Resources Top 5: Sometimes being a shallow gold digger is a good thing, right Redcastle?

You thought we were going to choose a pic of a red castle for this story, didn't you? (Pic via Getty Images)

- Tiny goldie Redcastle digs shallow gold mineralisation at WA’s Queen Alexandra prospect

- Battery metals hunter Accelerate is also busting a move

Here are some of the biggest resources winners in early trade, Thursday December 7.

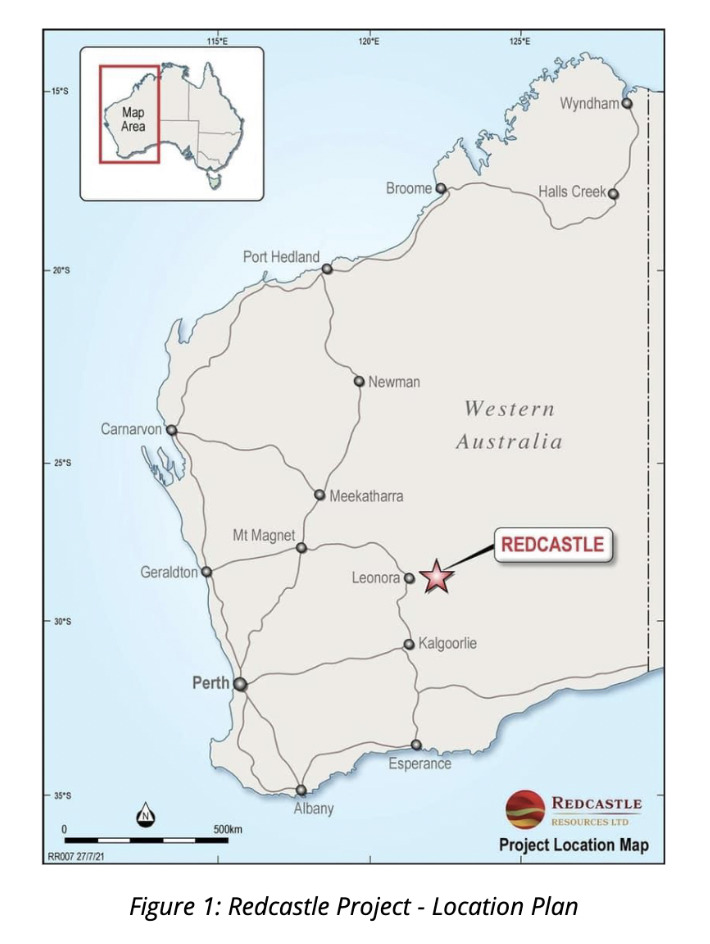

Redcastle Resources (ASX:RC1)

Here’s an absolute minnow of a WA goldie with a 25%+ story to tell today.

The $3.7m market capper completed an RC drilling campaign at its 100% owned Queen Alexandra prospect that involved drilling 37 holes, totalling 1,937m, on an area of 20m x 20m.

Samples were then sent off to a Kalgoorlie lab to ascertain gold content, and assays indeed confirm the presence of consistent, shallow gold mineralisation. High fives all round – they’re definitely not out there wasting their time.

Some highlights:

• Gold intersections in the upper 20m which increase in grade with depth and plunge to the southeast.

• Mineralisation (combo of subvertical and horizontal structuring) continuity on section and with a strike extent of 200m.

• Preliminary metallurgical testwork (using a concentrated leach method) reports a subsample from the 2022 high-grade sample RRC151at 115m as having a metallurgical recovery of 92% for gold.

RC1 share price

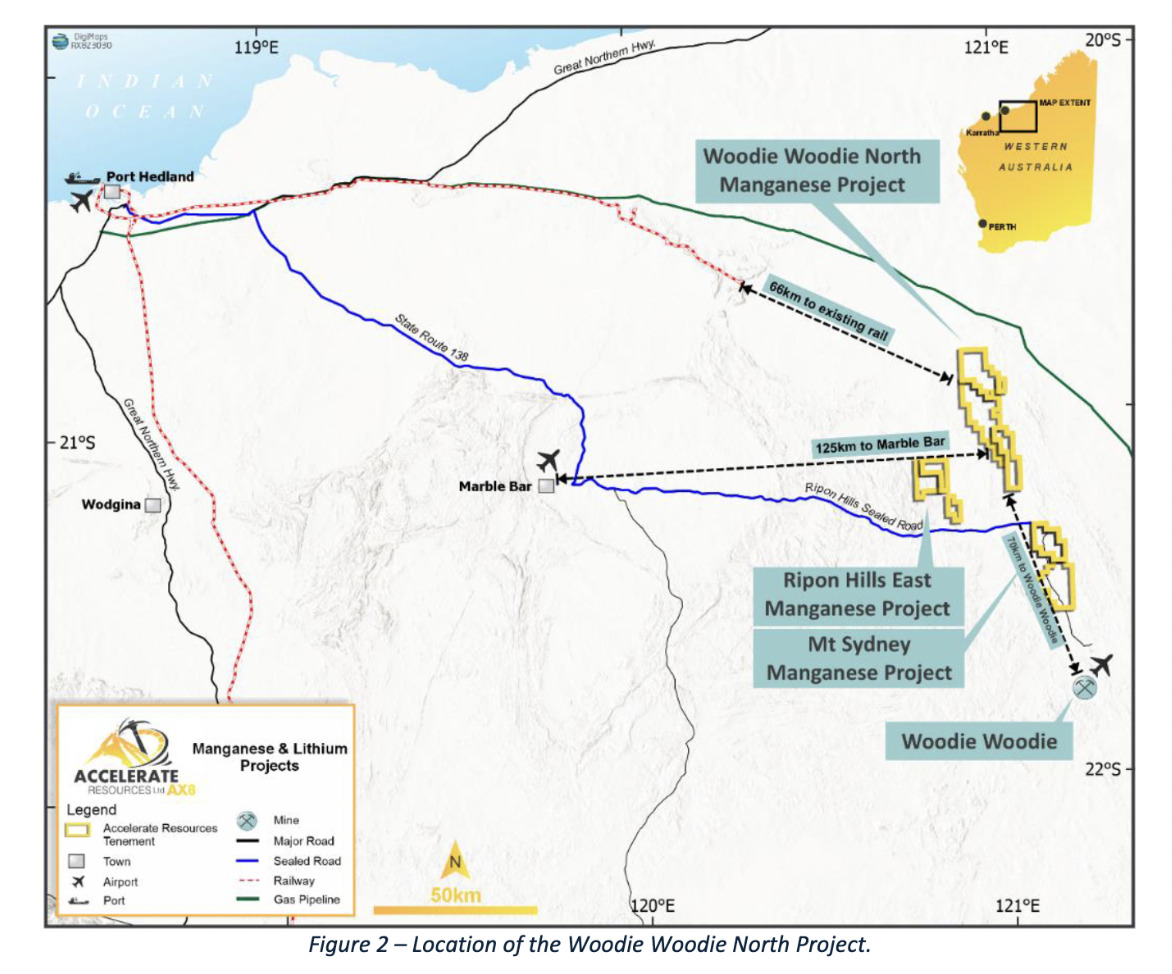

Accelerate Resources (ASX:AX8)

(Up on no fresh news)

This junior lithium and manganese hunter is also flying the double-digits ressie flag – but on not too much that’s landed so far today. It’s had some recent news of note, however.

On the last day of November, it announced figures regarding maiden inferred Mineral Resources at the Woodie Woodie North manganese project in Western Australia’s Pilbara.

Those totalled: 1.2Mt at 19.1% Mn (at 15% Mn cut-off) and exploration targets totalling 5.3–10.7Mt at 10–19% Mn.

These, reckon the company, confirm the project’s high grade and scale potential.

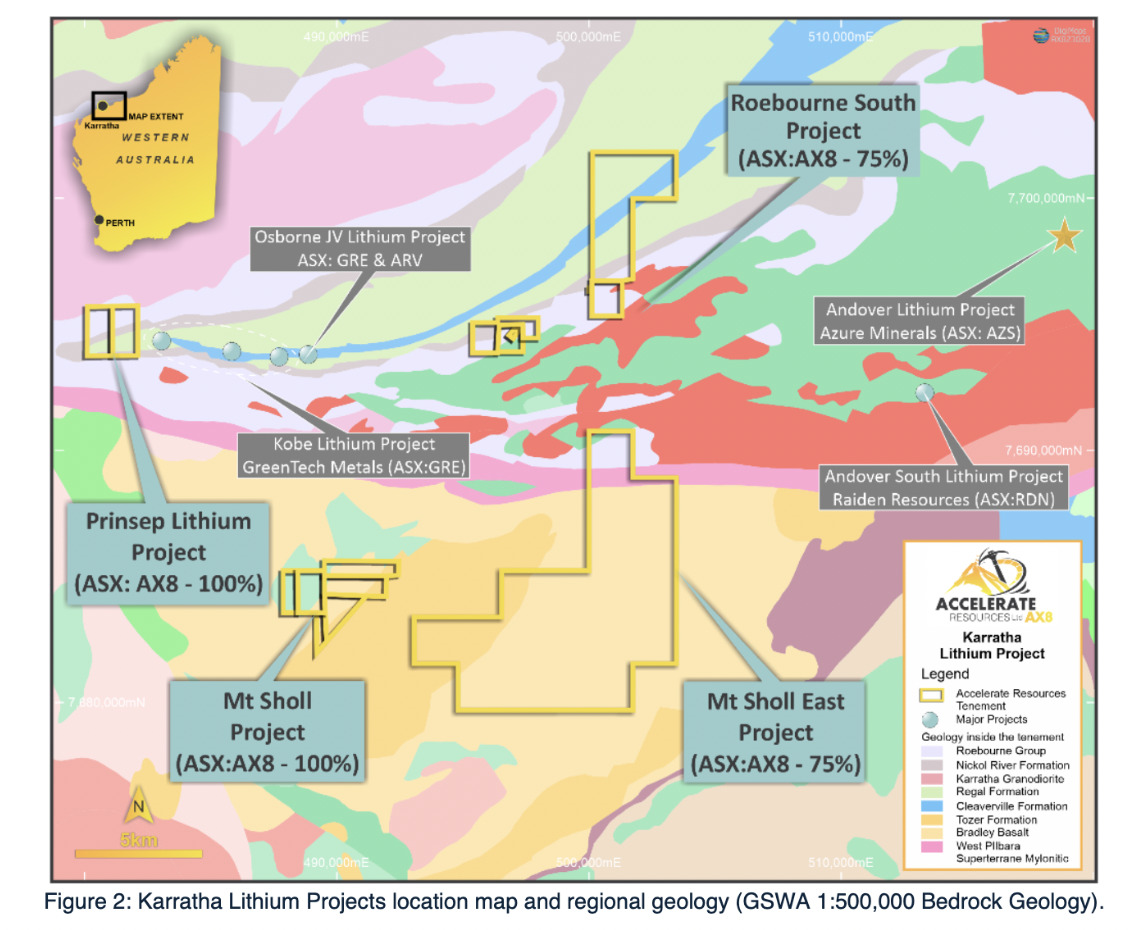

Elsewhere in the Pilbara, a few days earlier, AX8 reported solid, peggie-extending news regarding its Prinsep lithium project in WA.

The company began mapping and sampling of the project earlier this month and that’s now confirmed lithium mineralisation outcropping over 1.8km with widths up to 60m. It includes at least two parallel zones of spodumene-rich, lithium-bearing pegmatite systems spanning the entire width of the tenement area.

Prinsep is one of four recently acquired projects that make up the company’s Karratha lithium tenements, adding to the company’s growing battery metals portfolio.

Karratha is right in the heart of the Pilbara’s 40km-long Karratha-Roebourne lithium belt, where recent discoveries include Azure Minerals’ (ASX:AZS) monstrous Andover project (exploration target 100-240Mt at 1-1.5% Li2O).

AX8 share price

Apollo Minerals (ASX:AON)

(Up on no fresh news)

Apollo Minerals is primarily focused on gold exploration in Gabon, central Africa as well as the development of the Kroussou zinc and lead project in western Gabon, although the globally resourceful company is also on the hunt for copper over in Serbia.

Its most recent news regards significant funding to accelerate exploration at its Salanie gold project in Gabon.

The company has secured firm commitments for a placement to raise $3.4 million (before costs) strongly supported by a range of existing and new institutional, sophisticated and professional investors.

Apollo recently noted that results at Salanie “continue to identify multiple occurrences of visible gold in a mineralised, near surface, quartz vein system” and that a maiden drill program will begin there early 2024.

You can read more about the company’s planned acquisition of the Belgrade copper project in Serbia here.

AON share price

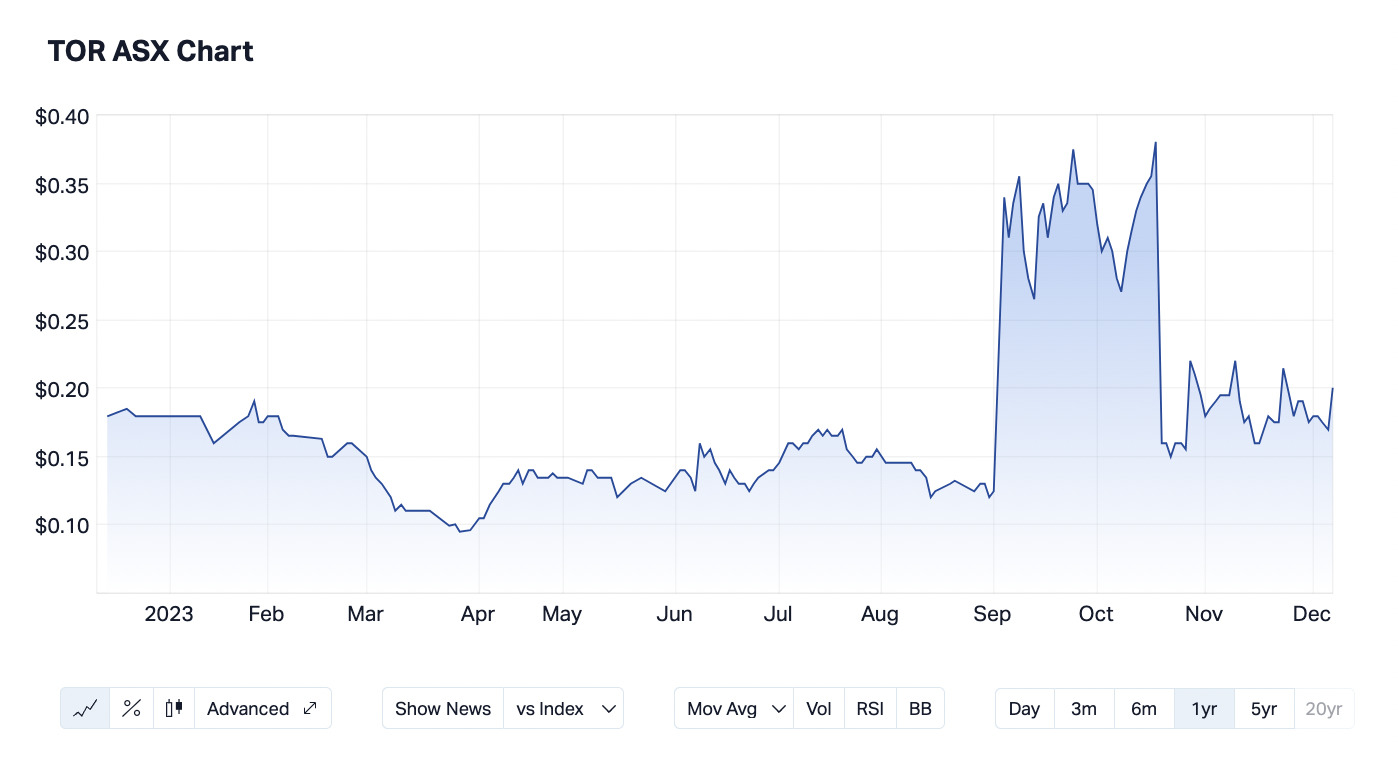

Torque Metals (ASX:TOR)

Torque Metals is back behind the wheel today cruising up the bourse with a near 20% gain at the time of writing this very sentence.

Hang on, we made a coffee and it now appears to be stuck in traffic in this sentence. And, in this one, it’s now a mere 9% gainer as various Energy stocks whizz by today.

Never mind, it still makes our Top 5 Resources grade.

News? Yep. Latest assay results are in at the company’s New Dawn lithium project and they reveal and confirm intersection of high-grade spodumene lodes, which is a pleasing outcome for all involved. It’s talking peak grade of 3.99% Li2O.

New Dawn, an unmined lithium and tantalum occurrence on granted mining leases, is literally about five stone throws (longest ever stone skim is 121.8m – look it up) (Ed: Official stone skim) from Aussie mining titan Mineral Resources’ big Bald Hill lithium mine, some 600m away.

The major highlight here is an intersection at 35m (cumulative) of lithium mineralised pegmatites in hole 23NDRC016. And that includes:

• 10m at 1.51% Li2O, from 51m, with 1m at 3.99% Li2O, from 52m

• and 15m at 1.17% Li2O, from 220m including 7m at 2.12% Li2O, from 221m

• and: 10m at 1.15% Li2O, from 265m including 6m at 1.76% Li2O, from 267m

But wait, there’s more… if you care to delve down further into the company’s latest ASX announcement.

Torque’s MD Cristian Moreno gave some insights on the assays, including:

“This repetition of several stacked pegmatites is a signature of the nearby operating Bald Hill mine.

“The presence of stacked pegmatites enhances the geological diversity of New Dawn and instils confidence regarding its potential scale.”

#ASXNews$TOR.AX inaugural RC drilling campaign at the New Dawn Lithium Project has intersected high-grade lithium (#spodumene) lodes with a peak grade of 3.99% Li2O.

35m (cumulative) of #lithium mineralised pegmatites intersected in hole 23NDRC016.https://t.co/oeRhBSDiKH pic.twitter.com/2qOhD6rtEE

— Torque Metals (@Torque_Metals) December 6, 2023

It’s been a rollercoaster for TOR over the past few months. But don’t just take our word for it – check out that Bart Simpson pattern above.

The company rerated heavily in September after buying New Dawn. Hype fizzled following some less-than spectacular initial drill results, but TOR — believing it has something special at New Dawn – doubled down with another drill rig, and this was enough to get punters interested again.

Today’s assay results might just be turning a few more heads in TOR’s direction.

TOR share price

Eagle Mountain Mining (ASX:EM2)

(Up on no fresh news)

This Arizona-focused copper ‘n’ gold explorer has some wind beneath its wings today, climbing higher up the local bourse as we tap on keys, with a 15% move. (Ed: Doh! It just had its wings clipped as we hit publish. Check the price chart below.)

We’re not seeing anything too fresh other than some good news it put out into the wild on December 4, so we’ll quickly remind you of some of those details.

Eagle Mountain Mining has identified a simplified process flowsheet for its Oracle Ridge copper project in Arizona, offering the potential for lower capital and operating costs, as well as a reduced environmental footprint.

Glycine leaching is currently being tested on run-of-mine ore and low-grade material, the next stage will be testing the rougher concentrate and the existing tailings.

Our report has more, much more. Check it out here.

Eagle Mountain Mining has identified a simplified process flowsheet for its Oracle Ridge copper project in Arizona, offering the potential for lower capital and operating costs.

Article by @StockheadAUhttps://t.co/hVmdadXgC4

$EM2 #Copper #Gold #EagleMountain #OracleRidge

— Eagle Mountain Mining Limited (@eagle_mining) December 4, 2023

EM2 share price

At Stockhead we tell it like it is. While Apollo Minerals and Eagle Mountain Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.