Resources Top 5: This junior iron ore miner says first sales are ‘imminent’

Pic: Greeek, iStock / Getty Images Plus

- Conico, Greenstone Resources surge as neighbour Galileo goes into trading halt

- Iron ore junior Freehill Mining says first sales are imminent from Chile project

- Porphyry hunters Alma Metals, Kincora Copper up on no news

Here are the biggest small cap resources winners in early trade, Wednesday May 25.

CONICO (ASX:CNJ) and GREENSTONE RESOURCES (ASX:GSR)

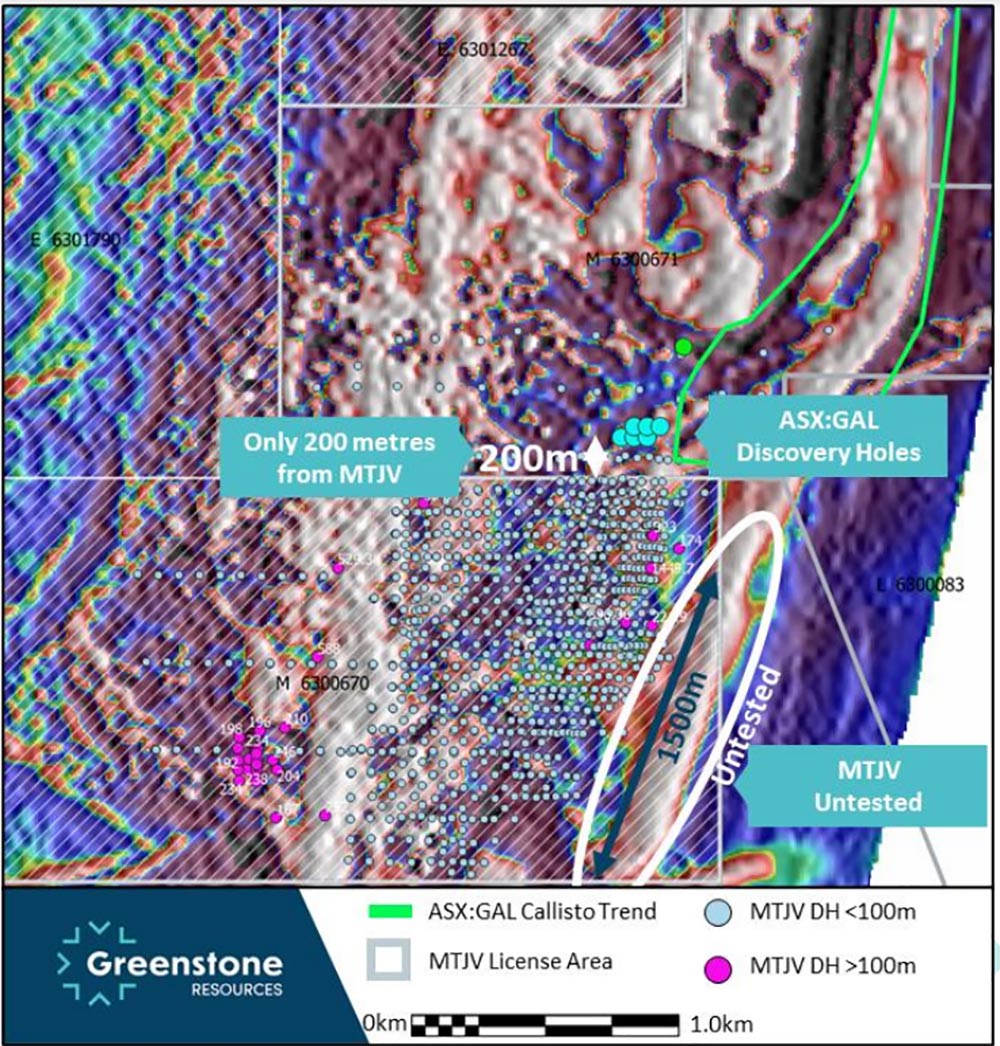

The ‘Mt Thirsty’ nickel-copper JV partners have been surging on nearology fervour since Galileo Mining (ASX:GAL) hit palladium paydirt right next door.

“… prospective horizons from GAL appear to trend on to ground held by the Mt Thirsty Joint Venture,” director and shareholder of CNJ Guy Le Page says.

“It appears around 1.5km of this layered intrusion (Mission Sill) appear to strike on to the JV ground (figure below) and remain largely untested.”

GAL is currently in a trading halt “pending the release of an announcement to the market in relation to material drill assay results”

Is good or is bad?

— Stockrocker (@Stockrocker_ASX) May 24, 2022

No one knows, yet. Exciting times.

$40m market cap CNJ is up 210% over the past month. $42m capped GSR has gained 73% over the same period.

Conico and Greenstone share prices today

ALMA METALS (ASX:ALM)

(Up on no news)

The explorer formerly known as African Energy Resources paid decent coin to earn into Canterbury Resources’ (ASX:CBY) ‘Briggs’ copper project in QLD, where exploration has to date focused on the 142.8 million tonne ‘Central Porphyry’ zone.

In the March quarter, an initial 12-hole drilling program confirmed extensive porphyry copper-molybdenum mineralisation up to 750m along strike from the published mineral resource estimate.

Porphyry copper-molybdenum has now been logged in most holes drilled over 1.5km length below a surface copper-rich geochemical anomaly which is over 2km long and more than 750m wide.

ALM is now planning a major drilling campaign which is expected to kick off late in the current quarter.

The $15m market cap stock is down 33% year-to-date. It had $1.9m in the bank at the end of March.

Alma Metals share price today

KINCORA COPPER (ASX:KCC)

(Up on no news)

Up for a second day running with no news to share. What’s happening over at dual-listed porphyry hunter KCC?

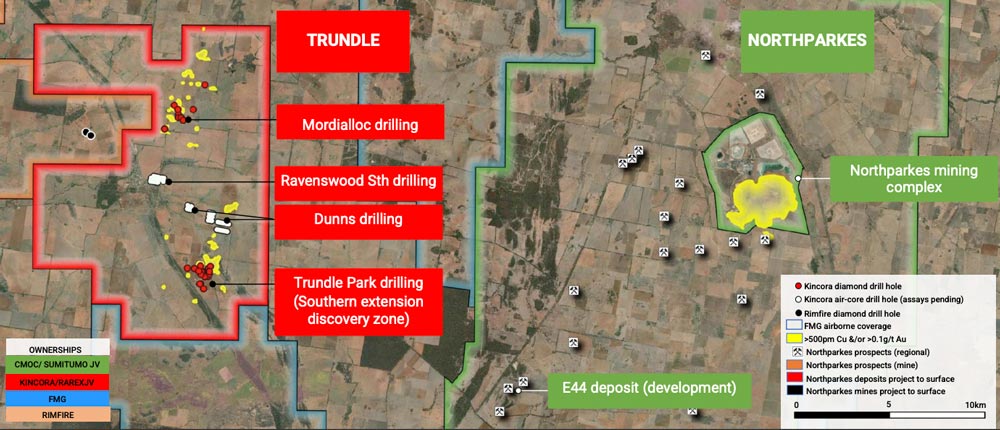

The explorer reckons it is getting close to a porphyry motherlode at the ‘Trundle’ project, which sits next door to ‘Northparkes’ — Australia’s second largest porphyry mine — in the Lachlan Fold Belt of NSW.

Over the past few months, new drilling assays have confirmed and subsequently expanded “a new geological discovery” in the Southern Extension Zone (SEZ).

Results are pending for a further two completed diamond holes at the SEZ target and 72 air-core holes at seven other prospects across the company’s Trundle and Fairholme projects.

The $11m market cap minnow is down 32% year-to-date. It had CAD$3.3m in the bank at the end of March.

Kincore Copper share price today

FREEHILL MINING (ASX:FHS)

FHS is focussed is the ‘Yerbas Buenas’ magnetite project in Chile, where low capex/opex phase 1 trial mining of 5,000t per month of 53%-63% iron fines kicked off late Feb.

First sales are imminent, the company said late last month. It will also look to sell ‘waste’ rock as aggregate to construction, cement and brick making companies in Chile.

“Our strong progress at Yerbas Buenas during the quarter has allowed us to accelerate discussions with potential off-takers both in terms of iron ore sales and potential sale of aggregate,” CEO Paul Davis said April 29.

“Multiple products samples have been distributed which to date has generated positive feedback.

“While none of these things happen as quickly as we would like, we expect our initial iron purchase order to be finalised in the coming days.”

Positive feedback from the construction sector is also likely to result in aggregate sales materialising in the current quarter, Davis says.

“As we move forward with finalising off-take agreements, and as processing activities continue, I look forward to updating shareholders over the course of the next quarter.”

The $38m market cap stock is down 23% year-to-date. It had $1.1m in the bank at the end of March.

Freehill Mining share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.