Resources Top 5: Popular zinc-copper IPO uncovers an embarrassment of riches, shares fly

Picv: Via Getty

- Machine learning reveals 34 new targets at Belararox’s flagship ‘Belara’ copper-zinc project

- Pinnacle Minerals building toward maiden resource at flagship Bobalong kaolin project

- Tyranna (lithium), OZZ (gold), Pursuit (gold, nickel, copper) up on no news

Here are the biggest small cap resources winners in early trade, Tuesday May 31.

TYRANNA RESOURCES (ASX:TYX)

(Up on no news)

Historical rock chip sampling has returned up to 7.49% lithium at TYX’s newly acquired ‘Namibe’ project in Angola, West Africa.

That’s high grade. Hard rock mines usually produce at an ore grade of between 0.8-1.5% lithium.

It’s important to note that, so far, sampling has confirmed widespread lithium anomalism but does not display any clear pattern of lithium mineral distribution, TYX says.

“The apparently random distribution of enrichment suggests that lithium pegmatites may be present throughout the project, rather than being restricted to any particular zone of the Giraul Pegmatite Field [and that] the potential to find many more lithium pegmatites within the project is high,” the company says.

“Once we have received the necessary shareholder approvals, Tyranna’s short-term goal will be to define drill-targets with an intention to commence drilling as soon as possible.”

TYX’s pivot to lithium has been well rewarded so far, with the $26m market cap stock now trading at four-year highs.

BELARAROX (ASX:BRX)

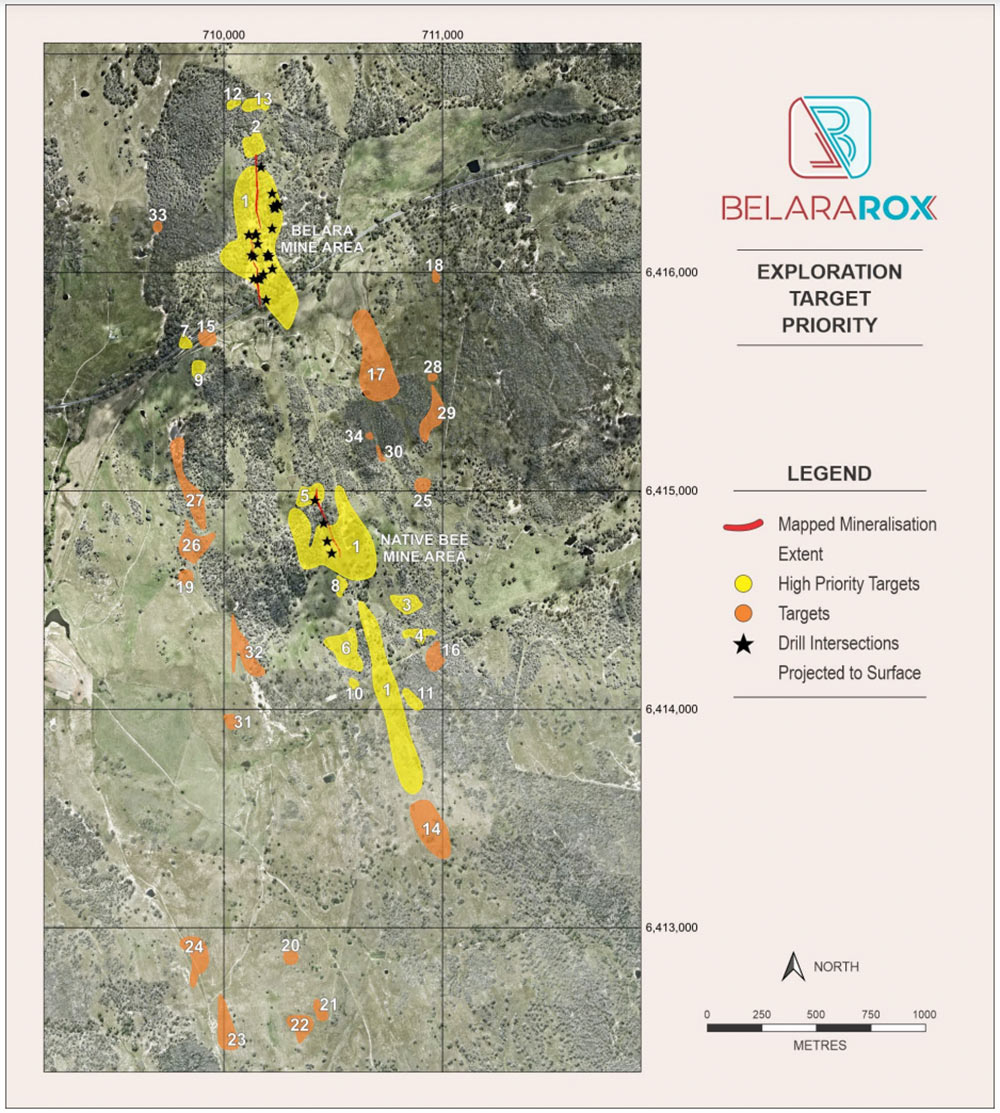

Machine learning techniques have revealed an embarrassment of riches at BRX’s flagship ‘Belara’ copper-zinc project.

The 34 new exploration targets outside existing resource areas will provide “a strong pipeline of mine-scale targets that will support organic growth through discovery into the future”, the company says.

Eleven new high priority targets – which have the same geophysical, geological, and geochemical characteristics as the historic resources at ‘Belara’ and ‘Native Bee’ — have a combined strike of 8km, which is about eight times the length of currently known mineralisation.

And near the mines themselves a total of 2,000m of prospective strike at Belara and 2,385m of prospective strike at Native Bee remains to be tested by drilling.

If successful, this could potentially increase the known resource strike by four times.

Like we said — an embarrassment of riches.

RC drilling of historic resource areas is expected to be completed by mid-July, with final assays anticipated in August.

A resource update will follow. Non-executive chairman Neil Warburton expects it will be “sizeable”.

BRX is up 235% on its January IPO price of 20c per share. It had $4m in the bank at the end of March.

OZZ RESOURCES (ASX:OZZ)

(Up on no news)

The share price of gold focused OZZ had steadily waned since it listed mid-2021, but today’s spike (on larger than usual volumes) could signal a return to form. It follows a refresh of the OZZ board announced yesterday, which will see David Wheeler and Giuseppe Graziano take the reins from outgoing directors Allan Lockett and Jonathan Lea.

On May 16 a 3,600m drilling program kicked off at the early stage ‘Rabbit Bore’ project in WA, with multiple gold, nickel and copper targets to be tested.

Rabbit Bore hosts 5km of prospective shear zones largely under cover, including several historical gold workings which have returned rock chip assays of up to 4.2g/t gold.

“Our work at Rabbit Bore to date, including soil geochemistry and aeromagnetic surveys, has clearly supported the prospectivity for gold, nickel and copper mineralisation,” former managing director Jonathan Lea says.

“The commencement of drilling marks the culmination of our systematic approach to defining targets in the most efficient and cost-effective way.

“The drilling will evaluate the most anomalous areas, with assay results expected to be returned progressively from June. “

With drilling approvals either in place or pending for other projects ‘Maguires’, ‘Mt Davis’ and ‘Peterwangy’, OZZ expects further drilling to progress immediately after this program.

“The remainder of 2022 is expected to see a high level of exploration activity and we are excited to have the opportunity to unlock the full potential of our highly prospective projects,” Lea says.

The $4.5m market cap minnow is up 8% year-to-date. It had $1.8m in the bank at the end of March.

PINNACLE MINERALS (ASX:PIM)

(Up on no news)

The newly listed kaolin stock is fairly advanced compared to its ASX peers.

Its main game is ‘Bobalong’ near Albany in southern WA, where recently completed drilling will be used to deliver a maiden resource.

PIM is targeting ~10Mt: enough to support a 350,000tpa operation over 30 years.

A scoping study – the first proper look at the economics of building a project – is already underway, alongside offtake discussions.

On a global scale the kaolin market is relatively unknown but not insignificant. It’s currently worth around US$6.4 billion, but demand is expected to grow to US$8.2 billion by 2024.

Due to its extraordinary white colour it is mainly used in the production of paper as well as ceramics, but has side markets in everything from pharmaceuticals to agriculture and cosmetics.

The high brightness level (around 80-85%) of PIM’s Bobalong clay makes it ideally suited to ceramics and paper markets as a direct shipping ore product, the company says.

The ~$4m market cap stock is down marginally on its listing price of 20c per share. It had about $4.5m in the bank at the end of March.

PURSUIT MINERALS (ASX:PUR)

PUR inked a deal to buy the ‘Commando’ project, just 38km from Kalgoorlie, in December last year.

The project ground was previously held in small parcels by undercapitalised companies, PUR says, so there had been little exploration here since the ’90s.

The explorer has been focused on doing the early-stage stuff at Commando, like soil and augur sampling, as it hones in on targets for maiden drilling.

Today, it announced “exciting” results from the first project-wide sampling program.

Augur drilling has defined four new +1km long gold anomalies called ‘Wedge’, ‘Whisperer’, ‘Bungarra’ and ‘Skink’ “requiring follow up AC drilling as soon as possible”.

Whisper and Skink have never been drilled, PUR says.

“Pursuit is very pleased to announce the discovery of four new prospects and a number of new gold anomalies at Commando following our recent auger sampling program,” managing director Bob Affleck says.

“This reinforces the prospectivity of this underexplored project.”

An augur is a small drill designed to get underneath the loose, transportable topsoil.

“Given that the aqua regia digest assay used is only a partial digest technique, the very high levels of anomalism reported here are considered very encouraging and highly significant,” Affleck says.

“The results provide the company with new quality targets for our forthcoming AC drilling program at Commando.”

AC, or aircore, is a good ‘first pass’ drilling technique to dial in tighter on prospective targets prior to deeper RC and diamond drilling.

The $26m market cap explorer is down 17% year-to-date. It had a substantial $6.9m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.