Resources Top 5: Punters get fired up by cobalt bounties, fresh nickel IPOs and rare earths acquisitions

Pic: via Getty Images

- Castillo Copper unveils maiden 21,556t cobalt resource at BHA project in NSW

- Freshly listed explorer Nordic Nickel leaps out of gate on debut

- Mamba Exploration enters deal to acquire rare earths-gold project called ‘The Don’ in WA

Here are the biggest small cap resources winners in early trade, Wednesday June 1.

CASTILLO COPPER (ASX:CCZ)

CCZ has unveiled a maiden 21,556 tonne cobalt resource (64 million tonnes at 318 parts per million) at the BHA project in NSW.

The resource at BHA’s ‘East Zone’ — at relatively shallow depths between 2-80m — also includes 44,260t of copper (63Mt at 0.07%).

It was calculated using old drilling data between 1970 and 2014.

A bunch of other prospects modelled weren’t included in the mineral resource estimate, because the drilling was either sparse or sketchy.

That means there is “considerable potential” to expand this cobalt-copper resource with new extensional drilling.

“To extend and increase confidence in the delineated deposits, CCZ’s geology team have mapped out a comprehensive drilling campaign that is intended to target diamond coring the known cobalt mineralisation downdip to at least 100m,” the company says.

“The board plans to implement the drilling campaign once all key approvals are secured.

“In addition, the board intends to re-assess the potential of the West Zone for cobalt mineralisation, given it is proximal to Cobalt Blue’s (ASX:COB) advanced operation.”

COB’s 81,000t Broken Hill cobalt project (BHCP) is the only large scale, non-African, greenfield primary cobalt project in the world.

It could be in production by mid-to-late 2025.

$20m market cap CCZ is down 40% year-to-date. It had $6.2m in the bank at the end of March.

NORDIC NICKEL (ASX:NNL)

The freshly listed nickel sulphide explorer sprang out of the gate on debut.

$12m raised at 25c per share via its IPO will go towards a portfolio of nickel sulphide exploration assets in Finland’s Central Lapland Greenstone Belt (CLGB).

“Despite hosting some of the world’s largest nickel and gold deposits such as Boliden’s Kevitsa nickel-copper-gold mine and Anglo American’s Sakatti copper-nickel-PGE deposit, this region is significantly under-explored for komatiite/intrusive hosted nickel deposits using modern exploration techniques – unlike more mature belts like Kambalda in Western Australia,” NNL managing director Todd Ross says.

“The CLGB offers a generational opportunity for nickel exploration. The advanced exploration already conducted within the Pulju project area allows Nordic to expand known mineralisation and drill outstanding deeper geophysical targets that could deliver company-changing discoveries.”

A maiden resource at the ‘Pulju’ project based on historical drilling is due out in July.

Maiden drilling will kick off January next year.

READ: Nordic is ready to race to the Finnish with a $12m war chest to drive nickel exploration

MAMBA EXPLORATION (ASX:M24)

The explorer bounced back from recent lows after entering a deal to acquire a rare earths and gold project called ‘The Don’ in the Kimberley region of WA.

It’s a good neighbourhood, with rare earths players PVW Resources (ASX:PVW) to the south and Northern Minerals (ASX:NTU) to the north of the project area.

“The company is always on the lookout for additional projects to enhance the value of our existing portfolio and ‘The Don’ certainly does that,” M24 managing director Mike Dunbar says.

“We are actively exploring in the Kimberley, so this additional package strengthens our land position in the region and provides us exposure to an extremely underexplored REE and gold project.

“Given the success that PVW Resources to the south and Northern Minerals to the north have had exploring the same sedimentary formations and aged rocks for REEs and gold, it was surprising that this Project had not been secured by the other active explorers in the area.”

Initial field reconnaissance of The Don (also known as ‘walking around’) will be conducted in parallel with the soil/rock sampling program at the ‘Copper Flats’ project that is planned for June.

Dunbar is a proven mine finder and builder.

He was involved in the discovery and development of the +2moz Thunderbox gold mine, the delineation and development of the +1Moz Dalgaranga gold mine, and the discovery and delineation of the +1Moz Glenburgh gold deposit.

$6m market cap M24 is down 31% year-to-date. It had $3.7m in the bank at the end of March.

DUNDAS MINERALS (ASX:DUN)

(Up on no news)

DUN listed late last year to hunt for big ‘Nova’ or ‘Tropicana’-like nickel, gold, and copper deposits at its namesake project in the Southern Albany-Fraser Orogen region of WA.

Discovered in 2005, the Tropicana deposit is now one of the largest gold mines in Australia, producing over 400,000oz in FY21.

Nova — an entirely new type of nickel discovery in the Fraser Range – was uncovered by micro-cap explorer Sirius Resources in 2012.

Within two months the Sirius share price was up 4000%, from 5c to over $2.50. And when it was finally acquired by major miner Independence Group (ASX:IGO) in 2015, the former penny stock was valued at $4.38 per share, or $1.8 billion.

DUN says its tenements, about 100km from Nova, are exciting because nearly all previous exploration targeted gold and base metals, rather than nickel.

Even that exploration was pretty lax, DUN says. A small amount of drilling was completed in parts of the area before 1995, prior to these major discoveries being made.

Nearly all holes were drilled to a depth of less than 50m.

After hitting broad zones of nickel in recent drilling at the ‘Jumbuck’ prospect – including 34m at 0.23% nickel – the company kicked off a 118km2 ground gravity geophysical survey late last month.

GREENSTONE RESOURCES (ASX:GSR)

GSR has raised $4.9m to fund PGE exploration right next door to Galileo’s (ASX:GAL) recent company changing discovery.

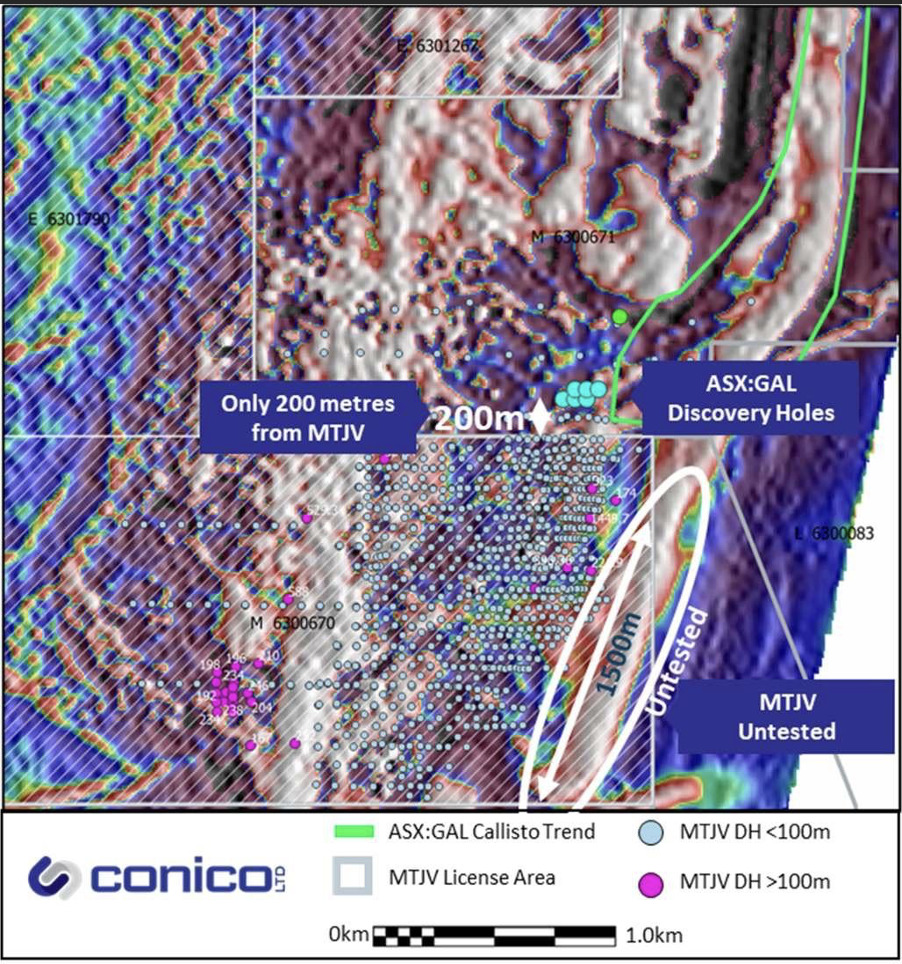

GSR and its ‘Mt Thirsty’ nickel-copper JV partner Conico (ASX:CNJ) have both been urging on nearology fervour since GAL hit palladium paydirt last month.

“… Prospective horizons from GAL appear to trend on to ground held by the Mt Thirsty Joint Venture,” director and shareholder of CNJ Guy Le Page says.

“It appears around 1.5km of this layered intrusion (Mission Sill) appear to strike on to the JV ground (figure below) and remain largely untested.”

Maiden drilling targeting extensions to Callisto will kick off within next 6-8 weeks, GSR says.

The cash will also be used to drill the ‘Burbanks’ and ‘Phillips Find’ gold projects.

“Greenstone is at transformational point, simultaneously growing the high-grade inventory at our flagship Burbanks Gold Project, while also maintaining aggressive exploration activities at both Mt Thirsty and Phillips Find,” GSR boss Chris Hansen says.

“With recent drilling over the past months at Burbanks North having returned multiple bonanza grade intercepts we have subsequently defined a new zone of mineralisation with a strike extent of over 1.5km and a depth of 450m, which still remains open in all directions.

“While exploration will continue to remain the core focus at both Burbanks and Phillips Find as we seek to expand the known mineralised horizon, we will shortly pursue a brief infill drill program at Burbanks North to support future resource estimates in this area.”

$48m market cap GSR is up 80% year-to-date.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.