Resources Top 5: High grade nickel discoveries, ancient mines, and a handful of promising gold stocks

Pic: Alexey Dozmorov, iStock / Getty Images Plus

- Recent IPO Dynamic Metals hits thick high-grade nickel in maiden drilling

- Ballymore Resources uncovers ‘significant, previously undiscovered gold deposit’ next to historic mine

- Hamelin Gold preps drilling at ‘camp scale’ gold targets

Here are the biggest small cap resources winners in early trade, Thursday March 16.

DYNAMIC METALS (ASX:DYM)

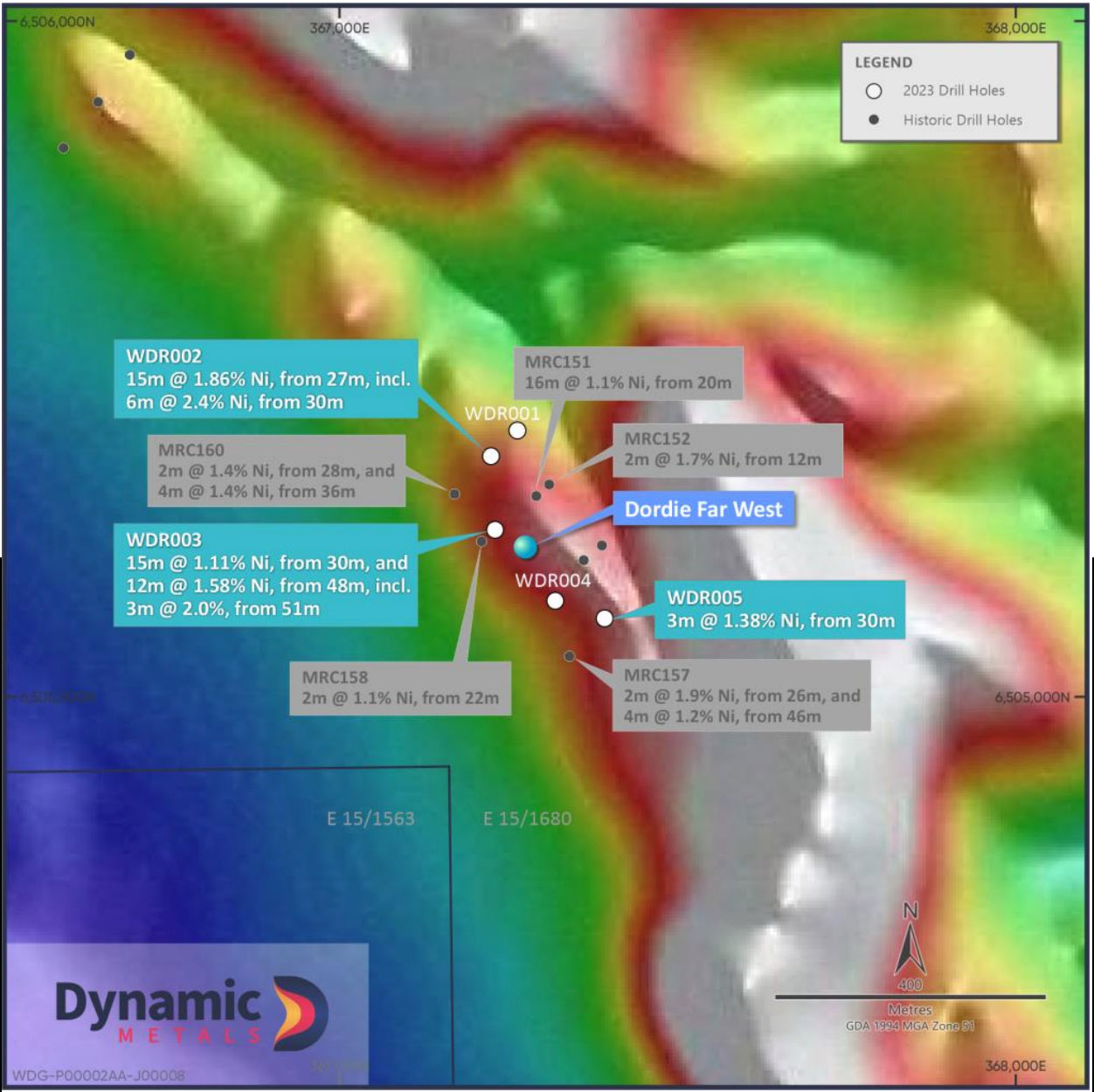

The recent IPO is enjoying a dream start to listed life, hitting thick, high grade nickel in 3 of 5 maiden drill holes at Dordie Far West (DFW), part of the Widgiemooltha project in WA.

Highlights include:

- 15m @ 1.86% nickel from 27m downhole, incl. 6m @ 2.4%

- 15m @ 1.11% nickel from 30m downhole

- 12m @ 1.58% nickel from 48m downhole, incl. 3m @ 2%

The five holes for 736m were drilled over a strike length of ~300m at DFW, where similar results were unearthed by producer Mincor Resources (ASX:MCR) in the late 2000s.

DYM will now submit 1m samples from the significant 3m composite intercepts to the lab for further assaying. Results from the 1m composites will be used to update the geological model at DFW to determine the next phase of drilling.

Meanwhile, a 6000m drill program is underway at the nearby Lake Percy nickel project.

The $8m capped stock is up 10% on its January listing price of 20c per share. It has ~$7m in the bank.

BALLYMORE RESOURCES (ASX:BMR)

BMR hit the bourse late 2021 with a portfolio of Queensland gold and base metals projects including ‘Dittmer’ (a historic high-grade goldfield), ‘Ruddygore’ (a large copper-gold porphyry target) and ‘Ravenswood’ (a bunch of drill ready targets in a 17Moz gold province).

New step out (extensional) drilling results from Dittmer announced today continue to grow the bonanza grade Duffer Lode.

Results from the first four holes have all hit paydirt, with highlights including 3.5m @ 8.89g/t Au & 2.7g/t Ag.

BMR says there is strong continuity in the mineralisation, with the Duffer Lode often +2m in true width with drill intersections regularly reporting +20 metre-gram gold intersections.

This is a significant, previously undiscovered gold deposit, BMR says.

“This step-out drilling program is expanding the previously unrecognised fault-repetition of the bonanza-grade Duffer Lode,” technical director David A-Izzeddin says.

“This work is demonstrating excellent continuity of the mineralised structure with widths generally exceeding the lode mined in the historic mine.

“Step out drilling indicates that the lode extends for over 260m along strike and over 200m down-dip and remains open beyond current drilling, with significant gold grades and improving down-hole widths.”

The Dittmer Phase 3 drilling program continues and is expected to be completed in April, with final assays to follow.

Dittmer was one of the highest-grade gold mines in Australia when operating, producing over 54,500oz gold, 23,400oz silver and 295t copper from just 17,100t of ore.

Historic mining only extended 90m below the access level. This newly recognised lode structure has been ‘up-faulted’ to within 20m of this level, representing an extremely shallow, high-grade gold-copper target.

It had never been drilled prior to BMR acquiring the project, and to date has only been tested to ~200m beneath the access drive.

The $16m capped stock is flat year-to-date. It had $3.8m in the bank at the end of December.

HORIZON MINERALS (ASX:HRZ)

(Up on no news)

In early 2022, a toll milling trial at HRZ’s 448,000oz Boorara gold project in the Goldfields was expected to de-risk larger scale mine development.

In total, 98,121 tonnes of ore was processed in the two campaigns at a grade of 0.93g/t Au and 90.2% recovery. The campaigns generated ~$1.35m cash to HRZ after all costs.

Plans change, however.

“Unfortunately, we’ve seen inflation and volatility in cost estimates increase materially since the second half of last year to a point where we now believe too much risk and potential for value destruction exists making it reckless to pursue a large-scale development in such an uncertain operating environment,” HRZ managing director Jon Price said late March.

“We are fortunate to have a [total +1.24] million-ounce resource within close proximity to the mining centre of Kalgoorlie-Boulder which provides significant opportunity and flexibility.

“Our location gives us the opportunity to monetise low tonnage high grade assets through a contract mining and toll milling model as we have done successfully in the past.”

The first of these assets is the 32,000oz Cannon pit, where a recent PFS envisaged solid cash flow of ~$10.1 million over five quarters “with a proven and relatively low risk operating strategy”.

This is based on a gold price of A$2600/oz (currently far higher at A$2886.5/oz).

Permitting is well advanced for a development decision in March quarter 2023, the company said in November.

Meanwhile, a 25,000m of brownfields drilling is planned across its portfolio in 2023 to grow the 1.24Moz resource.

The $30m capped stock is down 18% year-to-date. It had $1.6m in the bank at the end of December, plus $6m in listed investments and $3m in unused financing facilities.

READ: Bargain Barrel: Here are 5 of the cheapest emerging gold and silver producers on the ASX

HAMELIN GOLD (ASX:HMG)

HMG listed late 2021 as a spin-out of Encounter Resources (ASX:ENR) with a focus on monster gold discoveries in the remote, mineral rich Tanami Desert.

Following the high-grade discovery at ‘Sultan’ late last year, HMG has now identified several new ‘camp scale’ (multi-kilometre) gold targets ahead of a field program set to kick off next month. Very promising.

“Hamelin’s maiden exploration program in the West Tanami in 2022 delivered a high-grade gold discovery at Sultan and has resulted in a number of key learnings that significantly increased our understanding of the structural setting, the basement geology and the nature of the regolith,” HMG managing director Peter Berwick says.

“These learnings have been incorporated into our targeting activities resulting in the identification of several new camp scale gold targets.

“These targets exhibit the geophysical and geochemical footprints commonly associated with large scale gold systems, and in areas we consider previous exploration programs have been ineffective.

“The identification of a new suite of high-quality camp scale gold targets highlights the under-explored nature of this region and the vast opportunity that remains for the discovery of multi-million-ounce gold deposits in the West Tanami.”

The upcoming exploration blitz includes more drilling at Sultan (April), before the rig trundles across to the Eastern Corridor targets (May) and ‘Newkirk’ and ‘Olsen’ prospects (May, June).

The $10m capped stock is down 30% year-to-date. It had $4.2m in the bank at the end of December.

FIRETAIL RESOURCES (ASX:FTL)

(Up on no news)

A bunch of drill results incoming for this Firefly Resources spinout, which listed April 2022 with a portfolio of lithium, rubidium, nickel, cobalt, copper, manganese and gold projects in WA and Queensland.

FTL has some heavyweights on the major shareholder list, including miner Gascoyne Resources (ASX:GCY) and Chinese battery metals investor Jayson.

Jayson is affiliated with CATL, the world’s largest lithium battery cell manufacturer.

After an initial spike which saw the shares trade at a big premium to the 25c IPO price, FTL has been on a downward slide.

Results from maiden drilling completed October at the Yalgoo lithium project remain outstanding, but the company says assays should be back from the lab “in early 2023”. So, any time now.

The majority of drillholes were successful in intersecting pegmatites, the company says, with the widest intersection being 66m of pegmatite from 9m downhole.

Next up was the Mt Slopeaway nickel-cobalt-manganese project, where six historical holes were ‘twinned’ to confirm the resource of 4Mt @ 1% Ni, 0.2% Co and 1% Mn.

“We are eagerly awaiting result so that we can assess the true nature of the mineralisation of the project and advance our efforts to confirm the MRE and expand the in-ground resource,” FTL exec chair Brett Grosvenor said late January.

The $9m capped stock is down 16% year-to-date. It had ~$6m in the bank at the end of December.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.