Resources Top 5: Is this well-located explorer ready to catch up to its potential?

Pic: Will Russell/AFL Photos via Getty Images

- Augustus Minerals rises on news of ~18% copper rock chips at Tiberius target in WA’s Gascoyne

- Orion Minerals runs for second straight day on copper magic in South Africa

- James Bay Minerals, Rincon Resources, Chilwa Minerals among top ressie performers

Here are the biggest small cap resources winners in early trade, Tuesday April 23.

Augustus Minerals (ASX:AUG)

Floating around last year’s Noosa mining conference on the Sunshine Coast and one relatively obscure name was on the lips of a swag of brokers.

That was helped, of course, by the fact Noosa’s presenting partner Morgans did the corporate advisory for Augustus.

But they weren’t the only ones intrigued by the 3600km2 controlled by Augustus in WA’s Gascoyne at Ti-Tree, a nearology play for rare earths discoveries made by Dreadnought Resources (ASX:DRE) and lithium by Delta Lithium (ASX:DLI).

But what the 2023 listing was most excited about was the copper prospectivity of its ground.

Cf. these comments from MD Andrew Reid last year:

“We’ve got some great copper targets, I’m very bullish, and long on copper and we’ll probably expedite some of those copper targets first, but if we had a lithium one, I’d certainly be drilling that as quick as I could as well,” he said.

“There’s a lot of interest in a lot of companies going long on copper, there certainly is going to be a strategic shortfall in that sort of space and if we can latch on to something over the course of the next few months, then I certainly think that we’ll be expediting it and trying to develop a resource in that area first.”

READ: ‘Everything’s going to grow’: Morgans analysts say the time is now to go hard on commodities

Is it more Augustus the emperor or Augustus Gloop? The drilling will tell, and they may well have their copper targets at the Tiberius and Claudius targets after the rock chip results posted to the ASX today, which had AUG up over 66% today before reverting to a ~30% gain.

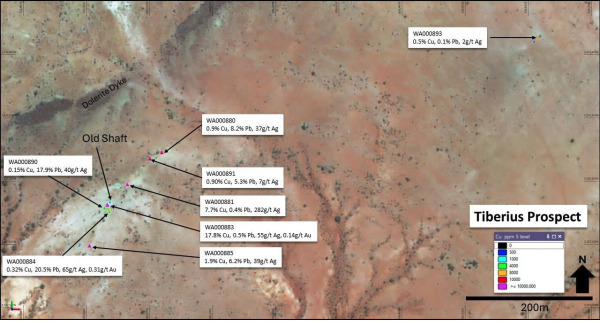

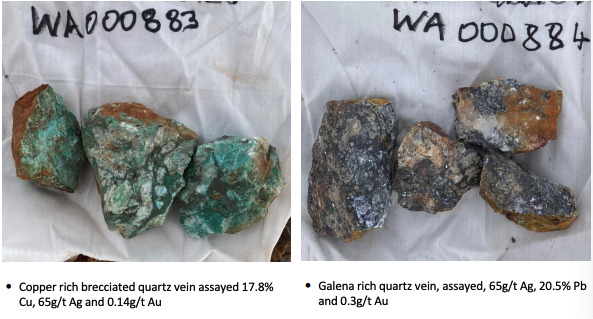

Assays include a ripping 17.8% copper and 282g/t silver at Tiberius, which is currently 3m wide and 200m along strike. At Claudius, 11km to the south, results have outlined a number of parallel zones over 100m by 300m at grades of up to 6.6% Cu and 86g/t Ag.

Located 200km east of Carnarvon, AUG says neither of the prospects are recorded on GSWA maps with just 26 rock chip samples behind the discoveries.

“These results highlight the potential of this underexplored area to host as yet undiscovered mineralisation,” AUG GM of Exploration Andre Ford said.

“Less than 5% of the 3,600 sq km area of the Ti-Tree Project has had any

previous exploration, and to discover unrecorded historic mining areas is very exciting. These results are a credit (to) the Augustus geological team.”

It’s worth noting rock chips aren’t a direct indicator of bed rock mineralisation. But it does mean there’s smoke, something investors still sitting on an ~85% loss against last year’s post IPO high of 33c hope is coming from a raging red metal fire.

Augustus Minerals (ASX:AUG) share price today

RINCON RESOURCES (ASX:RCR)

Whisper West Arunta in the wind ever since WA1 Resources (ASX:WA1) found its niobium-rich Luni carbonatite and speccy investors came flocking.

The bird call from Rincon Resources yesterday, which appears to have flowed through to an 18% morning gain, was news of a string of new gravity targets to prioritise for drilling around its West Arunta ground.

Those four new prospects are called K1, K2, Sheoak and Avalon, with three existing targets in the Pokali iron-oxide copper-gold prospect at Arrow, Dune and Surprise also enhanced by the ground gravity surveys.

Avalon is considered a dead ringer for Luni’s gravity footprint, a 3km east to west gravity anomaly high which could represent carbonatite-niobium-rare earths or IOCG mineral target for drill testing.

It also has comparable size and amplitude to two famous IOCG discoveries known as Prominent Hill and Ernest Henry.

A program of works application has been submitted with WA’s mines regulator to enable RC drilling at all targets.

“Multiple new gravity targets are a fantastic outcome from our recent ground gravity surveys at the West Arunta project. The new Avalon target is one of the best bullseye targets for carbonatite-Nb-REE or IOCG mineralisation styles that we have seen in the West Arunta region. We hope to emulate the success other companies such as WA1 Resources have had drilling these types of targets in the region,” quoth Rincon MD Gary Harvey.

The David Lenigas-chaired explorer said it has submitted a work program with the Tjamu Tjamu Aboriginal Corporation trying to obtain clearance for drilling at the Avalon and other targets.

Rincon Resources (ASX:RCR) share price today

JAMES BAY MINERALS (ASX:JBY)

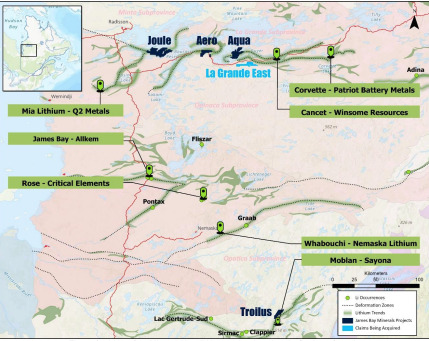

Also generating targets to drill in a hot exploration district is Robert Martin stable Canadian lithium explorer James Bay Minerals, which lifted this morning after announcing desktop studies had outlined 340 ‘high-priority’ targets at its La Grande East project.

As implied by the explorer’s name, that’s in the lithium hotspot of Quebec’s James Bay district in Canada.

Located 15km from James Bay’s Aqua Property, La Grande East includes 136 claims of which 62 have already been granted covering 7000 hectares on the Robert-Bourassa reservoir.

All up James Bay boasts over 37,000ha along the La Grande Greenstone Belt, a 55km east to west target zone in the district.

A field program is expected to start in the next four weeks to follow up airborne surveys, data from neighbouring properties and desktop studies completed since last year’s listing.

“We approach our summer field program with an exceptional pipeline of targets. The Company’s foundations are set by holding one of the largest land positions on the premium La Grande Lithium trend,” JBY executive director Andrew Dornan said.

“Our focus now is on ensuring that we target low-hanging fruit across all areas of the La Grande Project. This will ensure that we deploy capital efficiently on well-established targets.”

James Bay Minerals (ASX:JBY) share price today

ORION MINERALS (ASX:ORN)

Like the West Coast Eagles (for now, don’t get too excited too soon Harley Reid bagholders) a long suffering explorer is backing it up with a second straight win.

Investors are continuing to digest Orion’s (ASX:ORN) big copper discovery at Flat Mine East, part of the Okiep project.

That drill hit, by the by, was 49m at 4.86% Cu, well into the 99th percentile when it comes to copper discovery holes.

The dual Australian and Johannesburg listed explorer, which also holds the fully permitted Prieska copper and zinc project, was up 39% at midday AEST.

You can check out the full round up on this one in yesterday’s Res 5.

READ: Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Orion Minerals (ASX:ORN) share price today

CHILWA MINERALS (ASX:CHW)

(Up on no news)

Pretty much nothing to report for this African mineral sands hopeful, although maybe Base Resources’ (ASX:BSE) $375 million takeover from rare earths hunting US uranium producer Energy Fuels has the sector pricking up its ears.

Chilwa’s Mposa deposit contains 19.4Mt of heavy mineral sands at a grade of 4.3% for 830,000t at a 1% THM cut-off, part of a global resource at the Chilwa project of 61.6Nt at 3.9% containing 2.4Mt of total heavy minerals.

CHW released its quarterly update yesterday, showing it drilled over 1500m at Mposa during the quarter. It’s also been taking a novel approach to identifying drill targets, assessing some pretty imposing termite mounds at its Namaslima project to get a feel for early indications of mineralisation.

It has also begun a testwork program expected to last three months with Light Deep Earth Laboratory overseen by Perth mineral sands experts TZMI, who completed work on a 2015 scoping study at Lake Chilwa for previous owners.

Chilwa finished the March quarter with a healthy $4.8m in the bank.

Chilwa Minerals (ASX:CHW) share price today

At Stockhead we tell it like it is. While James Bay Minerals was a Stockhead advertiser at the time of writing it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.