Resources Top 5: Investors adore Equinox’s 70pc antimony grades

Equinox is getting more love from investors today than this kitty from this vaguely terrifying girl. Pic: Getty Images

- Equinox soars as it reveals 70% antimony grades at Alturas

- Native Mineral Resources snaps up two advanced gold projects in QLD for $18.9m

- Pantera commences first well testing at Smackover

Here are the biggest small cap resources winners in morning trade, Friday, November 8. Prices accurate at time of writing.

Equinox Resources (ASX:EQN)

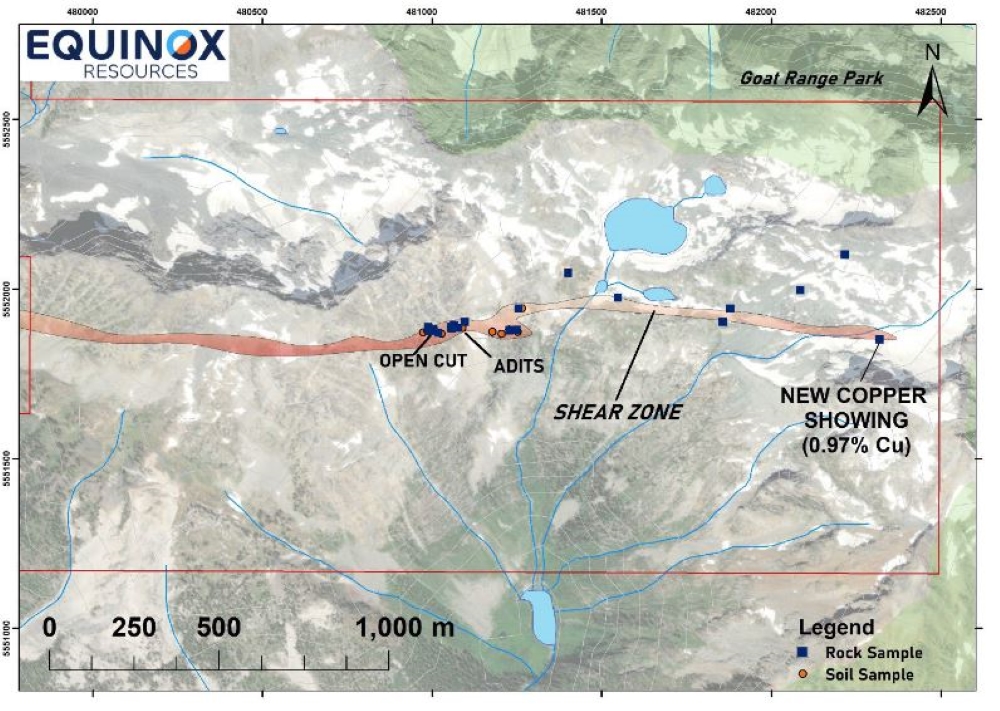

EQN boss Zac Komur reiterated the mining adage that ‘grade is king’, as exploration efforts confirm Alturas has the world’s highest naturally occurring grades of antimony in stibnite across a 1.5km-long shear zone, with hits of up to 70% confirmed from rock samples across the landholding.

“Considering that pure stibnite contains 71.4% antimony, these findings confirm Alturas as a truly unique and valuable asset,” Komur says.

“By strategically expanding our footprint with additional claims to the east and west, we are positioned to explore beyond the known mineralisation.”

WATCH MORE: Long Shortz with Equinox Resources: World’s highest naturally occurring antimony grade

Like many commodities, high grades at surface significantly de-risk the project, reducing waste material and processing costs.

On the back of those impressive results, additional ground totalling 3.3km2 has been staked to the east and west of the property, offering potential to expand the mineralised footprint.

There’s a good chance those rock samples lead to more mineralisation as 105t of antimony ore averaging 57.2% Sb had been historically sold from the Alps-Alturas antimony mine on the property.

Antimony prices have shot through the roof, fetching US$36,000/t at the end of October and it seems that any explorer with even a whisker of antimony at its project will get jumped on by investors – EQN scored a whopping 40% rise on the bourse on Friday morn.

The explorer has also run into Alturas’ polymetallic potential after discovering a copper-bearing field with 0.96% copper at the surface.

Elsewhere, drilling is ongoing at EQN’s Brazilian assets, with assay results pending from the Mata da Corda titanium and Campo Grande REE projects.

Native Mineral Resources (ASX:NMR)

Investors seem to be backing NMR’s decision to acquire a couple of advanced gold projects in the mineral-rich Ravenswood-Charters Towers region of QLD for $18.9m from Collins St.

The package includes the Far Fanning and Black Jack deposits which span across 17 granted mining leases, one mineral development license and six exploration permits, and comes with the Black Jack processing plant in Charters Towers which is currently on care and maintenance.

Far Fanning already has a resource estimate of 2.3Mt at 1.84g/t for 138,000oz and two additional resources – Great Britain and Granite – with a combined 2.3Mt for 186,000oz.

NMR completed due diligence by examining seven samples from historical stockpiles that showed grades as high as 72.5g/t gold within quartz and sulphide veins.

The $18.9m will be paid across 33 months with equal bullet payments of $1m paid on each of 20 December 2024, 20 March 2025 and 20 June 2025, with the remaining balance payable in monthly instalments.

Pantera Minerals (ASX:PFE)

(Up on yesterday’s news)

Focused on lithium in the US, PFE has started testing its first well at its Smackover lithium brine project in Arkansas and is one of the only ressie stocks to buck the trend on yesterday’s dip caused by the US election.

That’s because starting off a first well at a lithium brine asset is the sign of the next stage in a project’s development. Investors seem to recognise that too, with PFE again rising today >22%.

The Smackover project lies within its namesake formation which has a lot of brine deposits and was historically mined for bromine for the entire US market.

Nowadays it’s lithium in demand from those same brines and because mining infrastructure is already there, majors such as Exxon, Albemarle and Standard Lithium are all spending hundreds of millions in the same region.

PFE says it will test grades and re-entry well samples by multiple direct lithium extraction tech providers prior to planning an onsite DLE plant.

Flynn Gold (ASX:FG1)

FG1 has announced a maiden exploration target for its Golden Ridge project in NE Tasmania of a quite sizeable 3.5-5.4Mt at 3-4g/t for 449-520,000oz gold, above market expectations.

That target represents just 30% of the known strike length of a defined 9km long gold anomaly at the project.

The explorer reckons it may have a large intrusion related system on its hands and is starting to take the necessary steps to convert that targets into a maiden JORC resource.

Diamond drilling underway at Link Zone, testing extensions of known gold-vein mineralisation along strike and down-dip of the historical Golden Ridge Adit.

FG1 MD Neil Marston says the exploration target is open in all directions and encompasses less than 30% of the known gold anomalism at Golden Ridge which, he says, highlights the substantial future growth potential of the project.

“There is potential to significantly increase the tonnage and grade at Golden Ridge with in-fill and expansion drilling, which will be a major focus for the company during 2025.”

Adavale Resources (ASX:ADD)

(Up on no news)

Nothing but executive changes in the past couple of weeks as exec director David Riekie resigned and Allan Ritchie was appointed exec chair; both coming into effect at the end of last month.

ADD has prospectivity for uranium in South Australia and nickel in Tanzania.

Last the market heard was that drilling is being planned for next month across the junior’s MacDonnell Creek and George Creek uranium prospects and fieldwork across other prospectivity.

Work is expected to be done as it raised a cool $632,000 in a share placement during the last quarter.

Perhaps there’s some news due soon?

At Stockhead we tell it like it is. While Equinox Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.