Gold: The Tale of Cauldron and the “largely forgotten” Blackwoods Goldfield

Mining

Mining

“Sooner or later, everything old is new again,” author Stephen King wrote, according to the internet. It sums up the proclivity for ASX-listed explorers to revitalise very old, often high-grade mines in 2019’s buoyant gold price environment.

Old mines usually come with an existing resource — even if it isn’t up to JORC 2012 standards — and fresh gold is easier to chase down, which means a quicker path to production.

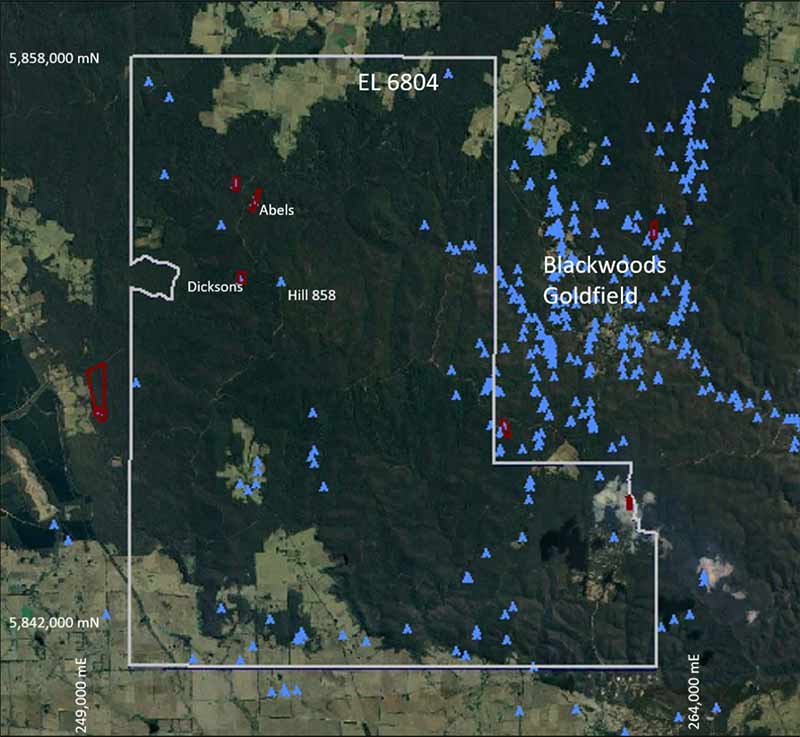

The list of explorers with old gold projects is growing. Next cab off the rank is uranium play/shell company Cauldron Energy (ASX:CXU), which today announced plans to acquire an initial 60 per cent interest in the 155sqkm Bullarto South gold project, in the historic Victorian goldfields around Ballarat.

There is more than 100 named shafts and pits within the Bullarto South project area.

Historical reports show Blackwoods Goldfield, 4km away, produced over 199,000oz of gold during the 1860’s Victorian goldrush — worth ~$US190m ($275.4m) today, Cauldron says.

Like the companies before them, Cauldron is attracted to mothballed projects because they have “historical exploration supportive of the potential for large-scale gold deposits and short-term generation of cash-flow”.

Near-term cash flow is an attractive prospect for any money starved small cap explorer — and their investors.

The systematic exploration of old gold workings continues to pay off for explorer Ausmex (ASX:AMG).

Greenpower Energy – now Great Northern Minerals (ASX:GNM) – just bought historic gold mines in Northern Queensland.

Silver Mines (ASX:SVL) is dusting off the Tuena project in NSW, a series of historic hard-rock and alluvial gold mines worked between the 1850s and early 1900s.

Stavely Minerals (ASX:SVY) — even though investor attention is focused on that huge copper discovery in Victoria — has the Mathinna project in Tasmania, essentially untouched since 1932.

According to official records, the district produced 289,000oz of gold grading close to 30 grams per tonne (g/t) back in the day.

There’s also Kingwest (ASX:KWR), Norwest Minerals (ASX:NWM), Rox Resources (ASX:RXL), Venus Metals (ASX:VMS) and many more.

Great Southern Mining (ASX:GSN) recently picked up the Cox’s Find mine, which produced 77,000 ounces at more than 21g/t between 1935 and 1942.

“One only has to look at the depths of extraction of modern-day mining (and subsequent resource cut-off grades) to know that this wouldn’t be the first historic gold mine to be resurrected on significant ounces discovered at depth,” Great Southern chairman John Terpu told Stockhead.

He is talking about guys like Spectrum Metals (ASX:SPX) and Bellevue Gold (ASX:BGL), who are enjoying wild success in 2019. The list of success stories will continue to grow in 2020.