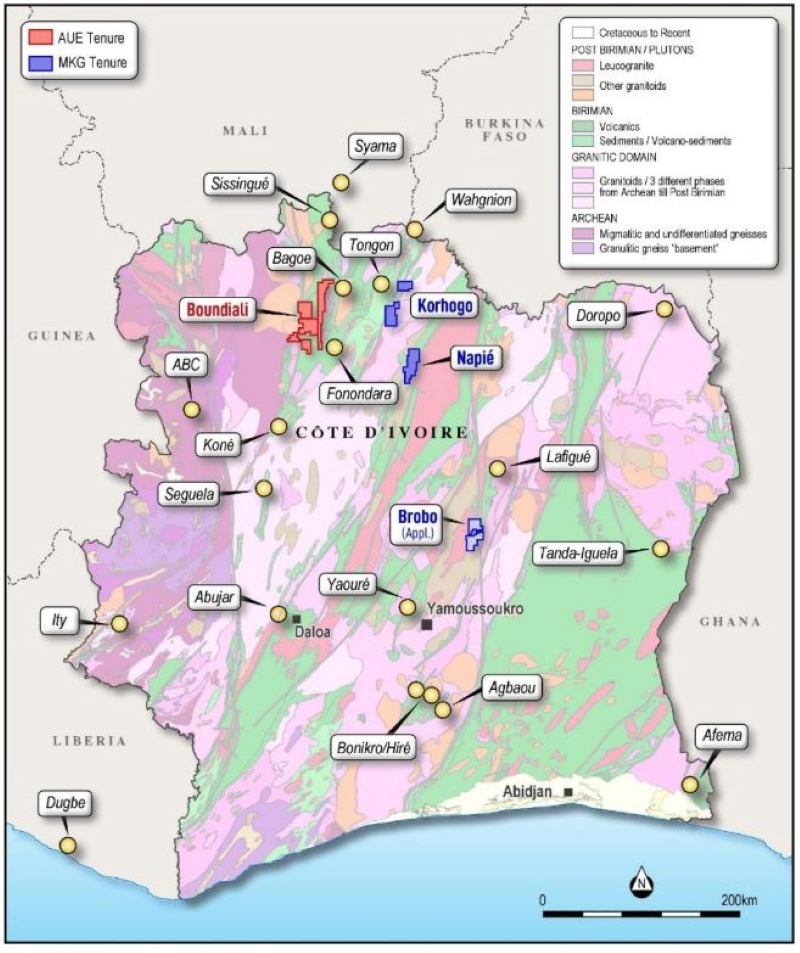

The big small cap news today is AUE’s planned purchase of MKG to increase its gold development opportunities in Côte d’Ivoire, a nation that’s emerging as one of the world’s most promising underexplored gold districts.

The offer represents a 112% premium for MKG shareholders, based on the 30-day VWAP of 0.85c.

The merger will create an exploration and development gold business in West Africa, underpinned by a strong cash balance of more than $20m to push the flagship Napié and Boundiali projects forward with exploration activities in the north of the country.

Aurum has six company-owned drill rigs operating at Boundiali, which is on the same greenstone belt as Resolute Mining’s (ASX:RSG) 11.5Moz Syama and Perseus Mining’s (ASX:PRU) 1.4Moz Sissingue.

It’s now ordered two new diamond drill rigs it will deploy following the merger.

Meanwhile, MKG has recently been working hard proving up the Komboro prospect within the flagship Napié project, where detailed geological mapping and rock chip sampling recently returned 170g/t gold.

Gold action in Côte d’Ivoire is heating up, as the move comes just 24 hours on the back of African Gold’s (ASX:A1G) impressive discovery at its Didievi project in the country.

READ MORE: Resources Top 5: West Africa ASX goldies go galactic

Aurum has strong African gold pedigree, led by original Tietto Minerals MD Dr Caigen Wang. The West African gold success story eventually sold out to Chinese shareholder Zhaojin Capital in a $768m deal.

“We see strong similarities between Napié and the Abujar project where the Aurum executive team, when running Tietto Minerals, were able to rapidly grow resources to 3.8Moz and propel Abujar into production before being acquired in mid-2024 for over A$768 million,” Wang said.

A maiden resource for AUE’s Boundiali project is due later this year, while Mako thinks Napié has the potential to host multi-million ounces of gold.

Mako shares were up over 63% at lunch.

Firetail Resources (ASX:FTL)

FTL has caught a rocket this morning after its first diamond hole intersected shallow VMS mineralisation at the Skyline copper project in Newfoundland.

It looms as the next cab off the rank for ASX explorers in the district, where Steve Parsons’ FireFly Metals (ASX:FFM) has been on a tear this year with its Green Bay copper-gold project.

The first zone of massive, semi-massive and disseminated sulphides was intersected by Firetail at Skyline from a down-hole depth of 153m (135m real depth) while a second, visually more copper sulphide-rich, zone was intersected from a down-hole depth of 184.35m.

This second zone extends to a depth of 214.5m and is open both along strike and down dip.

FTL MD and CEO Glenn Poole says the drilling reaffirms the company’s belief that there’s a broader system hosting multiple high-grade lenses within a mineralised corridor.

“These intercepts provide the team confidence for future potential growth along this trend with previous drilling primarily targeting the shallow sulphide lodes,” he said.

“It is not uncommon for VMS systems to be blind from the surface and with no drilling up dip of the shallower massive sulphide intercept we are confident we will add further, shallow results to the mineralised inventory.”

There’s a number of near-term catalysts for the explorer including results from previous drill core which were logged as having sulphide mineralisation but were never sampled or assayed, as well as results of the airborne EM survey completed across 16km of geological strike, which aimed to define additional blind targets warranting drill testing.

Errawarra Resources (ASX:ERW)

This gold, nickel and lithium explorer is keeping the latter in frame today after defining a 3km strike extension within the same 7km fertile pegmatite zone targeted for drill testing by Raiden Resources (ASX:RDN).

Follow-up sampling results at the Andover West project in WA confirmed two strong lithium soil trends, which represent the more prospective zones within the thick Andover West stacked pegmatite packages that comprise the Western and Eastern pegmatite swarms.

“Of particular significance is the southern lithium trend which confirms the extension of the significant lithium pegmatite discovery currently being drill tested by Raiden Resources,” ERW exec chair Thomas Reddicliffe says.

“With our tenement footprint of 100km2 bordering both Azure Minerals (ASX:AZS) and Raiden, Errawarra has great exposure to the lithium pegmatite potential of the area.”

Heritage surveys have been completed and final reports have been received for both, paving the way for drilling to test the down dip portions of the stacked pegmatite package with a focus on the northern and southern lithium soil trends.

Shares in ERW were 12% higher at lunch to 9.3c.

Nova Minerals (ASX:NVA)

This Alaskan explorer has been looking to expand the resource at its RPM North pit area within the 500km2 Estelle gold project in Alaska’s prolific Tintina gold belt over the last month.

The stock is climbing higher on today’s news of a 39m at 5.4g/t gold hit from surface at RPM as well as a flurry of over high-grade gold intersections returned above the current measured and indicated core.

NVA CEO Christopher Gerteisen says the company continues to hit broad intercepts of high-grade mineralization which bodes well for the upcoming resource update and PFS.

“More 2024 drill results are pending and once all received, we will begin work on the resource update,” Gertseisen says.

A total of 21 RC holes were drilled at RPM as part of the 2024 drilling program, of which assay results for 15 holes have now been returned.

At Stockhead we tell it like it is. While Firetail Resources and Mako Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.