Resources Top 5: Hopeful uranium stocks, an important graphite deal, and lots of imminent news flow

Pic: Ian Carroll (aka "icypics"), Getty Images

- Aspiring graphite miner Black Rock invited to finalise agreement with Tanzanian government

- Cauldron Energy dusts off Yanrey uranium project, despite government opposition

- Redstone (copper, cobalt), Latrobe (magnesium) and Empire (gold, copper, nickel, PGEs) up on no news

Here are the biggest small cap resources winners in early trade, Tuesday December 7.

CAULDRON ENERGY (ASX:CXU)

(Up on no news)

When the WA state government implemented a ban on most new uranium mines in 2017, CXU stopped work at its flagship ‘Yanrey’ uranium project and began searching for other dirt to play with.

It now has a historic gold project called ‘Blackwood’ in Victoria and a silica sands play called ‘Ashburton’ in WA. It is also poking around Yanrey again, which is a lot more interesting now that uranium prices are on the move.

While government support (or lack thereof) for new mines has not changed, a recent survey uncovered a bunch of “highly prospective targets for follow-up drilling” at Yanrey.

“Our ultimate objective is to explore for uranium mineralisation amenable to extraction by ISR,” CXU exec chairman Simon Youds says.

“Economic deposits of sandstone-hosted, palaeochannel-style uranium can be mined using ISR in the lowest cost quartile of uranium mined globally.”

“This characteristic makes these deposits extremely attractive for mining at any uranium price and necessarily must form the basis of any uranium resource portfolio.”

Yanrey exists within a larger uranium province that is slowly being uncovered, Youds says.

“There is potential here for a scale comparable to the best uranium-endowed province globally and that, with astute leadership, Western Australia is at the threshold of a new energy resources boom.”

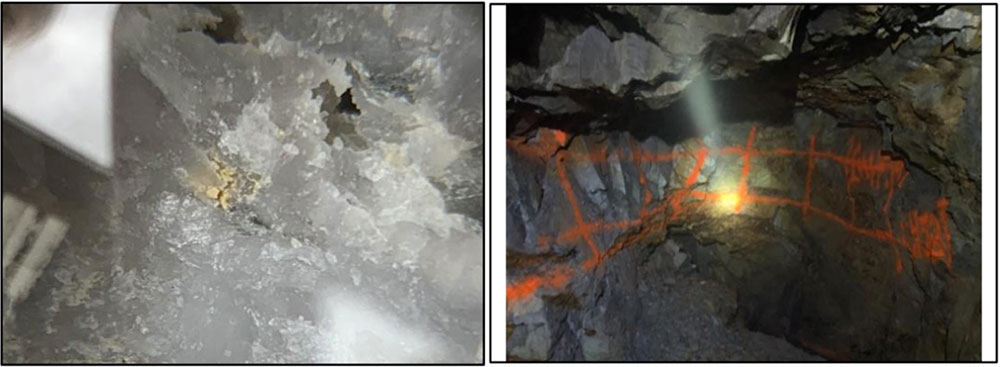

At Blackwood, CXU has stumbled upon visible gold in an underground area historically excavated for access purposes only:

“The visible gold observed, coupled with the beautiful sandstone-shale contact and structurally complex geology, provides an exciting new target for drill testing,” Youds said in November.

“The observation of visible gold further increases our confidence in the remaining mineral potential of these historical mines.”

The $11.5m market cap stock is down 6% over the past month, and 30% year-to-date. It had $1.5m in the bank at the end of September.

REDSTONE RESOURCES (ASX:RDS)

(Up on no news)

The nanocap, which has partially bounced back from recent losses in early trade Tuesday, is drilling to grow the 38,000t copper, 535t cobalt ‘Tollu Copper Vein’ deposit, part of the ‘West Musgrave’ project in WA.

Tollu hosts “a giant swarm of hydrothermal copper rich veins” in a mineralised system covering a +5sqkm area, ~40km from OZ Minerals’ (ASX:OZL) world-class Nebo-Babel nickel-copper deposit.

A conceptual (theoretical, not real yet) exploration target suggests up to 627,000t of copper may be present, the company says.

Recent portable XRF analysis of new drilling returned hits like 16m at 2.62% copper from a 74m downhole, including 6m at 6% copper from 76m.

These will be confirmed by traditional assay, the company says. Labs are backed up to the hilt, so who knows when that will be.

RDS say exploration will continue “at the earliest opportunity” in 2022 with a deeper RC drilling program at priority targets.

The $12m market cap stock is up 30% over the past month. It had $2.6m in the bank at the end of the September quarter.

BLACK ROCK MINING (ASX:BKT)

It’s been a good news week for aspiring graphite miner BKT.

Today it announced it had been invited by the Mining Commission to attend a ceremony in Dar es Salaam, Tanzania on Monday 13 December “to finalise an agreement with the Government of Tanzania”.

Black Rock managing director John de Vries is currently in country and is expected to attend, BKT says.

The company has also just completed a massive 500t pilot plant run – the largest ever, it says — to send off for qualification (testing) to potential customers in North America, Asia and Europe.

This will ultimately support project financing, BKT says.

The company now needs to finalise off-take terms with cornerstone investor POSCO, and secure finance to underpin a $US116m Phase 1 development capex program.

The $183m market cap stock is down 10% over the past month, and up 115% year-to-date. It had $9.3m in the bank at the end of September.

LATROBE MAGNESIUM (ASX:LMG)

(Up on no news)

Early works – like fixing fences, site clean-up, contracting — are happening apace at LMG’s magnesium project in Victoria’s Latrobe Valley, with construction on an initial 1,000 tonne per annum magnesium plant due to kick off in Q1 2022.

Production starts up to 12 months later in Q4 2022.

The plant will be expanded to 10,000 tonnes per annum magnesium shortly thereafter, with further plant capacity expansion to be considered once it is operating successfully.

Magnesium has the best strength-to-weight ratio of all common structural metals and is increasingly used in the manufacture of car parts, laptop computers, mobile phones, and power tools.

In November, LMG said current magnesium price was US$6,150 per metric tonne and expected to hold.

“LMG’s revenue estimates are based upon US$3,250 per tonne which was the magnesium price in June 2021, before the China supply shortage commenced in September 2021,” it says.

“If the current price of US$6,150 per metric tonne held long term, it would increase LMG’s estimate of EBITDA for its 10,000tpa plant by some $56m.”

In 2020, world magnesium production was ~1 million tonnes, of which China supplied ~85%. China has begun a 13-year plan to increase Mg in cars from 8.6kg to 45kg by 2030, requiring an additional 1 million tonnes of new Mg production per annum.

$131m market cap LMG is down 21% over the past month, and up 335% year-to-date. It has raised $11.5m via placement to help fund the initial $39m 1,000tpa plant.

EMPIRE RESOURCES (ASX:ERL)

(Up on no news)

This busy polymetallic explorer has already drilled 13,000m so far in 2021 at the ‘Penny’s and Yuinmery’ projects in WA, with diamond drilling of some juicy gold, copper, and nickel-copper-PGE targets at Yuinmery due to kick off sometime this month.

ERL would’ve drilled even more if not for issues getting hold of a rig, something the company intends to fix in 2022.

“Our exploration plans for 2022 include the lock-in of a core drilling rig and driller for exclusive use by Empire,” chairman Michael Ruane says.

“This should assist in accelerating at least the drilling component of our exploration programs for the forthcoming period. The rig will be particularly useful for the deep drilling required for the promising Yuinmery targets (eg Smiths Well/YT01).”

The rig should be ready for commissioning this month, he says.

The $14.85m market cap stock is up 30% over the past month. It had about $3.5m in the bank at the end of November.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.