Resources Top 5: Investors hot for copper around Lachlan Fold Belt

Copper stocks are on the rise across Australian projects. Pic: Getty Images.

- Golden Deeps up a whopping 217% on 80m sulphide mineralisation find

- MinRex reveals six high priority targets at Mt Pleasant

- Copper finds send shares up for Renegade Exploration and Stelar Metals

Here are the biggest small cap resources winners in morning trade, Tuesday, September 3. Prices accurate at time of writing.

Copper prices are returning after a near-four month dip from around US$10,750/t, down to just over US$8500/t last month. A turnaround in the past few weeks however, has meant confidence is back in the red metal playground with prices due to remain strong up until early next year, according to London Metals Exchange.

“The reduction of social copper inventories in China indicates that end users are beginning to restock despite firm prices,” LME says.

“This trend aligns with typical autumn patterns, where copper demand usually strengthens during the third and fourth quarters, continuing until the Chinese New Year …and seasonal restocking suggests robust demand in the coming months, driven by industrial activities and preparation for peak usage periods.”

Copper rose 2.4% over the last month, rising above the US$9000/t mark once again.

Golden Deeps (ASX:GED)

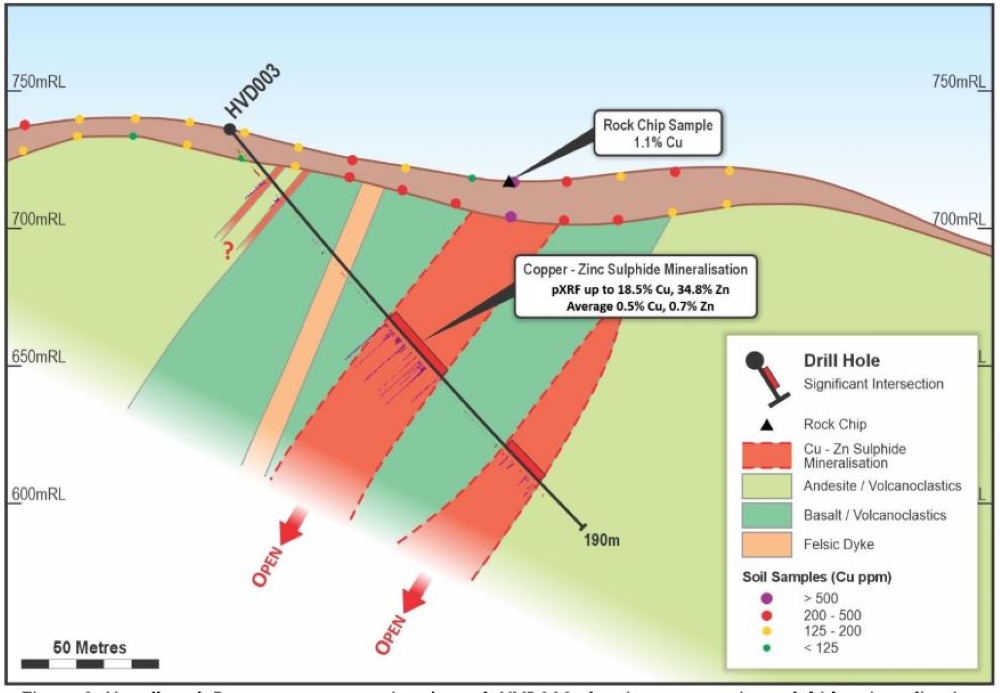

GED was clearly top of the pops in early trade, up 217% on the back of a huge 80m sulphide find at its Havilah project in NSW’s prolific Lachlan Fold Belt.

After pXRF readings indicating high concentrations of up to 18.5% copper and 34.8% zin, GED took out the diamond drill and intersected a huge 80m zone rich in Cu-Zn sulphides.

The Lachlan Fold Belt has created a bit of a buzz lately, with four major deals in the past year or so alone being made in the gold, copper and base metal-laden mining district.

Global mining major Anglogold Ashanti has made a couple of deals – a $135m earn-in to >7000km2 across five projects owned by Infection Resources and a $50m investment to earn an 80% interest in Kincora Copper’s (ASX:KCC) Northern Junee-Narromine Belt project.

Juniors S2 Resources (ASX:S2R) and Legacy Minerals (ASX:LGM) have been making deals to test for Cadia-style porphyry mineralisation in the region, too.

The semi-massive sulphides that GED has discovered in the third diamond hole at the Hazelbrook North anomaly within Havilah aligns with the surface soil and rockchips which showed up the high-grade copper and zinc pXRF readings.

The diamond drill program is continuing and initial assays of the find are on their way.

GED was clearly top of the pops in early trade, up an eye-whopping 217% to trade at 8.9c a share at time of writing.

MinRex Resources (ASX:MRR)

Also buzzing around the Lachlan Fold Belt, MRR has found some targets for drilling into its multi-commodity Mt Pleasant project, which has prospectivity for copper, molybdenum and gold.

Drilled down into by CSR and Pacminex up until 1982, reviewed data from exploration efforts have shown a molybdenum, scheelite and chalcopyrite (Mo-W-Cu) mineralisation >1.1km in length, 750m in width and to a vertical depth of 540m.

Airborne surveys have been conducted and show six high-priority target areas, which the explorer says will now be evaluated by field recon and sampling efforts.

Stocks in the junior are up 25% today to trade at a penny (1c).

Stelar Metals (ASX:SLB)

High-grade copper gossans containing up to 22% Cu have been assayed from rock chips at SLB’s Baratta project in South Australia.

Results have revealed a significant, third parallel copper-bearing gossan extending the eastern zone of mineralisation at the project and “reinforce the consistency of copper-grade along the mapped 3.6km strike of multiple stacked copper-rich gossans”, notes the explorer.

What’s a gossan you may ask? Well… (give me a minute to remember) ahh yes – gossans are basically iron and manganese oxides that overlay potentially major sulphide-based ore deposits of copper and other base metals.

SLB reckons Baratta has striking similarities to the Central African Copper Belt that spans the DRC and Zambia – where ~20% of the world’s copper is currently mined.

Mapping and rockchip sampling is continuing as part of a staged exploration campaign to unlock the projects’ mineral wealth.

Shares in the $5.4m market-capped junior are up almost 12%, trading at 8.5c.

Renegade Exploration (ASX:RNX)

Drones have been flying over RNX’s Mongoose prospect at its Cloncurry copper-gold project where it’s identified an Ernest Henry-style IOCG system, with the hope that the data will reveal a better understanding of what’s below the surface.

Over 130 line kilometres were completed by the flying saucers and results will inform target delineation ahead of a new drilling campaign RNX plans to kick off.

“The part CEI-funded Mongoose Deeps2 diamond drill hole which discovered the presence of an IOCG-style magnetic breccia zone is the driver for this latest work which is a precursor to drilling sometime in late September,” said Renegade boss Rob Kirtlan.

“The drone survey is done at 30m height which provides intense magnetic data to better understand the IOCG system we are working with.

“We do see substantial surface mineralisation as evidenced by the maiden resource at Mongoose we defined late last year.

“However, the bigger prize may be found deeper so the use of geophysics is the best tool to define a larger feeder system for what we see at surface,” said Kirtlan.

Shares in the junior are up 12.9%, trading for 0.9c.

Falcon Metals (ASX:FAL)

(Up on recent news)

Metallurgical wizardry has confirmed its heavy mineral concentrate at FAL’s Farrelly project has favourable characteristics to be produced using conventional (cheaper) processing methods.

Recoveries of zircon, ilmenite rutile and monazite showed high recoveries and a 65kg sample was tested to show a grade of 12.2% total heavy minerals.

The explorer is in the advanced stages of planning an extensional drilling program and expects to get to ground during Q4 this year.

“It is still early days for the high-grade Farrelly discovery, however, it is highly encouraging to see the sighter test confirming the deposit is amenable to conventional processing methods without any notable issues,” said FAL MD Tim Markwell.

“With no major material processing issues identified in the scope of the test work to date, Falcon’s focus will return to continuing exploration to determine just how large this deposit is.”

The $56m market-capped junior has been on a heater since the start of the year, up 113% YTD, including 8.74% today to trade at 32c a share.

At Stockhead we tell it like it is. While Renegade Exploration is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.