Resources Top 5: It’s all about uranium today on the ASX … excellent

Excellent... Mr Burns ... sorry Donald Trump, fires up uranium stocks with nuclear power bump. Pic: Getty Images

- Uranium stocks surge on the ASX as Donald Trump pumps up nuclear sector with executive orders

- Focus Minerals sells Laverton assets to Genesis Minerals in $250m cash deal

- Verity and Infini lift on no news

Your standout resources stocks on Monday, May 26, 2025.

Uranium stocks

Something a little different for Resources Top 5 today, because the whole uranium market is moving in lockstep after Donald Trump unloaded four major executive orders to stir the sector to life. We’re counting this for two.

It’s the latest in a host of wins for nuclear power in the States, as the Republican administration picks its winners and losers in the energy space.

Nuclear received a carve-out preserving the production tax credits delivered to clear energy generators in the Inflation Reduction Act, a Biden-era bill intended to spur major renewables and EV investments largely junked in a House of Reps vote last Thursday.

A catalogue of four EOs have been signed by Trump to “reestablish the United States as the global leader in nuclear energy”.

One calls on the Secretary of Energy Chris Wright to develop a plan to expand domestic uranium conversion capacity – the US is currently heavily reliant on Russia for this, a dangerous game indeed – another wants to speed up the time to test reactors and have them safely operational at department facilities within two years from application.

A fourth calls for privately funded advanced reactors to be stationed at DoE sites for the purpose of powering AI infrastructure, other critical or national security needs, supply chain items or on-site infrastructure.

Its goal is to operate an ‘advanced nuclear reactor at the first site no later than 30 months from the date of (the) order.’

The third EO, critical for the uranium sector, includes calls to grow nuclear energy capacity in the USA from 100GW in 2024 to 400GW in 2050, by lowering “regulatory and cost barriers to entry”, as well as promoting the extension of the current fleet and reactivation of closed or partly closed facilities.

We’ll let Canaccord analysts led by Katie Lachapelle break down what this means for US stocks.

“Key takeaways include:

- Headline goal of quadrupling the US nuclear fleet from ~100GW (of) capacity today to 400GW by 2050 – implies an additional ~150Mlb of annual U3O8 demand and a CAGR of 6% out to 2050 (for the US alone).

- Targeting first new reactor deployment before Trump leaves office in early 2029, including “5 GW of power uprates to existing nuclear reactors and 10 new large reactors with complete designs under construction by 2030.”

- Red tape removed – Nuclear Regulatory Commission (NRC) now has 18-months to decide on new reactor licences; a process that currently can take at least five years.

Uranium spot prices have staged a comeback since mid April, lifting from two-year lows of US$63/lb to ~US$70.5/lb.

But yellowcake companies on the ASX were walking on air like Ralph Hinkley.

As of 12.45pm AEST today, miners Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) were up 13% and 10% respectively.

Deep Yellow (ASX:DYL), Lotus Resources (ASX:LOT) and Bannerman Energy (ASX:BMN) rose ~15%, ~12% and ~8% for the advanced developer crowd.

African U stocks Elevate Uranium (ASX:EL8) and Aura Energy (ASX:AEE) lifted 8.2% and 7.7% respectively, while enrichment play Silex Systems (ASX:SLX) and Canadian developer NexGen Energy (ASX:NXG) were close to 6% up.

American uranium explorer and resource holder GTI Energy (ASX:GTR), which sits in the key domestic producing state of Wyoming, was up 25% on higher than normal volume.

Focus Minerals (ASX:FML)

Speaking of walking on air, howsabout Focus Minerals – the stock with the ticker code that’s summed up its past 13 years of existence.

China’s Shandong Gold piled into the company in 2012, taking a 49% stake in the Aussie gold junior for a hearty $229m.

It was money poorly spent. The gold price tanked in early 2013 and within months it had shut all three mines it was operating and sacked 200 people.

While other companies responded to successive gold booms by reopening shuttered operations and feasting on record prices, Focus has been a slow-moving beast, sitting on the sidelines until it restarted the Coolgardie gold project in 2023.

But $120m capped Focus – Shandong now holds around 63% – has had a handy boost today, inking a $250m deal that will see Raleigh Finlayson’s Genesis Minerals (ASX:GMD) take its Laverton gold project off its hands.

Genesis gets ~4Moz of gold in and around its Laverton mill in WA’s Northern Goldfields. Critically, it means the company will be able to fill the mill in future with its own ore sources and process the bulky Tower Hill deposit closer to home at an expanded Gwalia plant.

The 1.5Mtpa Barnicoat mill also seems to head Genesis’ way, whether it keeps the plant or its worthwhile trading on remains to be seen.

Cash is king and that’s the key for Focus. The company sold a modest 5376.6oz of gold in the March quarter, losing $7.2m from its operations.

FML is also thinning out capital to ramp up the Bonnie Vale underground mine at Coolgardie, finishing the March term with $20.7m in the bank against $186.86m of liabilities.

The $250m payment will get the company into a net cash position right away and avoid further outlay to develop Laverton itself.

“We are extremely pleased with the outcome achieved in the sale of Laverton and believe the consideration payable represents compelling value to our shareholders,” Focus exec chair Wanghong Yang said.

“Proceeds from the sale of Laverton will strengthen the financial position of the Company as it continues with development at the Bonnie Vale Underground Mine and open pit mining operations at the Coolgardie Gold Project.”

FML shares were up ~90% at 2.45pm AEST, while Genesis also lifted a tidy 3% to crest above a $5bn market cap.

Infini Resources (ASX:I88)

(Up on no news)

Infini Resources gets its own entry after lifting a presumptuous ~30%, seemingly off the back of the same nuclear Trump news that has the rest of the uranium sector crowing.

The latest update from this minuscule small cap – MC circa $6m – saw a bit of senior leadership arrive to the party in the form of new CEO Rohan Bone.

“We are delighted to welcome Rohan as CEO of Infini Resources,” exec director David Pevcic said of Bone.

“His depth of experience and demonstrated success in delivering complex mining projects makes him the ideal candidate to lead Infini as we implement our strategy to transition from exploration to development.

“The Board looks forward to working closely with Rohan to unlock the full value of our portfolio and deliver long-term shareholder value.”

A former Alcoa, Tata Steel and Thyssenkrupp executive, the aim is to progress uranium and lithium assets the company boasts across Canada and WA.

Those include the Portland Creek uranium project in Newfoundland and the Reynolds and Boulding Lake projects in Saskatchewan.

XRF readings of drill hits at Portland Creek have shown some promise and sits near the large but low grade Des Herbiers deposit, which holds an inferred resource of 162Mt at 123ppm U3O8 for 43.95Mlb.

Verity Resources (ASX:VRL)

(Up on no news)

Equally up inexplicably, the former Si6 Metals, Verity Resources surged 25% on Monday.

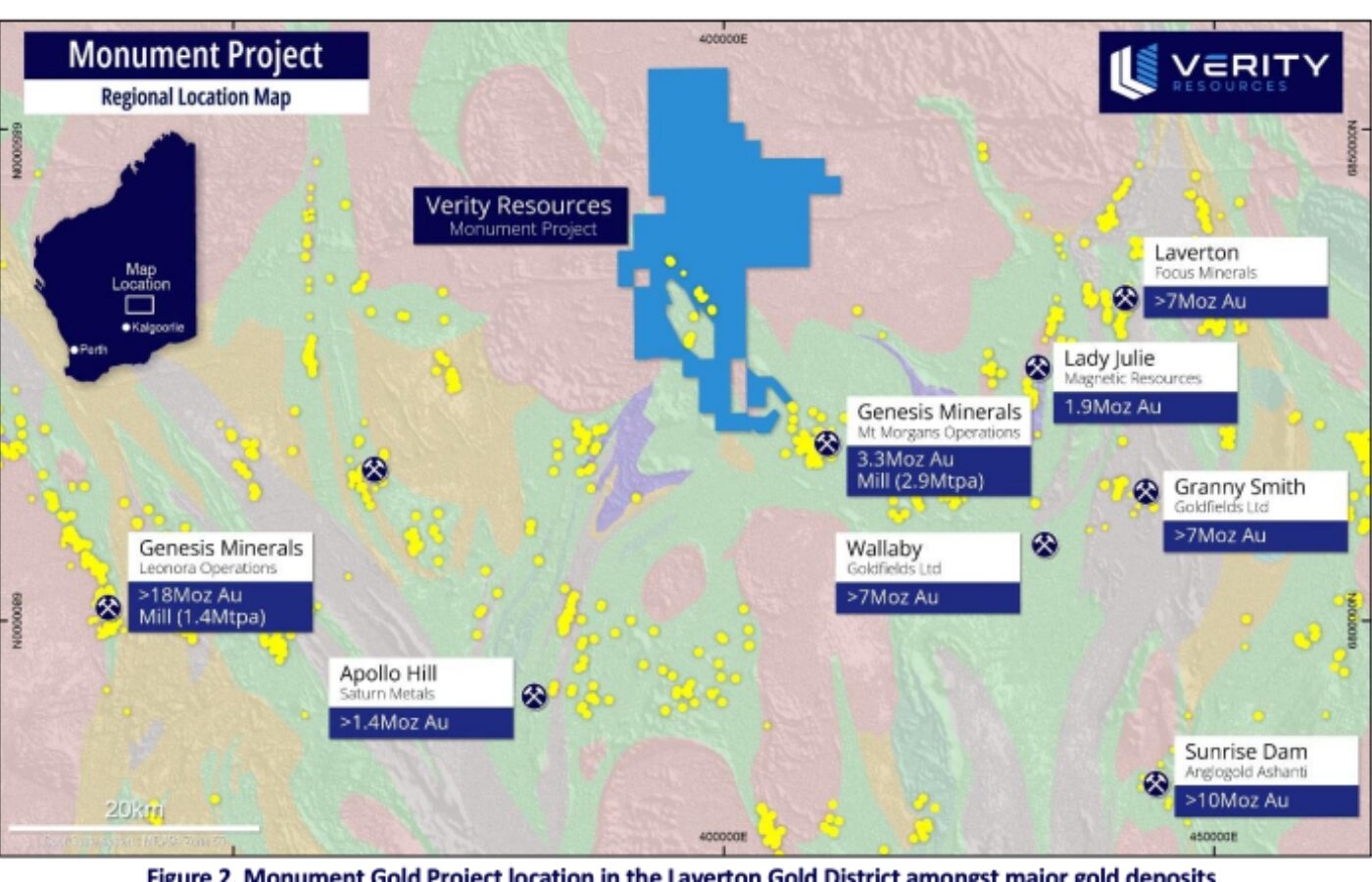

Its latest news came from the 154,000oz Monument gold project near Laverton in WA, which may hold a clue.

It sits very much in the neighbourhood of Genesis’ Mt Morgans operation and investors are probably wondering how much its gold could be worth to Finlayson and new exec director David Coutts after the Focus deal.

Aircore drilling commenced this month at Monument, where VRL is following up gold anomalism ranging up to 6.17g/t from the Star Well prospect, and the Triton prospect.

It’s in an analogous position to the Fred’s Well prospect, which previously hit 24m at 3.24g/t from 44m including 12m at 6.35g/t.

With gold prices flying, a review and validation studies of the 154,000oz across the Korong and Waihi mineral resources is ongoing, with resource drilling expected to take place in June.

The plan is to both upscale and improve the confidence level of the project’s resource.

At Stockhead, we tell it like it is. While Elevate Uranium, Aura Energy and GTI Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.