Resources Top 5: Small garnet stock spikes 200pc, Mark Bennett’s S2R preps drill for next Fosterville

Picture: Getty Images

- Heavy Minerals bags in early trade after boosting resources at Port Gregory garnet project in WA

- S2R – the crew that unearthed the world-class Nova deposit — is getting ready to drill around Fosterville gold mine

- Forrestania has now earned 50% in the 293sqkm Hydra lithium project (HLP) in James Bay, Canada

Here are the biggest small cap resources winners in early trade, Monday July 10.

HEAVY MINERALS (ASX:HVY)

The microcap spiked over 200% in early trade after boosting resources at the Port Gregory garnet project in WA by 23% to 166Mt at 4% for 6.6Mt total heavy mineral (THM).

That includes 5.9Mt of contained garnet, representing ~5 years of current global demand, HVY says.

Port Gregory will contribute more than 10% to world garnet production when the mine comes online, pencilled in for 2027.

“The updated mineral resource estimate now credibly positions HVY to be the next potential garnet producer in the Port Gregory region,” HVY CEO Andrew Taplin says.

A 2022 scoping study – the first proper look at the economics of building a project – envisaged a 16-year project producing 141,000t garnet and 6000t ilmenite per year.

It would take 4.2 years to pay back the $110m capex bill, with free cash flow expected to be $588m over life of mine.

“The updated Mineral Resource estimate will inform the Port Gregory Project Pre Feasibility Study that is scheduled to commence imminently and is expected to contribute further value to the already strong financial metrics.

“The company remains of the view that its Port Gregory garnet project is a world-class asset.”

Garnet sand is a good abrasive, and a common replacement for silica sand in sand blasting. It is also used in waterjets to cut steel, and in water filtration.

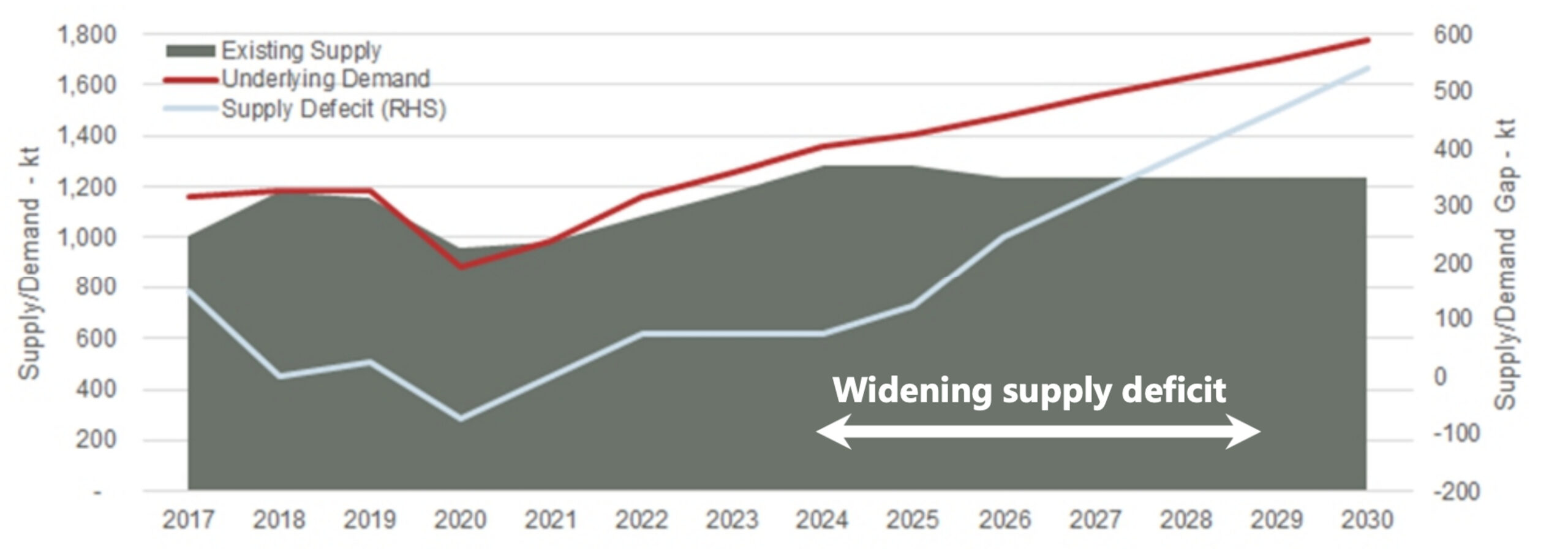

HVY says industrial garnet demand is forecast to outstrip supply in the coming years with a widening deficit forecast from 2024 onwards, unless additional supply is brought to market.

Pricing has already begun to respond accordingly, the company says.

The tightly held $12m capped stock (~53m shares on issue) is up 90% year-to-date. It had $892,000 in the bank at the end of March, which means some sort of cap raise is probably imminent.

S2 RESOURCES (ASX:S2R)

A focus of Barry Fitzgerald’s latest column, S2R – also known as ‘the crew that unearthed the world-class Nova deposit’ — is getting ready to finally start drilling for the next ultra-high-grade Fosterville gold deposit near Bendigo.

In 2021, Mark Creasy-backed S2R secured the coveted Block 4 surrounding Fosterville, one of Australia’s highest grade and largest gold mines.

S2R boss Mark Bennett told BFitz that while the wait to get on to the ground had been frustrating, the value of the ground has only gone up as Fosterville owner Agnico increasingly becomes hamstrung in terms of its operating/exploration space.

“We entirely surround their mine lease, so we are west, east, north and south,” Bennett says.

“We cover about 50km north to south and about 10km across, and a number of areas that Agnico are mining are actually trending towards our boundary at depth.

“What’s more, as part of winning the tender (Kirkland received Blocks 1, 2 and 3 but wanted Block 4) we received all of the data that Kirkland had been accumulating before having to relinquish the ground.

“So we inherited $25-$30m worth of data – airborne and ground geophysics, geochemistry, and some drilling data.’’

The $75m capped stock is up 9% year-to-date. It had $6.3m in the bank at the end of March.

INTERNATIONAL GRAPHITE (ASX:IG6)

(Up on no news)

On Friday IG6 reported more high-grade graphite at Mason Bay, part of the Springdale project in WA.

Standout results included 11m @ 11.7% Total Graphitic Carbon (TGC) from 57m downhole from Mason Bay, the fourth discovery at Springdale and one of seven high priority exploration targets identified by AEM survey.

Assays for the balance of the 20km resource and exploration drilling program are due to be received by mid-July, with a new resource estimate to be published soon after.

IG6 wants to build an integrated mine and downstream graphite business in southern WA, with the ultimate goal to produce Battery Anode Material (BAM) for battery makers.

IG6 has already established a piloting facility (a smaller version of a commercial plant), for the downstream processing of graphite products.

The $18m capped stock is down 20% year-to-date. It had $2.2m in the bank at the end of March, plus a $4.7m grant from the Australian government (to be drawn down in instalments).

FORRESTANIA RESOURCES (ASX:FRS)

FRS has now earned 50% in the 293sqkm Hydra lithium project (HLP) in James Bay, Canada, after forming a JV with TSXV-listed ALX Resources.

The early-stage project comprises eight sub-projects, all of which either overlie or are positioned on the margins of highly prospective greenstone belts, FRS says.

“Outcropping pegmatites have been identified at various sites across the HLP and given the proximity to recent major discoveries, there is obvious potential to find additional lithium-caesium-tantalum (‘LCT’) type pegmatites, and lithium resources,” it says.

“Field work at the HLP is expected to recommence shortly following delays associated with the forest fires that have recently affected the James Bay Region.”

Late last month the stock exploded higher on huge vols after hitting pegmatite in 13 of 14 drill holes at the Calypso prospect, part of the Forrestania project in WA.

The thickest intercept was 63m, the company says. (Probs not true width.)

But following a ‘please explain’ from the ASX, FRS updated the ann with a table showing that not all pegmatites necessarily contain spodumene, and the late day selloff commenced.

All-important assays are due in around four weeks.

The $12m capped stock is flat year-to-date.

MAGNUM MINING & EXPLORATION (ASX:MGU)

(Up on no news)

MGU has a couple of ‘green steel’ magnetite projects in the US: Buena Vista (Nevada) and Appalachian (West Virginia).

More than $34m has been spent at Buena Vista over the past decade, says the company, which bought the 232Mt at 18.6% fe project in 2020.

The stock recently inked a Memorandum of Understanding (MOU) with Mitsubishi for the offtake of all products from proposed operations at Buena Vista.

The MOU covers all products from the project including Direct Shipping Ore (DSO), iron concentrate, HIsmelt-produced pig iron and slag, all steel plant wastes, and excess biochar.

The $23m capped stock is up 75% year-to-date. It had $3.6m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.