Resources Top 5: Brazilian lithium pivot sends OzAurum on 200pc gain and Gina Rinehart loads up on Future Battery Minerals

Pic via Getty Images

- By jingo, by crikey and estou animado. OzAurum has spodded it’s way spectacularly up the bourse

- While not turning quite as many heads, other lithium sorts, including FBM and BNR, are having a decent day, too

Here are the biggest small cap resources winners in early trade, Friday September 15.

OzAurum Resources (ASX:OZM)

Aussie goldie junior OzAurum has exploded in the right direction this morning, leaving the rest of the resources pack in its RC-drilling dust. OZM has burst up about 200% at the time of writing.

Must be some more beaut results from its Mulgabbie North gold project in WA, right?

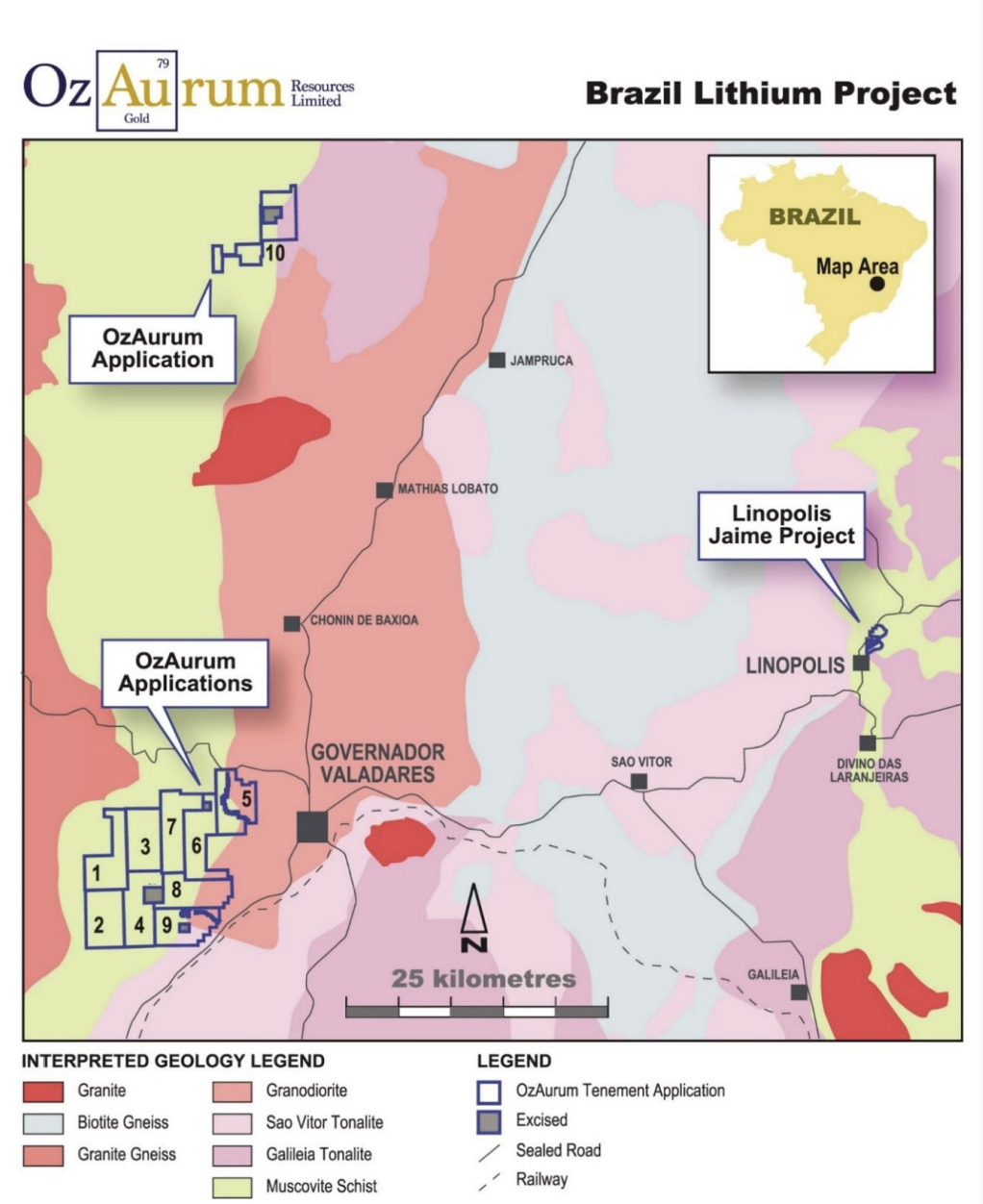

Not this time. The bigger news is that the explorer has announced it’s joining the lithium-hunting party. Over in Brazil.

Battery metals – if you can’t beat ’em, join ’em, eh?

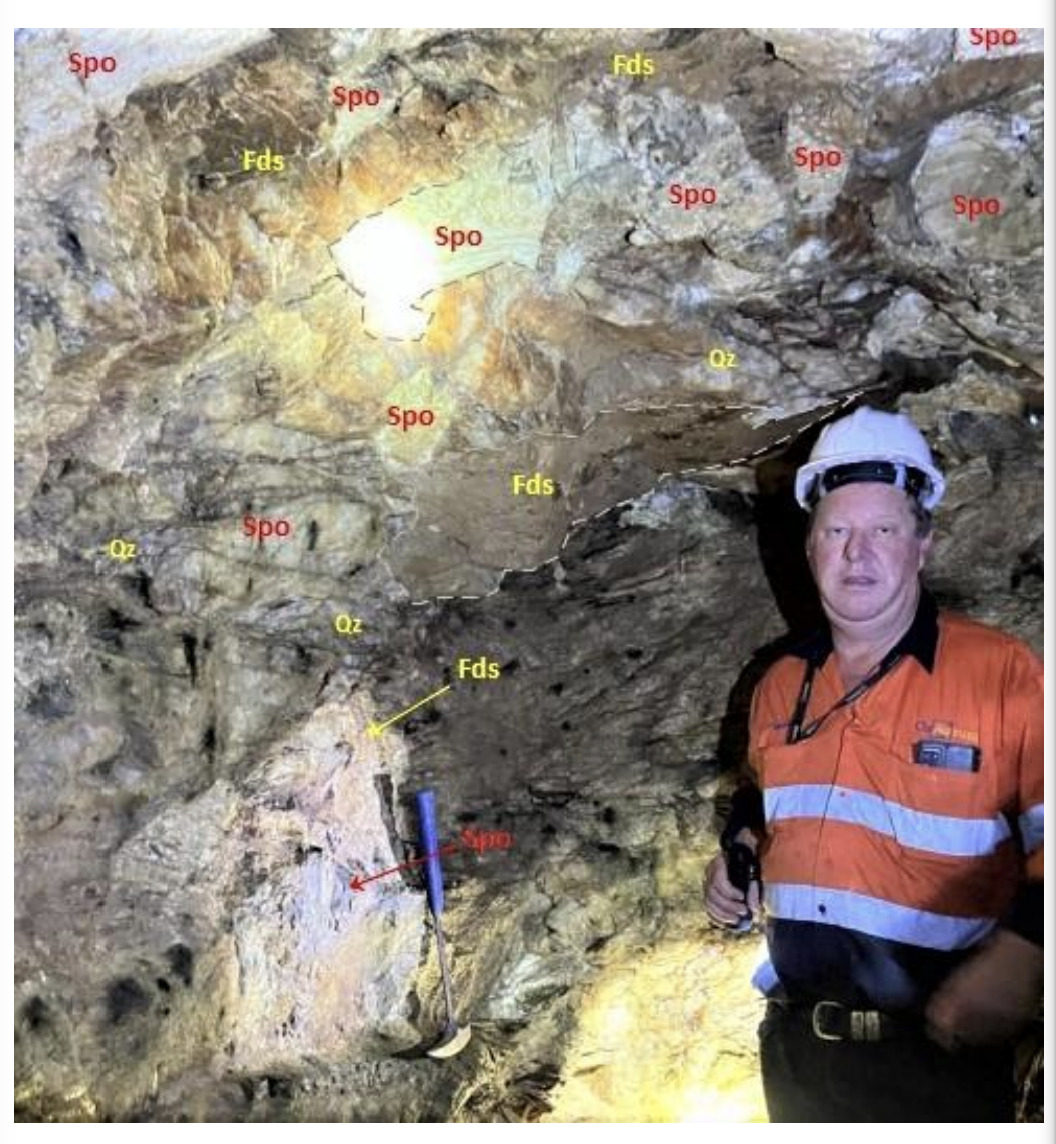

Specifically, OZM is acquiring the acquire the Linopolis Jaime hard rock lithium project in the State of Minas Gerais, where it appears to be onto some particularly juicy-looking spodumene (see below).

The Linopolis Jaime project, says OzAurum, is on a strategically held area of over 20 lithium – cesium – tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar by the Pacheco family and other artisanal miners for more than 50 years.

Also, the project’s spod grades are revealed to be up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide zone consisting of at least 20% volume coarse spodumene crystals up to 1m in length mapped over +7m in true width.

As the company notes, coarse spodumene crystals are rarely seen in lithium deposits. Greenbushes and Mt Marion lithium deposits are examples where they are known to occur.

And the other thing that’s attracted the company to bust a Brazilian move – it’s an untapped site. There has been no lithium exploration within the project area previously.

We’re starting to see why the OZM share price is on a tear today.

OZM share price

Future Battery Minerals (ASX:FBM)

FBM is double-digits up on news of a heavily oversubscribed $7.6 million placement to accelerate exploration at its Kangaroo Hills and Nevada lithium projects.

But why is it up big? Placements normally tank a share price as investors who missed the discount tap out.

Not when the big kahuna herself, Gina Rinehart, is tipping in around a third of the cash to become a major player in your stock.

Hancock Prospecting’s $2.65 million commitment is small change for Australia’s richest person, but looms large especially given her big plans to diversify from iron ore to WA lithium.

She has spent many times that to grab a 7.72% stake in Liontown Resources (ASX:LTR) in recent days, raising question marks over the path US giant Albemarle will have to tread to nail down a $6.6 billion takeover for the Kathleen Valley mine owner it’s board is right keen on.

So what about Future Battery Minerals? One of its projects is located in the Goldfields region of WA, and the other one is in… Nevada, USA.

A spodumene-coloured star for whoever can guess which is where.

Kangaroo Hills is 100% owned by the company and has seen completion of a Phase 3 reverse circulation (RC) drill programme with 7,000m drilled to date, awaiting assay results for about 50 holes.

The Nevada project is 80% FBM owned, where Phase 3 RC and DD resource drilling is kicking off at Lone Mountain in late September.

Some further tweet-based info…

#ASXNews$FBM.AX received firm commitments to raise $7.6m under a placement from institutional, sophisticated investors & cornerstone Hancock Prospecting

Funds will accelerate exploration drilling programmes across the Kangaroo Hills & Nevada Li Projecthttps://t.co/ZWSMuxvvIP pic.twitter.com/MNzbJv95pC

— Future Battery Minerals Limited (@FBM_Limited) September 15, 2023

FBM share price

Bulletin Resources (ASX:BNR)

(Up on no news)

Not seeing too much round the traps that would be giving this small gold and lithium hunter a 25% boost up the bourse today.

The last piece of valuable info recorded that we’re aware of, was this:

Bulletin News: First Two Dalgaranga Tenements Granted at the Mt Farmer Project. View here: https://t.co/F6c552KUwf #BNR $BNR #Bulletinresources #Lithium

— Bulletin Resources Limited (@BulletinRes) July 11, 2023

Earlier this year, Bulletin expanded its Mt Farmer project tenement holding, almost doubling the area from 59km2 to over 100km2.

The project surrounds Aldoro’s (ASX:ARN) 2km2 P59/2137, which hosts the Niobe rubidium-lithium project.

Bulletin’s tenement applications have over 5km strike of the potential greenstone host to the Rubidium bearing pegmatite unit.

Those northeast extensions up towards the Dalgaranga gold mine have now given the Mt Farmer project two out of three tenements granted with 44km2 granted out of total project area of 103km2.

BNR share price

EV Resources (ASX:EVR)

(Up on no news)

Also in rude health on the daily timeframe, on not a lot to report, is another global battery-metals-hunting small cap, EV Resources.

What’s doing? While we keep one eye on announcements to see what turns up, let’s recap some of its more recent news…

Shaking hands with Peruvian locals regarding a permit for copper and silver drilling at the Don Enrique project in Quero…

$EVR.AX signed a binding agreement signed with local community at Quero, in Peru.

The Quero community support is an important step forward to #drilling Don Enrique #Copper #Silver Project & #EVR is finalising a drilling application permit for submission.https://t.co/lhvja72pNy pic.twitter.com/LtgoIKqY7C

— EV Resources Limited (@EVResources_EVR) August 30, 2023

And the recent raising of US$3.4m to advance the company’s copper exploration in the Americas.

via @MiningNewsNet$EVR.AX has raised US$3.4 million through a convertible note issue to Obsidian Global.

The notes have a 24-month maturity with a face value of $1.08 and can be used to advance exploration at #EVR's #copper portfolio in the Americas.https://t.co/3Y8e9Lh4dQ

— EV Resources Limited (@EVResources_EVR) August 11, 2023

Earlier this year, shares in EVR surged after the company announced a $25m investment commitment from Sapphire Global Energy to further develop its battery minerals portfolio.

Aside from its Americas copper hunting exploits, EVR owns a number of projects including the Shaw River lithium project in Western Australia’s Pilbara region and the Austrian Alps lithium projects in the Eastern Alps.

EVR share price

Anson Resources (ASX:ASN)

In the slightly larger end of small-cap resources town, Anson ($203m market cap) has some news today. It may not be quite in double-digits gains territory as we type, after cooling off a fraction from an early burst, but it’s still worth a mention here.

The company reports it’s ramped up its lithium carbonate production at its Sample Demonstration Plant in Florida to meet demand from potential offtake partners.

“The demonstration plant is producing battery-grade lithium carbonate using the Paradox lithium project’s DFS flowsheet and production ramp-up is a key step in Anson’s qualification process with potential offtake partners,” wrote Anson in its ASX press release this morning.

Anson Executive Chairman and CEO Bruce Richardson said:

“Our qualification process for potential offtake partners is progressing very well. The DLE technology Anson has selected for the Paradox Lithium Project has been proven commercially, and now we are in process of providing battery-grade lithium carbonate samples to large vehicle manufactures and their CAM’s in the USA as part of a structured supply qualification process in order to qualify as a supplier to these end-users.

“Samples of different quantities are required by various groups in the supply qualification process, and Anson continues to ramp-up production at its demonstration plant to meet demand.”

ASN share price

At Stockhead we tell it like it is. While Future Battery Metals and Anson Resources are Stockhead clients at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.