Resources Top 5: Juniors up with news on the way and a Marquee antimony find

Pic: Getty Images

- Marquee Resources shoots on antimony find

- Killi makes 400% gains in just over three weeks as it drills Mt Rawdon West

- Maiden resource to pop out soon from First Lithium’s Blakala

Here are the biggest small cap resources winners in morning trade, Monday, September 2. Prices accurate at time of writing.

Marquee Resources (ASX:MQR)

MQR has entered the antimony race with what it says is a significant ~220m-long structural trend of mineralisation at its Mt Clement (Eastern Hills) project that abuts Black Cat Syndicate’s (ASX:BC8) Mt Clement antimony-lead deposit and is 30km southwest of its Paulsens gold mine.

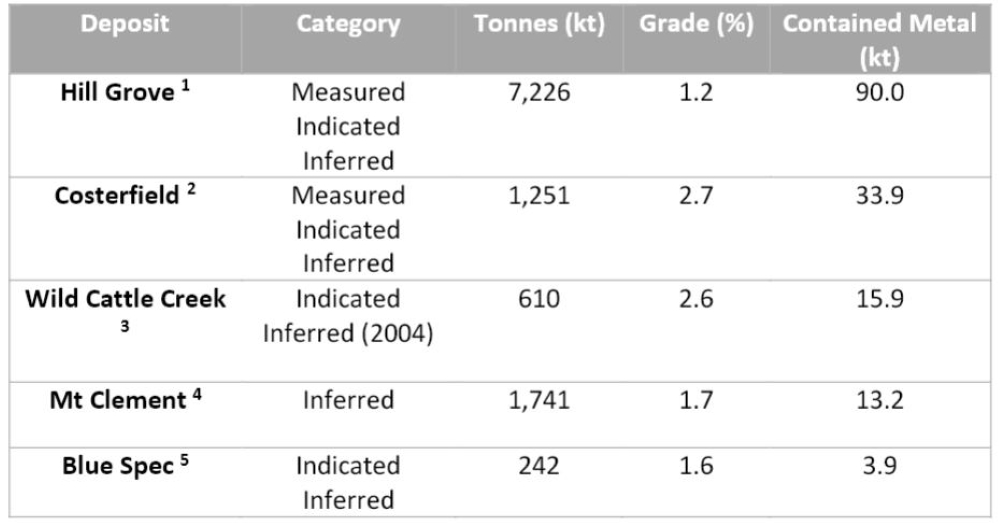

It was originally explored by BHP (ASX:BHP) in the mid-’70s, by Taipan Resources in the mid-’90s and most recently Artemis Resources (ASX:ARV) in 2013, which published a JORC resource of 13.2kt at 1.7% antimony (plus 18.7kt lead, 7oz gold and 434koz silver).

The explorer says Black Cat’s Mt Clement is currently the fourth largest and third highest grade antimony deposit in Australia – and remains open in all directions.

The limited drilling completed also indicates that mineralisation is open down dip and depth extensions will be targeted in future drilling programs.

Native title approvals have been secured for Mt Clement to get some augur treatment (first-pass drilling) across the landholding and MQR exec chair Charles Thomas says the company is excited to get to ground.

“Historical drilling has intersected significant zones of antimony mineralisation on Marquee’s tenure, and we are hopeful that with further detailed work we can extend… and identify as-yet undiscovered zones.”

MQR shares are on the rise, up 60% in a month, including ~33% today to trade for 1.7c.

Killi Resources (ASX:KLI)

(Up on no news)

KLI has shot up once again, yet there’s no updates from its current drilling campaign at the Kaa prospect at its Mt Rawdon West project in QLD.

It’s the first time the virgin ground has been drilled into and KLI has interpreted Kaa to potentially host a new epithermal gold system for the region – which could be huge for the explorer.

Soil and rock chip analysis had returned high levels of gold, silver, copper, antimony and other rare metals with assays of up to 238g/t gold, 585g/t silver, 2860ppm bismuth, 5.35% copper and 3.58% antimony.

Ten targets are being drilled across a 1.8km gold-copper trend down to a depth of 200m, where the company reckons it contains the highest chances of mineralisation so far.

Shares are up a whopping 400% since July 8, including 30% in early trade today, swapping for 17c.

First Lithium (ASX:FL1)

(Up on no news)

Shovelling into West Africa’s lithium prospectivity, FL1 is due to release a maiden resource estimate for its Blakala lithium deposit in Mali.

Back in August, FL1 identified very high-grade lithium within the main pegmatite from the remaining two holes from Series 2 drilling of Blakala in Mali.

Highlight intersections included 41m at 1.91% Li2O from 81m and 29.7m at 1.66% Li2O from 115.2m, including 6.6m at 2.79% Li2O from 138.2m.

Blakala is one of three highly prospective hard rock lithium assets in the West African country, led by Ganfeng Lithium’s (previously owned by Leo Lithium) world-class Goulamina deposit and London-based Kodal, looking to bring Bougani into production in Q4 this year.

Listing just 10 months ago and with news imminent on a resource, FL1 shares are up 22.7%, trading at 13.5c.

Rincon Resources (ASX:RCR)

Niobium and REE anomalies have been detected at RCR’s Avalon and Sheoak targets at its West Arunta project in WA.

The West Arunta has a swarm of exploration of late, ever since WA1 Resources (ASX:WA1) exposed the region’s high-grade niobium with its 200Mt Luni deposit.

Thirteen RC holes and three DDH tails were drilled, encompassing 3,746 metres to test the four gravity anomaly targets – Avalon, Sheoak, K1, and K2 — outlined by ground gravity surveys earlier this year.

While still early doors, Rincon says preliminary observations based on drill samples and hand-held pXRF data is highly encouraged by the presence of syenite associated with elevated Nb-REE’s, because such occurrences have potential to coexist with carbonatite intrusions within such alkaline igneous complexes that host significant deposits.

The critical minerals hunter is up 18% today, trading at 3.3c a share.

HyTerra (ASX:HYT)

(Up on last week’s news)

HYT is on a tear since Fortescue (ASX:FMG) obtained a strategic 39.8% interest in the company, which is searching for natural hydrogen at the flagship Nemaha hydrogen and helium project in Kansas.

The explorer was drilling two wells in the US Midwest tenure, yet the injection of funding has now ballooned that out to a total six wells across the project.

Why is FMG interested? Well, back in July the mining giant chose to pull back efforts to produce 15Mtpa of green hydrogen by 2030 due to costs, yet natural, or ‘white’ hydrogen presents a cheaper option for its clean energy goals.

READ MORE: Fortescue counts on white hydrogen with $21.9m investment in HyTerra

Stocks rose 54% on the news last week and are up another 17% today, trading at 4.8c.

At Stockhead we tell it like it is. While First Lithium and Hyterra are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.