Resources Top 5: Mako Gold surges on strong quarter; True North Copper bags $42m funding

Sculptures by the Sea was done with taking things literally. (Pic via Getty Images)

- It’s still quarterly reporting season a-go-go for ASX ressie stocks

- Mako Gold, Manhattan Corp and Mantle Minerals are all up on Q4 postings

- Meanwhile True North Copper bags big loan capital from global mining fund

Here are some of the biggest resources winners in early trade, Wednesday January 31.

Mako Gold (ASX:MKG)

As Stockhead’s Michael Washbourne reminded us this morning, Mako Gold’s share price surged 55% earlier this week on the back of positive progress at its flagship Napié project in Côte d’Ivoire as well as a timely and favourable plug from respected mining guru Barry Fitzgerald.

And today, the African-focused goldie is surging further on the back of a positive Q4, 2023 report.

Some highlights:

• Detailed geological mapping and rock chip sampling are ongoing at the Tchaga North prospect at Napié. The focus there is primarily on western greenstone/granite contact targeting high-grade gold where recent drilling returned values up to 45g/t gold.

• Mapping has discovered a new structural trend with quartz veining which has yet to be tested by drilling. The company says that’s low-cost work that will generate new high-grade gold targets for drill testing.

• Meanwhile Mako’s Korhogo project has seen geological mapping and rock chip sampling completed as it hunts for new manganese zones.

• And from a funding perspective, Mako secured binding commitments to raise $2m (before costs) through a placement at 1c per share.

There’s more, besides, including an exclusivity agreement with Goldridge Resources, but we suggest you read the company’s full quarterly report if interested in delving deeper.

MKG share price

Manhattan Corp (ASX:MHC)

Minerals explorer MHC is also up nicely today on its quarterly posting (which actually came yesterday).

Chief highlights included:

• The completed processing of a 1,396.3 line-kilometres high-resolution, airborne drone magnetic survey at MHC’s Chebogue lithium project in Nova Scotia Canada, which occurred over the Spodumene Boulder Discovery area.

The survey identified several low magnetic responses that MHC believes may be associated with spodumene-bearing pegmatite boulders at the Big Betty prospect. That’s a site that’s returned strong assays including: 3.40%, 3.23%, 3.19% Li2O and more.

Regarding its cash position, the company reported that, as of December 31: “cash and cash equivalents totalled $2.6m (down from $3.4m on 30 September 2023)”.

Regarding some more recent news, MHC is looking to rejuvenate exploration of its Ponton uranium project northeast of Kalgoorlie, with ministerial consent being sought for further drilling of the contained Double 8 deposit.

There’s method to Manhattan’s move, as yellowcake prices have skyrocketed since the start of 2023, this week hitting 16-year highs of +US$100/lb.

More on that > here.

MHC share price

Mantle Minerals (ASX:MTL)

This gold, nickel ‘n’ lithium explorer is up about 20% today after its Q4 activities and cashflow report landed in the ASX in-tray.

Digging into that, then, we can tell you the company is particularly pleased about:

• Completion of an aircore drilling program at the Roberts Hill gold tenement near Port Hedland in WA; with 174 holes totalling 13,475m.

• And not far from that, the company’s Mt Berghaus project has seen its Gold Exploration Licence granted. Which means some 13,000m of aircore drilling can now be locked in for the first half of 2024.

• In November, the company also signed access agreements at Roberts Hill and Mt Berghaus with De Grey Mining (ASX:DEG).

Moving beyond the Q4 report, more recently, Mantle announced a nickel resource upgrade at its Highway deposit, which lies within its Pardoo Ni-Cu project in the Pilbara region of WA.

The upgrade follows an infill drilling program completed in September 2022.

The total (Indicated and Inferred) MRE is now 16.5Mt at 0.407% Ni for a total of 67,005t of nickel metal.

MTL share price

True North Copper (ASX:TNC)

This Queensland copper hunter has made a solid start to the year – in terms of positive news at least. Share-price wise, it’s up double digits so far today, down about 5% so far YTD.

The company has made a big announcement today, revealing it’s secured a huge amount of funding – $42 million – to come in two tranches, from the Nebari Natural Resources Credit Fund. That’s a global mining financial solutions company based in the US, which also includes a Perth office.

The capital comes in the form of a four-year “senior secured loan facility”, subject to certain conditions including (for Tranche 2) the commencement of commercial production of sulphide ore at TNC’s Cloncurry Copper Project (aka, CCP).

TNC notes that this agreement came after it completed its due diligence regarding the company and its projects.

Some commentary from True North Copper MD Marty Costello:

“Nebari Natural Resources Fund [is] a highly respected and experienced financier of mining projects globally. [The funding] marks a significant milestone for our company. These funds will be used to refinance the environmental bond, as the key next step in our mining restart at the Cloncurry Copper Project, as well as provide working and restart capital.

“TNC will soon announce the approved Cloncurry Copper Project mine plan. We’re incredibly excited about restarting mining and bringing the Cloncurry Copper Project into production, at a time where the world’s copper supply is really tightening up and the metal price is rising.”

TNC recently signed a binding offtake and toll-milling agreements with one of the world’s largest miners, Glencore, for its Cloncurry copper project.

TNC share price

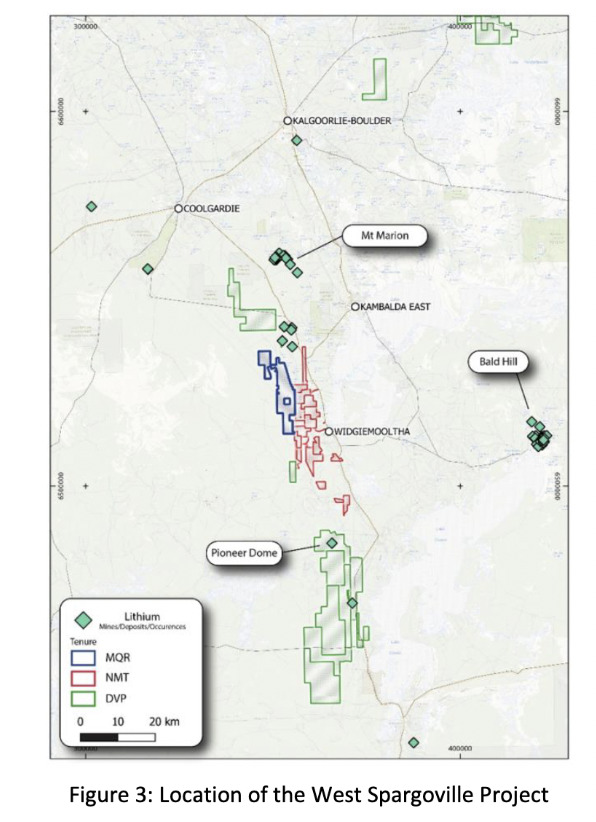

Marquee Resources (ASX:MQR)

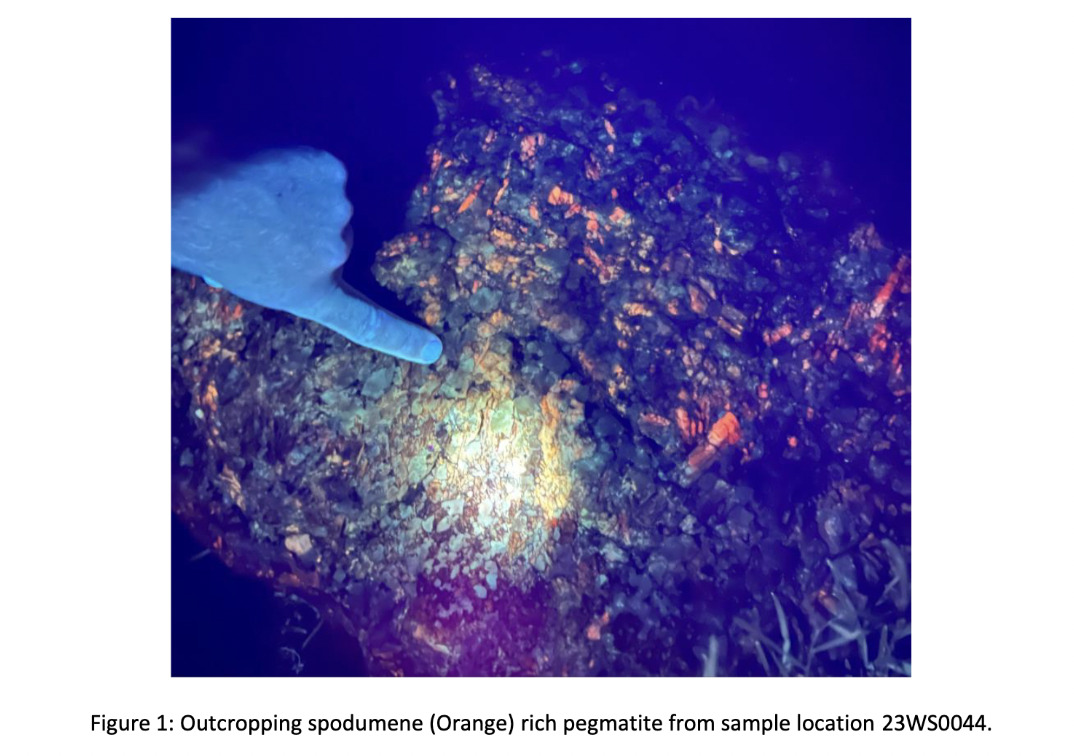

Step aside, copper, gold, uranium… some spodumene coming through here…

Marquee Resources has announced a spod-bearing pegmatite update from its West Spargoville Project (aka, WSP), which is in the core of the Southern Yilgarn Lithium Belt, an area that is well known for high-profile spoddy action, including the Bald Hill mine, the Mt Marion mine, the Buldania project and Pioneer Dome project.

Oh, and the world-class Earl Grey deposit and Mt Cattlin Mine are located further west and south respectively, too.

Marquee notes that its recent outcrop sampling at WSP has produced assays of up to 2.6% Li2O.

Cue an exploration ramp-up? Yep, and exploration budgets for that have already been signed off.

New high-priority pegmatites will be targeted by the company following full data consolidation, it says, with strong exploration support from its JV partner – a mega one in Mineral Resources (ASX:MIN).

Marquee’s executive chairman, Charles Thomas, said:

“The recent mapping programme has uncovered multiple new mineralised pegmatites and these assay results of up to 2.6% Li2O reconfirm my view that we are closing in on unlocking the true value of the West Spargoville Project.

“To have the continued strong support from industry leading company and our JV partner, Mineral Resources Limited in this uncertain time for many junior lithium exploration companies, also provides us with great confidence that we have a company-making project and are heading in the right direction [at West Spargoville]”.

MQR share price

At Stockhead we tell it like it is. While Mako Gold and Manhattan Corp are Stockhead advertisers at time of publication, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.