Resources Top 5: Is this ASX junior your invitation to a copper M&A party?

Suitors may want to sit down and talk M&A with these ASX winners. Pic: Getty Images.

- SolGold’s US$750m stream funding deal for Cascabel sends DGR Global shares intergalactic

- Stelar hits 27% copper at Baratta in the Central African Copper Belt

- NAE pops on no news, still dining out on Wagyu

Here are the biggest small cap resources winners in morning trade, Tuesday, July 16. Prices accurate at time of writing.

DGR Global (ASX:DGR)

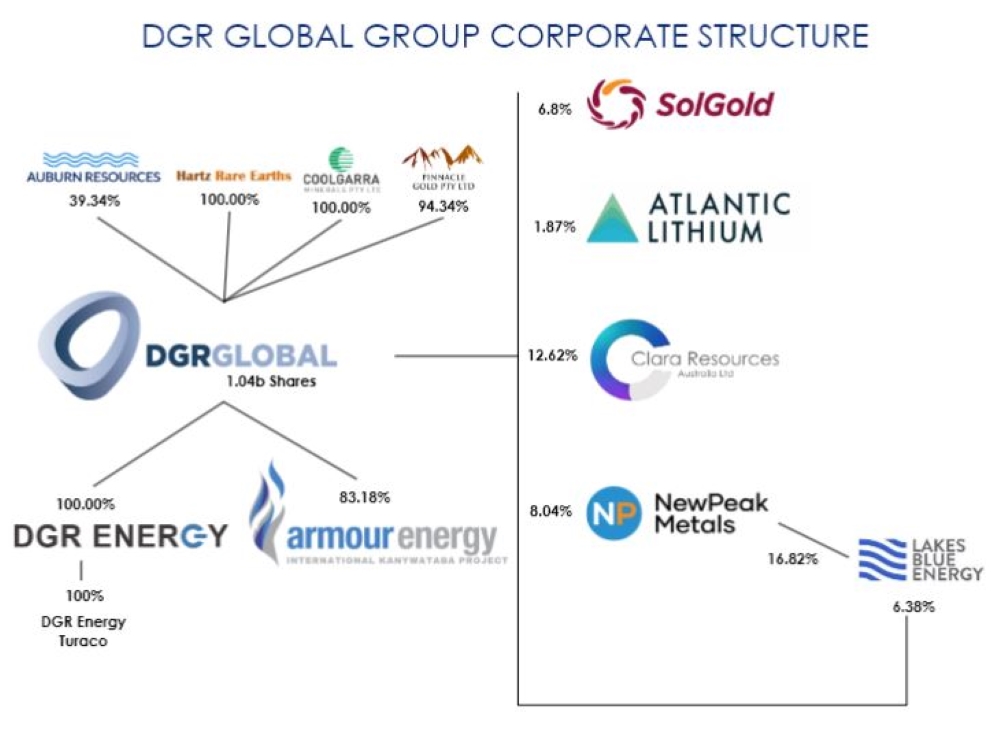

Resources company creator DGR has shot up 233% in early trade and would normally be at risk for a speeding ticket if it wasn’t for SolGold’s whopping US$750m streaming deal for the development of its Cascabel copper-gold project in Ecuador.

DGR has got plenty of fingers in quite a few pies, and it looks like the SolGold one is super hot right now.

Why? ‘cause DGR has a 6.8% in the London/Canada-listed SolGold, which is up 64% since early March, a run that started around the time it released a pre-feas study posting an NPV of US$3.2bn on Cascabel, making it what could be Ecuador’s biggest mining investment ever.

The cash injection deal for SolGold announced today equates to about 47.5% of the pre-production capital investment required for mine construction, the plant module and related project infrastructure.

Stream investors Osisko (which already has a net smelter royalty deal in place with SolGold), and Franco-Nevada are the entities anty-ing up the benjamins.

It should be noted two of Solgold’s biggest shareholders are BHP (ASX:BHP) and Newmont Corporation (ASX:NEM) (via its 2023 acquisition of Newcrest), who have held a fair bit of competitive tension on the register for years.

They’ve both railed against these sorts of streaming-related funding arrangements in the past, which would mean they’d have to deal with onerous sales contracts if they ever wanted to put their money with their mouth is and take over the mine, either together or as a standalone.

Both are as hot for copper right now as David Lee Roth was for teachers in 1984, but their sights seem to have been set at loftier targets in recent times.

The PFS pegs Cascabel to produce 277,000ozpa gold and 794,000ozpa silver and 182,000tpa copper across an initial 28-year mine life.

SolGold was over 12% up in London overnight. But for DGR, the development deal could put into the shop window – at a market cap of just $26m, even after today’s booming run, what easier way to immediately snap up a near 7% stake, boost your holding or get a seat at the table if the M&A feast which has long promised to take place at SolGold finally occurs.

With that kind of windfall and future potential, it’s no wonder DGR shares shot through the roof in trade today, soaring like an Ecuadorian condor by ~175% to 2.5c at time of writing.

Stelar Metals (ASX:SLB)

High-grade rock chip samples showing up to 28.7% copper have been assayed across a 3km strike at its Baratta copper project in the Central African Copper Belt.

21 out of 72 samples returned >10% copper along a series of multiple strike-extensive targeted areas of Baratta – a historical mine that was in action between 1896 and 1904.

120 years later, SLB is confident of Baratta’s potential to add to the world’s second-largest copper producing province behind Chile (shared across the Belt between the DRC and Zambia).

The deposits are sediment-hosted ‘stratabound’ deposits, which make up ~20% of copper production worldwide.

Surface sampling and geological mapping is already underway to potentially extend known mineralisations.

Shares have popped 34% to 2.5c in early trade.

New Age Exploration (ASX:NAE)

(Up on no news)

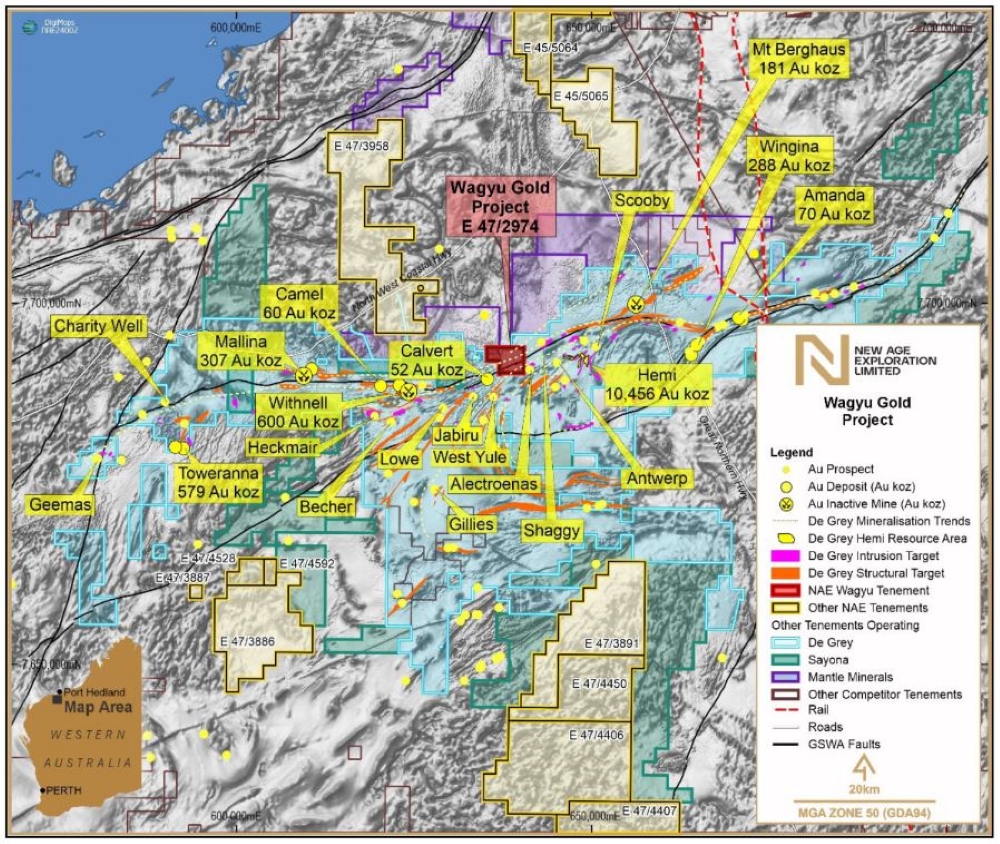

Pilbara gold hunter NAE hasn’t had much going on lately but that hasn’t stopped the share price of the minnow bouncing 33% today.

The only news we know about of late is a $1 sale of its stagnant Lochnivar coal project while it concentrates on promising gold and lithium projects up in the WA Pilbara.

NAE has a seriously well-positioned tenement near De Grey Mining’s (ASX:DEG) world-class and still emerging +10.5Moz Hemi gold deposit in the WA Pilbara and has just recently started getting boots on the ground.

An intensive six month exploration program is underway and AC drilling is about to begin across developed gold targets at the tenure.

“With approvals for drilling now in place, and a cultural heritage survey start date confirmed, we are all very excited about drilling these exceptional “Hemi-style” targets along strike from the ~10.5Moz Hemi gold deposit,” NAE exec director Joshua Wellisch says.

Shares in the junior have risen 33% so far in today’s trade.

Aurora Energy Metals (ASX:1AE)

(Up on no news)

Nothing much ado about 1AE today except its share price, which has risen 24%, and the last this Stockhead heard anything, it was looking at material improvements to a scoping study-backed recovery rate of 69% uranium from its Aurora project in the US.

The hope is that the optimised scoping study will increase recovery rates and refine requirements for a pre-feasibility study in early 2025.

A project manager has been appointed and work programs are currently being finalised.

Shares are up nearly a quarter to trade at almost 2c and are up a total 75% over the last 12 months.

Far East Gold (ASX:FEG)

FEG’s signing of new chairman Justin Werner and a binding agreement to acquire 100% of and advance its high-grade Idenburg gold project has put a heater under the company’s share price today.

READ MORE: Far East Gold picks up potential company maker and successful mining executive as Chairman

Idenburg, in Indonesia’s Papua province, is within the same region as world-class multi million-ounce gold and copper projects, including the 70Moz Grasberg mine.

The project has attracted some bigwigs to the tenure over time, including Barrick, Newmont and Placer Dome and has an exploration target of up to 7.2Moz for up to 6.1g/t gold.

Shares in the gold hunter rose 50% to 21c at time of writing, with around 650,000 of the 258m shares it has on issue changing hands.

At Stockhead we tell it like it is. While New Age Exploration and Far East Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.