Resources Top 5: Investors send ASX antimony juniors into the clouds (again)

Pic: Getty Images

- Locksley throws hat into booming antimony ring with up to 11.2% grades sampled at Mojave

- Critical Resources confirms antimony prospects on boundary of Larvotto’s Hillgrove

- Belararox snaps up highly prospective copper project in Botswana

Here are the biggest small cap resources winners in morning trade, Thursday, September 12. Prices accurate at time of writing.

Locksley Resources (ASX:LKY)

LKY has used the past 12 months looking for REEs at its Mojave project near Las Vegas which abuts America’s largest and only operating rare earths mine Mountain Pass. The latter delivers about 15% of the world’s supply.

Interestingly, and perhaps fortuitously too right now, Mojave plays host to the historical Desert Antimony mine containing quartz-stibnite veins that produced about 100-1000 tonnes with antimony (Sb) grades ranging from 15-20%.

The explorer has sampled the area and rock chips have thrown up Sb grades as high as 11.2% across a now identified 230m-long strike and even a copper sample that grades 4.12% copper – results that bode well for future exploration.

Stocks with high grades of antimony have been going gangbusters over the past month or so, ever since China announced export restrictions of the material of which it has a monopoly over, sending explorers on a worldwide hunting expedition to prove up the largest and most economic deposit they can.

Last year the antimony market was valued at just over US$1 billion and is predicted to more than double by 2036 at a 7.3% CAGR, with demand for its use in battery manufacturing anticipated to be one of the major growth drivers.

Packets in the $5m LKY have been heavily traded – $1.24m worth in fact – shooting up 45.8% to swap for 3.5c, then settling up 25% to 3c a share.

Critical Resources (ASX:CRR)

CRR has confirmed its antimony credentials at tenure that abuts the southern boundaries of August’s best-performing ressie stock – Larvotto Resources’ (ASX:LRV) Hillgrove project, which contains 93,000t Sb.

The junior’s Halls Peak project is a 884,000t zinc, copper and base metals deposit with some silver and gold trimmings, yet it’s the nearology to Hillgrove that has the explorer excited at the moment.

CRR non exec director Nigel Broomham says the Mayview Homestead prospect, just 2.7km east of Larvotto’s Hillgrove, stands out as particularly promising.

“Data recorded from the Geological Survey of NSW which includes grades of 1.55% Sb indicates that it could potentially extend the well-established Hillgrove antimony-gold system, given its alignment with similar fault structures,” Broomham says.

“Looking ahead, we are engaging leading geologists to refine our understanding of these prospects and plan comprehensive fieldwork, including mapping and sampling, to validate our initial findings.”

The market agrees today and CRR is up 20% to trade at 1.2c.

TG Metals (ASX:TG6)

(Up on no news)

TG6 shares have been on a steady upward trajectory since the start of the week after announcing high-grade lithium of up to 2.32% Li2O from drill cores at its Burmeister project in the burgeoning Lake Johnston minerals district in southwest WA.

The infil and extensional RC drilling campaign has increased confidence in TG6’s exploration target of 15.6-20.1Mt at 0.97% to 1.19% Li₂O at the project and results will be incorporated into an upcoming maiden resource.

The explorer sparked a rush of exploration into the region last year with its Burmeister find, with Charger Metals (ASX:CHR) receiving an up to $42.5m farm-in investment from Rio Tinto (ASX:RIO) for 75% of its own Lake Johnston project; Mt Malcolm Mines (ASX:M2M) expanding its footprint; and Kingsland Minerals (ASX:KNG) also acquiring tenements in the emerging hard rock lithium mining district.

It’s also targeting the nearby Jagermeister prospect, which is pulling up grades that could see it become similar in size, if not bigger than Burmeister.

That remains to be proved, yet TG6 CEO David Selfe says that “every new round of drilling increases our confidence that TG Metals has the premier lithium deposits in the Lake Johnston greenstone belt and the most prospective tenements for further lithium exploration potential”.

“We are seeing thickening of the pegmatites towards a north-westerly direction at both Burmeister and Jaegermeister, which underpins our confidence that the current exploration target can be exceeded with further drilling,” Selfe said last week.

Stocks in the lithium hunter are up 33% to trade at 16c a share at time of writing.

Belararox (ASX:BRX)

Belararox has inked a deal to snap up the Kalahari copper project in Botswana in a move that secures a second significant copper-prospective play for the company in a highly prospective and mining friendly jurisdiction.

The junior already owns the Toro-Malambo-Tambo (TMT) asset in Argentina, strategically smack bang in the middle of several large operating mines and neighbours such as Filo del Sol, the project being acquired by BHP (ASX:BHP) and Lundin for US$4 billion.

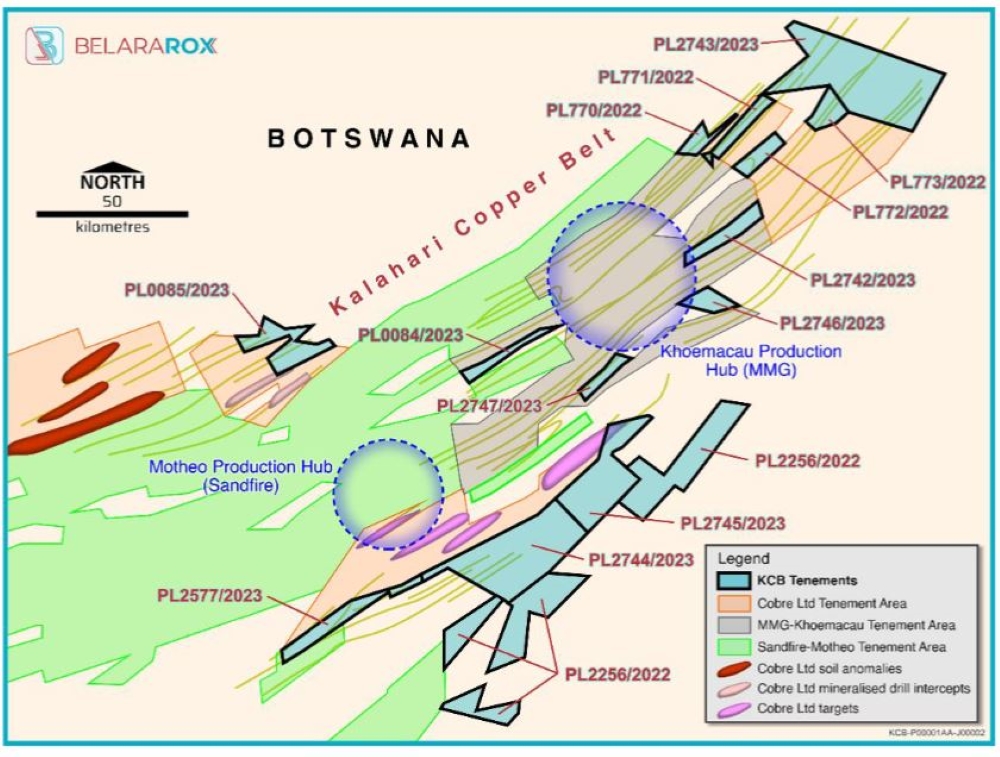

BRX is buying the project through the acquisition of KCB Resources and will receive 4286km2 of prospective tenure across 14 prospecting licences on the Kalahari Copper Belt.

There’s also several world-class copper-silver orebodies in proximity and along strike of the licences, including Sandfire Resources’ (ASX:SFR) Motheo copper mine, MMG’s Koemacau mine and Cobre’s flagship Ngami copper project.

Shares in BRX jumped on early trade, up 15% to trade at 27c.

MTM Critical Metals (ASX:MTM)

Investors like what they see with MTM’s flash joule heating (FJH) sustainable gold recovery tech being used to recover gold from electronic waste, which the junior says has massive market potential as >60Mt of e-waste is generated annually across the globe and is said to contain >US$70 billion in potential recoverable content.

Initial tests announced today yielded ~70% gold recoveries from waste using no costly acid and can be utilised across not just gold, but also a range of critical minerals, too.

Test work is completed, underway or planned on a range of additional sample streams including refractory minerals such as spodumene (lithium), monazite (rare earths), & pyrochlore (niobium); precious metal recovery from e-waste; and critical metal (Li, Co etc) recovery from spent lithium-ion batteries (‘black mass’).

“This technology holds the potential to unlock significant economic value through environmentally responsible metal extraction, delivering lasting benefits for shareholders, the industry, and the environment,” MTM CEO Michael Walshe says.

Shares in the ressie are on a heater since early August, rising >100% in the last month including 16.3% today to swap parcels for 5.7c.

At Stockhead we tell it like it is. While Belararox and TG6 Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.