Fortescue counts on white hydrogen with $21.9m investment in HyTerra

HyTerra will form a strategic alliance with Fortescue to pursue global white hydrogen opportunities. Pic: Getty Images

- Fortescue acquires 39.8% strategic interest in HyTerra in return for a $21.9m investment

- Proceeds allow HYT to expand its planned two well program into a six well campaign

- Strategic alliance formed to progress Nemaha and explore global opportunities

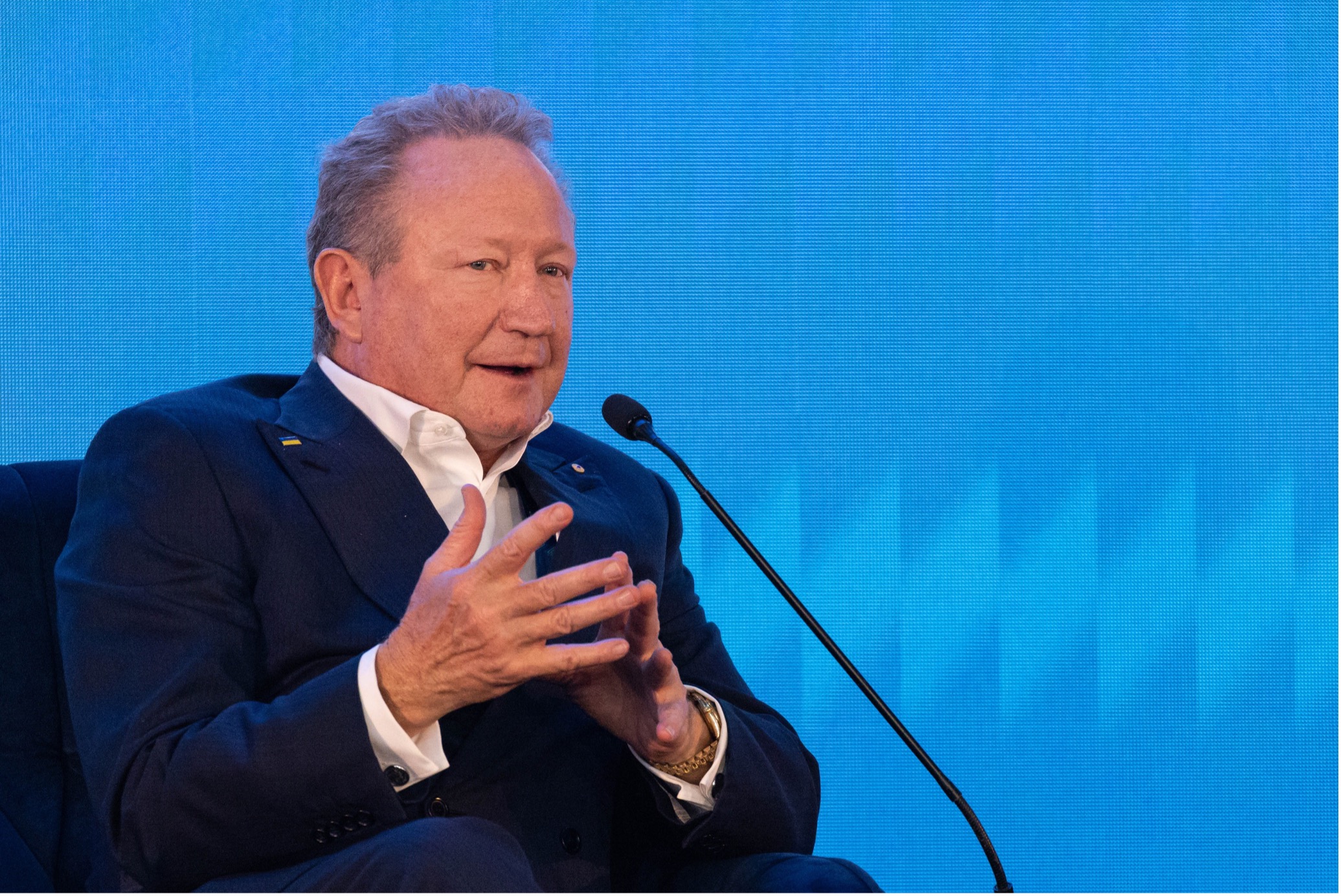

Special Report: Natural hydrogen explorer HyTerra has received a major vote of confidence after Andrew Forrest’s Fortescue acquired a strategic 39.8% interest in the company for $21.9m.

The investment, which is made through a subscription of 644.1 million shares priced at 3.4c each, will provide the company with funds to increase its ground holding and progress a geophysics and expanded exploration drilling campaign at the flagship Nemaha hydrogen and helium project in Kansas.

Investors clearly think that the investment is the bee’s knees, sending shares in the company up 54.84% on to 4.8c on Thursday morning.

HyTerra Limited (ASX:HYT) last month selected Murfin Drilling Company, an experienced contractor with more than 20,000 wells under its belt, to drill deeper than historical wells to test predicted primary targets with better hydrogen and helium potential.

Permits have already been received to drill the Sue Duroche 3 and Blythe 13-20 wells, though more permits are being prepared for other hydrogen and helium prospects.

While the company had originally planned to drill an initial two wells, Fortescue’s investment has expanded this into a fully-funded six well campaign that is expected to begin after finalisation of the subscription, increasing HYT’s potential to unlock commercial opportunities in the US Mid-West.

The company will also enter into a Strategic Alliance Agreement with Fortescue, which will be the HyTerra’s largest shareholder, to progress Nemaha and explore new opportunities globally.

“We are very pleased with this opportunity. An investment by Fortescue is a testimony to the hard work and delivery performance of the HyTerra team, the diverse geological plays available within our Nemaha project leases, and our global growth opportunities in the pipeline,” HYT executive director Benjamin Mee said.

“This investment would enable HyTerra to have a strong financial position going forward; but it’s the possibility to propel the global decarbonisation journey with such a visionary company that is truly exciting!

“HyTerra would then drill six wells across multiple geological plays to choose the best areas to develop and through the strategic alliance with Fortescue, use this knowledge and data to pursue other global opportunities.”

Fortescue still keen on hydrogen

While Fortescue had in mid-July decided to pull back on its goal to produce 15Mtpa of green hydrogen by 2030 due to the high cost of renewable electricity needed to power the electrolysers that split water molecules into hydrogen and oxygen, it maintained a strong interest in using hydrogen to decarbonise hard-to-abate industries.

This continued interest has now been confirmed with the iron ore, technology and energy giant sticking its finger into the natural hydrogen pie, no doubt due to its potential to have massively lower production costs.

Known as white hydrogen, it demonstrates an expanded focus from Fortescue on the sources the $60bn resources giant will invest in to pursue its diversification into green energy.

HYT’s Nemaha project is particularly well placed to demonstrate the potential of white hydrogen, situated in the centre of a major industrial and manufacturing hub between Kansas City and Wichita.

This places it in close proximity to existing railways, roads, and pipelines that connect it to a long list of potential offtakers nearby including ethanol and ammonia manufacturers and petrochemical plants, all of which already use hydrogen in their processes.

Historical wells across the company’s current 12,839 acre landholding confirmed the presence of hydrogen and helium, with some returning up to 92% hydrogen and 3% helium.

It is certainly enough for HYT to have tagged Nemaha with a best estimate prospective resource of 105.5 billion cubic feet of hydrogen and 0.59Bcf of helium.

The presence of helium provides significant upside as it is an irreplaceable input for many important technologies, including MRI machines, allowing it to command prices of ~US$450 per thousand cubic feet, which is many multiples of the natural gas price.

Subscription agreement

Under the agreement, Fortescue will subscribe for 644,117,647 HYT shares priced at 3.4c each.

These include ~322 million free attaching options exercisable at 5.1c and expiring three years from the issue date.

The agreement is subject to shareholder approval and no material adverse effect occurring on or before the business day before satisfaction of the shareholder approval, which is expected no later than November 11, 2024.

This article was developed in collaboration with HyTerra, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.