Far East Gold picks up potential company maker and successful mining executive as Chairman

Far East Gold says the project is similar to the large, high-grade gold lodes in Kalgoorlie. Pic: via Getty Images.

- Far East Gold acquires potentially multi-million-ounce Idenburg gold project in Indonesia

- Project has exploration target of up to 7.2Moz at up to 6.1g/t gold

- Massive mining name installed as chairman in Nickel Industries boss and founder Justin Werner

Special Report: Far East Gold has delivered a potentially company-making transformation, installing one of Australia’s most successful mining executive Justin Werner as its chairman, and announcing the acquisition of a potentially multi-million-ounce gold project in Indonesia.

The company has signed a binding agreement with PT Iriana Mutiara Idenburg for exclusive rights to explore, develop, and operate the Idenburg Gold Project in Indonesia’s Papua Province.

The Idenburg project covers 95,280 hectares (952.8km2) and is known for high-grade lode gold occurrences characteristic of orogenic gold systems – similar to areas such as the 60Moz-plus Kalgoorlie Goldfields and the Mother Lode district of California.

It’s a region when combined with Papua New Guinea that hosts several multi-million-ounce gold and copper deposits including the world class Grasberg (+70Moz Au), where Werner once worked as a turnaround consultant, Porgera (+7Moz Au), Frieda River (20Moz Au) and Ok Tedi (20Moz Au).

Idenburg comes with strong pedigree of its own, having previously attracted some of the world’s largest gold producers to explore the property including Barrick (joint venture), Newmont and Newcrest (due diligence investigations) and Placer Dome (exclusive exploration option).

A multi-million-ounce company maker?

Idenburg is a high potential asset from the same stable as FEG’s Woyla, where trench sampling has returned assays including 16m at 2.93Au, 2g/t Ag, incl. 9m at 5.16Au, 2.41g/t Ag and. 1m at 28.3g/t Au, 9.9g/t Ag.

The main reason Idenburg was not advanced further in the past was due to previous forestry classifications over the major prospect areas, which restricted open cut mining.

These restrictions have now been removed, delivering FEG the tantalising opportunity to be the company that finally gets to realise its immense potential, demonstrated in historical samples that have returned wide and high-grade gold intervals in multiple instances from surface.

“The Idenburg project is being acquired from the same local partner who owns the Woyla CoW (Contract of Work) that FEG is currently exploring,” Far East Gold (ASX:FEG) managing director Shane Menere said.

“Given the strong interest shown in the Idenburg project by numerous parties, the fact that FEG has been given the opportunity to further develop the project is an endorsement of the work that has been done to date by the highly experienced FEG team, including being the first company in the Woyla CoW’s history to successfully drill the project.

“Many of Indonesia’s major world class copper-gold discoveries including Grasberg and Batu Hijau are found located within CoW’s which are the preferred form of licence for foreign investors.

“We are very excited based on the extensive historical database of exploration work and many high-grade drill intercepts that demonstrate the potential for Idenburg to host a multi-million ounce company maker.”

Pic: Map showing the location of the Idenburg COW in Papua Indonesia relative to the locations of world class multimillion ounce gold-rich porphyry copper deposits. Source: FEG.

Extensive experience in Indonesia

FEG has also appointed experienced mining executive Justin Werner as chairman – who knows Indo like the back of his hand having been involved in the country’s mining industry for more than two decades.

Werner has been a non-executive director with FEG since its inception, and has been the MD of global top-10 nickel producer, Nickel Industries (ASX:NIC) since March 2008.

He has turned NIC from a peripheral nickel miner and processor into one of the world’s largest producers of refined nickel, growing production exponentially in the past five years despite the collapse of other miners amid price volatility.

FEG CEO Shane Menere said Werner’s extensive experience in the mining industry and global capital markets made him an invaluable addition to the leadership team.

“We are delighted to announce the appointment of Justin Werner as chairman of Far East Gold,” Menere said.

“Justin brings a deep understanding of the Indonesian resources sector having developed a number of successful mines in country along with strong record in capital markets.”

“With the signing of a binding term sheet for the highly prospective Idenburg project, continued strong drilling results from our Woyla project and preparations in place to commence our maiden drill program at Trenggalek, the board believes Justin’s experience and insight will be invaluable as we look to drive forward development of our suite of highly prospective copper and gold projects.”

Promising historical exploration results

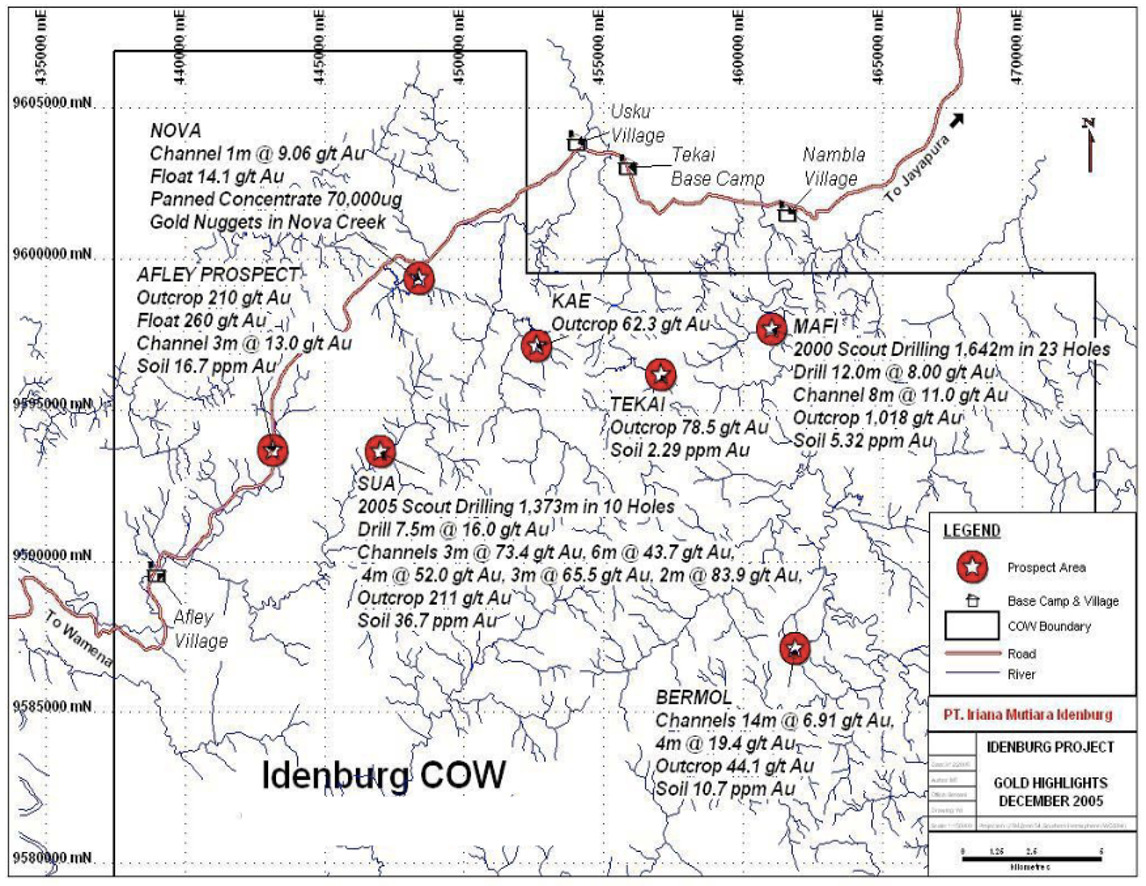

Over US$25m in historical exploration has been completed to date at Idenburg, including over 5531m of diamond drilling.

Of the 14 prospect areas identified to date, only five have been drill tested. They are focused within three main prospects – Sua, Mafi and Bermol – with the mineralised zones intersected at each still open along strike and at depth.

Some notable historical intercepts include:

- 4m at 5.96g/t gold from 41m, including 2m at 11.4g/t gold from 43m (Sua prospect)

- 5m at 16g/t gold from 21m, including 1.6m at 52.5g/t gold (Sua prospect)

- 6m at 8.01g/t gold from 6m, including 1.25m at 25.7g/t gold from 15.75m (Mafi prospect)

- 1m at 7.50g/t gold from 14.4m, including 1.4m at 16.3g/t gold from 18m (Mafi prospect)

- 5m at 5.40g/t gold from 16m, including 2m at 11.8g/t gold from 17m (Bermol prospect); and

- 5m at 4.15g/t gold from 46m, including 3m at 7.08g/t gold from 46m (Bermol prospect).

In addition, metallurgical test work at the Sua prospect has returned 50-60% gravity recoverable gold with >95% recovery by Carbon in Leach.

Exploration target up to 7.2Moz

FEG has now contracted SMG Consultants in Jakarta to assess historical exploration results at Idenburg, leading to the identification of significant gold exploration targets and resource potential.

SMGC’s independent evaluation suggests an upper range exploration target of 7.2 million ounces of gold at 6.1g/t Au, spread across 14 prospect areas.

The lower range exploration target is estimated at 189,000 ounces at 1g/t Au.

Menere said Idenburg presented an exceptional opportunity for Far East Gold, with further exploration required to discern if each prospect area extends beyond the limits indicated by historical data.

“It is rare to find a project of such calibre with a substantial historical database of work completed by many of the world’s major gold miners,” he said.

“The independent assessment by SMGC confirms the significant exploration potential of this project.

“We are committed to advancing exploration efforts to unlock the full value of this promising asset.”

Pic: Idenburg project area in 2005 showing numerous prospects with high grade gold intersected in surface samples and drill holes. Source: FEG

Commercial terms allow up to 100% ownership

FEG has picked up the term sheet for just $150,000 which includes three months exclusivity to complete a binding Conditional Share Purchase Agreement plus a payment of AU$50,000 for each 30-day extension by agreement of the parties (up to three extensions).

The company will move to 51% ownership of the project by paying $250,000 on signing of the CSPA, the issuance of at least 2,500,000 shares to the vendors and a commitment to spend $5m on the project within 24 months of signing the CSPA.

FEG will move to 80% ownership on the completion of a feasibility study in Indonesia to allow the CoW to move from exploration phase to a 30 year mining operation phase, and 100% ownership if the vendors elect to have the remaining 20% economic interest either carried on terms to be agreed in the CSPA or convert to a 2% Net Smelter Royalty.

In addition, upon announcement to the ASX of at least 1Moz of gold to a mineral resource estimate with a minimum average gold grade of 0.5 grams per ton, FEG will issue a ‘milestone payment’ of 13,000,000 fully paid shares calculated at the 30 day VWAP.

Far East Gold’s CEO Shane Menere will be joined by Non-Executive Chairman Justin Werner for an online Q&A session to discuss the Idenburg acquisition and Justin’s appointment on Thursday, 18th July at 1.00pm AEST.

This article was developed in collaboration with Far East Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.