Resources Top 5: Investors froth over ASX copper plays amid bullish demand outlook

Pic: Stockhead/ Via Getty Images

- Oz Minerals to pay Havilah up to $405m for 1.1Mt copper, 3.1Moz gold, and 23,200t cobalt ‘Kalkaroo’ project

- Felix Gold secures more ground within world class Fairbanks Mining District of Alaska

- Golden Deeps (copper, vanadium), Cosmo Metals (copper), and Rubix Resources (copper, zinc) up on no news

Here are the biggest small cap resources winners in early trade, Tuesday May 17.

HAVILAH RESOURCES (ASX:HAV)

At the recent Indaba Mining conference in Cape Town, billionaire mining magnate Robert Friedland said that around 700Mt of copper has been mined, ever.

About the same amount will be required again in the next 22 years to keep up with the green energy movement.

The big miners know this and have been working to shore up resources while copper prices are still reasonable.

Today, mid-tier miner Oz Minerals (ASX:OZL) announced plans to pay HAV up to $405m for the flagship 1.1Mt copper, 3.1Moz gold, and 23,200t cobalt ‘Kalkaroo’ project in South Australia.

Kalkaroo is at pre-feasibility study stage and is potentially one of Australia’s largest undeveloped open pit copper-gold deposits, right next to OZL’s existing operations.

The deal involves OZL spending up to 18 months evaluating Kalkaroo’s potential. After that, if it decides to move forward, OZL will pay HAV $205m for the asset.

On top of that, $65m could be paid upon a 30% uplift in Kalkaroo’s resource estimate, as well as “a copper price linked contingent payment in each year of production up to a maximum cumulative amount of $135 million”.

That’s $405m all up.

Meanwhile, the companies will form an exploration alliance to hunt for more giant deposits across HAV’s South Australian tenure, paid for by OZL.

“Under the Strategic Alliance, OZ Minerals will pay Havilah $1 million per month during the Option and Alliance Period, with 50% of the payments directed towards Havilah identifying and advancing nearby exploration opportunities within the Curnamona Province,” OZL says.

“Including the monthly payment, OZ Minerals expects to spend up to $76 million during the Option and Alliance Period to undertake studies and for exploration activities at the Kalkaroo project and on alliance activities.”

The HAV board has unanimously recommended that shareholders vote in favour of the deal.

The $100m market cap stock is up near 100% in early trade.

HAV share price

FELIX GOLD (ASX:FXG)

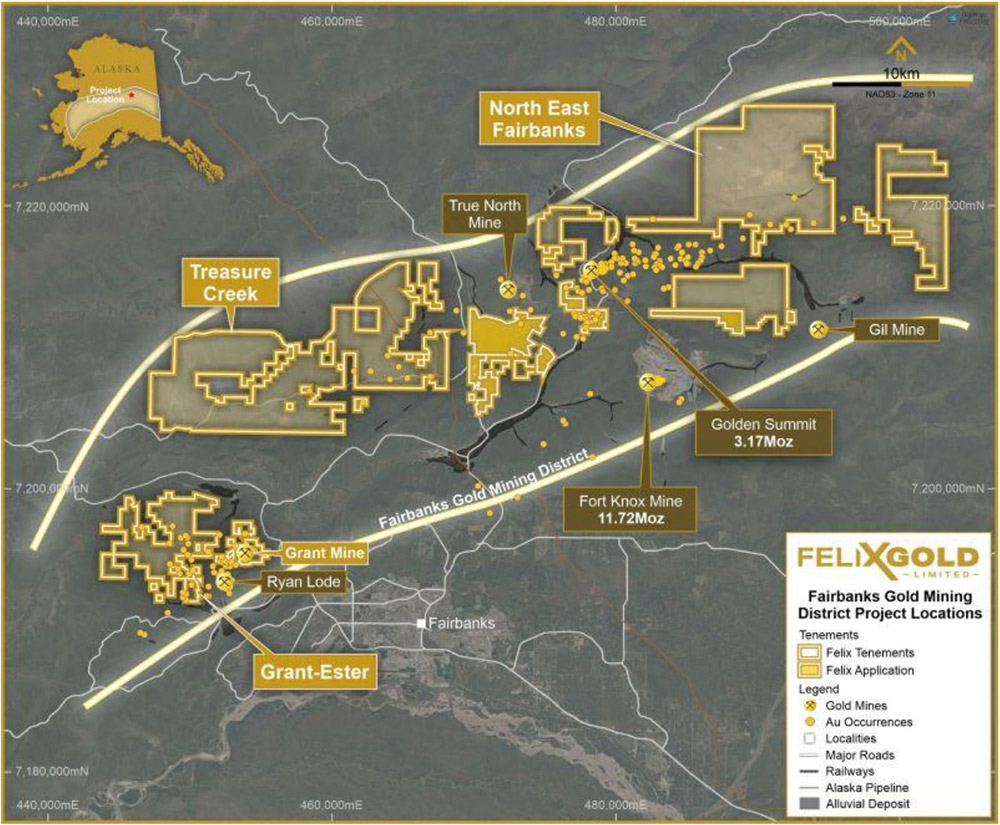

Yesterday, FXG secured more ground within the “world class” Fairbanks Mining District of Alaska, where historical gold production exceeds 16Moz.

It now holds four key projects across over 392km2 of tenure in the heart of this gold district.

The acquisition of this new project — literally sandwiched between Kinross’ 11.8Moz Fort Knox mine (400m away) and Freegold Ventures’ 3.17Moz Golden Summit Project (200m away) — has been a major priority over the past 12 months and represents a significant milestone, the company says.

FXG is set to commence more detailed evaluation activities shortly, with drill testing of key targets on this ground planned for H2 CY2022.

The recently started 7,000m RC drilling program at the ‘Treasure Creek’ project is also progressing well, the company says.

All up, the hard-working explorer plans to drill between 10,000m and 15,000m across its Fairbanks tenure through 2022.

The $14.5m market cap stock is up 6% year-to-date. It had $10.6m in the bank at the end of March.

FXG share price

COSMO METALS (ASX:CMO)

(Up on no news)

Cosmo Metals, a spin-out of gold explorer Great Boulder Resources (ASX:GBR), listed earlier this year after raising ~$7m at 20c per share.

Its main game is the 450sqkm ‘Yamarna’ project, a stone’s throw from Gold Road’s (ASX:GOR) and Gold Fields’ +7Moz ‘Gruyere’ gold mine.

In February, a maiden six-hole drilling program at the flagship ‘Mt Venn’ copper-nickel-cobalt deposit hit thick, shallow, and higher-grade copper zones including a highlight 46m @ 0.80% Cu from 141m.

A ~3,000m, three-week drilling program kicked off April, testing advanced targets at Mt Venn and ‘Eastern Mafic’. Results are pending.

An initial Exploration Target for Mt Venn is also expected in the current quarter, CMO says.

The $4.5m market cap minnow is down 10% on its IPO price. It had ~$4m in the bank at the end of March.

CMO share price

GOLDEN DEEPS (ASX:GED)

(Up on no news)

In April, GED re-rated after pulling up an impressive ~53.5m grading 3.6% copper equivalent from surface (1.15% copper, 0.62% vanadium, 3.49% lead, 4.57g/t silver) at the historical ‘Nosib’ prospect in Namibia.

This includes a high grade 11.74m at 8.5% copper eq from 2m (this was a vertical drillhole, so not true width).

The shallow, high-grade, copper-vanadium-lead-silver mineralised zone at Nosib has now been tested over a 100m strike length and continues from surface to ~50m vertical depth.

It remains ‘open’ (i.e. – GED has not found the edges yet) to the northeast and southwest at surface.

This latest drilling paves the way for a maiden resource and open pit planning studies, GED says.

The nearby ‘Abenab’ vanadium project in Namibia was the highest-grade deposit of vanadate ore in the world from 1921 to 1947.

This ore type is different – and better, Golden Deeps says — to all other primary vanadium projects.

It is simpler to beneficiate and concentrates to a very high level for further processing either on-site or by other offtakers.

$27m market cap GED is up 70% year-to-date. It had $1.7m in the bank at the end of December.

GED share price

RUBIX RESOURCES (ASX:RB6)

(Up on no news)

The recently listed junior has a portfolio of four base metals and gold projects in Queensland and WA.

Its key asset is ‘Paperbark’, 25km from the ‘Century’ mine held by New Century Resources (ASX:NCZ) in North Queensland.

A drill program (still subject to government approvals) has been developed to test two key priority targets – ‘Grunter North’ (copper) and the ‘JB’ (zinc).

Grunter North contains numerous high grade rock chips up to 42.7% Cu (that’s pretty high) across a ~1km strike (that‘s pretty long).

There’s also historical shallow drilling which noted copper oxide, “highlighting the potential for a high-grade copper sulphide deposit at depth” RB6 says.

Despite this, the target has been subject to very limited deep drilling.

The company intends to punch in up to six holes for ~1,400m.

At ‘JB’, where multiple historical drillholes hit very broad, low-grade zinc-lead, RB6 is intending to drill up to four holes for ~1,500m.

The $4.6m market cap tiddler is flat year-to-date. It had ~$4m in the bank at the end of March.

RB6 share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.