Resources Top 5: Petratherm running to a 600pc month gain on titanium rich sands discovery

Petratherm and more ASX ressie juniors are running wild today. Pic: Getty Images

- There’s so many junior resources stocks moving today we gave you 7

- Petratherm stuns with heavy mineral sands discovery in South Australia

- Gallium, germanium and antimony juniors climb as China shuts out US from buying

Your standout small cap resources stocks on Wednesday, December 4.

PETRATHERM (ASX:PTR) and NARRYER METALS (ASX:NYM)

The heavy mineral sands discovery at Petratherm’s Muckanippie project has sent the explorer’s shares to an extraordinary ~600% gain over the past month, including over 75% early on Wednesday after drill results confirmed a “highly significant new HMS discovery” at the Rosewood prospect.

The word ‘bonanza’ has been pulled from the big dictionary of mining terms to describe the first results from a 2km trend at the South Australian site.

PTR says high-value mineral species leucoxene and rutile are present in the heavy mineral assemblage based on analysis of the heavy mineral fraction, consistent with historical results to 1km to the east.

Natural rutile, a titanium feedstock used in paint pigments and welding among other applications, is generally considered to be coming into a period of supply shortages.

Here are the results for your enjoyment:

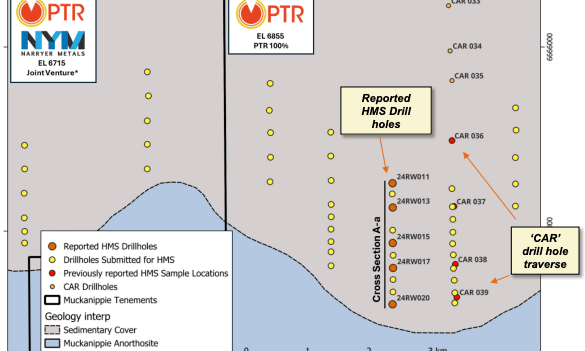

- 24RW020 – 22 m at 19.1% heavy minerals from 8m including;

- 4m at 27.9% HM from 9m and including 1m at 39.7% HM from 11m

- 24RW017 – 17m at 9.7% from 6m including;

- 4m at 22.2% HM from 8m.

- 24RW015 – 11m at 10.0% HM from 6m including;

- 6m at 15.4% HM from 7m

- 24RW013 – 20m at 8.9% HM from 4m including;

- 8m at 12.1% HM from 5m and 3m at 21.3% HM from 21m; and

- 24RW011 – 10m at 6.8% HM from 3m including;

- 4m at 11.7% HM from 3m.

“The maiden Petratherm drill results are outstanding and confirm Rosewood is a highly significant new HMS discovery within the company’s broader Muckanippie project,” PTR boss Peter Reid said.

“Recent mineral analysis of the HM fraction from historical drill holes 1 kilometre east of today’s drill results indicated favourable concentrations of high value Leucoxene and Rutile. The bonanza HM grades and thicknesses reported are highly significant and a major step towards both confirming the potential scale of mineralisation and de-risking the viability of the project.

“Assay results from a further 45 drill holes from Rosewood are expected in the coming weeks along with detailed mineral analysis of the HM assemblage. We look forward to providing results as they come to hand.”

There are still 45 drill holes to be reported, so there’s plenty more news flow on the horizon. The lines have been drilled over seven traverses covering an area of 8km by 2km, giving a sense of the scale of these kinds of finds.

Muckanippie runs over a string of tenements in the North Gawler Craton with a complex network of owners. A number of tenements are 100% owned by PTR, including EL6855 where the reported drill hits are located.

Two of the seven traverses drilled at Rosewood though are on EL6715, a joint venture with Narryer Metals (ASX:NYM).

That’s seen stock in the ~$6m capped Richard Bevan led explorer run 55% higher intraday, even though the reported hits weren’t on its turf, with investors loading up before results from drilling on the JV ground come through.

ALDORO RESOURCES (ASX:ARN)

Aldoro is up almost 50%, running on the announcement of 262m of niobium at the carbonatite found at the Kameelburg project in Namibia.

Peak assay results from a pre-drill chip sampling exercise clocked in at 94 line metres at 0.93% niobium pentoxide and 30m at 1.2% Nb2O5.

On average the 262m of surface samples came in at 0.52% Nb2O5.

Niobium has become a hot commodity on the ASX after the Luni discovery was made in WA’s West Arunta region by boom explorer WA1 Resources (ASX:WA1).

The mineral trades at US$57,000t, with 0.15% Nb2O5 equivalent to 1g/t of gold according to Aldoro. It’s a strategic commodity in the US, Japan and EU.

NIMY RESOURCES (ASX:NIM), BATTERY AGE MINERALS (ASX:BM8), FELIX GOLD (ASX:FXG) and MTM CRITICAL METALS (ASX:MTM)

Our other cohort of resources gainers comes from a trio of stocks exposed to one of this year’s most geopolitically charged mining stories.

China has locked the United States out of the market for gallium, germanium and antimony, along with graphite items.

It’s the latest reinforcement of Chinese export controls on the critical commodities, coming after the outgoing Biden administration enhanced restrictions on selling US tech, including semiconductors to China.

“In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted,” a Chinese commerce ministry statement said, according to Reuters.

The announcements are largely symbolic and a bit of a chest-puffing exercise.

Antimony exports have already dropped 97% since September, while no Chinese gallium or germanium has made it to the States, at least not through direct sources, through October this year.

But it is seen as a “considerable escalation in tensions”, consultancy Project Blue’s Jack Bedder told Reuters.

Nimy Resources was among the big movers, surging more than 70% late in trade having last week announced intentions to compile a JORC resource over a 900 by 650m gallium anomaly identified at its Mons project, previously explored for both Kambalda and Mt Keith style nickel sulphides.

Up almost 27% Wednesday, Felix Gold owns the 831,000oz Treasure Creek gold project in Alaska, a prospective gold asset on the doorstep of major Kinross Gold’s Fort Knox mine and plant.

But it is also looking into the prospect of commercialising antimony prospects on its ground, which includes the historic Scrafford mine.

Scrafford could be brought back to life by the end of 2025 as the US looks for friendly sources of antimony to replace production previously sourced from China. Trading at US$14,000/t in 2022, the supply crunch has sent antimony close to US$40,000/t, including a ~200% gain this year.

That’s seen the number of explorers on the ASX looking for the defence metal surge in 2024.

Historic production at Scrafford has been as high as 58% Sb, the chemical symbol for antimony, with total production record of 1.79t at 38.58% Sb.

High-grade antimony has also been found at NW Array, with hits of up to 26.1% Sb and a top thick intercept of 15.2m at 5.5% Sb from 21.3m.

Battery Age Minerals, which listed originally as a Canadian lithium explorer, said last week it was putting greater emphasis on its Bleiberg germanium project in Austria.

The semiconductor metal is largely produced as a by-product of base metals refining, with China in charge of ~54% of global metal supplies.

The largest secondary producer of germanium is Umicore in Belgium, which also sources concentrates from places like the DRC.

BM8 said CEO Nigel Broomham and chief geological advisor Dr Simon Dorling recently completed a fieldwork program at Bleiberg, collecting data to refine targets for frilling.

It plans to explore potential extensions of known mineralisation, including the “West Extension”.

Closed in 1993, Bleiberg was ranked as the world’s sixth-largest germanium mine when it was shut having churned out 172t historically based on a review of 100 years of historic mining data acquired by BM8 in February.

MTM meanwhile took its month gain to 87.5% with another big run, less than a week after announcing a strategic partnership with New York headquartered Indium Corporation, which will provide access to scrap containing high concentrations of indium, gallium and germanium.

The ASX junior is planning to use its innovative flash joule heating technology to process the scrap into end products of the critical minerals.

A whole range of other critical minerals juniors have moved higher on the news including graphite miner Syrah Resources (ASX:SYR) and US focused silver/antimony explorer Sun Silver (ASX:SS1).

At Stockhead, we tell it like it is. While Petratherm, Felix Gold, Sun Silver and MTM Critical Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.