Resources Top 5: Sarytogan keeps it 99.99 in Kazakhstan; Bastion aims to offload copper project

The other angels called him "Mr 0.01 Per Cent". (Pic via Getty Images)

- Sarytogan Graphite notches a thermal purification win for its graphite produced in Central Kazakhstan

- Bastion Minerals has a potential buyer of its Chilean copper project

- Buxton Resources notes beaut assay results from its maiden drilling for copper in Arizona

Here are the biggest small cap resources winners in early trade, Monday August 28.

SARYTOGAN GRAPHITE (ASX:SGA)

Sarytogan, which is exploring and developing a graphite project in Central Kazakhstan, is leading the daily resources pack at the time of writing.

It’s barnstormed its way up after announcing that thermal purification has far exceeded battery anode material grade for its Kazakh graphite deposit.

Graphite, as you very likely know, is a multi-use commodity used in all sorts of applications, including pencils, electric motors, arc lamps, nuclear reactors, and… probably most crucially in the current climate, electric vehicle batteries.

In fact, something of a quiet achiever in the EV battery components sector, graphite comprises at least 25% of most EV batteries.

The company reports that the thermal purifaction of its graphite has achieved a 99.99% Total Graphitic Carbon (TGC) result, with the sample being a “representative 50g sample of Sarytogan Graphite previously treated by flotation and alkaline roasting to 99.70% TGC”.

Sarytogan Acheives 99.99% Graphite Purity By Thermal Purification. #ASX $SGA #Graphitehttps://t.co/EzdQiZG4vr pic.twitter.com/7jQ352WvUg

— Sarytogan Graphite (@Sarytogan) August 27, 2023

A Pre-Feasibility Study (PFS) is now underway, and that, says Sarytogan, will evaluate chemical vs thermal purification flowsheet options.

Sarytogan MD Sean Gregory said that the 99.99% result “shoots the lights out when it comes to graphite purity by far exceeding the 99.95% specification for battery anode material”.

“We can now add “ultra-high-purity” to the superlatives used to describe the giant, exceptionally high-grade, and now ultra-high-purity Sarytogan Graphite Deposit,” he continued.

SGA share price

BASTION MINERALS (ASX:BMO)

Bastion has announced this morning that it’s signed a binding Letter of Intent (LOI) with ASX listed Hot Chili (ASX:HCH) for an option for HCH to acquire the Cometa copper project in Chile for up to US$3.3 million in cash.

BMO says the divestment will enable it to focus on its highly prospective Canadian lithium projects and its Swedish Rare Earth Element (REE) project.

Shareholders are so far this morning giving this news their ticks of approval, with BMO’s share price pumping at the time of writing, with a 38% gain.

The explorer says its has received confirmation from the ASX that shareholder approval is not required for the divestment of the Chilean copper project.

#ASXNews$BMO.AX signed a binding LOI with Hot Chili Ltd for an option for HCH to acquire the Cometa #Copper Project in Chile for up to US$3.3 million in cash

On ground exploration is expected to commence in Q3 2023 at the Gyttorp #REE Project in Swedenhttps://t.co/X1W1ESq31I pic.twitter.com/BKzJzVH0P7

— Bastion Minerals Limited (@BastionLimited) August 28, 2023

BMO also notes that its lithium exploration results are due in Q3, with Canadian geological consultancy Orix Geoscience Inc onsite at the McCombe North and Raleigh Lake lithium projects in Ontario, Canada.

And, in a further update, regarding the company’s Swedish “Gyttorp” REE project, on ground exploration is expected to commence in Q3 of this year – in other words, imminently.

Executive Chairman Ross Landles said that the Bastion board is “thrilled” at the prospect of Hot Chili buying up the Cometa copper project:

“Hot Chili Ltd has a strong track record of consolidating tenure around its Costa Fuego project and has already undertaken significant due diligence on Cometa.

“The option over Cometa has the potential to create significant near term value for shareholders. This is the right buyer at the right time for Bastion.”

The last time we took a good look at BMO, it was a $5m market capper and up 13% year to date. It’s since lost ground, with a current market cap of $4.16m, but perhaps its consolidation of lithium-based direction can get it back to where it was in July and moving in the right direction once more.

BMO share price

BUXTON RESOURCES (ASX:BUX)

Buxton has announced “exceptional” assay results from its maiden diamond drill hole at its Copper Wolf project in Arizona, USA, which kicked off in April this year.

It’s the first exploration in the project area since 1993, with drillhole CW0001DD targeting areas proximal to and beneath historical hole RC-UC-17 which ended in porphyry style copper-molybdenum mineralisation.

The specifics include: returns of 83.76 metres at 0.86% CuEq from 527.91 metres with assays up to 2.35% CuEq.

The company notes the drill hole was abandoned at 611.67 metres in strong Cu-Mo mineralisation (0.95% CuEq), and that the drilling is 100% funded by the company’s joint-venture partner IGO Limited (ASX:IGO).

Buxton’s CEO Marty Moloney provided the added context and hype:

“These assays have confirmed Copper Wolf as a bona fide porphyry copper molybdenum system that can deliver on grade.

“The second drillhole is now showing that Copper Wolf can also deliver on scale. These really are exceptional results, particularly given this was Buxton’s maiden drillhole… The opportunity here is breathtaking.”

BUX share price

WESTAR RESOURCES (ASX:WSR)

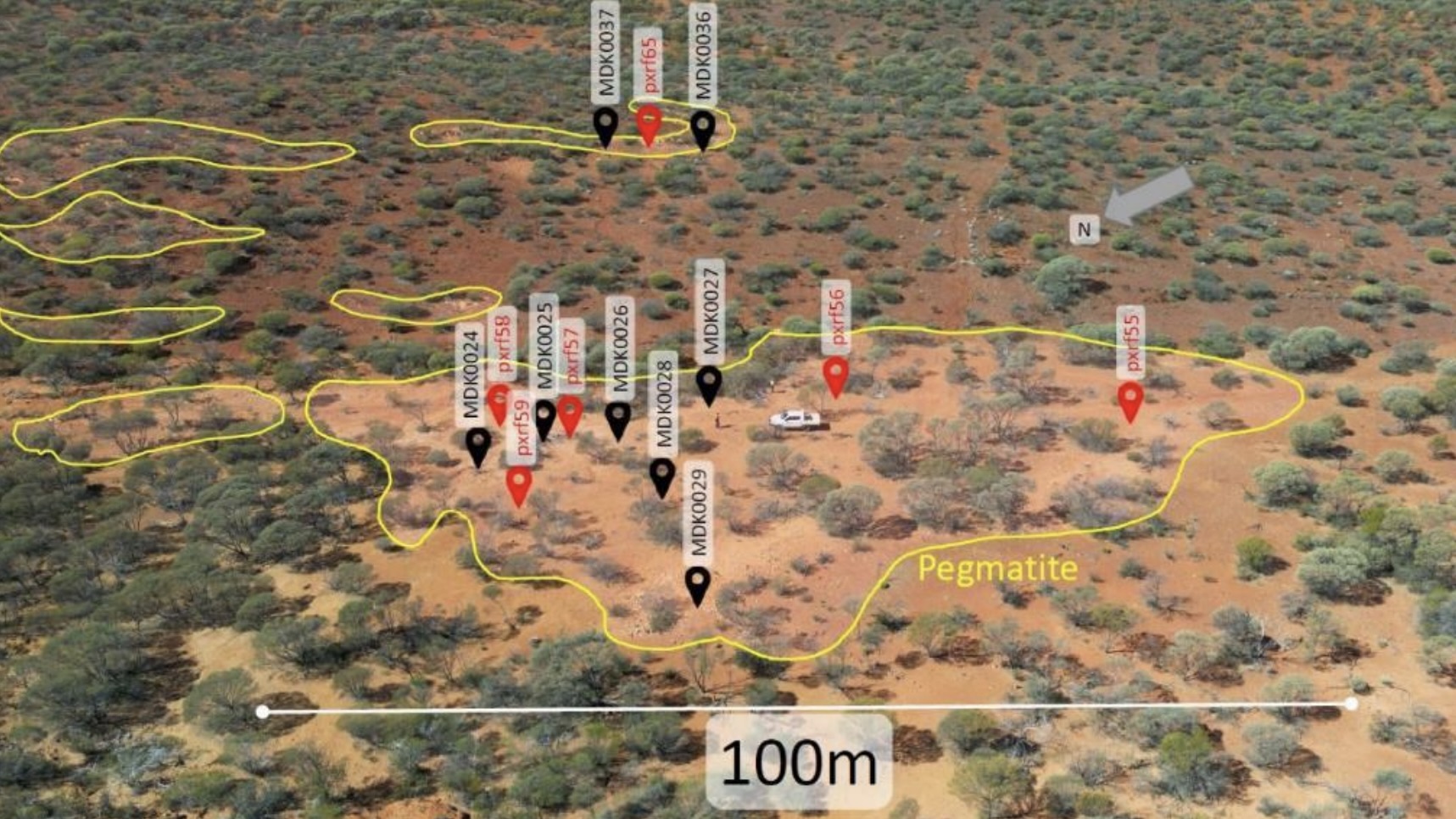

Perth-based exploration company Westar has announced the completion of a recent mapping and sampling field program, which extends the prospective strike of the pegmatite system at the Mindoolah lithium-gold project in the Murchison Region of Western Australia.

A precious-metals hunting minnow, Westar has, in hardly a shock move, been pivoting to “future metals” of late, focusing on, yep, lithium.

The findings from the program reveal over 40 outcropping pegmatites mapped over 7km along strike, while surface sample assays confirm that the largest pegmatite outcrop (100m x 50m) is the most prospective for lithium.

The Mindoolah project, notes Westar, contains numerous historically mapped pegmatites that remain untested for Lithium Caesium Tantalum (LCT) mineralisation.

“Surface sampling and subsequent focused pXRF analysis of mica from pegmatite outcrops has highlighted a likely fractionation sequence and mineralogical zoning within the pegmatite outcrop clusters,” reads the company announcement this morning.

Westar Executive Director Lindsay Franker said: “We have followed up on our initial reconnaissance work during the due diligence phase to better define drill targets within the 7km corridor of pegmatite at Mindoolah.

“Using quick and proven analysis methods to assess fertility of outcropping pegmatites in the field, we have defined prospectivity and scale of LCT pegmatite zones at Mindoolah.

“In addition, new fractionated pegmatite areas have been discovered which have not previously been mapped by historical explorers, presenting additional targets for testing.”

WSR share price

KOONENBERRY GOLD (ASX:KNB)

(Up on no news)

There’s no readily noticeable fresh news to speak of regarding KNB, so we’ll remind you of its last update of significance – an official approval to get stuck into maiden drilling operations at the Bellagio gold prospect.

That’s a project located about 160km north-east of Broken Hill in NSW and the company’s aircore drilling program has been scheduled to commence in August. It’s possible that the company has an update on this – possibly the engagement of a drilling contractor at a guess – so keep your eyes peeled for an upcoming announcement.

The campaign will be testing beneath multiple high-grade gold samples from outcropping quartz veins, including 39.4g/t gold and 22.5g/t gold rock chips, and a robust gold in soil anomaly with a maximum result of 33ppb Au.

The company’s managing director, Dan Power, noted earlier this month: “The long-awaited final approvals for Bellagio open the door for the first ever drilling program to test outcropping quartz veins which have returned some spectacular gold results to date.”

Incidentally, do you, every time you read the name Koonenberry Gold, think of the jingle for those old Goulburn Valley Gold commercials featuring the “Oarsome Foursome” (who won gold at the Barcelona Olympics in 1992)? Or is it just me? In any case, for your sake we hope not, because that thing’s an earworm that won’t bloody quit.

KNB share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.