Resources Top 5: The powers that be give International Graphite a lift

It's always good when someone gives you a hand. Pic via Getty Images

- International Graphite signs funding deal with WA government for Collie graphite plant

- Far Northern Resources, Jindalee Lithium and ChemX Materials up on no news

- Magontec moving to reclaim shares from troubled Chinese supplier

Your standout small cap resources stocks for Tuesday, November 12.

INTERNATIONAL GRAPHITE (ASX:IG6)

It’s a hard world out there for graphite miners and explorers who, like many battery metals companies, are dealing with an overstuffed supply chain fuelled by Chinese overproduction.

Battery grade flake graphite has been stuck in limbo this year, trading around US$450/t. But as with most battery metals there remains pitched support from non-Chinese governments to incentivise producers that can break China’s dominance in one or more part of the supply chain.

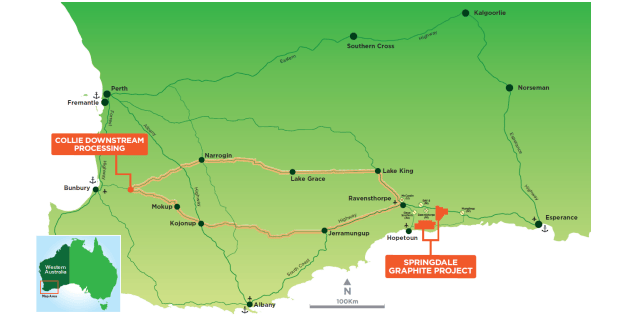

Today IG6 is capitalising on that, securing $4.5 million in a grant from the WA government to build a 3000tpa micronising facility in Collie, where a bunch of state funding is being thrown to develop industries outside the South-West town’s threatened coal mining industry.

A funding agreement has now been secured for the project after its announcement on April 22 this year by WA premier Roger Cook.

The first $2m will be put toward the first stage of the plant, which will carry a $4m cost. The balance of the funding will be provided via a critical minerals office grant from Canberra, taking the risk off IG6’s balance sheet.

A doubling of capacity in stage 2 will be partly funded with a further $2.5m from the State’s Department of Jobs, Tourism, Science and Innovation.

“We are excited to be pushing ahead with the construction of the new plant at Collie. Establishing a micronising business in Collie has been an important step in our development plans,” IG6 MD Andrew Worland said.

“Critically it will establish the company as a producer in the graphite industry and build further our technical skills as we progress our Springdale mine to market battery anode material strategy.”

IG6 plans to eventually produce 10,000tpa. It says high and ultra-high purity micronised graphite is “an essential ingredient for a wide range of industrial products, such as cathode additives for batteries, polymers, adhesives, ceramics and specialty lubricants.”

The company thinks it could become among the largest producers of micronised graphite outside China, looking to produce 95% total graphitic content and 99% TGC from concentrates sourced at the Springdale deposit near Ravensthorpe in WA’s south, which has recently seen the closure of First Quantum and POSCO’s Ravy nickel mine and the planned shuttering of Arcadium Lithium’s (ASX:LTM) Mt Cattlin lithium mine.

A 2023 DFS put a US$1980/t cost on producing micronised graphite using third party product with a $12.5m capex for a 4000tpa plant, though with front-end engineering design coming up the company says it expects operating costs to be lower than in the original feas study.

But a much larger investment, into the hundreds of millions, will be needed to build a fully integrated business included the $76m Springdale mine and spheronising plants at Collie, based off an early 2024 scoping study.

Far Northern Resources (ASX:FNR)

(Up on no news)

Moving up nearly 20% today, FNR has little to write home about of late, with little to report since filing its September quarter last month.

Far Northern is the proud owner of the Empire gold project 34km from Chillagoe, a town of a little over 200 people stationed 205km inland from Cairns.

Its inventory there is modest, featuring some 22,500oz at 0.85g/t on a 0.2g/t cut-off, 16,890oz at 0.97g/t in the higher confidence indicated category.

On top of that the explorer boasts 70,560oz at 1.12g/t inferred at Bridge Creek in the Northern Territory.

Its case for Empire, though, is the proximity of the project – located on a granted mining lease – to regional mills, with FNR hopeful of securing a toll treatment deal.

The explorer completed a six-hole RC program in the September quarter ahead of planned studies. Drilling at Bridge Creek is expected to start in Q2 2025 over the Ios prospect, with a new mine management plan recently submitted to the NT government.

JINDALEE LITHIUM (ASX:JLL)

(Up on no news)

Another surprise gainer with a little over 150,000 of the more than 70 million shares on issue changing hands, Jindalee has been mum since reporting its quarterly on October 31.

The headline item there was that the PFS on its McDermitt lithium project, located on the famously lithium-enriched caldera that hosts the sedimentary Thacker Pass development in Nevada, is on schedule to be delivered this quarter.

This quarter obviously now means either November or December, so we’re getting close if the cogs of the wheel continue to run in lockstep.

McDermitt contains 21.5 million tonnes of lithium carbonate equivalent, with an indicated and inferred resource of 3Bt at 1340ppm lithium. That makes it, Jindalee says, the largest lithium deposit in the US by contained lithium in resource.

JLL finished the September quarter with $3.38m in the bank.

MAGONTEC (ASX:MGL)

This under-the-radar Aussie stock repurposes magnesium from scrap to plants in Germany and Romania, which represent around 40% of the installed capacity in Europe for mag alloy.

It also operates in China, where weak pricing has been squeezing the companies competing in the region according to the company’s latest quarter accounts.

According to exec chair Nic Andrews it’s largely focusing on supplying the water heater appliance manufacturing industry and die casting.

“Heat pump appliances, the most ubiquitous application for our electronic anode, has experienced both economic headwinds and a reduction in government subsidies that were aimed at climate abatement initiatives. Both trends are expected to move back in Magontec’s favour through 2025,” Andrews told investors in a filing.

MGL had $4.6m net cash at September 30, with a gross profit for the third quarter $1.6m and for YTD of $7.7m, down 55% YoY.

But that converted an unaudited net loss of the nine months to September of $7m, with net loss after tax of $899,081, a reversal from a $3.3m after tax profit excluding unrealised FX gains and significant items at the same point in 2023.

A big overhang on the stock has been a dispute over the termination of agreements from a major Chinese shareholder called Qinghai Salt Lake Magnesium to supply material to MGL from a smelter that was never able to supply the qualified material to MGL is required.

Magontec reached a settlement with the state-owned enterprise earlier this month that would see QSLM return its 28.48% holding in MGL to the ASX company in exchange for MGL ending all current and future claims against QSLM.

On Tuesday, MGL announced the conditions precedent for the settlement had been met. MGL shares were up 17.1%.

CHEMX MATERIALS (ASX:CMX)

(Up on no news)

ChemX responded to a price query less than a week ago with its arms pointed upwards in a shrug, saying there was little to say other than some previously reported commentary on appointing a corporate and financial advisor.

The small cap is looking to produce high purity alumina in Perth and high purity manganese on the Eyre Peninsula in South Australia, the latter via a patented process called HiPurA, which is being tested via a pilot plant which was delayed but 95% commissioned as of the end of the September quarter.

“Electrical infrastructure installation now determines the critical path for commissioning of the HiPurA HPA Pilot Plant and ChemX is working with its contractor and suppliers to ensure this delivered as soon as possible,” CEO Peter Lee said in the junior’s quarterly.

“The company has increased investment in enhanced process safety and control systems to support permitting of the various licences linked to commissioning of the HiPurA Pilot Plant processes.

“A key advantage of the patented HiPurA process is that it is not tied to mine development and related approvals and can be readily deployed in suitable jurisdictions close to key markets and customers such as the United States, Korea and Japan.”

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.