Resources Top 4: Insane grades of uranium and REEs top morning trade

Pic: Getty Images.

- Infini shoots up on enormous high-grade samples of U3O8 at Portland Creek project

- Lindian’s Stage 1 PFS reckons its Kangankunde REE project will return an IRR of 80%

- SIPA hits Barry Fitzgerald’s watchlist on weekend. Up 23% today.

Here are the biggest small cap resources winners in morning trade, Monday, July 1.

Infini Resources (ASX:I88)

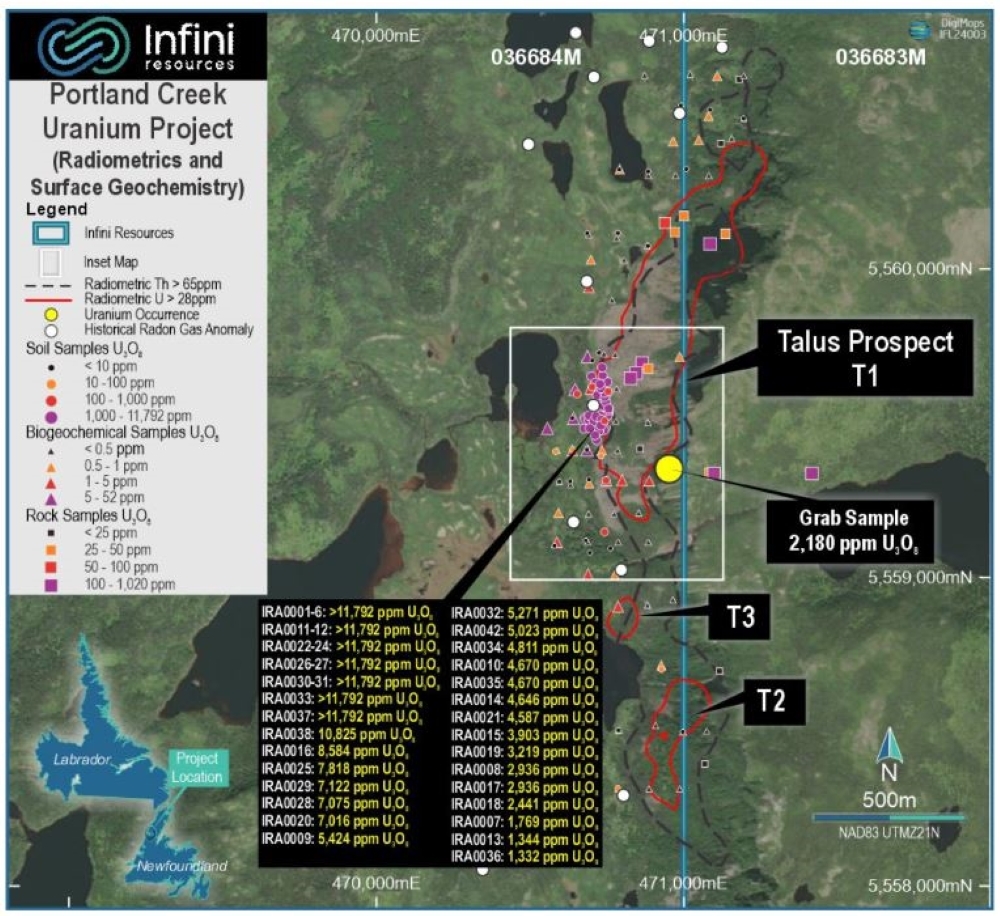

Maiden field sampling results at Infini’s Portland Creek uranium project in Newfoundland, Canada, have exceeded lab testing limitations in 17 samples – meaning they are above 1.18% (11,792ppm) U3O8 – therefore sent for additional testing using higher grade tech.

Those are some seriously high numbers, which the company says are “nothing short of outstanding” and some of the highest returned grades of yellowcake in the world.

The company says another 52% of the samples tested have come back with readings above 1000ppm U3O8, which is impressive in itself.

Shares skyrocketed more than 100% in early trade today, sitting at 32c at the time of writing.

Lindian Resources (ASX:LIN)

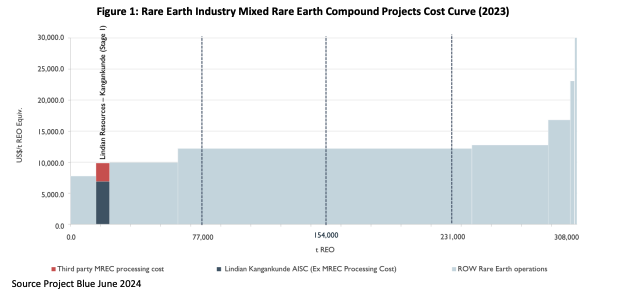

A pre-feasibility study for Stage 1 of Lindian’s Kangankunde rare earths project in Malawi have returned economically viable results that show an internal rate of return of a whopping 80%, predicting the project would be one of the cheapest operations in the world.

The PFS shows a maiden ore reserve of 23.7Mt could be used to produce ~15,300tpa of concentrate with a 55% TREO grade, resulting in the sale of ~8,400tpa of rare earths oxides and ~1640tpa of NdPr.

LIN says the project now boasts a net-present value of $831m with development costs coming in at just $60m and average all in sustaining costs over the life of the mine of just US$3.7/kg ($5.5/kg).

NdPr prices in China are sitting at around US$50/kg, levels at which few current producers are profitable. But Lindian says at current prices Kangankunde would make around US$11m in average annual EBITDA.

It has used much higher prices in the study based on forecasts from Project Blue, anticipating shortages of NdPr will drive the magnet metals above US$100/kg in the 2030s, with average annual EBITDA of US$84m ($124.5m) over the life of mine. We’ll see.

With a payback period of just two years for its 45-year mine life, the post-tax NPV-to-capex is over a 10:1 ratio – a value representation not often seen in the mining industry.

“We have been discussing funding options for Stage 1 with several parties over a number of months and the PFS is the key catalyst to progress these negotiations, as well as attract new funding interest,” CEO Alwyn Vorster says.

The strong economics, Lindian says, also provide confidence for a potential Stage 2 expansion that would increase annual production.

With key approvals are in place and construction contract talks in motion, the explorer-turn-developer is now in search of funding for the project.

Shares in the $150m market-capped company are up 33% to 14c in morning trade.

SIPA Resources (ASX:SRI)

(Up on no news)

Exploration is ramping up at SIPA’s northern WA projects with field activities across its Paterson North, Skeleton Rocks, Barbwire Terrace and Wolfe Basin projects that contain nickel copper and base metals mineralisation.

A project update last week revealed plans to drill at Paterson North, targeting intrusion-related copper-gold mineralisation northeast of Rio Tinto’s Winu copper-gold discovery.

At Skeleton Rocks, the explorer is looking at outcropping and buried greenstone units, prospective for gold, lithium and nickel-copper-platinum group element (Ni-Cu-PGE) deposits where limited drilling had been completed.

Surveys will be conducted at the 50:50 Barbwire Terrace JV with Buru Energy (ASX:BRU) and studies are being undertaken to look at Warralong and Wolfe Basin to determine exploration programs.

(And just quietly, SIPA got a little mention from our very own resources soothsayer Barry Fitzgerald over the weekend. Check that out … here.)

Perpetual Resources (ASX:PEC)

(Up on no news)

Perpetual has just inked a deal for land near Meteoric Resources (ASX:MEI) world-class 545Mt at 2561ppm Caldeira ionic clay-hosted rare earths deposit, which has some of the highest concentrations of REEs on the planet.

The deal covers four licenses, named the Raptor project, over 380 hectares in Brazil’s hot REE mining district.

Perpetual plans to commence due diligence across the tenure and undertake sampling and drilling activities.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.