Resources Top 5: Iconic silver-zinc mine restart looking bigger and better, gold miner makes surprise lithium find

Pic: Via getty

- Polymetals Resources drills into 71m at 11.02% zinc equivalent at the mothballed Endeavour mine

- Mt Monger Resources up ~130% since acquiring Canadian rare earths-niobium exploration project called Pomme in February

- Ora Banda Mining makes “significant lithium discovery” at Davyhurst project in the WA goldfields

Here are the biggest small cap resources winners in morning trade, Wednesday, April 26.

POLYMETAL RESOURCES (ASX:POL)

Aspiring silver-base metals miner POL drilled into 71m at 11.02% zinc equivalent at the mothballed Endeavour operation in NSW, bolstering its mine restart strategy.

The drill intercept at the shallow, unmined South Lode includes a super high grade 8m chunk @ 0.89g/t gold, 914g/t silver, 8.9% zinc, 5.3% lead and 0.16% copper from 154m (29.2% ZnEq).

(Zinc is used for equivalent calculations as it is the dominant metal at Endeavor, says POL, which works out the eq calcs using current spot metal prices and predicted recoveries.)

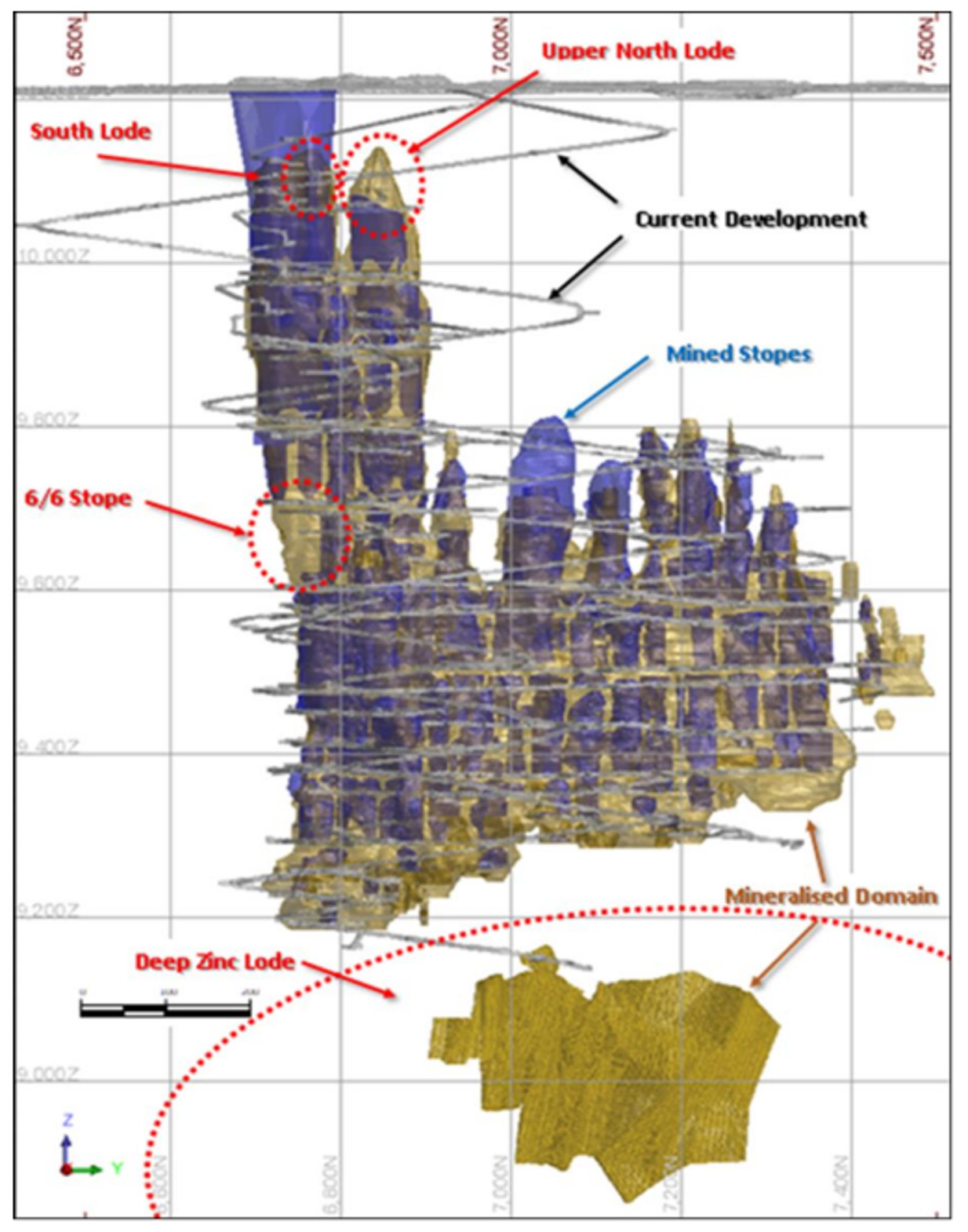

You can see how shallow South Lode is here:

POL says it wasn’t mined previously due to a 1996 cave in, which displaced the remaining resources.

“It is most encouraging to know that part of the near surface South Lode remains in situ at Endeavor,” POL boss Dave Sproule says.

“We will plan to further test the zone to quantify metal endowment over the coming months.”

The elevated silver grades and contained gold within the unmined North Lode and remaining South Lode also has potential to generate significant value upside, Sproule says.

“Following receipt of all assays from the Phase 1 RC drilling program, metallurgical testwork will be expedited to confirm metal recoveries, additional South Lode drilling will be undertaken, a new resource estimate will be completed, and mining reserves determined for both the North and South Lodes.”

North Lode will underpin a restart strategy for the iconic mine, POL says, which was mothballed by previous owner Toho Zinc in 2019 due to depleting reserves after ~37 years of operation.

32.2Mt of ore grading 8.01% zinc, 5.04% lead and 89.2g/t silver had been mined and processed to that point, with a 16.3Mt resource remaining when POL bought the project for ~$10.4m in shares (52m shares priced at 20c).

$18m capped POL – which listed on the ASX mid 2021 to hunt gold deposits in the West African nation of Guinea — is now up 55% year-to-date.

It had $1.9m in the bank at the end of December.

MT MONGER RESOURCES (ASX:MTM)

MTM is up ~130% since acquiring a Canadian rare earths-niobium exploration project called ‘Pomme’ in February.

Proceeds from a recent $3m raise will be used for a maiden drill campaign and metallurgical testwork at Pomme, which it bought from TSX listed explorer Geomega Resources for ~$1m in cash and shares.

MTM directors tossed in a collective $70,000 as part of the placement.

The company says Pomme has similar geology to Geomega’s advanced 266Mt Montviel carbonatite REE-Nb deposit, just 7km away.

Just two holes were punched into Pomme back in 2012, but they both returned thick mineralised intersections interspersed with high grade chunks, including a highlight 508.3m @ 0.43% TREO, 413ppm Nb2O5 and 1.48% P2O5, from 73.7m depth.

GBM RESOURCES (ASX:GBZ)

GBZ offloaded its remaining 50% share of the non-core Malmsbury gold project to Novo Resources (TSX:NVO) for $1m cash and 4m NVO shares (worth ~$1.5m at current prices).

It also keeps a 2.5% net smelter royalty (NSR), which is a percentage of revenue the company could receive in the future from gold sales.

For GBZ, it’s a zero-risk way to retain exposure to the project.

Its focus is on the Drummond Basin in Queensland where it has expanded JORC resources to ~1.84Moz of gold across the Mt Coolon, Yandan and Twin Hills projects.

In October last year it inked a $25m farm-in agreement with gold giant Newcrest (ASX:NCM) over the 330,000oz Mt Coolon.

NCM can acquire up to 75% of Mt Coolon by spending up to $25m and completing a series of exploration milestones – including 23,000m of drilling – over six years.

GBZ purchased Mount Coolon in February 2015 from DGO (recently acquired by Gold Road Resources) for $850,000 cash and 50m shares.

The deal frees up GBZ to focus its efforts (and money) on Twin Hills and Yandan, which have a combined resource of ~1.38Moz.

2023 will see an expanded drilling program “which is aiming to define 2-3Moz and support GBZ’s transition into a mid-tier Australian gold company”, it says.

Another divestment option is GBZ’s small loss-making heap leach gold operation in South Australia called White Dam, which produced 135oz in the December quarter for ~$500,000 revenues.

The $16m market cap stock is down 20% year-to-date. It had $5m in the bank at the end of December, and debt via convertible note facility (if not converted).

READ: The Small Cap +1Moz Gold Club: A Guide, Part 2

ENRG ELEMENTS (ASX:EEL)

Uranium prices are stirring.

Spot #Uranium spiked hard today⏫ to nearly a new 52-week high with #Nuclear fuel brokers @EvoMarkets UP +$1.05 to $53.68/lb #U3O8⏫ ‘Uranium Markets’ UP a buck to $53.50⏫ and @Numerco UP +$1.12 to $53.36⏫ Spot’s highest level since 9 May 2022.⚛️⛏️ #UraniumSqueeze pic.twitter.com/T2H2majYwo

— John Quakes (@quakes99) April 25, 2023

A good time for the explorer formerly known as Kopore Metals to boost uranium resources by 100% at the flagship Agadez project in Niger.

The new 21.5 Mlbs U3O8 resource from the shallow Takardeit deposit also includes a 6.8% increase in grade (31.1Mt at 315 ppm U3O8).

EEL is already planning its next resource upgrade, with a new drilling program expected to kick off mid-year.

“This resource update demonstrates the exciting potential of the Agadez project and with a drilling program planned to commence in the coming months, we look forward to further building on this mineral resource estimate at Takardeit and to identify other priority regional exploration targets within our tenement package,” EEL managing director Caroline Keats says.

EEL says the geology at Agadez is similar to Orano SA’s Cominak/Somair and Imouraren uranium mines in Niger, and the deposits held by $600m capped Global Atomic Corporation (TSE:GLO) and $120m capped GoviEx Uranium (CVE:GXU).

Niger was the seventh largest uranium producer globally in 2021-22, the company says.

The $15m capped stock is down 43% year-to-date. It had $1.5m in the bank at the end of March.

ORA BANDA MINING (ASX:OBM)

The junior gold miner has made a “significant lithium discovery” at its Davyhurst project in the WA goldfields.

OBM’s main game remains gold, but as part of a ‘3-Year Strategy to Create Value from investing in Exploration’ a small team is focussed on lithium.

Hole one of a maiden three-hole program at the Federal Flag target hit a highlight 11.1m (estimated true width of 10m) @ 1.28% Li2O from 54m in fresh pegmatite, including 8m @ 1.56% Li2O and a maximum value of 1m @ 2.13% Li2O.

Most hard rock lithium mines contain an ore grade between 0.8%-1.5% Li2O, so this is a good start.

Assays for the remaining two holes are pending, but OBM is already planning follow-up drilling.

“Whilst the first results are very encouraging, this is very early days in unlocking the lithium potential and we will continue to work this up with a small, focused team and disciplined drill programs,” says MD Luke Creagh, a veteran mining engineer who was COO at Australia’s #2 gold miner Northern Star Resources (ASX:NST).

“It is important to note that our lithium exploration will be conducted without compromising our gold focused exploration objectives of finding a second high-grade underground mine to compliment Riverina Underground and drive further production growth and increased cashflows for the company.”

OBM has historically struggled to make a go of its troubled Davyhurst gold operation near Kalgoorlie.

Ongoing cost and performance issues prompting the company to initiate a strategic review and ‘reset’ of its operations earlier last year.

It has now offloaded $14.2m worth of non-core projects and approved development of the 303,000oz at 4.1g/t Riverina Underground, which is fully funded.

Steady state production is pencilled in for Q4, FY24, when it will churn out ~600,000t of ore per annum at estimated all in sustaining costs of less than $1,650/oz.

The aspiring 100,000ozpa miner has rebounded strongly with a 430% gain since Creagh took control mid last year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.