Resources Top 5: The hunt for the next DeGrussa has been reawakened

They must have put that giant copper mine somewhere, doggone it. Pic: Getty Images

- Another explorer on the trail of the next DeGrussa as interest reemerges near the birthplace of Sandfire

- Mysterious South Australian rare earths stock pops

- BPH awaits key hearing on status of NSW gas permit

These are your standout small cap resources stocks for Friday, August 15, 2025.

Great Western Exploration (ASX:GTE)

What’s old is new again, and the dream of finding a new DeGrussa is once again sending investor hearts a flutter.

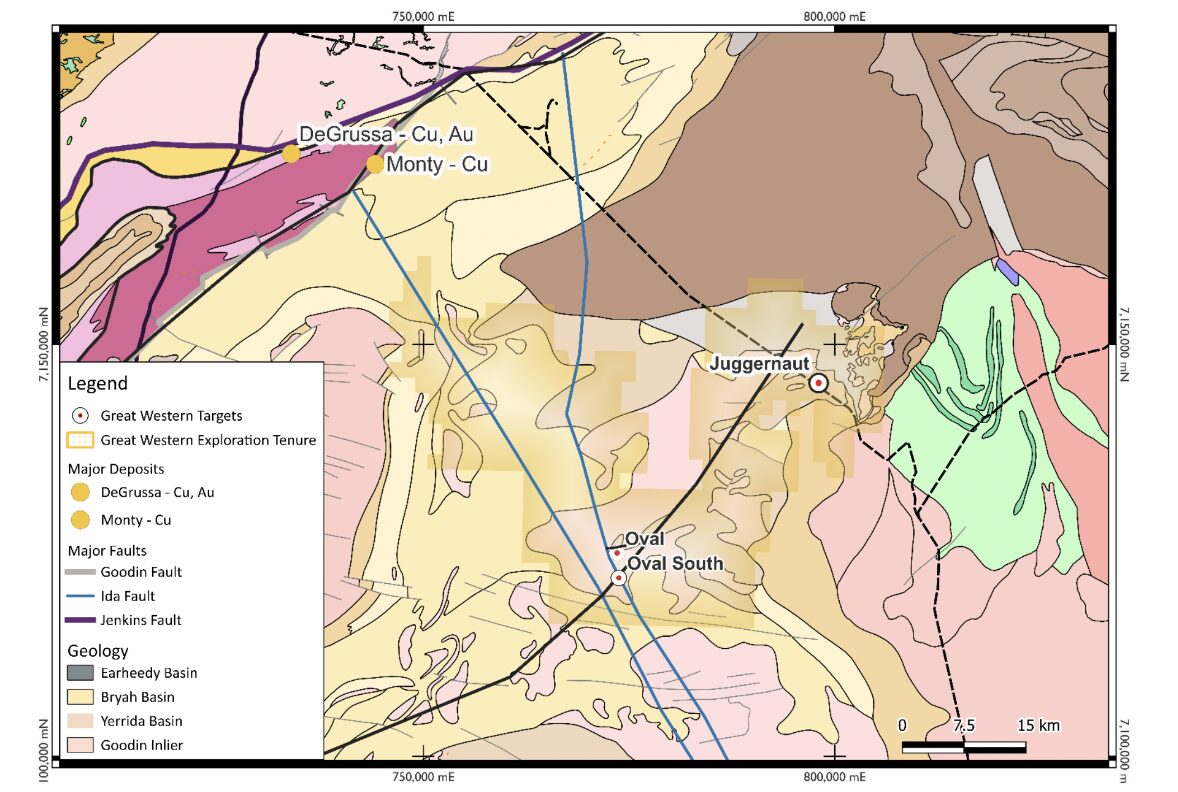

Not long after Solara Minerals (ASX:SLA) re-emerged with a slice of former Sandfire Resources (ASX:SFR) ground near the famous but now dry copper and gold mine in WA’s Bryah Basin, Great Western Exploration is stirring big dreams with its own progress in the copper and gold district.

It’s unsurprising explorers would hope to find a new volcanogenic massive sulphide discovery in the region. Sandfire’s original revelation in 2009 was a multi-millionaire maker, driving its shares from 4c to $8 in a little over a year.

Numerous second movers into the region pulled up donuts, but explorers with long memories have a sense there must be more to find.

A gravity survey from GTE at its Yerrida North project is the latest to throw up some sweet, red smoke, via a gravity survey at the Oval prospects that defined the potential core of a large VHMS copper-gold system.

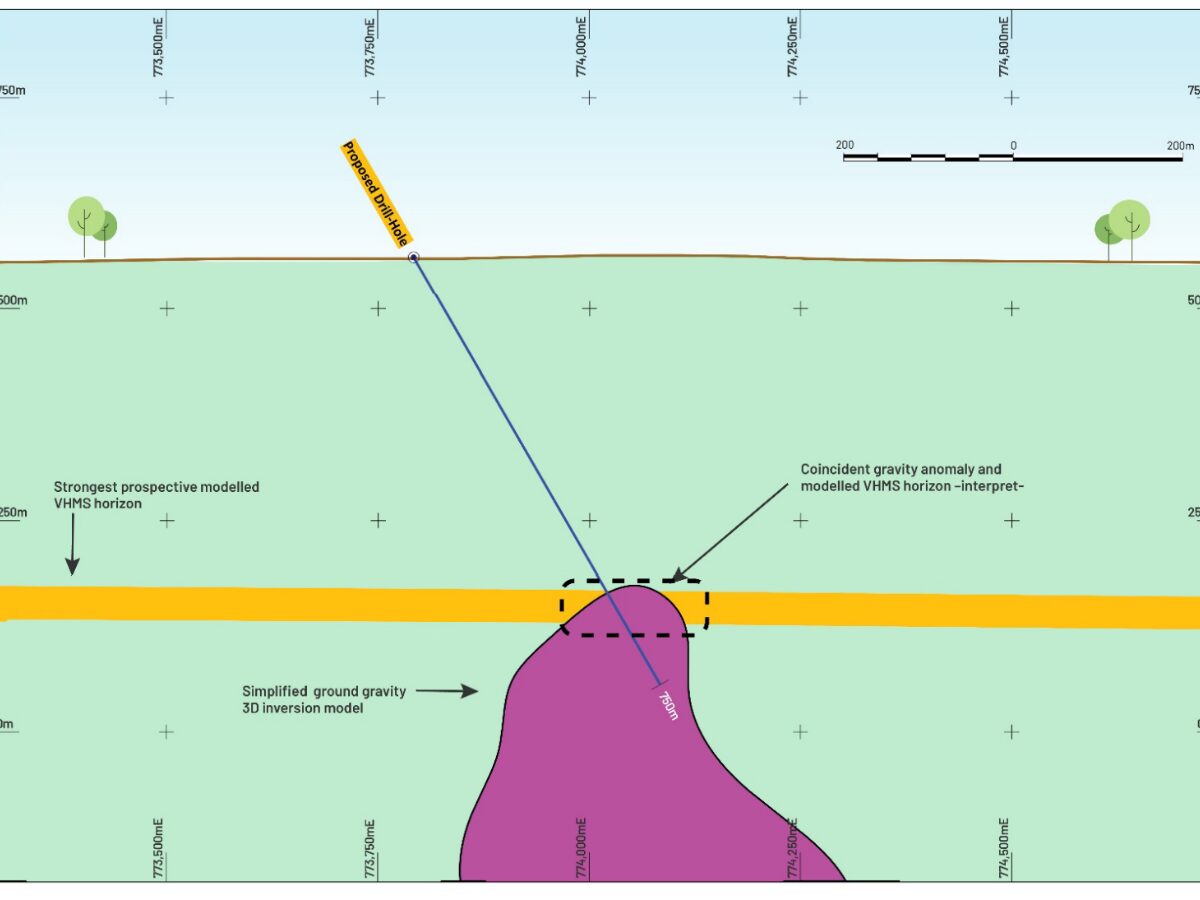

The company thinks previous drilling only tested the fringes of multiple VHMS horizons. A 750m Hail Mary has been designed to test the gravity anomaly, which GTE is hoping to get co-funding for under the next round of the WA government’s Exploration Incentive Scheme, a program involved in numerous modern day finds including the Gruyere gold mine and Nova nickel mine.

GTE is well funded on its own, with around $2.7m in the bank to progress exploration intiatives.

“Inversion 3D modelling of the ground gravity data found the gravity anomaly was coincident with the modelled prospective VHMS horizon at the Oval South Target,” the company said in a market announcement.

“The anomaly is interpreted to reflect higher density rocks, potentially representing massive sulphides situated at the central ‘black smoker’ zone of a large VHMS copper-gold mineralising system. The Company also interprets that both Oval and Oval South belong to the one potential VHMS mineralisation system.”

Great Western says many geological attributes of the Oval targets bear similarities to DeGrussa, which sits northwest of Oval alongside the Monty satellite mine.

Kaili Resources (ASX:KLR)

This mysterious junior explorer was backed by a Chinese coal company called Inner Mongolia Yitai, but now seems to be majority owned by its new chairman Jianzhong Yang via some machinations largely explained through the issue of a couple of substantial shareholder notices.

It’s had very little to report of late aside from a bunch of board changes, but awoke from its slumber with a 200% charge after receiving approval to drill into three rare earth projects in South Australia.

In fact, that 200% has now become a 500% SURGE at the time of writing.

Known as Lameroo, Karte and Coodalya, the SA mines department’s thumbs up will enable Kaili to go in and test the Loxton/Parilla Sands in the Murray Basin around 200km east of Adelaide.

It’s hoping to find something similar to the Koppamurra project, where Australian Rare Earths (ASX:AR3) has outlined a JORC 2012 resource of 236Mt at 748ppm total rare earth oxides.

Drilling has already taken place at Lameroo, which returned results including 1m at 356ppm TREO from 18m, 1m at 271ppm from 2m and 1m at 228ppm from 19m.

Nothing too exciting on width or grade, with around 17% of the TREO comprised of high value magnet rare earth oxides.

KLR is planning to sink shallow aircore holes at all three tenements down to 20m deep, with roadside traverses for the drilling locations already complete.

BPH Energy (ASX:BPH)

(Up on no news)

BPH has been one of the big gainers this week despite a lack of any announcements – mandatory speeding ticket served by the ASX.

According to BPH it was not aware of any information that has not already been announced that could account for the trading, but there are some catalysts ahead.

It is expecting a hearing in September in relation to its investee company’s PEP 11 permit in the offshore Sydney Basin. Advent – an unlisted company that BPH holds a 36% interest in – is seeking a judicial review to confirm that it holds the permit, the subject of a controversial rejection in 2021 when Scott Morrison appointed himself Resources Minister without telling anyone.

It was something that wasn’t learnt until ScoMo was turfed out of The Lodge with Anthony Albanese’s election win a year later.BPH maintains the permit is in force with respect to matters such as reporting, payment of rents and the various provisions of the Offshore Petroleum and Greenhouse Gas Storage Act 2006.

While by no means certain, confirming the permit is in good standing could be potentially transformational, as PEP 11 could host multiple trillion cubic feet of gas, which could go a long way towards meeting East Coast gas demand, though drilling will be required to actually confirm if gas is present.

Finding more gas is becoming increasingly critical for the National Electricity Market given falling supplies and the collapse of a plan to underwrite new liquefied natural gas import terminals that would have bridged the demand-supply gap.

Alice Queen (ASX:AQX)

As it looks to shuffle the deck of its portfolio, Alice Queen has aimed to move the dial by lodging a mining lease application for its Horn Island gold project in the Torres Strait.

The Queensland Department of Natural Resources and Mines (DNRM) has registered a mining lease for the asset, which contains a historical open pit with more than 524,000oz gold in resource.

It comes as the company seeks a development partner to take the project forward, a process that AQX managing director Andrew Buxton says has garnered strong interest.

“A substantial body of work has gone into this application, representing a huge effort over the past decade by our team and expert consultants,” he said.

The lease would give the company the right to extract gold, copper and silver, and could be a stepping stone to securing the right partner to take on the project.

The company applied for a term of 15 years over an area totalling 445 hectares at Horn Island, where a scoping study in 2021 outlined a potential 8.5 year mine life, producing 37,000oz per annum.

That was conducted at an Aussie gold price of just $2450/oz, compared to over $5000/oz today.

AQX also boasts the Viani gold project in Fiji, but flagged its intention to deal for new assets as recently as mid-July.

“Looking ahead, the company will also focus on finding gold projects in other jurisdictions, where potentially costs are lower, cash flow can be generated more easily, and value can be created for shareholders more quickly,” chair Jianying Wang said as the firm announced the appointment of corporate heavy hitter Paul Williams, a former general counsel at Mitsui’s coal business, to its board.

“We believe this will bring greater development opportunities for Alice Queen.”

Diablo Resources (ASX:DBO)

There’s no place to be for copper right now like the United States, where optimism about the pro-development ideology of the Trump administration has put local copper, gold and critical minerals names in the line of sight of investors.

Diablo is up today on news that drilling is set to take off at the Phoenix copper project in Utah, targeting two priority areas of sediment hosted copper mineralisation along strike from the producing Lisbon Valley copper mine, a low grade heap leach operation which uses electrowinning to produce pure copper cathode.

Drilling at the Trenton prospect will test the potential of the East Bounding Fault, a major fault zone known to be associated with copper mineralisation, while exploration at the Philadelphia prospect is set to target the historical Philadelphia copper mine where shafts and adits span some 750m of strike.

Diablo CEO Lyle Thorne said all the interpretation and exploration involved in identifying these priority areas has now reached a stage where the company is ready to drill.

“To our knowledge this is the first drilling to have been completed at either prospect area,” he said.

“It is an exciting time in the company’s development, and we look forward to keeping the shareholders fully informed of the drilling progress and results.”

On Friday, copper futures sat near $4.47 per pound, having tumbled from over US$5.50/lb after tariffs proposed by US President Donald Trump proved to be a bluff. In the meantime, supply concerns have emerged after an accident caused by an earthquake killed six people at a mine in Chile.

Codelco’s suspension of underground operations at the El Teniente mine reduced near-term output estimates by 20,000 to 30,000 metric tonnes, the State-owned miner said, close to 10% of the mine’s output.

Copper prices have declined 18.43% over the past month yet remain 8.04% above levels seen a year ago.

At Stockhead, we tell it like it is. While BPH Energy and Alice Queen are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.