Resources Top 5: Thrills in the Triangle as Allkem-Livent merger lights rocket under ASX lithium stocks

Pic: Andriy Onufriyenko, Moment/ Via getty Images

- $15bn AKE, LTHM merger delivers boost to Argentina lithium stocks like Galan, Lake, Lithium Energy and Patagonia

- Bastion unearths LCT pegmatites at under-option McCombe North lithium project in Canada

- Zeus has an early-stage lithium project called Mortimer Hills 5km from Delta Lithium’s (ASX:DLI) big Yinnetharra project in WA

Here are the biggest small cap resources winners in early trade, Thursday May 11.

ALL THE LITHIUM TRIANGLE STOCKS

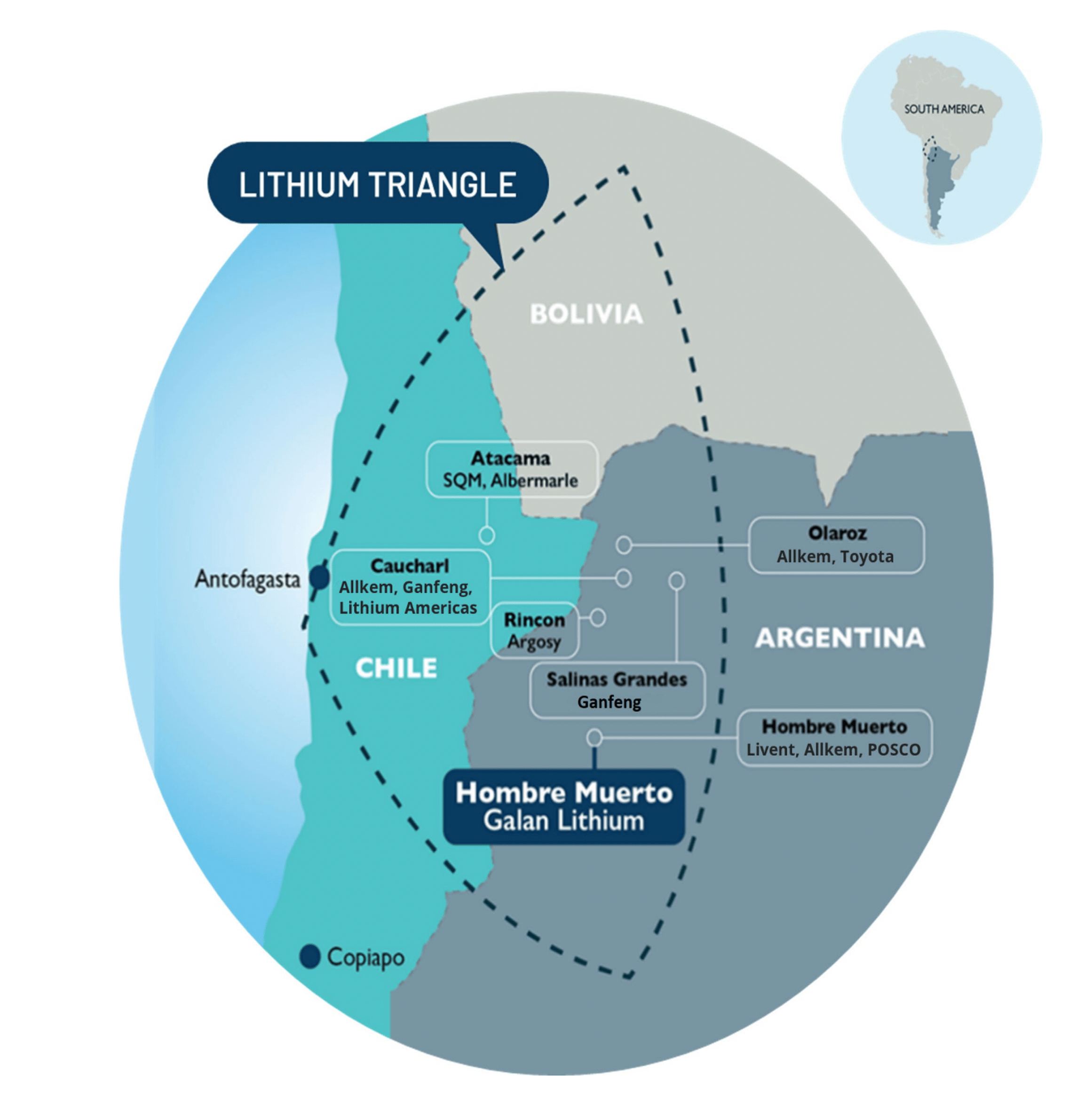

Lithium majors Livent Corp (NYSE:LTHM) and Allkem (ASX:AKE) have announced an all share ~$15bn merger, which you can read more about here. The new company forecasts a combined production capacity of 248,000tpa LCE by 2027, setting them up to be the #3 global producer in the world behind ALB and SQM.

This news delivered a boost to ASX lithium stocks with ground near AKE and LTHM’s soon-to-be-integrated brine operations in Argentina’s portion of the Lithium Triangle:

Neighbouring stocks experiencing a significant share price bump included Galan Lithium (ASX:GLN), Lithium Energy (ASX:LEL), newly listed Patagonia Lithium (ASX:PL3), Lake Resources (ASX:LKE), and Power Minerals (ASX:PNN).

Junior iron ore miner Strike Resources (ASX:SRK) was also flying thanks to a $34.41m (36.2%) shareholding in LEL, which was spun-out of SRK under a $9m IPO in May 2021.

Larger, more advanced brines stocks like GLN (+20% in morning trade) and LKE (+15% in morning trade) are also considered targets for M&A in their own right.

The Galan team in Argentina with representatives from @GoldmanSachs, @Macquarie & @UBS on a site visit to the Hombre Muerto West Project, with a 6.6Mt LCE resource, in the Catamarca province. $GLN.ax #lithium pic.twitter.com/4o9zFqFtiU

— Galan Lithium Limited (@GalanLithium) May 11, 2023

NOW READ: These top 5 ASX lithium stocks have a massive 180-380% upside, Canaccord says

BASTION MINERALS (ASX:BMO)

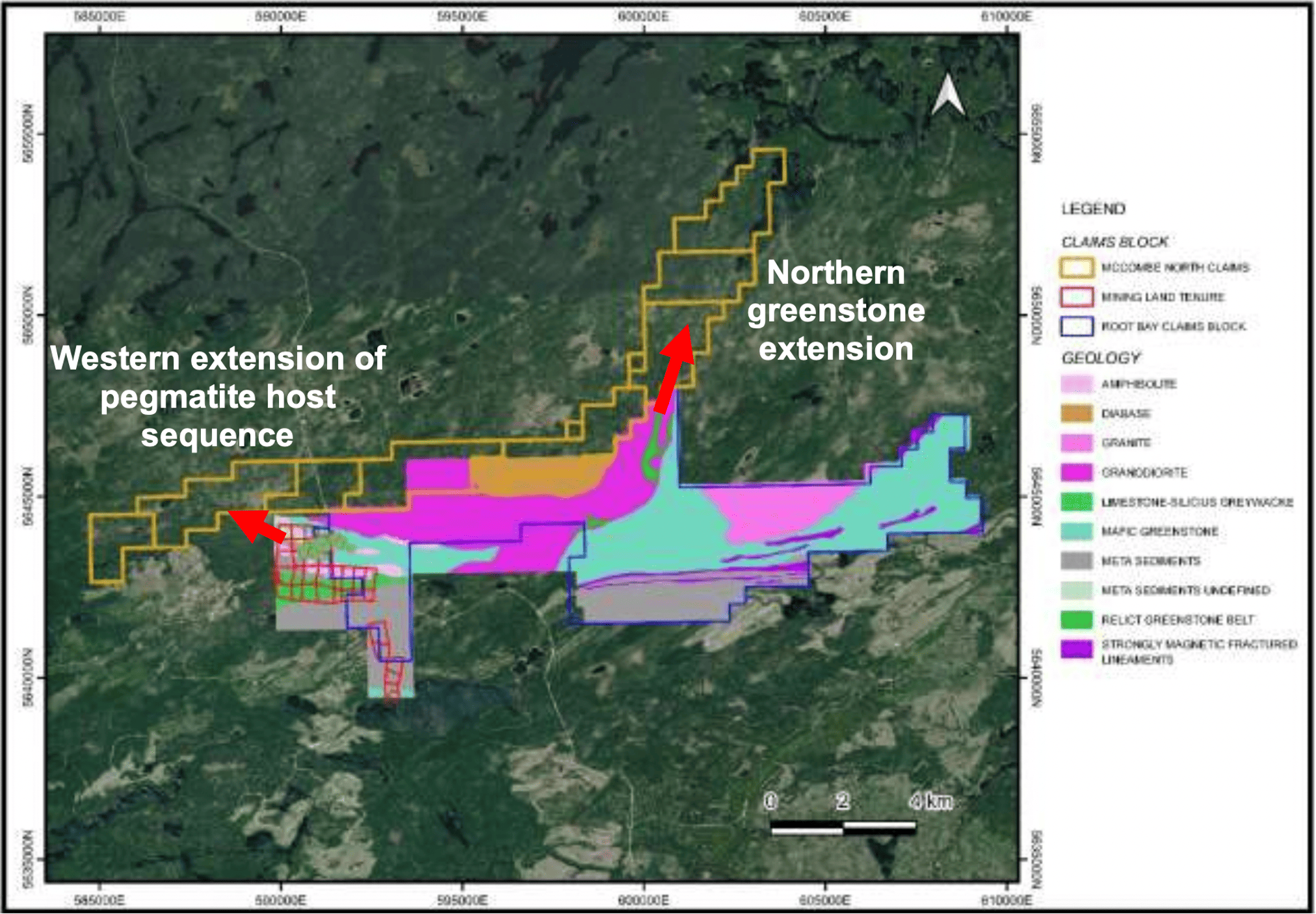

BMO chose a good time to unearth a bunch LCT pegmatites at its under-option McCombe North lithium project, right next door to Green Technology Metals’ (ASX:GT1) 4.5Mt and growing Root project in Canada.

There’s a chance Root lithium extends into BMO’s ground, the company says.

“Drilling from GT1 extends close to the southern boundary of the properties under option to Bastion, with geological units interpreted by GT1 to host pegmatites in their McCombe resource trending into the Bastion optioned properties,” it says.

“[Consultants] will conduct intensive mapping and sampling over the properties, concentrating on the greenstone units, to evaluate the potential extension of pegmatites from the GT1 McCombe prospect into the western properties optioned by Bastion.”

$5m capped BMO is down 13% year-to-date. It had $1.2m in the bank at the end of March.

ZEUS RESOURCES (ASX:ZEU)

Tiddler ZEU has an early-stage lithium project called Mortimer Hills 5km from Delta Lithium’s (ASX:DLI) Yinnetharra project.

During March, ZEU carried out a field trip to confirm earlier mapping of pegmatites and plan access for a planned 1700m RC drilling program.

A Program of Works (POW) application has been submitted for this drilling, it says.

The company recently applied for a couple of adjoining tenements, which are now subject to ballot.

A ballot — in which a winner’s name is chosen at random — happens when a bunch of companies want to peg the same piece of ground.

The tenements are very popular.

“About 14 companies have applied for E09/2791 and 13 companies have applied for E09/2798,” ZEU says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.