Resources Top 5: Runs on the board for rare earths explorer Narryer

Narryer Metals is off the mark at Rocky Gully. Pic: Getty Images

- Narryer surges on rare earths find with “hard rock style” grades in shallow clays

- Labyrinth raises $19.5m with a little help from Genesis Minerals

- Medallion hits high grade gold in Ravensthorpe

Your standout small cap resources stocks for Wednesday, November 20.

NARRYER METALS (ASX:NYM)

Richard Bevan secured a major win for investors back in 2020 with his bottom-of-the-market bet on a nickel project virtually abandoned by BHP (ASX:BHP) called West Musgrave, trading his junior Cassini Resources to OZ Minerals in a $76 million deal.

It eventually gave those investors a window to part of the $9.6 billion of cheese BHP paid for Oz, ironically picking up West Musgrave as a $1.7 billion development asset as part of the trade. Weak nickel prices put that project on ice, but the work Bevan and his team did to put it in the shop window can’t be questioned.

He’s now nabbed a first run on the board as executive chair at Narryer Metals, which is similarly exploring in an unusual part of WA.

While the Great Southern is a popular locale for farmers and tourists, whale watching and history buffs, its reputation for exploration falls shy of the traditional mining regions of the Goldfields, Mid West and Pilbara.

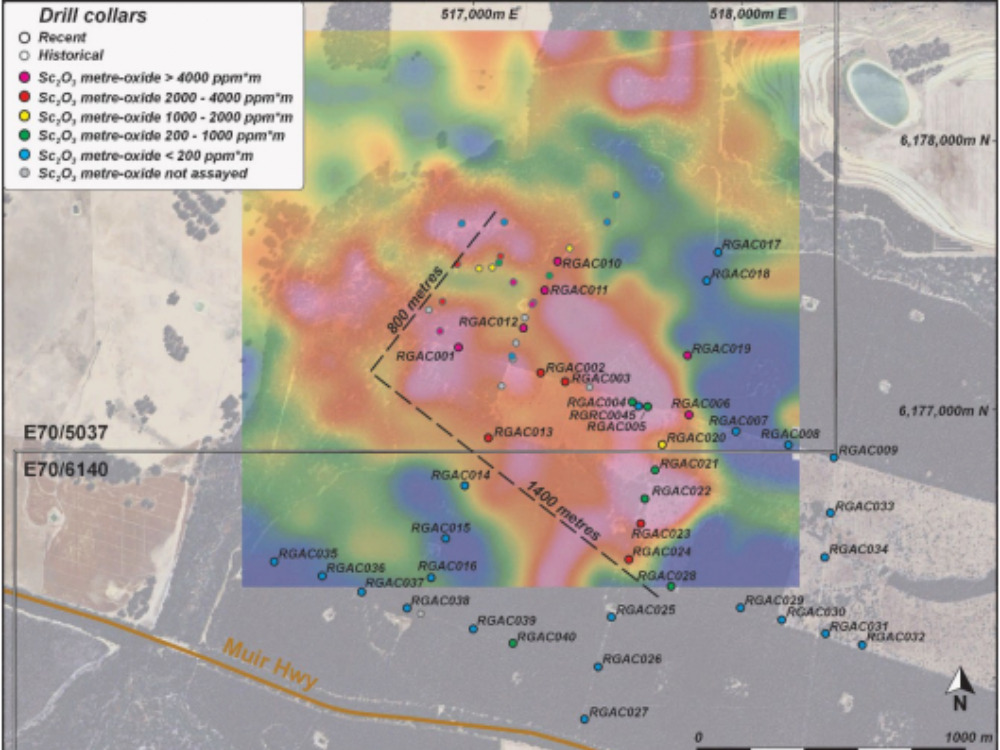

Narryer has caught the eye, however, with some shallow drilling returning high grades of scandium and rare earths from a first aircore program at Rocky Gully, also reporting hints of critical minerals gallium and vanadium.

Scandium highlights included:

- 19m at 232ppm Sc2O3 (scandium oxide), including 5m at 407ppm (RGAC011);

- 19m at 212ppm, including 3m at 339ppm (RGAC001); and

- 22m at 263ppm, including 7m at 410ppm (RGAC006).

Rare earths hits reported include:

- 20m at 2929ppm TREO, including 1m at 1.06% TREO (RGAC011);

- 5m at 6936ppm TREO, including 1m ar 1.8% TREO (RGAC024); and

- 10m at 4453ppm TREO, including 5m at 6198ppm TREO (RGAC010).

That includes heavy magnet rare earths terbium and dysprosium and light magnet metals neodymium and praseodymium, with mineralisation from surface over an area of 1400m by 800m.

We’ve seen many false dawns for rare earths discoveries in WA, with prices of around US$60/kg for NdPr placing most current producers in a loss-making position. Heat has come out of the market, but that could mean the current wave of discoveries will be walking into brighter conditions as they reach a development-ready state.

“This is a great result from our initial air core program. We’ve delineated high-grade zones of a range of critical metals including scandium, rare earths, gallium and vanadium. This mineralisation starts from surface and results to date reflect only the top 30m,” Bevan said, noting that grades seen in drill hits were higher than those typically seen in shallow clay deposits.

“The scandium and REE mineralisation compare favourably with other projects in Australia with respect to grade and potential scale and we can add to this with the other high-value critical minerals present in the system.

“It is also very promising that we are seeing high-grade TREO over 1% in assays. These grades are very high for clay hosted deposits and are more typical of hardrock mineralisation.

“We have only explored about 5% of the Rocky Gully tenement package and these results strengthen our belief there is potential to find a larger carbonatite mineralised deposit in the bedrock on the Project area.”

Plenty of water to run under the bridge here, of course. Just 5% of Rocky Gully’s 79km2 expanse has been explored with more drilling and all important metallurgical and mineralogical testing to come.

Narryer clocked an 80% gain earlier this morn.

LABYRINTH RESOURCES (ASX:LRL)

Labyrinth has caught the eye of Raleigh Finlayson, whose multi-billion dollar gold player will grab a 7% share in the junior, taking $1.45 million of a $19.5m, 21c a share placement in the buzzy gold explorer.

That comes on top of the sale of the Mulwarrie gold project to LRL, which has set its sights on reviving the historic Comet Vale and Vivien project in the Northern Goldfields of WA.

The brownfields drilling plan is a tried and tested strategy exemplified in none other than Finlayson and his competitive buddy Bill Beament at Saracen and Northern Star Resources (ASX:NST), which transformed from struggling minnows to merge into a now $20 billion gold giant.

Since then, ex-NST execs like Luke Creagh, Simon Lawson and Shaun Day have followed similar if not exactly traced playbooks at recent Aussie gold success stories Ora Banda (ASX:OBM), Spartan Resources (ASX:SPR) and Greatland Gold.

It will come as little surprise to the punters at home that LRL’s CEO Charles Hughes followed a similar path, working as a senior geo at Saracen, NST and Bellevue Gold (ASX:BGL) (led by fellow NST alum Darren Stralow) before a stint at Delta Lithium (ASX:DLI).

Investors, including Hughes’ ex-boss Finlayson, will be keen to see what RC drilling reveals at Comet Vale, where the Sovereign Trend previously produced 200,000oz at 20g/t gold. A diamond drill rig is due there next month, with drilling expected at Vivien and Mulwarrie next year.

“We are very pleased with what has been a highly successful capital raising for the company. The support received from Genesis along with existing, long-term and new Labyrinth shareholders reflects the exciting potential of the company’s projects,” Hughes said.

“After completion of the placement, the company is expected to hold approximately $21m in cash, placing us in an excellent position to quickly ramp-up exploration at our WA-focused, high-grade gold projects.”

KORE POTASH (ASX:KP2)

Kore owns 97% of two projects in Congo’s Sintoukola Basin – Kola and DX Potash – which host an imposing capex that can only be delivered from external sources.

With that in mind, the UK-headquartered firm says it has settled the terms of an EPC contract with China’s PowerChina, the world’s 105th-largest company and sixth-largest contractor with a fixed price of US$1.929 billion.

Kore says that makes it less likely for the massive development to fall foul to blowouts, with US$708.9m allocated to build transport and pipeline infrastructure which will reduce its reliance on the Republic of Congo’s state infrastructure.

PowerChina will be tasked with completing the project within 43 months, with ‘significant penalties’ to the contractor should it run more than 270 days over time.

Despite the official signing in Brazzaville on November 19, Kore says there remain a number of critical milestones to hit before construction can begin.

Notably, it will be looking to procure a debt and royalty financing proposal with a group called the Summit Consortium over the next three months. Theoretically, Kore will maintain a 90% holding in the eventual project (10% for the Congolese state) through the Summit financing.

The 2.2Mtpa muriate of potash project is intended to run for 33 years, supplying key agricultural markets in Brazil and Africa.

MEDALLION METALS (ASX:MM8)

There’s a gaping hole emerging in the mining scene down in Ravensthorpe, where First Quantum and POSCO’s nickel operation shut this year and the Mt Cattlin lithium mine is expected to shut in 2025.

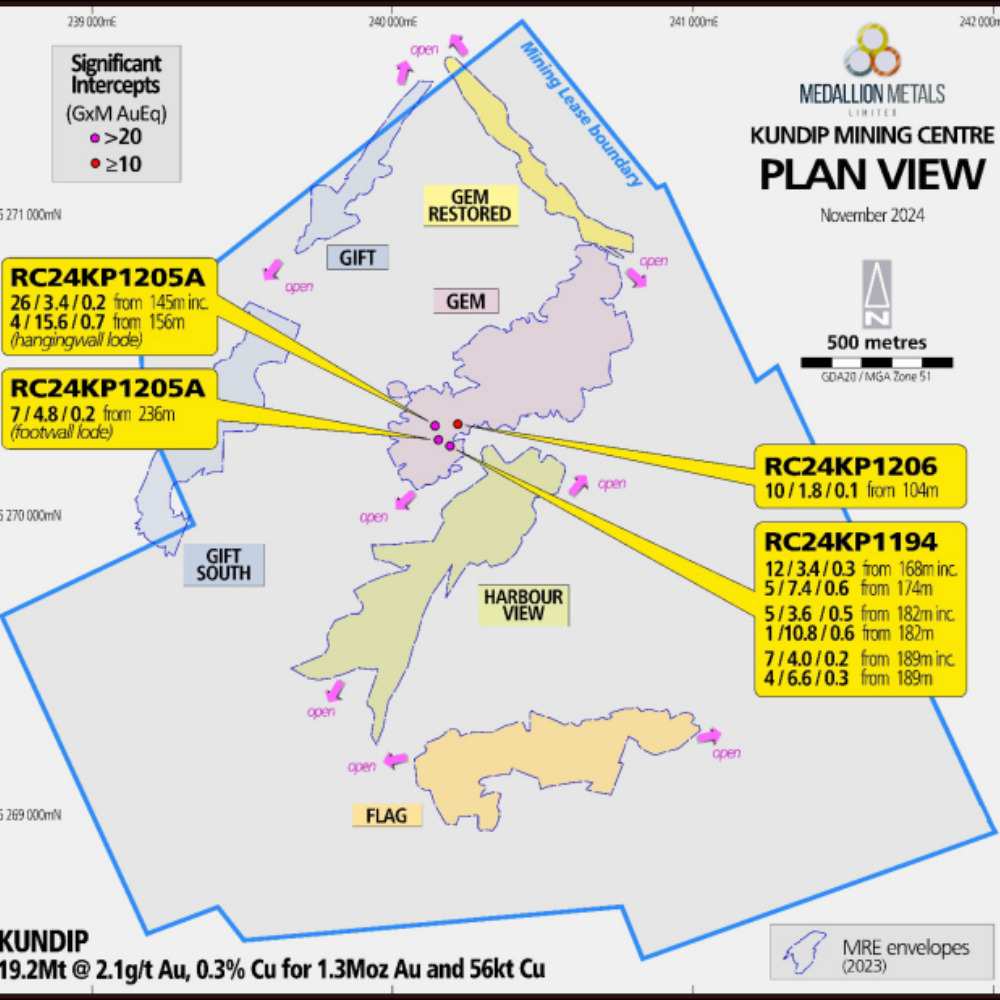

That’s shone a light back on Kundip, a long-dormant copper and gold project, where Medallion recently hit some thick, high grades from infill drilling at the Gem Loda.

The best intercept was a 26m strike at 3.4g/t gold, 0.2% copper and 3.7g/t silver from 145m, with a 4m intercept included in that at 15.6g/t Au, 0.7% Cu and 12.2g/t Ag.

There are a few more hits in a similar if less spectacular vein, with MM8 toasting the upside potential in the hanging wall and footwall lodes at the site. Those hits will inform a mineral resource estimate update and potential final investment decision.

“It’s great to be drilling again and demonstrating the potential of Kundip. These are extremely positive results to encounter first up,” MM8 managing director Paul Bennett said.

“Not only are we confirming the grade and continuity of the deposit, which is the principal aim of the infill program, but we are also likely increasing the resource and demonstrating the potential upside from high grade hits outside the modelled lodes.

“The lodes are visible in the chips and core and we expect a lot more good news to flow from this program which has just started reporting results.”

The updated underground MRE is due in H1 2025, with 7500m of a 15,000m drill drive into high-grade sulphide resources completed. A diamond rig is due in December with drilling to wrap up early next year.

The Ravensthorpe project hosts a current MRE of 1.46Moz gold equivalent at 2.5g/t AuEq, with higher gold prices and a plan to repurpose IGO’s mothballed Forrestania nickel processing plant opening up a potential pathway to production.

Lightning Minerals (ASX:L1M)

(Up on no news)

L1M announced the discovery of spodumene crystals earlier this week at its Esperança project in Brazil’s Minas Gerais state using laser-induced breakdown spectroscopy of 4.04% Li2O.

The explorer says it’s fully funded for drilling at the walk-up target in the first quarter of 2025, progressing its Brazilian projects alongside assets in WA’s southern Goldfields.

Lightning shares have lifted ~43% in the past month, with the explorer boasting a market cap of ~$8.5m.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.