Resources Top 5: ‘Queenslander! Queenslander!’ True North Copper and Bowen Coking Coal make gains

'Queenslander' (actually born in NSW) Billy 'More, MORE' Moore. (Getty Images)

- True North Copper is a hero at Vero today, announcing exceptional copper-cobalt-silver drill results.

- Lake Resources, about to deliver a preso in Argentina, is up on anticipation of positive lithium-ops updates.

- Raiden has kicked off significant lithium hunting near the Azure Minerals monster hit.

Here are the biggest small cap resources winners in early trade, Thursday August 10.

TRUE NORTH COPPER (ASX:TNC)

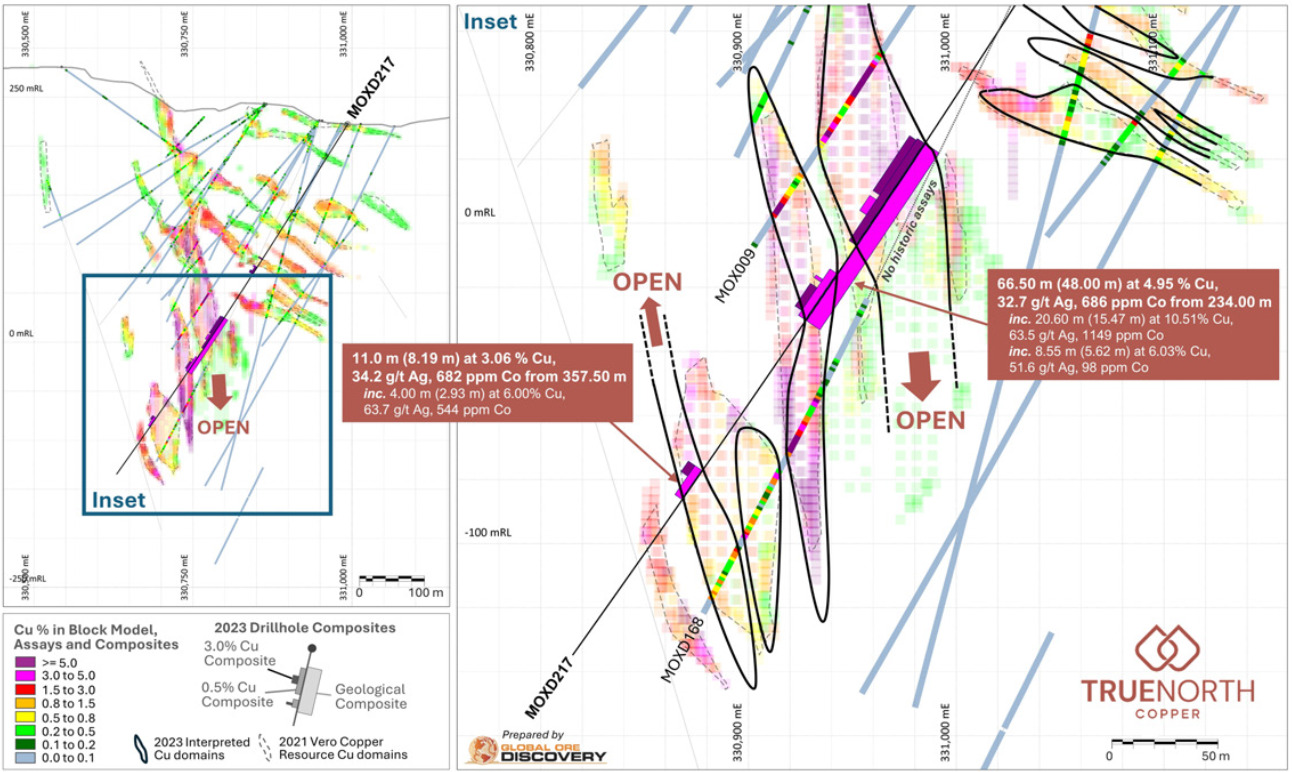

Cairns headquartered True North Copper has announced “exceptional high-grade copper-cobalt-silver mineralisation” at the company’s first drillhole of an initial diamond drilling program at the Vero Resource, part of its 100% owned Mt Oxide project in Queensland.

Specifically, TNC has intersected 48m at 4.95% copper from 235m depth, 8m at 3.1% copper from 358m and 9m at 6.2% copper from 178m (all true widths, also contains lower silver and cobalt grade).

TNC says it is now conducting further infill drilling on the Vero Resource as well as targeted extensions along strike and at depth.

It also aims to test other prospects within the Mt Oxide Project, with regular assay updates expected every 4-6 weeks through to the end of 2023.

Planning for follow-up drilling, airborne geophysics, district scale mapping and development of a new 3D mineral system model are also underway.

True North Copper’s Managing Director, Marty Costello said: “These drill results are simply stunning, not only returning superb grades but also showcasing the ever-expanding nature of the Vero high grade ore body.

“With every drillhole, we are increasing our confidence and expanding the extent of the resource. We continue to see encouraging visuals from the holes drilled to-date and look forward to reporting assays in the coming weeks.”

TNC share price

LAKE RESOURCES (ASX:LKE)

Lake Resources is a “clean lithium developer” focused on its the exploration of lithium brine at its flagship Kachi Project in the Catamarca Province within the “Lithium Triangle” in Argentina.

Why’s it up today? Investors are liking the fact it’s due to present at The XII International Seminar on Lithium today (August 10) in Salta, Argentina, which it’s also sponsoring.

Among other things, the company will be providing details on the Kachi Project, including a recent operational update on a new phased approach to delivering maximum plant capacity of 50,000tpa, as well as an innovative, sustainable DLE (Direct Lithium Extraction) process that will be used to produce high purity lithium carbonate.

LKE share price

RAIDEN RESOURCES (ASX:RDN)

Raiden has kicked off its lithium hunt at the Roebourne, Arrow and Mt Sholl projects.

The company reports its campaign includes detailed mapping of outcropping pegmatites and rock sampling, following up on the recently announced high-grade, lithium bearing pegmatites on the Roebourne Project.

And that project happens to be right next to Azure Mineral’s monster Andover lithium discovery where recent drilling has intersected up to 209.4m at 1.42% Li2O from 219m.

Raiden is one of a few other similar outfits neighbouring Azure Minerals, in fact. It’s a “lithium street party in the Pilbara” wrote Stockhead’s Jess Cummins.

“The recent lithium discovery by Azure Minerals has positioned the Pilbara as one of the most desired jurisdictions for lithium explorers,” RDN managing director Dusko Ljubojevis said recently.

“With a credit to Raiden’s management team, the company has managed to secure prospective ground, immediately adjacent to one of the most exciting lithium discoveries this year.”

In an announcement today, Ljubojevic noted: “We will be evaluating the greater potential of the entire portfolio of projects in the Pilbara, including Mt Sholl and Arrow for Li-bearing pegmatites. We hope to achieve similar success across the other projects as the Roebourne project.”

RDN share price

EURO MANGANESE (ASX:EMN)

EMN had an up-and-down July but has kicked off August nicely so far.

The $52m market capped manganese producer has this morning announced key developments on its Bécancour Plant in Québec. This, notes the company, is a crucial link in its chain for producing and providing high-purity manganese products in Canada for the North American electric vehicle (EV) market.

Manganese, as our very own Jess Cummins noted back in July, is a battery metals quiet achiever, and is gaining increasing traction as demand for lithium-ion batteries swells.

This lesser-known raw material, wrote Jess is “a key stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles”.

Regarding some specifics about the Bécancour Plant, a ‘Scoping Study’ was completed by EMN, which evaluated the development of a dissolution plant capable of producing 48,500 tonnes per annum of battery-grade manganese sulphate.

The study delivered strong preliminary project economics with a post-tax Net Present Value of C$190 million and a post-tax Internal Rate of Return of 26%.

Additionally, the company is undertaking a ‘Feasibility Study’ for the plant, which will further refine its design, costs and economics, and further opportunities.

The company has signed an MOU with MMC, a South African producer of high-purity electrolytic manganese metal, to supply the Bécancour plant with battery-grade, selenium-free, 99.9% HPEMM feedstock.

“Our growth plans to supply the North American lithium-ion battery market with high-purity manganese are advancing,” said Dr. Matthew James, President & CEO of Euro Manganese, adding:

“Completion of the Bécancour Plant Scoping Study, preparing for the Feasibility Study, and signing the MoU with MMC lays the foundations to deliver significant additional value for our stakeholders.”

EMN share price

BOWEN COKING COAL (ASX:BCB)

Bowen has today reported beaut shipping performance, achieving its monthly goal of moving four hefty vessels in July, and exporting ~179 kilotonnes of coal from its Bluff Mine near Blackwater, and Broadmeadow East Pit (coking), part of the Company’s Burton Mine Complex near Moranbah in Queensland.

“Our July shipping performance follows 199Kt being shipped in June across four vessels,” noted Bowen Coking Coal chief executive Mark Ruston.

Additionally, the company reports a 45% upgrade in the resource estimate for its Hillalong South project near Glenden, QLD, on the back of its 2022 exploration program.

Hillalong South is the southern part of the company’s Hillalong project in the northern Bowen Basin, and is owned 85% by Bowen and 15% by Japanese conglomerate, Sumitomo Corporation.

BCB share price

At Stockhead we tell it like it is. While Lake Resources and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.